Business Travel Market Analysis & Overview:

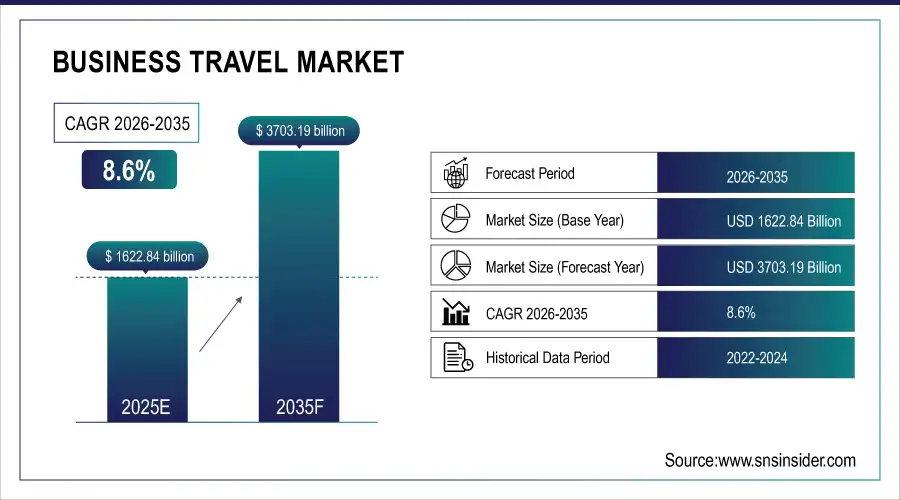

Business Travel Market Size was valued at USD 1622.84 Billion in 2025 and is expected to reach USD 3703.19 billion by 2035, growing at a CAGR of 8.6%.

Governments worldwide are actively supporting the sector through policies and incentives aimed at reducing travel costs and enhancing accessibility. With the demand for seamless corporate travel on the rise, infrastructure modernization projects which include high-speed rail networks and airport upgrades, have gained priority across Europe. In emerging economies such as India, business travel expenditures have risen by 15%, due in part to government initiatives like "Make in India" that promote manufacturing and export activity. China has also experienced a surge in corporate travel, leaving thousands of companies with no choice but to provide transportation for its Belt and Road Initiative, facilitating multilateral cooperation in Asia, Africa, and Europe. With these trends and heightened reliance on the in-person meetings needed for negotiations, mergers, and partnerships, business travel is shown to be the backbone of economic growth and international connectivity.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 1622.84 Billion

-

Market Size by 2035 USD 3703.19 Billion

-

CAGR of 8.6% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Business Travel Market - Request Free Sample Report

Business Travel Market Trends:

-

Rising investment in travel risk management systems to enhance employee safety amid global uncertainties.

-

Growing adoption of real-time location tracking, automated alerts, and integrated health notifications in travel management platforms.

-

Implementation of travel safety dashboards to monitor employee whereabouts and provide rapid crisis response.

-

Increased focus on duty-of-care compliance and employee wellness initiatives in corporate travel programs.

-

Expansion of technology-driven proactive travel safety measures in industries with high travel demands, such as consulting and multinational operations.

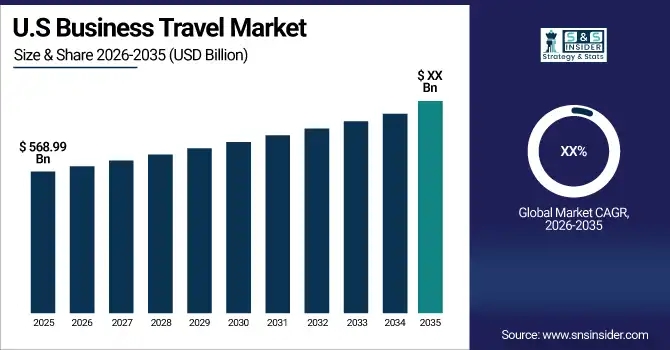

The U.S. Business Travel Market is projected to grow from USD 568.99 billion in 2025. Growth is driven by increasing corporate globalization, rising employee travel requirements, adoption of digital travel management solutions, focus on duty-of-care and traveler safety, and investments in technology-enabled booking, expense management, and real-time risk monitoring platforms.

