Digital Risk Management Market Report Scope & Overview:

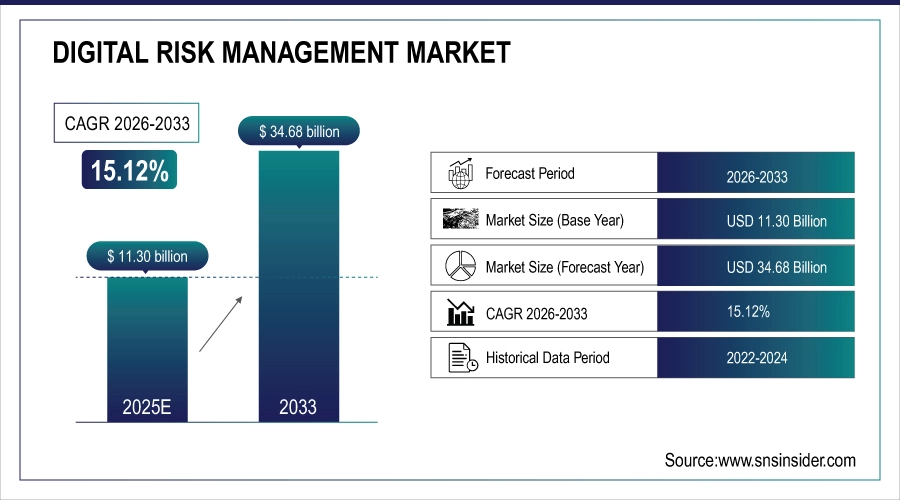

The Digital Risk Management Market was valued at USD 11.30 billion in 2025E and is expected to reach USD 34.68 billion by 2033, growing at a CAGR of 15.12% from 2026-2033.

The Digital Risk Management market is witnessing rapid growth due to the increased reliance on digital technologies like cloud computing and the Internet of Things, which have made organizations more vulnerable to a wide range of risks. This growing digital infrastructure has led to a rise in cybersecurity threats, regulatory compliance challenges, and data privacy concerns. In 2023 alone, there were 2,365 cyberattacks, affecting 343,338,964 victims, which held the previous record. As a result, businesses are investing in advanced DRM solutions to mitigate these risks effectively. Nearly 75% of organizations now report having an incident response plan, with 63% regularly testing it, reflecting the heightened urgency for reliable risk management tools, particularly in sectors like finance and healthcare.

Digital Risk Management Market Size and Forecast:

-

Market Size in 2025E: USD 11.30 Billion

-

Market Size by 2033: USD 34.68 Billion

-

CAGR: 15.12% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Digital Risk Management Market - Request Free Sample Report

Digital Risk Management Market Key Trends:

-

Integration of AI and machine learning – Organizations are leveraging AI/ML for real-time threat detection, predictive risk assessment, and automated incident response to minimize digital vulnerabilities.

-

Expansion of cloud-based risk management – Increasing cloud adoption is driving demand for scalable, SaaS-based digital risk management platforms that offer flexibility, faster deployment, and cost efficiency.

-

Regulatory compliance pressure – Rising global data protection and cybersecurity regulations (GDPR, CCPA, DORA, etc.) are compelling enterprises to adopt robust digital risk frameworks.

-

Growing third-party and supply chain risks – Businesses are increasingly monitoring risks from vendors, partners, and supply chains as digital ecosystems expand and interconnect.

-

Rise of cyber resilience strategies – Beyond prevention, companies are focusing on resilience by integrating business continuity, disaster recovery, and incident response into risk management.

-

Increased adoption in BFSI and healthcare – Highly regulated sectors with sensitive data are driving strong demand for digital risk management solutions to protect against fraud, breaches, and compliance failures.

-

Convergence with GRC platforms – Digital risk management is increasingly merging with Governance, Risk, and Compliance (GRC) solutions to provide an enterprise-wide, integrated risk visibility.

