AI Data Center Market Report Scope & Overview:

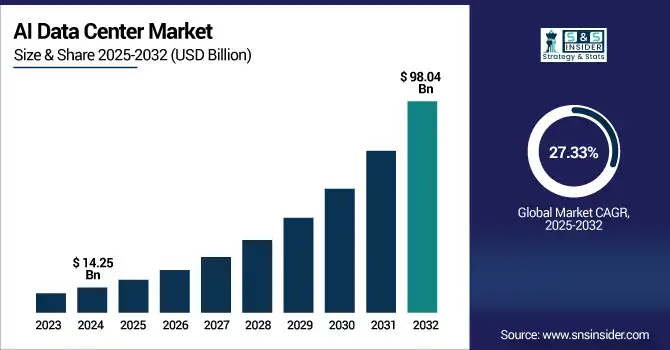

AI Data Center Market size was valued at USD 14.25 billion in 2024 and is expected to reach USD 98.04 billion by 2032, growing at a CAGR of 27.33% from 2025-2032.

To Get more information on AI Data Center Market - Request Free Sample Report

The AI Data Center Market is experiencing rapid growth due to the surging demand for high-performance computing infrastructure required to support AI workloads such as model training, inference, and data analytics. The proliferation of AI applications across industries including healthcare, automotive, finance, and cybersecurity is fueling investments in specialized data centers equipped with GPUs, TPUs, and advanced cooling technologies.

-

A U.S. Department of Energy report finds that an 8‑H100 GPU node draws approximately 74% of its rated thermal design power during AI training, equating to nearly 8 kW per node underscoring the significant energy demands of AI workloads.

-

Google’s TPU v6, launched in October 2024, delivers 4.7× more performance than its predecessor v5e, while the TPU v7 “Ironwood,” unveiled in April 2025, reaches a peak performance of 4,614 TFLOPS in clustered configurations.

Additionally, the rise of generative AI, edge AI, and large language models is driving the need for scalable, energy-efficient, and AI-optimized data center architectures.

-

Notably, data centers in the U.S. now account for about 4.4% of national electricity consumption up from 58 TWh in 2014 to 176 TWh in 2023—with projections suggesting usage could reach between 325 and 580 TWh by 2028, representing as much as 12% of U.S. power demand.

Cloud adoption and the increasing deployment of AI-as-a-Service platforms are further accelerating the expansion of AI-centric data center infrastructure.

U.S. AI Data Center Market size was valued at USD 3.35 billion in 2024 and is expected to reach USD 20.12 billion by 2032, growing at a CAGR of 25.21% from 2025-2032.

The U.S. AI Data Center Market is growing due to rising demand for generative AI, cloud-based services, and advanced analytics. Increased investments by tech giants in AI infrastructure, government support for AI innovation, and the need for high-performance, energy-efficient computing environments are further accelerating market expansion across key industries.

AI Data Center Market Dynamics

Drivers

-

Surging demand for generative AI and large language models is accelerating the global deployment of high-performance AI data center infrastructure.

The rapid rise of generative AI software and LLMs such as ChatGPT and Bard has created an immediate demand for powerful AI data centers. High computational power including GPUs, TPUs and highspeed interconnections is needed for these models, which traditional data centers do not have access to. Enterprises and hyperscalers are quickly expanding infrastructure to accommodate this demand. AI data centers, from training deep neural networks to massive inference workloads, are the backbone. Their position is strengthened by growing corporate investments in AI-based automation, analytics and customer engagement solutions.

-

To support this scale, every additional 100 MW of AI data center capacity could require 19–25 million cubic feet of natural gas per day, potentially adding 4.5–6.5 billion cubic feet per day to U.S. natural gas demand by 2028.

-

Furthermore, according to the International Energy Agency (IEA), a single 100 MW data center can consume up to 2 million liters of water dail equivalent to the water usage of approximately 6,500 households.

Restraints

-

High energy consumption and carbon footprint of AI data centers pose serious environmental and operational sustainability concerns.

Large-scale AI models require an extraordinary amount of compute and cooling power to train, driving energy consumption and carbon footprints that run contrary to corporate sustainability objectives. Tougher climate regulations are forcing operators to decarbonize, and rising energy prices have the potential to make profitability even more elusive, particularly for small companies. Moving to greener data centres that use renewable energy, liquid cooling and energy-saving chips costs money. High operational energy requirements will persist to limit AI data center scalability and wider regional application, unless such solutions are widely accepted.

Opportunities

-

Adoption of liquid cooling and sustainable infrastructure opens avenues for energy-efficient, scalable, and greener AI data center ecosystems.

The shift towards sustainable infrastructure is opening up substantial innovation opportunities in AI data centers. What’s more, liquid cooling can reduce PUE. Complemented by on-site renewables and smart energy optimisation, these centres can work towards carbon-neutral goals. This pivot draws in green financing, government support and ESG-focused partnerships. Suppliers of modular, environmentally friendly deployments are making strong headway around the world, particularly in areas with rigorous climate rules and high energy prices. Sustainability is increasingly an important point of differentiation in the market.

