GCCs in the BFSI Market Report Scope & Overview:

Get More Information on GCCs in the BFSI Market - Request Sample Report

The GCCs in the BFSI Market Size were valued at USD 40.43 billion in 2023 and are expected to reach USD 132.18 Billion by 2032, growing at a CAGR of 12.54% over the forecast period 2024-2032.

The global capability centers (GCCs) in the banking, financial services, and insurance (BFSI) market represent a strategic shift in how organizations operate in an increasingly digital and competitive landscape, primarily driven by the need for cost optimization. As financial institutions face rising regulatory pressures and the demand for enhanced customer experiences, they must discover effective ways to streamline operations without sacrificing quality. GCCs enable organizations to centralize their operations, reducing redundancies and reducing costs. This shift is crucial in a market where profit margins are often tight and the pressure to innovate is relentless. For instance, India is now home to 170-175 BFSI GCCs operated by around 85-90 multinational corporations (MNCs). Key cities such as Bengaluru, Mumbai, and Delhi NCR lead the sector, with Bengaluru alone accounting for 30% of all centers. These centers employ approximately 540,000 professionals, offering competitive salaries, particularly in technology roles, which are 20% higher than traditional IT services. The future looks promising for BFSI GCCs, with rising demand for advanced tech expertise, regulatory compliance, and further expansion by global banks. A notable example is JPMorgan, which has allocated USD 15 billion for global tech spending, including USD 2 billion dedicated to its India GCC.

GCCs can develop advanced risk management models that utilize big data analytics to identify and mitigate potential risks proactively. This approach not only safeguards the institution’s assets but also enhances its reputation with regulators and customers alike. The regulatory framework for financial institutions, including BFSI GCCs, has identified liquidity risk as a major concern, particularly following bank failures in 2023. The revised "Interagency Policy Statement on Funding and Liquidity Risk Management" from July 2023 underscores the importance of strong contingency funding plans. In 2024, regulatory oversight is focused on ensuring that Global Custodian Banks (GCCs) can manage liquidity stress scenarios using proper asset-liability management (ALM) and participating in asset-liability committees (ALCOs).

GCCs in the BFSI Market Dynamics

Drivers

-

GCCs are increasingly favored by organizations in the BFSI sector due to their potential to significantly reduce operational costs.

GCCs enable these organizations to tap into qualified workforce at reduced pay scales, particularly in emerging nations like India, the Philippines, and Eastern Europe, where labor expenses are significantly lesser when compared to Western countries. Additionally, GCCs are created to streamline functions like IT services, back-office tasks, customer support, and compliance management. This concentration facilitates a more efficient method, reducing repetitive procedures and utilizing economies of scale. By doing this, BFSI companies can enhance operational efficiency, lower expenses, and increase overall profitability. Furthermore, advancements in automation and artificial intelligence (AI) are crucial in improving operational efficiency in GCCs. Automated tools can manage repetitive tasks like handling transactions, providing customer support, and managing data, thus leading to a decrease in manual work and expenses.

-

The proliferation of GCCs in the BFSI sector is the access to a global talent pool.

Financial institutions need specialized skills to address increasing complexities in cybersecurity, data analytics, regulatory compliance, and financial technology (fintech) innovations. In their home markets, many of these skills may be rare or costly, but GCCs in countries such as India, China, and Poland provide a wider and more cost-effective talent pool due to their highly educated workforces. GCCs allow BFSI companies to access a wide range of talent, including software engineers, data scientists, and legal, and compliance experts, regardless of location restrictions in their home countries. Having access to talent from around the world ensures that BFSI companies are more prepared to innovate, adapt to regulatory changes, and utilize advanced technologies. Moreover, workers in these areas frequently come into contact with international norms and are knowledgeable about regulatory frameworks that are relevant in various markets, resulting in a stronger and more flexible labor force. BFSI companies can accelerate innovation and technology adoption by setting up GCCs in tech hubs with access to talent proficient in cutting-edge technologies.

Restraints

-

Geopolitical tensions and regional instability affecting strategies for GCC BFSI institutions to mitigate risks and enhance financial stability.

Geopolitical tensions and regional instability create major obstacles for the Banking, Financial Services, and Insurance (BFSI) sector in the Gulf Cooperation Council (GCC) region, impacting their risk management approaches and financial well-being. Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain are situated in a region that has a history of political instability, with diplomatic disagreements, sanctions, and conflicts. These geopolitical factors may cause economic disturbances, affecting foreign investments, trade, and market confidence. In the GCC, uncertainties facing BFSI institutions heighten risks linked to cross-border transactions, foreign exchange fluctuations, and credit defaults. In this kind of environment, banks and financial institutions need to implement strict risk management tactics, like improving their due diligence procedures, spreading out their investment holdings, and holding onto more capital reserves to protect against possible economic disruptions. Moreover, they might concentrate on growing domestic activities instead of global expansions to reduce vulnerability to geopolitical risks.