Looking forward, the future of the Digital Risk Management market is filled with significant opportunities. The rise of technologies like artificial intelligence and machine learning is set to revolutionize how organizations predict, assess, and mitigate digital risks. 80% of organizations identify AI as an emerging risk while adopting the technology themselves. These advancements will allow for faster, more efficient responses to emerging threats, enabling businesses to be more proactive in risk management. Additionally, the expansion of IoT and cloud services is expected to create new vulnerabilities, increasing the demand for sophisticated DRM solutions. For example, in August 2024, Qualys expanded its TruRisk platform with Qualys TotalAI, targeting security and compliance challenges related to generative AI and large language models. This evolution will drive future growth in the DRM market.

Digital Risk Management Market Drivers:

-

Escalating Cybersecurity Threats Push Demand for Advanced Digital Risk Management Solutions

The digital landscape is witnessing a surge in cybersecurity threats, with cyberattacks becoming more frequent and sophisticated. High-profile incidents such as ransomware attacks and massive data breaches are highlighting the vulnerabilities of organizations across sectors. This growing threat landscape has driven the demand for advanced Digital Risk Management solutions to proactively identify, assess, and mitigate risks. As cybercriminals continuously evolve their tactics, traditional security measures often fall short, necessitating more sophisticated DRM tools that can monitor potential threats in real-time, detect anomalies, and respond swiftly. Organizations are increasingly focusing on strengthening their cybersecurity frameworks, ensuring they have the right technology in place to protect sensitive data, preserve their reputation, and maintain business continuity. The rise in these security challenges is therefore a critical driver of the expanding DRM market.

-

Growing Recognition of Non-Traditional Risks Fuels Demand for Innovative Digital Risk Management Solutions

Organizations are increasingly aware of a broader spectrum of risks beyond traditional cybersecurity concerns. Emerging risks such as third-party vulnerabilities, supply chain disruptions, and reputational damage have become critical focus areas. These non-traditional risks can have significant financial and operational impacts, underscoring the need for more comprehensive Digital Risk Management strategies. As businesses increasingly rely on external partners, the potential for exposure through third-party vendors or partners has risen, necessitating enhanced monitoring and mitigation processes. Additionally, supply chain disruptions whether due to cyber incidents, geopolitical issues, or natural disasters highlight the need for DRM solutions that can identify and address these complex, interdependent risks. As organizations shift their focus to managing these emerging threats, the demand for advanced DRM solutions continues to grow, driving market expansion

Digital Risk Management Market Restraints:

-

High Implementation Costs Limit Digital Risk Management Adoption for Smaller Enterprises

The high upfront investment required for advanced Digital Risk Management solutions presents a significant challenge for smaller enterprises. Implementing DRM systems involves substantial costs, including the purchase of specialized software, hardware, and the hiring or training of skilled personnel. For small and medium-sized enterprises, these expenses can be prohibitively high, making it difficult for them to justify such investments. SMEs often face budget constraints and may prioritize other areas of their business over cybersecurity, leaving them more vulnerable to emerging risks. This financial barrier not only hinders the adoption of DRM technologies but also limits the ability of smaller businesses to stay competitive in a rapidly digitalizing world. As a result, the high cost of implementation remains a key obstacle for many organizations in the DRM market.

-

Integration Challenges Delay the Adoption of Digital Risk Management Solutions

Integrating Digital Risk Management solutions with existing IT infrastructure, business processes, and legacy systems can be a complex and time-consuming process, deterring many organizations from adopting new technologies. Companies with established systems and workflows may face significant technical hurdles when trying to incorporate DRM tools, especially if the systems are outdated or incompatible with modern solutions. This integration complexity can lead to disruptions in daily operations, additional costs, and longer implementation timelines. Furthermore, the need for specialized technical expertise to manage the integration process adds to the resource burden. As a result, organizations may delay or avoid adopting DRM solutions altogether, fearing the potential operational challenges and costs associated with integration. These difficulties in aligning DRM solutions with existing business environments contribute to slower market adoption.