-

Huawei reports its full liquid-cooled cabinets reduce cooling power consumption by 96%, lowering PUE from 2.2 to 1.1 and saving approximately 500,000 kWh/year per 50 kW rack equivalent to around 237 tons of CO₂ emissions avoided.

-

Similarly, Mitsubishi Heavy Industries, KDDI & NEC achieved a 94% reduction in server cooling energy using immersion liquid cooling, attaining a PUE of 1.05 in a Tier‑4 demonstration data center.

-

In addition, a joint analysis by Vertiv and NVIDIA shows that implementing approximately 75% direct-to-chip liquid cooling can reduce total data center power consumption by 10.2%, improve Total Usage Effectiveness (TUE) by 15.5%, and cut server fan energy use by up to 80%.

Challenges

-

Managing heat dissipation and thermal efficiency for AI-intensive workloads is a technical bottleneck in data center operations.

AI model training generates higher levels of heat than traditional IT workloads, putting overwhelming stress on traditional cooling solutions. Traditional air-cooling is often unable to meet the cooling requirement of server with high density GPU and ASIC, which can negatively affect the server performance, reduce the service time and increase the power consumption. More-advanced cooling methods such as liquid immersion and direct-to-chip cooling provide relief but require significant upfront investment and retrofit of infrastructure. There is a continuing need to scale these remedies in a cost-effective manner across various geographies and types of facilities. Without the standardization, how to manage the thermal load of AI data centers will be a significant challenge for the scalability and reliability of AI data centers.

AI Data Center Market Segmentation Analysis

By Component

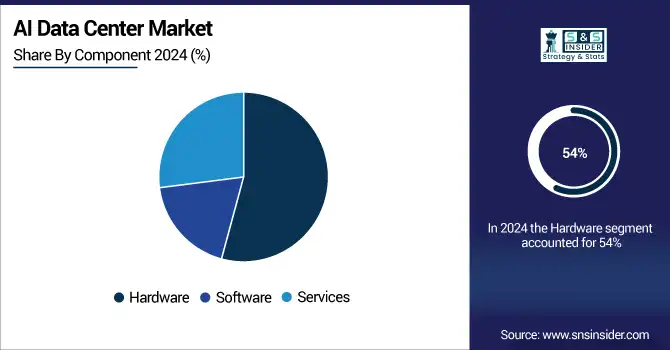

Hardware segment dominated the AI Data Center Market with the highest revenue share of about 54% in 2024 due to the substantial demand for specialized AI chips, including GPUs, TPUs, and FPGAs, essential for training and inference workloads. The rapid scaling of AI workloads necessitates high-performance computing infrastructure, driving heavy investments in hardware. Additionally, growing deployment of energy-efficient servers and advanced cooling systems further boosts hardware adoption across global AI data centers.

Services segment is expected to grow at the fastest CAGR of about 28.64% from 2025-2032 due to increasing reliance on managed, integration, and optimization services to support complex AI deployments. As organizations face growing complexity in handling AI workloads, they increasingly turn to external service providers for seamless implementation, performance tuning, and continuous infrastructure support. The need for scalability, reliability, and faster deployment cycles accelerates the demand for specialized AI data center services.

By Data Center Type

Hyperscale Data Centers segment dominated the AI Data Center Market with the highest revenue share of about 35% in 2024 due to their unmatched capacity to handle large-scale AI model training and storage requirements. These facilities, backed by tech giants, offer optimized infrastructure, integrated AI accelerators, and high-throughput networking. Their ability to support diverse AI workloads at scale while ensuring energy efficiency and centralized orchestration makes them foundational to current enterprise and cloud AI strategies.

Edge Data Centers segment is expected to grow at the fastest CAGR of about 29.04% from 2025-2032 due to the increasing demand for real-time AI processing near data sources. Applications such as autonomous vehicles, remote healthcare, smart factories, and video analytics require low-latency computing. Edge data centers enable AI inference closer to end users, improving responsiveness while reducing bandwidth costs. The 5G rollout and IoT expansion further accelerate this decentralization trend in AI infrastructure.

By AI Application

AI Model Training segment dominated the AI Data Center Market with the highest revenue share of about 29% in 2024 owing to the growing need to build large, complex models like GPT, DALL·E, and Gemini. Training requires vast computational resources and prolonged runtimes, resulting in significantly higher infrastructure and power costs. Organizations are investing heavily in GPU clusters and distributed systems to handle model complexity, making training the costliest and most resource-intensive workload in AI.

AI Model Inference segment is expected to grow at the fastest CAGR of about 29.39% from 2025-2032 due to the massive deployment of AI-powered applications across industries. As trained models are deployed for customer service, fraud detection, recommendation engines, and image recognition, the need for fast, scalable inference surges. With more enterprises shifting AI models into production environments, optimizing low-latency and cost-effective inference workloads drives rapid growth in this segment.

By Industry Vertical

BFSI segment dominated the AI Data Center Market with the highest revenue share of about 29% in 2024 due to widespread adoption of AI for fraud detection, algorithmic trading, credit scoring, and risk analytics. The financial sector's emphasis on security, real-time data processing, and compliance creates a consistent demand for high-performance AI infrastructure. Continued investments in AI-driven digital transformation by banks and insurers strengthen BFSI's leadership in AI data center utilization.

