Crowdfunding Market Size & Overview:

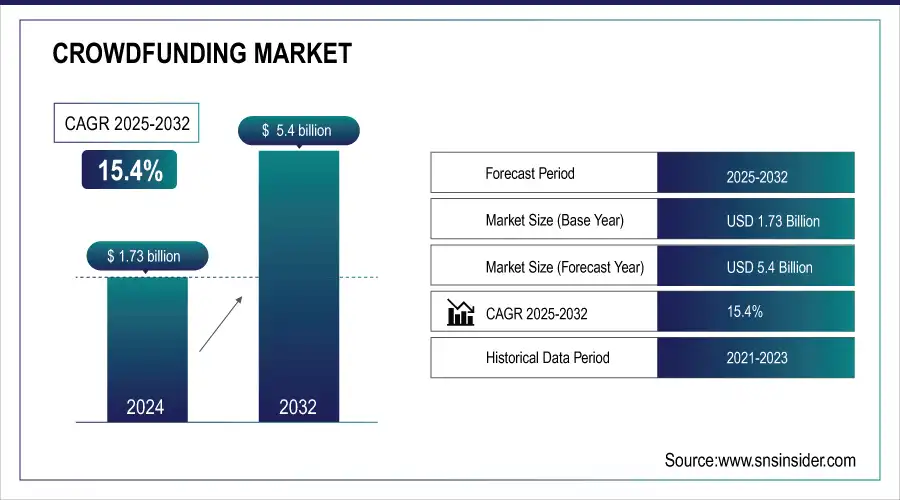

Crowdfunding Market Size was valued at USD 1.73 Billion in 2024 and is expected to reach USD 5.4 Billion by 2032, growing at a CAGR of 15.4% over the forecast period 2025-2032.

The crowdfunding market has experienced rapid expansion, largely fueled by a surge in government support and regulatory developments that have aimed at making funding accessible for, in particular, small and medium-sized enterprises (SMEs) and self-employed individuals. According to the latest government statistics, platforms raised a record volume of funds for projects and startups across sectors, achieving a cumulative 30% annual growth rate over the past five years. One example is the recent increase in equity crowdfunding limits set by the U.S. Securities and Exchange Commission (SEC), which allows companies to raise to $5 million per year instead of the previous year's cap of $1.07 million. The EU is similarly adopting regulatory frameworks through the European Crowdfunding Service Providers (ECSP) regulation, harmonizing crowdfunding rules across member states. This allows higher participation by investors while keeping accountability and opens up the market to grow rapidly. In addition, widespread access to the internet and digitalization as well as increased social media power have resulted in an increasing number of crowdfunding campaigns, becoming a necessary financing method.

Get More Information on Crowdfunding Market - Request Sample Report

Crowdfunding Market Size and Forecast:

-

Market Size in 2024: USD 1.73 Billion

-

Market Size by 2032: USD 5.4 Billion

-

CAGR: 15.4% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Trends in the Crowdfunding Market:

-

Rising adoption of equity crowdfunding platforms by startups and SMEs to raise capital.

-

Growing popularity of reward-based campaigns for creative projects and product launches.

-

Integration of blockchain and fintech technologies to enhance transparency and security in transactions.

-

Increasing participation of institutional investors, venture capitalists, and angel investors on crowdfunding platforms.

-

Expansion of mobile and digital platforms for easier campaign management and investor engagement.

-

Rising regulatory support and legal frameworks in multiple regions to encourage crowdfunding activities.

-

Focus on niche markets, social causes, and community-driven projects.

-

Global expansion with emerging economies adopting crowdfunding due to limited traditional financing options.

Reward-based crowdfunding allows creators to raise seed or pre-seed funding via online platforms, offering investors non-monetary rewards or "perks" in return. Perceived as a kind of pre-sales, they allow to raise funds while also creating a community for lasting support and promotion. This type of model is especially ideal for early-stage projects or companies. Australia's Okra Solar is an example, running a rewards-based campaign that raised over USD 45,000 to be applied towards a pilot of its "plug-and-play smart controller" that enables electricity sharing between neighbour’s. Totaling 22.4% of successful campaigns to date, reward-based crowdfunding has supported market expansion by providing greater visibility for fledgling projects.

Crowdfunding Market Drivers:

-

The growing accessibility and adoption of digital payment platforms enable seamless transactions, making it easier for global supporters to contribute to crowdfunding campaigns.