Digital Risk Management Market Segmentation Analysis:

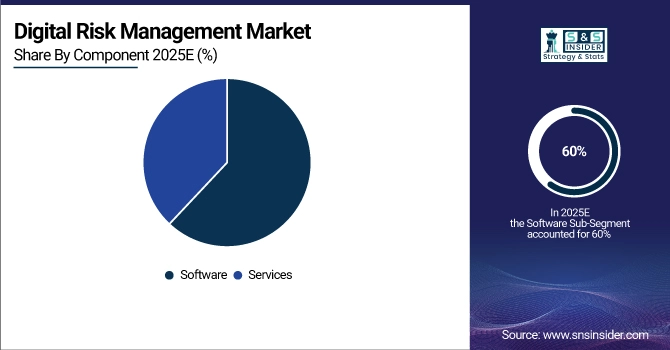

By Component, Software Segment Leads with 60% Share, While Services to Witness Fastest Growth

The Software segment dominated the Digital Risk Management market in 2025, with the highest revenue share of about 60%. This dominance is primarily due to the increasing need for advanced software solutions to address evolving cyber threats and regulatory requirements. Organizations are investing heavily in DRM software to enhance their cybersecurity infrastructure, automate risk assessments, and streamline compliance processes. The growing complexity of digital landscapes and the rise of sophisticated cyberattacks further amplify the demand for these software solutions, solidifying their market leadership.

The Services segment is expected to grow at the fastest CAGR of about 16.45% from 2026 to 2033, driven by the increasing need for personalized, expert-driven support in digital risk management. As businesses prioritize risk mitigation strategies, they require ongoing consultation, monitoring, and incident response services to effectively manage their digital risks. The shift toward cloud computing, along with the growing complexity of digital ecosystems, has accelerated the demand for specialized services, positioning the Services segment for rapid growth in the coming years.

By Organization Size, Large Enterprises Dominate Market, SMEs Set for Rapid Expansion

The Large Enterprise segment dominated the Digital Risk Management market in 2025, holding the highest revenue share of about 68%. This dominance is driven by the substantial budgets and resources that large enterprises allocate toward robust risk management strategies. These organizations face a broad range of complex risks, from cybersecurity threats to regulatory compliance, and therefore invest heavily in advanced DRM solutions. Additionally, large enterprises often require scalable, comprehensive risk management frameworks to protect vast amounts of sensitive data, which further drives their market leadership.

The Small and Medium-Sized Enterprise segment is expected to grow at the fastest CAGR of about 16.94% from 2026 to 2033. This growth is attributed to the increasing recognition among SMEs of the critical need to protect digital assets against evolving threats. As cyberattacks become more prevalent and regulations more stringent, SMEs are increasingly adopting affordable, scalable DRM solutions to safeguard their operations. The rise of cloud-based risk management platforms, which offer cost-effective, flexible options, is also fueling the rapid adoption of DRM solutions in this segment.

By Industry Vertical, BFSI Sector Holds Largest Share, Healthcare to Grow at Fastest Pace

The BFSI segment dominated the Digital Risk Management market in 2025, capturing the highest revenue share of about 32%. This dominance can be attributed to the critical need for safeguarding sensitive financial data and ensuring compliance with stringent regulations such as GDPR and PCI-DSS. The BFSI sector is a prime target for cyberattacks, including data breaches and financial fraud, prompting significant investment in advanced DRM solutions to mitigate these risks and protect customer trust.

The Healthcare segment is expected to grow at the fastest CAGR of 18.93% from 2026 to 2033, driven by the increasing need to protect patient data and comply with healthcare-specific regulations such as HIPAA. As the sector adopts digital transformation technologies, including electronic health recordsand telemedicine, the risk of cyber threats intensifies. Healthcare organizations are prioritizing digital risk management to protect sensitive patient information from cybercriminals and ensure the security of critical health data, fueling the sector's rapid growth in DRM adoption.