IT & Telecom segment is expected to grow at the fastest CAGR of about 29.37% from 2025-2032 as the industry accelerates AI-driven automation, network optimization, and customer personalization. AI is integral to managing 5G networks, predictive maintenance, and intelligent customer support systems. The need for agile, scalable data center infrastructure to support these AI applications across distributed environments drives strong investment in AI capabilities among IT and telecom service providers.

By Deployment

Cloud-Based segment dominated the AI Data Center Market with the highest revenue share of about 62% in 2024 due to the increasing preference for flexible, scalable AI computing platforms offered by major cloud providers. Enterprises rely on cloud-based AI services to avoid heavy upfront hardware investments and quickly deploy models. The availability of advanced AI chips, toolkits, and data management in the cloud ecosystem fuels its dominance across AI-driven digital initiatives.

Hybrid segment is expected to grow at the fastest CAGR of about 29.31% from 2025-2032 as organizations seek to balance cloud scalability with on-premise control and data sovereignty. Hybrid architectures allow enterprises to run sensitive AI workloads locally while leveraging public cloud for large-scale training. The model supports regulatory compliance, cost optimization, and performance flexibility. Increasing demand for customizable and secure AI deployments accelerates hybrid adoption in diverse industry verticals.

AI Data Center Market Regional Outlook

North America dominated the AI Data Center Market with the highest revenue share of about 37% in 2024 due to early adoption of AI technologies, strong presence of hyperscalers like Google, Microsoft, and Amazon, and robust investment in AI infrastructure. The region also benefits from a mature cloud ecosystem, high AI talent concentration, and aggressive innovation in generative AI, driving significant demand for advanced, high-performance AI data center deployments.

The U.S. is dominating the AI Data Center Market due to massive investments, presence of major cloud providers, and advanced AI infrastructure deployment.

Asia Pacific is expected to grow at the fastest CAGR of about 29.04% from 2025–2032 due to rapid digital transformation, government AI initiatives, and booming demand from sectors like e-commerce, fintech, and manufacturing. Countries like China, India, and South Korea are heavily investing in AI research, cloud infrastructure, and edge data centers. Rising data consumption, urbanization, and local tech ecosystem expansion accelerate regional adoption of AI-driven data center infrastructure.

China is dominating the AI Data Center Market in Asia Pacific due to large-scale AI adoption, government support, and massive investments in hyperscale infrastructure.

Europe is witnessing steady growth in the AI Data Center Market, driven by digital transformation, data localization laws, and rising AI adoption across industries. Countries like Germany, France, and the UK are investing heavily in sustainable, energy-efficient AI infrastructure.

Germany is dominating the AI Data Center Market in Europe due to its strong industrial base, AI investments, and advanced data infrastructure capabilities.

Middle East & Africa and Latin America are emerging markets in the AI Data Center sector, fueled by growing cloud adoption, digitalization initiatives, and investments in smart city projects, with governments and enterprises increasingly deploying AI-driven infrastructure to boost efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

AI Data Center Market companies are Advanced Micro Devices, Inc., Amazon Web Services, Inc., Arista Networks, Inc., Cisco Systems, Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, Hitachi Vantara LLC, Intel Corporation, International Business Machines Corporation, Juniper Networks, Inc., Microsoft Corporation, NetApp, Nutanix, NVIDIA Corporation.

Recent Developments:

-

August 2024, AMD acquired ZT Systems for $4.9 billion, strengthening its capabilities in delivering full-rack AI data center systems optimized for hyperscalers and large-scale AI workloads.

-

March 2025, Arista launched EOS Smart AI Suite with cluster load balancing; by July, it acquired VeloCloud to enhance enterprise AI networking and optimize data center fabric intelligence.

-

June 2025, Cisco launched N9300 AI-smart switches, a Secure AI Factory with NVIDIA, and full-stack Nexus Dashboard solutions tailored for next-gen AI-ready data center architectures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.25 Billion |

| Market Size by 2032 | USD 98.04 Billion |

| CAGR | CAGR of 27.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Data Center Type (Hyperscale Data Centers, Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, Modular & Portable Data Centers) • By AI Application (AI Model Training, AI Model Inference, Big Data Analytics, Computer Vision Processing, Natural Language Processing (NLP), Autonomous Systems & Robotics, Cybersecurity & Fraud Detection) • By Industry Vertical (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government & Defense, Energy & Utilities, Media & Entertainment, Automotive, Others) • By Deployment (On-Premises, Cloud-Based, Hybrid) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Advanced Micro Devices, Inc., Amazon Web Services, Inc., Arista Networks, Inc., Cisco Systems, Inc., Dell Technologies, Google LLC, Hewlett Packard Enterprise Development LP, Hitachi Vantara LLC, Intel Corporation, International Business Machines Corporation, Juniper Networks, Inc., Microsoft Corporation, NetApp, Nutanix, NVIDIA Corporation |