GCCs in the BFSI Market Segmentation Overview

By Service Type

IT and Digital Services dominated the GCCs in the BFSI market in 2023 with 20% market share, mainly because of the industry's growing dependence on digital transformation and technological incorporation. Financial institutions use these abilities to enhance operational efficiency, provide personalized digital experiences, and improve data security. The increasing demand for IT services is fueled by the transition to digital banking, partnerships with fintech companies, and enhanced data analysis techniques. For instance, JP Morgan Chase has employed its Global Capability Center in India to create digital platforms and improve customer services, with a focus on AI and machine learning solutions.

Core Banking Operations is projected to become the fastest-growing segment within GCCs for the BFSI market, due to the demand for centralized and efficient management of functions like loan processing, account management, and payment systems. It allows financial institutions to keep a single, centralized platform for essential services, leading to improved customer experience and more efficient processes. The increasing use of cloud-based core banking systems continues to speed up this expansion. For example, Citi has utilized its GCCs to automate and oversee essential banking tasks, improving the efficiency of loan approval and transaction processing times.

By Technology:

The digital payments & fintech solutions segment led the market in 2023 with a major market share, mainly driven by the Digital Payments & Fintech Solutions segment. The increasing popularity of this sector is fueled by the rising demand for electronic payments, mobile banking, and digital wallets, especially in the GCC area. The popularity of digital banking services, like contactless payments and real-time fund transfers, is driven by the young population and high smartphone usage in the region. Businesses and consumers in the GCC benefit from secure digital payment gateways provided by companies such as PayTabs, ensuring smooth transactions. Moreover, Ripple offers blockchain solutions for international payments, simplifying money transfers in the area.

Artificial Intelligence (AI) & Machine Learning (ML) is projected to become the fastest-growing segment in the GCCs in the BFSI market during 2024-2032. The use of AI and ML is growing for custom banking experiences, evaluating risks, and detecting fraud. These technologies help banks examine extensive amounts of data, offering anticipatory perspectives and streamlining intricate decision-making processes. For instance, Emirates NBD uses AI-powered chatbots to improve customer service and simplify inquiries. In addition, HSBC utilizes ML algorithms to enhance anti-money laundering (AML) and compliance screenings, resulting in quicker detection of suspicious transactions.

By Company Size

Large size segment dominated the market in 2023 with a 73% market share because of their abundant resources and skill in handling major operations. GCCs are frequently utilized to consolidate back-office tasks, optimize operations, and improve customer interactions across various locations. This allows them to lower expenses and enhance productivity, leading to a more powerful worldwide influence. Major global banks and insurance companies, like JPMorgan Chase and AXA, use GCCs for tasks such as risk management, data analysis, and intricate financial modeling to stay ahead in the international market by making use of their extensive resources.

The small and mid-size segment is anticipated to become the fastest-growing segment during 2024-2032. These companies frequently concentrate on specialized financial services and solutions tailored to meet particular market requirements. They also use GCCs to reduce costs and expand operations without making large infrastructure investments. Instances of fintech startups and regional banks utilizing GCCs to create mobile banking apps or to improve customer satisfaction with chatbots.

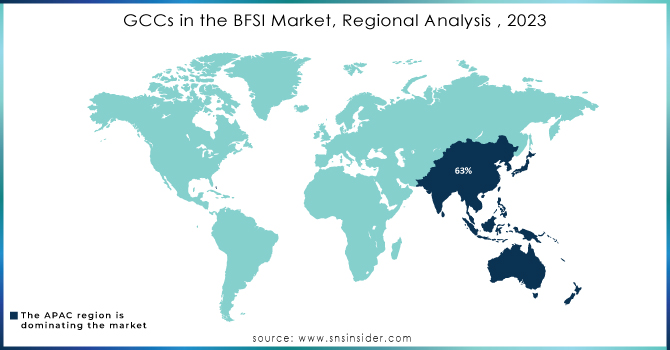

GCCs in the BFSI Market Regional Analysis

The APAC region held the major market share of 63% in 2023 and led the market, due to its vast population and rapidly expanding economies like China, India, and Southeast Asia, holds a dominant position in the GCC BFSI market. The rise of digital banking, fintech innovations, and increased investment in advanced technologies like AI and blockchain drive growth. Countries in the APAC region are leveraging GCCs to improve customer engagement, streamline operations, and enhance service offerings. Companies like Tencent and Ant Group in China, and Infosys in India, are utilizing GCCs to enhance financial inclusion and develop seamless banking experiences.

Although India is still a popular choice because of its large skilled workforce and cost benefits, many other countries also offer attractive opportunities for Global Capability Centers (GCCs). The Philippines is famous for its proficient English speakers and vast expertise in Business Process Outsourcing (BPO), specifically in IT and customer service fields. Poland is becoming increasingly popular for IT services due to its strong presence of technical graduates and convenient integration for European operations. Ireland provides attractive corporate tax rates and a talented workforce specializing in IT, pharmaceuticals, and finance. Malaysia is known for its strong infrastructure and attractive government benefits, particularly in the fields of IT and HR services. Vietnam's burgeoning economy and affordable prices make it appealing for IT and software development. Mexico enjoys advantages from being near the United States and having a strong manufacturing industry. Romania is known for its robust technical education system and affordable prices, especially in the field of IT services. In conclusion, Canada has a well-educated workforce and a good quality of life, making it an attractive destination for the technology and finance industries.