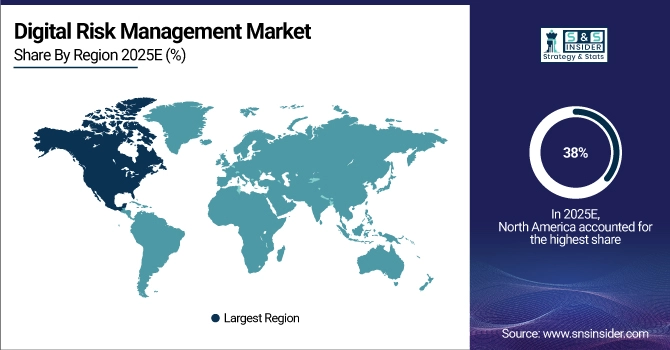

Digital Risk Management Market Regional Analysis

North America dominates the Digital Risk Management market in 2025

In 2025, North America holds an estimated 38% share of the Digital Risk Management (DRM) market, driven by rising cyberattacks, strict regulatory frameworks, and advanced IT infrastructure. The region benefits from high enterprise spending on cybersecurity solutions, especially in BFSI, healthcare, and technology sectors. Growing adoption of cloud computing and AI-based risk management solutions further strengthens market expansion. Additionally, increasing emphasis on compliance with data protection regulations like HIPAA, SOX, and CCPA positions North America as the global leader in DRM adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States leads North America’s Digital Risk Management market

The U.S. dominates the North American DRM market due to its advanced digital economy, heavy investments in cybersecurity, and strict regulatory environment. Enterprises across industries, particularly in finance and healthcare, allocate significant budgets to protect sensitive data and ensure compliance. The presence of global DRM solution providers and cybersecurity innovators also boosts adoption. Rising cases of ransomware and data breaches have prompted enterprises to adopt proactive risk management solutions, making the U.S. the largest contributor to North America’s DRM revenues.

Asia Pacific is the fastest-growing region in the Digital Risk Management market in 2025

The Asia Pacific market is projected to grow at an estimated CAGR of 17.8% from 2026 to 2033, fueled by rapid digitalization, cloud adoption, and rising cybercrime incidents. Enterprises in emerging economies are accelerating DRM adoption to safeguard sensitive data and comply with new cybersecurity regulations. Industries such as BFSI, e-commerce, and manufacturing are heavily investing in digital security infrastructure. The region’s strong focus on digital transformation and the rise of data-driven enterprises support rapid expansion, positioning Asia Pacific as the fastest-growing region during the forecast period.

-

China leads Asia Pacific’s Digital Risk Management market

China dominates the Asia Pacific DRM market due to its vast digital ecosystem, rapid adoption of advanced technologies, and increasing cyber threats. Government regulations mandating stricter data protection, combined with heavy investments in IT security, are driving adoption across industries. Large enterprises in BFSI, e-commerce, and manufacturing prioritize digital risk solutions to safeguard critical assets. Additionally, the country’s leadership in cloud computing and AI integration supports large-scale DRM deployment. These factors make China the leading contributor to Asia Pacific’s fast-growing DRM revenues.

Europe Digital Risk Management market insights, 2025

Europe accounts for an estimated 25% share of the DRM market in 2025, driven by stringent regulations such as GDPR, which mandate strong compliance and data protection frameworks. Enterprises across BFSI, automotive, and manufacturing sectors are rapidly deploying DRM solutions to meet regulatory obligations and strengthen cyber resilience. The region’s demand for cloud-based DRM is also rising, fueled by digital transformation initiatives. Germany dominates Europe’s DRM market due to its strong financial sector, advanced IT infrastructure, and high emphasis on cybersecurity compliance. Germany’s strict regulations and strong enterprise budgets increased investments in DRM, ensuring compliance and protecting sensitive data across industries.

Middle East & Africa and Latin America Digital Risk Management market insights, 2025

The Middle East & Africa and Latin America show steady DRM adoption in 2025, supported by digital transformation initiatives and rising cyber threats. In the Middle East, the UAE and Saudi Arabia lead investments in DRM, focusing on securing critical infrastructure, BFSI, and oil & gas industries. Africa’s adoption is gradually expanding, led by South Africa’s financial and healthcare sectors. In Latin America, Brazil dominates with strong fintech growth and rising cyberattacks, while Mexico follows with increasing regulatory compliance and digital ecosystem expansion.

