AI-Driven Pension Fund Analytics Market Report Scope & Overview:

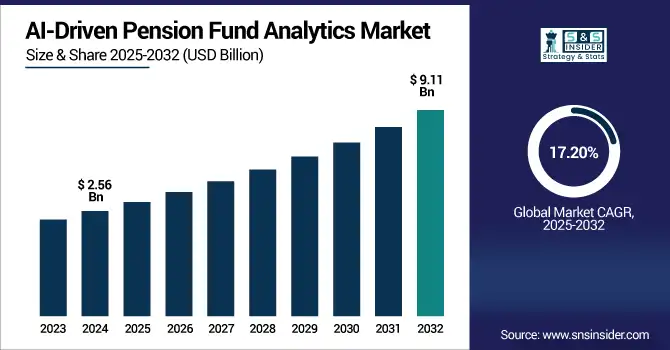

The AI-Driven Pension Fund Analytics Market size was valued at USD 2.56 billion in 2024 and is expected to reach USD 9.11 billion by 2032, expanding at a CAGR of 17.20% over the forecast period of 2025-2032.

To Get more information on AI-Driven Pension Fund Analytics Market - Request Free Sample Report

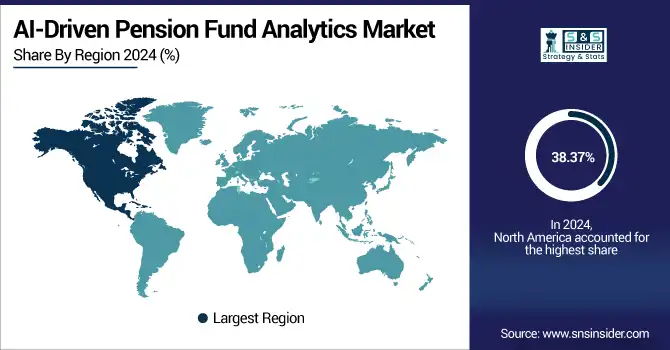

The AI-Driven Pension Fund Analytics market is growing at a fast pace as pension funds are increasingly using AI to make better decisions, mitigate risk, and grow returns. Machine learning, predictive analytics, and natural language processing functions enhance portfolio management, regulatory compliance, and performance analysis, among other factors. Applications include risk management, portfolio optimization, and reporting. Cloud services for scaling and performance are the most common reasons. The largest market is North America, while the fastest-growing market is Asia Pacific.

According to the research, AI and machine learning are becoming essential in investment decisions, with 73% of institutional investors embracing them. The other 67% have moved to cloud analytics, where increased process efficiencies have lowered post-investment reporting by 35-50% and mitigated potential reporting failures.

The U.S AI-Driven Pension Fund Analytics Market size reached USD 0.76 billion in 2024 and is expected to reach USD 2.54 billion in 2032 at a CAGR of 16.14% from 2025 to 2032.

The U.S. AI-Driven Pension Fund Analytics Market is primarily driven by an innovative financial ecosystem across the region, high adoption by solutions across asset management firms such as BlackRock, Fidelity, and Vanguard, and pension fund participants. Artificial intelligence is growing in use among American pension funds for risk analysis, regulatory compliance, and portfolio optimization. A growing need for transparency, faster processing of large data, and predictive modelling makes it essential to integrate AI tools into pension fund investment strategies. Finally, the U.S.'s existing leadership in AI pension analytics is further fueled by supportive government policies, digital transformation in financial services, a deep pool of talent, and tech infrastructure.

Market Dynamics

Drivers:

-

Increased Adoption of Predictive Analytics and AI for Pension Risk Management Drives Market Expansion.

The increasing dependence on predictive analytics and AI for managing long-term risk and improving pension fund performance is a major factor driving the AI-driven pension fund analytics market growth. As concerns over fund solvency and life expectancy have reached new heights, pension funds are now taking up AI to help with scenario analysis, asset-liability modeling, and actuarial forecasting.

According to research, with the adoption of AI-powered asset-liability modeling, Northern Trust has a 35% increase in portfolio stress-testing efficiency. 67% of large pension funds are now using cloud-based predictive analytics that allows real-time actuarial insights and improves decision-making.

Restraints:

-

High Costs of Implementation and Limited Technical Expertise Among Fund Managers Restrain Market Growth.