Need Any Customization Research On GCCs in the BFSI Market - Inquiry Now

Key Players in GCCs in the BFSI Market

The major key players in the GCCs in the BFSI Market are:

-

Accenture (Digital Banking Solutions, Fraud Detection Services)

-

Cognizant (Cognizant Banking Platform, Insurance Services)

-

TCS (Tata Consultancy Services) (TCS BaNCS, TCS iON)

-

Infosys (Finacle Banking Solution, Infosys Risk and Compliance Management)

-

Wipro (Wipro HOLMES, Wipro’s Digital Banking Suite)

-

HCL Technologies (HCL Banking and Financial Services, HCL Cybersecurity Services)

-

Capgemini (Capgemini Financial Services Solutions, Capgemini Digital Insurance Services)

-

IBM (IBM Watson Financial Services, IBM Cloud for Financial Services)

-

Deloitte (Deloitte Digital Banking, Risk Management Solutions)

-

EY (Ernst & Young) (EY Financial Services Advisory, EY Risk Transformation)

-

KPMG (KPMG Digital Transformation, KPMG Regulatory Services)

-

FIS (FIS Modern Banking Platform, FIS Risk and Compliance Management)

-

SAS (SAS Analytics for Banking, SAS Fraud Management)

-

Oracle (Oracle Financial Services Analytical Applications, Oracle Banking Digital Experience)

-

SAP (SAP Banking Services, SAP Financial Services)

-

MUFG (Mitsubishi UFJ Financial Group) (MUFG Banking Solutions, MUFG Digital Transformation)

-

Standard Chartered (Standard Chartered FinTech Investments, SC Ventures)

-

BNP Paribas (BNP Paribas Digital Banking Solutions, BNP Paribas Corporate & Institutional Banking)

-

JP Morgan Chase (JP Morgan Payments, JPMorgan Digital Banking)

-

HSBC (HSBC Global Banking and Markets, HSBC Digital Solutions)

-

American Express (Payment Solutions, Fraud Detection Services)

-

Visa (Payment Processing Solutions, Risk Management Solutions)

-

Mastercard (Payment Gateway Services, Data Analytics Solutions)

-

PayPal (Digital Wallet Services, Merchant Solutions)

-

BNY Mellon (Investment Management Services, Custody Solutions)

-

Goldman Sachs (Investment Banking Services, Asset Management Solutions)

Recent Developments

-

September 18, 2024: Global tech giant Microsoft spent close to about Rs 1,000 crore to acquire two land parcels in the IT district of Hinjewadi over the past two months in a strategic acquisition that will allow the technology major to establish its footprint in the country.

-

September 2, 2024: Bengaluru emerged as the talent magnet and one-stop destination for active talent with ideal skills for the BFSI Global Capability Centers according to the report. The city hosts about 35 percent of the country’s BFSI GCCs and boasts about having 26 percent of the active talent pool with mandatory/accommodative skills.

-

January 31, 2024: Mizuho Financial Group, Japan’s third-largest financial services group, established its Global Business Centre in Chennai. The Chennai center will play a vital role in managing high-end IT/ITeS such as Robotic Process Automation RPA, Artificial Intelligence AI, systems development, cybersecurity, and general banking operations.

| Report Attribute | Details |

|---|---|

| Market Size in 2023 | USD 40.43 Billion |

| Market Size by 2032 | USD 132.18 Billion |

| CAGR | CAGR of 12.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Core Banking Operations, Financial Services, Insurance Services, Actuarial Services, IT and Digital Services, Customer Support Services) • By Technology (AI & ML in Banking, Blockchain, Robotic Process Automation (RPA) in BFSI, Big Data and Analytics, Cloud Computing, Cybersecurity Solutions, Digital Payments, Fintech Solutions) • By Company Size (Small, Medium, Large) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Cognizant, TCS (Tata Consultancy Services), Infosys, Wipro, HCL Technologies, Capgemini, IBM, Deloitte, EY (Ernst & Young), KPMG, FIS, SAS, Oracle, SAP, MUFG (Mitsubishi UFJ Financial Group), Standard Chartered, BNP Paribas, JP Morgan Chase, HSBC, American Express, Visa, Mastercard, PayPal, BNY Mellon, Goldman Sachs |

| Key Drivers | • GCCs are increasingly favored by organizations in the BFSI sector due to their potential to significantly reduce operational costs. • The proliferation of GCCs in the BFSI sector is the access to a global talent pool. |

| RESTRAINTS | • Geopolitical tensions and regional instability affecting strategies for GCC BFSI institutions to mitigate risks and enhance financial stability. |