-

Equity crowdfunding is expanding rapidly as more countries introduce supportive regulations, allowing retail investors to fund startups and potentially earn financial returns.

-

With internet access and social media presence growing worldwide, campaign visibility and reach improve significantly, aiding in gathering wider support.

High internet and social media penetration play an important role in the success of crowdfunding campaigns. The global internet users in 2024 were nearly 5.16 billion and there were a total of 4.9 billion social media users. Such massive access to global and digitally enhanced networks allows digital crowdfunding initiatives to reach high-volume diverse audiences with both unprecedented efficacy and efficiency. Accessing potential supporters via quick and sometimes free channels like Facebook, Instagram, Twitter, and LinkedIn. Take the platform Kickstarter; they attribute some of their success to their social media integration as campaigns are often shared and endorsed causing them to go viral and rapidly spread through other influencers or community leaders.

Social media and digital marketing techniques allow for targeted advertising, helping campaigns reach specific demographics. Crowdfunding platforms such as Indiegogo are also benefiting from data-driven insights, providing audiences with helpful guides to target campaigns and optimize them along a spectrum so that when campaigns use these social media tools, they are 200% more likely to reach their funding goal. Moreover, social channels of crowdfunding were found to attract younger, tech-savvy demographics, especially in Asia-Pacific, where the young digital audience is of great size and fast-growing. This digital reach not only propels a campaign whether public or private into a wider audience, but also spurs comments and shares from backers, adding to the legitimacy and allure of campaigns. As more people engage online, social media remains a powerful tool driving crowdfunding’s growing success.

Crowdfunding Market Restraints:

-

Complex regulations and compliance requirements, varying by region, make it difficult for crowdfunding platforms to operate across borders smoothly.

-

Instances of scams and lack of transparency in some campaigns reduce investor confidence, impacting overall crowdfunding participation.

Regulatory and compliance challenges, which complicate platform operations within differing regions, are preventing crowdfunding from reaching its full potential. The context of crowdfunding deals with a complex web of financial, securities, and data privacy laws which differ not just from country to country, but from region to region. Platforms will have to manage complex webs of fraud protection and statutory investor protection laws, including securities regulations surrounding equity crowdfunding. Such rules can be expensive and hard to enforce, especially for smaller platforms that may lack the resources to comply. Moreover, the ever-changing nature of regulations can be a source of uncertainty for investors as well as the platforms themselves, as potential investors may be deterred from participating due to fear of legal action. For example, this usually involves compliance with anti-money laundering (AML) laws and know-your-customer (KYC) requirements, which are expensive to implement and maintain, increasing operational and administrative costs. As platforms go global, they must comply with the laws of every jurisdiction, which complicates scaling and limits market opportunity.

Crowdfunding Market Segmentation Analysis:

By Type, Debt-Based Crowdfunding Leads Market in 2024

The crowdfunding market growth can be attributed to the debt-based crowdfunding segment which held over 59% of the global revenues in 2023. This is due to the increasing preference for debt-based models as they allow for a structured repayment procedure without usually incurring ownership dilution. The segment growth is attributed to government-supported aided debt-based programs including small business loans along with tax incentives to the investors who opt for debt-based crowdfunding. Accelerated through more democratically accessible credit via regulated crowdfunding platforms such as the U.K.‘s Funding Circle program which has given thousands of SMEs low-interest debt. In addition to that, since the investors are on the lookout for predictable returns, debt-based crowdfundings have a wider buyer base than equity-based ones, making them occupy a substantial market share as well.

By Application, Food & Beverage Industry Dominates Crowdfunding Market

The food & beverage industry dominated the global crowdfunding market, accounting for more than 23% share in 2023. The large share of the food & beverage industry can be attributed to the high-touch nature of the sector and its frequent requirement for up-front capital for prototyping, packaging, and distribution. Governments have also backed crowdfunding efforts in the food sector by offering small business grants and sustainable food production development programs. According to the USDA, food-related crowdfunding projects are found to have a higher completion and overall success rate than many other sectors of crowdfunding. An overall boost in consumer interest along with support from the Government has ensured that the food & beverage industry remains the frontrunner in the crowdfunding landscape.