Despite its advantages, the adoption of AI-driven analytics in pension funds is hindered by the high initial cost of implementation, system integration complexity, and lack of in-house AI expertise. Smaller funds, in particular, face difficulties in justifying the investment without assured ROI. ongoing model updates, strict compliance-to-regulation alignment, and cybersecurity are essential and therefore deepen operational costs. The problem is compounded by the absence of competent AI talent with an understanding of financial modeling.

Opportunities

-

Rising Demand for Customized AI Models Among Institutional Investors Opens New Growth Opportunities.

This rise in demand for personalized models based on fund strategies and the region's regulatory landscape is opening up significant growth opportunities. The last few months, providers including Amundi and Mercer have introduced AI-based scenario simulation tools and environmental, social, and governance (ESG) compliance scoring vehicles specifically for pension plans. Asset managers are capitalizing on this by creating adaptable, goal-oriented investment models and balancing the nuanced needs of stakeholders with the transparency and control required.

Challenge:

-

Interpreting Complex Pension Data Across Multiple Systems and Legacy Platforms Remains a Key Challenge.

One of the critical challenges is aggregating and analyzing complex, unstructured data from fragmented legacy systems across various pension management platforms. Many pension funds operate with outdated infrastructure, limiting seamless data integration and model training. AI models require clean, standardized, and high-volume data for accurate predictions, which remains difficult to achieve in siloed or paper-based environments. Integrating real-time analytics with existing enterprise systems, while ensuring regulatory compliance, often requires expensive, long-duration digital transformation projects, further delaying market maturity.

Segment Analysis

By Component

The software segment held the largest AI-driven pension fund analytics market share at 64.47% in 2024, driven by rising demand for real-time data analytics, portfolio risk modeling, and actuarial forecasting tools. AI-based platforms offer automation, data visualization, and predictive analytics capabilities, enabling pension managers to optimize performance. AI-driven pension fund analytics market companies such as BlackRock and Vanguard have recently expanded their AI-integrated investment tools to offer dynamic asset allocation support and ESG screening capabilities.

The services segment is witnessing the fastest CAGR of 17.96%, attributed to the rising need for consulting, system integration, and AI customization among pension fund operators. As AI platforms become more sophisticated, organizations require expert support for deployment, regulatory alignment, and real-time portfolio analytics. This segment benefits from increasing complexity in investment regulations and the need for continuous compliance updates. The demand for professional guidance in AI-enabled decision-making is a key growth driver in this segment.

By Deployment Mode

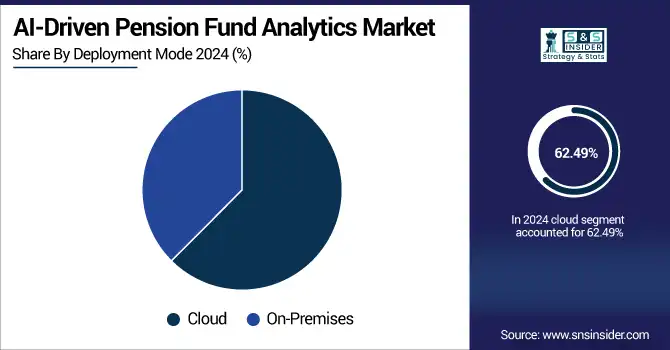

The cloud segment captured 62.49% of the total market revenue in 2024, owing to its scalability, low infrastructure cost, and ease of access to real-time analytics. Pension funds are increasingly transitioning to cloud-based platforms for enhanced performance benchmarking and risk modeling capabilities. The rising demand for flexible and secure fund analytics tools that allow remote collaboration and dynamic scalability is a core driver fueling cloud deployment.

The on-premises segment is forecasted to grow at a CAGR of 17.83%, driven by stringent data privacy regulations and the need for complete control over financial data among public institutions and large funds. Pension fund managers in government and defense sectors prefer on-site systems due to concerns over third-party data access. Companies like AXA Investment Managers and UBS Asset Management have invested in secure on-premise AI platforms for sensitive pension analytics. Security-driven AI deployment, especially in highly regulated regions, continues to push growth in this segment.

By Application

In 2024, the risk management segment led the market with 31.48% revenue share, underpinned by rising concerns over market volatility, inflation, and demographic shifts. AI-powered platforms are now essential for forecasting funding gaps, stress-testing investment strategies, and managing longevity risk. The drive for proactive decision-making, coupled with fiduciary accountability, is compelling funds to deploy AI solutions for risk scenario analysis. This segment’s growth is strongly supported by increasing regulatory scrutiny and the shift to forward-looking risk assessment models.