Competitive Landscape for the Digital Risk Management Market

IBM Corporation

IBM Corporation is a U.S.-based global leader in enterprise technology and consulting, specializing in artificial intelligence, hybrid cloud, and security solutions. The company offers advanced digital risk management platforms that integrate threat intelligence, identity governance, and compliance monitoring. IBM’s role in the DRM market is significant, as it supports large enterprises with end-to-end risk management strategies, combining AI-driven analytics with managed security services. By leveraging its expertise in cloud and cybersecurity, IBM enables organizations to detect, respond, and recover from digital threats while meeting regulatory requirements across industries.

-

In 2024, IBM expanded its digital risk management portfolio with AI-powered threat detection and hybrid-cloud security services tailored for regulated industries.

Oracle Corporation

Oracle Corporation, headquartered in the U.S., delivers enterprise-grade digital risk management solutions integrated with its cloud infrastructure and business applications. The company focuses on embedding risk and compliance controls across ERP, HCM, and database platforms, helping organizations secure mission-critical data and streamline regulatory compliance. Oracle’s role in the DRM market is crucial, as it provides unified visibility of risk across enterprise processes and third-party ecosystems. Its integrated approach ensures scalability and automation for organizations navigating increasingly complex regulatory and digital landscapes.

-

In 2024, Oracle introduced enhanced DRM controls within its Oracle Cloud ERP suite, emphasizing automated compliance workflows and identity-driven governance.

SAP

SAP, based in Germany, is a global leader in enterprise software, offering digital risk management solutions closely aligned with business processes. SAP integrates risk analytics, compliance monitoring, and identity management into its ERP systems, enabling enterprises to detect and mitigate risks directly within operational workflows. Its role in the DRM market is essential, providing contextual risk insights for industries such as manufacturing, retail, and logistics. By embedding risk controls in supply chain and financial processes, SAP helps organizations maintain compliance and enhance digital resilience.

-

In 2024, SAP expanded its DRM offerings with integrated third-party risk monitoring tools and enhanced data governance features across its ERP platforms.

SAS Institute Inc.

SAS Institute Inc., headquartered in the U.S., is a global leader in analytics and risk intelligence solutions. The company specializes in digital risk management through advanced data modeling, machine learning, and behavioral analytics. SAS enables enterprises to identify fraud, assess operational risks, and predict compliance issues with high accuracy. Its role in the DRM market is central, particularly in sectors such as BFSI and healthcare, where real-time insights and predictive risk scoring are critical for protecting sensitive data and ensuring compliance.

-

In 2024, SAS launched upgraded predictive analytics models for DRM, focusing on real-time fraud detection and risk assessment in financial services.

Digital Risk Management Market Key Players:

-

IBM Corporation

-

Oracle Corporation

-

SAP

-

SAS Institute Inc.

-

Broadcom

-

NAVEX Global Inc

-

LogicManager Inc.

-

Metric Stream

-

Rapid7

-

Microsoft Corporation

-

ServiceNow Inc.

-

Rsam

-

Proofpoint Inc.

-

RSA Security LLC

-

Optiv Security Inc.

-

Qualys Inc.

-

OneTrust

-

Riskonnect Inc.

-

ZeroFox Holdings Inc.

-

SecurityScorecard

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 11.30 Billion |

| Market Size by 2033 | USD 34.68 Billion |

| CAGR | CAGR of 15.12% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-premise) • By Organization Size (Large Enterprise, Small and Medium-Sized Enterprise) • By Industry Vertical (BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Oracle Corporation, SAP, SAS Institute Inc., Broadcom, NAVEX Global Inc., LogicManager Inc., MetricStream, Rapid7, Microsoft Corporation, ServiceNow Inc., Rsam, Proofpoint Inc., RSA Security LLC, Optiv Security Inc., Qualys Inc., OneTrust, Riskonnect Inc., ZeroFox Holdings Inc., SecurityScorecard, Archer Technologies LLC, Galvanize, LogicGate Inc., Resolver Inc., BitSight, Hyperproof Inc. |