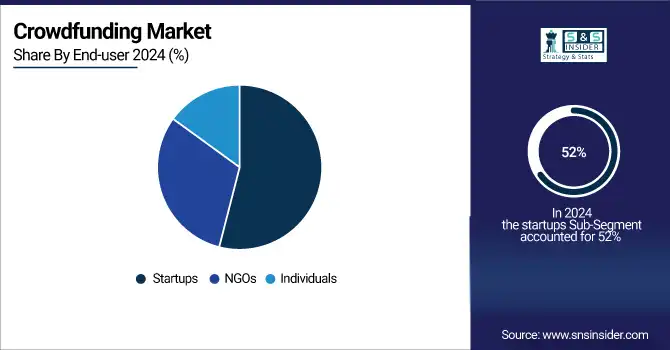

By End-User, Startups Hold Largest Market Share in Crowdfunding

The startups segment held the largest market share, accounting for 52% in 2023. Startups are increasingly leveraging crowdfunding as a key source of initial capital, with many governments encouraging this trend. For example, Japan’s government recently introduced tax incentives for investments made in startups through crowdfunding. These measures have increased the volume of startup crowdfunding campaigns all over the globe, as young businesses now prefer crowdfunding rather than traditional funding channels. Apart from these, government-supported startup incubators and accelerators are also pushing startups to turn to crowdfunding, thereby strengthening the market share of the segment.

Crowdfunding Market Regional Analysis:

North America Dominates Crowdfunding Market in 2024

In 2024, North America dominates the crowdfunding market with an estimated 40% share, fueled by its mature startup ecosystem and supportive regulations. The presence of established platforms like Kickstarter, Indiegogo, and GoFundMe encourages entrepreneurs to seek alternative funding, while investors benefit from structured and transparent opportunities. Strong digital payment infrastructure and widespread internet penetration enhance participation from both individual and institutional backers. Government incentives and policies promoting small business financing further stimulate market growth, ensuring consistent adoption of debt-based, equity-based, and reward-based crowdfunding models across diverse sectors.

Do You Need any Customization Research on Crowdfunding Market - Enquire Now

-

United States Leads North America’s Crowdfunding Market

The U.S. dominates due to its mature venture capital environment, widespread use of online funding platforms, and strong digital payment infrastructure. Government initiatives, such as JOBS Act provisions supporting equity crowdfunding and tax incentives, encourage investment in startups and SMEs. High technology penetration, combined with a culture of entrepreneurship and innovation, supports diverse crowdfunding models including debt, equity, and reward-based funding. Major platforms like Kickstarter, Indiegogo, and GoFundMe are headquartered in the U.S., enhancing access, investor confidence, and the overall scale of the crowdfunding market in North America.

Asia Pacific is the Fastest-Growing Region in Crowdfunding Market in 2024

The Asia Pacific crowdfunding market is projected to grow at a CAGR of 22% from 2025 to 2032, driven by a surge in startup activity and entrepreneurial ventures. Expanding fintech infrastructure, including secure digital payment systems and online investment platforms, supports seamless crowdfunding transactions. Rising digital literacy and smartphone penetration enable wider participation from investors and backers. Government initiatives promoting small business funding and innovation further accelerate adoption. These factors collectively enhance the region’s reliance on online crowdfunding platforms, positioning Asia Pacific as the fastest-growing market globally.

-

China Leads Asia Pacific’s Crowdfunding Market

China dominates the Asia Pacific market due to its booming entrepreneurial ecosystem, rapid urbanization, and strong government support for SMEs and technology-driven startups. Policies promoting online financing, small business loans, and fintech innovation encourage the use of crowdfunding platforms. Widespread mobile payment adoption, a growing middle-class investor base, and high internet penetration further support crowdfunding growth. Domestic platforms such as JD Crowdfunding and Demohour, along with international platform partnerships, provide opportunities for investors and entrepreneurs alike. China’s combined infrastructure, investor participation, and government backing make it the key driver of Asia Pacific’s crowdfunding market.

Europe Crowdfunding Market Insights, 2024

Europe holds a significant share in 2024, driven by increasing entrepreneurial initiatives, investor-friendly policies, and expanding digital funding platforms. The UK’s supportive equity crowdfunding regulations and government-backed small business initiatives boost platform adoption and investment opportunities.