Portfolio optimization is the fastest-growing segment, projected at a CAGR of 18.46%. AI-powered tools facilitate dynamic asset rebalancing, adaptive sector allocation, and strategy optimization based on investment factors to improve pension fund returns. Vanguard and Robeco have recently rolled out AI-driven portfolio construction models that incorporate ESG, inflation sensitivity, and yield optimization. The demand for maximizing risk-adjusted returns in dynamic markets is a key driver.

By End-User

Public pension funds held a dominant share of 35.48% in 2024, driven by government-led initiatives to modernize retirement systems using AI and improve fund solvency. Public institutions are using AI analytics for liabilities forecasting, budget allocation, and regulatory reporting. Recent initiatives by U.S. state retirement systems and European pension boards have incorporated AI for dynamic fund allocation and performance benchmarking.

Private pension funds are projected to grow at a CAGR of 18.17%, as employers and fund managers adopt AI tools to deliver better investment returns and employee retirement planning. AI enables personalized fund recommendations, performance tracking, and risk-adjusted benchmarking for defined contribution schemes. Fidelity and Schroders have launched AI-enhanced pension interfaces for private firms. Rising competition, regulatory demands for fiduciary responsibility, and a shift towards goal-based pension planning are accelerating private fund adoption.

Regional Analysis

North America held the dominant share of 38.37% in 2024 in the AI-Driven Pension Fund Analytics market due to the early adoption of AI technologies, large pension assets under management, and the presence of advanced financial institutions. Regulatory initiatives promoting transparency and digital transformation across public and private pension funds have further propelled regional demand for intelligent analytics solutions. The United States leads the region with its strong fintech ecosystem, robust investment in AI innovation, and the scale of pension fund operations, including major players such as CalPERS and BlackRock, integrating AI for portfolio optimization and risk modeling.

Europe is witnessing steady adoption of AI-driven analytics across pension funds, supported by strict regulatory frameworks such as MiFID II and ESG compliance. Institutions are leveraging AI to improve risk governance, actuarial accuracy, and long-term sustainability of pension liabilities. Germany dominates due to its strong public pension infrastructure, increasing digital investment in finance, and emphasis on algorithmic compliance tools for risk and performance management.

Asia Pacific is the fastest-growing region with a CAGR of 20.38% in 2024, driven by rapid digitalization, rising pension fund assets, and increased government support for AI-based financial reforms. Countries are adopting AI for asset forecasting, real-time reporting, and demographic-based risk modeling. China is the leading country due to its government-driven AI strategy, massive public pension fund base, and integration of AI in financial infrastructure through platforms like Ant Group and Ping An.

The Middle East & Africa and Latin America are emerging markets for AI-driven pension fund analytics, focusing on improving fund governance, fraud detection, and demographic forecasting. The UAE leads MEA with AI-integrated public funds, while Brazil dominates Latin America through fintech partnerships and pension reform-driven digital innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the AI-Driven Pension Fund Analytics Market are BlackRock, State Street Global Advisors, Northern Trust, Mercer, Aon, JP Morgan Asset Management, Fidelity Investments, Vanguard Group, Allianz Global Investors, UBS Asset Management, and others.

Key Developments

-

In June 2025, BlackRock launched Asimov, an AI-powered virtual investment analyst designed to analyze research notes, filings, and emails, offering deeper portfolio insights and enhancing decision-making across its asset management and pension fund analytics services.

-

In June 2025, BlackRock, through its JioBlackRock Mutual Fund venture, introduced its flagship AI-powered platform Aladdin in India, enhancing portfolio management and risk analytics capabilities for institutional investors entering the country’s rapidly evolving financial market.

-

In March 2025, BlackRock, Microsoft, NVIDIA, and other partners expanded their AI Infrastructure Partnership, pledging investments in advanced AI data centers and sustainable energy infrastructure to support the growing demand for large-scale AI deployments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.56 Billion |

| Market Size by 2032 | USD 9.11 Billion |

| CAGR | CAGR of 17.20% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software, Services) •By Deployment Mode (On-Premises, Cloud) •By Application (Risk Management, Portfolio Optimization, Regulatory Compliance, Performance Analysis, Reporting, Others) •By End-User (Public Pension Funds, Private Pension Funds, Corporate Pension Funds, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BlackRock, State Street Global Advisors, Northern Trust, Mercer, Aon, JP Morgan Asset Management, Fidelity Investments, Vanguard Group, Allianz Global Investors, UBS Asset Management. |