-

United Kingdom Leads Europe’s Crowdfunding Market

The UK dominates due to its strong regulatory support for crowdfunding, mature fintech ecosystem, and wide availability of digital payment infrastructure. Platforms like Crowdcube and Seedrs have expanded equity and debt-based crowdfunding adoption across startups and SMEs. Government tax incentives, investor protection regulations, and a culture of entrepreneurship attract both local and international investors. High awareness of alternative financing, combined with the growing need for startup funding, ensures that the UK remains Europe’s leading crowdfunding market in 2024.

Middle East & Africa and Latin America Crowdfunding Market Insights, 2024

The crowdfunding market in the Middle East & Africa and Latin America is experiencing steady growth in 2024, supported by emerging fintech adoption, growing startup ecosystems, and increasing investor awareness. In the Middle East, initiatives in the UAE and Saudi Arabia are promoting funding for tech startups and SMEs through digital platforms. In Latin America, Brazil and Mexico lead adoption, leveraging government-backed incentives, financial inclusion programs, and mobile payment penetration. Growing entrepreneurship and increasing internet access are driving the expansion of crowdfunding solutions in both regions.

Competitive Landscape for the Crowdfunding Market:

Kickstarter

Kickstarter is a U.S.-based crowdfunding platform that enables creators to fund innovative projects across arts, technology, design, and media. The company provides a streamlined platform for project owners to pitch ideas, set funding goals, and receive pledges from backers globally. Kickstarter operates on an all-or-nothing funding model, ensuring that projects only receive funds if goals are met, which builds trust and accountability. Its role in the crowdfunding market is vital, as it empowers entrepreneurs and creators to bring ideas to life without traditional financing constraints.

-

In 2024, Kickstarter launched an updated platform interface with enhanced project analytics, backer engagement tools, and integrated social sharing capabilities to boost funding success rates.

Indiegogo

Indiegogo is a U.S.-based crowdfunding platform that supports entrepreneurs, innovators, and creators in raising funds for a wide range of projects, including technology, creative works, and social initiatives. Indiegogo offers flexible funding options, allowing campaign owners to retain funds even if goals are partially met, increasing accessibility for diverse projects. Its role in the crowdfunding market is significant, as it enables global participation and provides robust marketing, analytics, and distribution support to ensure project visibility and success.

-

In 2024, Indiegogo introduced enhanced campaign customization features and international payment integrations, facilitating seamless global backer engagement and broader project reach.

GoFundMe

GoFundMe is a U.S.-based leading donation-based crowdfunding platform, primarily focused on personal causes, charity initiatives, and community projects. The platform allows individuals and organizations to raise funds directly from supporters without equity or repayment obligations, making it highly accessible. GoFundMe’s role in the crowdfunding market is critical, as it provides a trusted, secure, and easy-to-use channel for raising funds for emergencies, education, healthcare, and social causes worldwide.

-

In 2024, GoFundMe expanded its platform to include enhanced social sharing, automated donor recognition, and analytics for campaign performance tracking.

Patreon

Patreon is a U.S.-based subscription-focused crowdfunding platform that enables creators, artists, and content producers to receive ongoing financial support from subscribers or “patrons.” The platform allows creators to monetize their work through membership tiers, providing exclusive content and experiences for supporters. Patreon’s role in the crowdfunding market is central, as it facilitates continuous funding streams for creators while building community engagement and loyalty.

-

In 2024, Patreon introduced upgraded membership management tools, analytics dashboards, and integrations with social media and content platforms to optimize creator revenue and audience engagement.

Crowdfunding Market Key Players:

-

Kickstarter

-

Indiegogo

-

Patreon

-

SeedInvest

-

Crowdcube

-

Republic

-

CircleUp

-

Wefunder

-

StartEngine

-

Kiva

-

LendingClub

-

FundRazr

-

Ulule

-

RocketHub

-

Invesdor

-

iFunding

-

Crowdfunder

-

GoGetFunding

| Report Attributes | Details |

| Market Size in 2024 | USD 1.73 Billion |

| Market Size by 2032 | USD 5.4 Billion |

| CAGR | CAGR of 15.4 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Equity-based Crowdfunding, Debt-based Crowdfunding, Others) • By Application (Food and Beverage, Technology, Media and Entertainment, Real Estate, Healthcare, Others) • By Investment Size (Small and Medium Investment, Large Investment) • By End-user (Startups, NGOs, Individuals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Kickstarter, Indiegogo, GoFundMe, Seedrs, Crowdcube, Fundable, Patreon, CircleUp, Wefunder, Crowdfunder |