Business Travel Market Growth Drivers:

Advanced safety technologies for business travel are a really important trend that is reshaping the industry. In 2025, companies are increasingly investing in travel risk management systems to prioritize employee safety amid a volatile global landscape. A recent survey revealed that 40% of employees expressed concerns about safety during work-related trips, while 41% indicated they had never received comprehensive risk information about their travel destinations. In response, organizations are using technologies like real-time location awareness, automated notifications of geopolitical threats, and integrated health alerts in travel management solutions. For example, organizations now utilize platforms that offer real-time information regarding travel restrictions, weather disruptions, and localized threats. Such tech empowers pre-emptive decisions and on-the-spot crisis support. A notable example is the deployment of "travel safety dashboards," which allow managers to monitor employees' whereabouts and ensure swift responses to emergencies. Industries with high travel needs, such as consulting and multinational operations, have significantly benefited from these advancements. This is particularly useful for industries with extensive travel demands, like consulting and multinational business, which have greatly benefited from these developments.

Business Travel Market Restraints:

One significant restraint in the business travel market is the rise in operational costs due to inflation and increasing service prices. Airlines and hotels have renegotiated contracts post-pandemic, often with less favorable terms for corporate buyers. Although some companies have mandates requiring a return to travel, many struggle with the need to balance the demand for travel against the challenges of responsibly managing elevated costs. For instance, Companies are investing extra hours and effort into their budgets to integrate higher ticket and hotel prices and stay efficient. As a result, organizations have been forced to change their travel policies, which frequently involve tighter budget constraints or less travel.

Business Travel Market Segment Analysis:

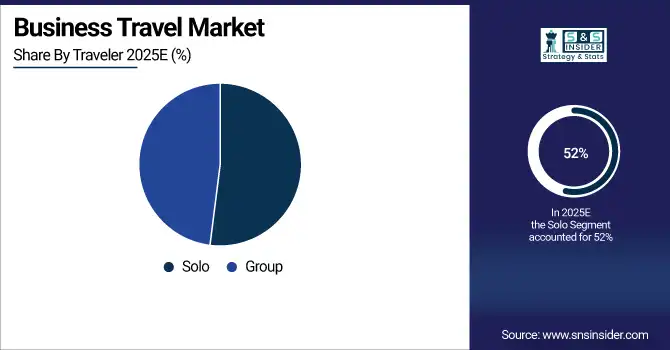

By Traveler

The solo segment accounted for the largest revenue share of 52% in 2025 due to several factors, including the restructuring of businesses in the current climate as well as the increasing importance of cost-effective travel. It is certainly no secret that many of the high-growth industries like technology, finance, and consulting, expect their professionals to travel independently to meetings, conferences, and site visits. According to the U.S. Bureau of Labor Statistics, more than 62% of the personnel in these professions traveled alone on business trips in 2025, which reflects the importance and efficacy of business trips that occur in the form of solo traveling in the corporate world today. The logistical simplicity of solo travel is a significant advantage, allowing companies to minimize coordination efforts and travel costs. These are sustainability measures that many firms have been implementing and solo travel usually caters to their purpose better than group travel as it uses fewer resources. In addition, regional governments like Asian Pacific authorities have enforced policies for small and medium enterprises (SMEs) to enhance travel business development during solo travels. Japan’s Ministry of Land, Infrastructure, Transport, and Tourism has established grants to help small and medium enterprises (SMEs) send representatives abroad on various business missions.

By Purpose

In 2025, business travel for marketing purposes accounted for nearly 36% of the market revenue share, owing to the need to uphold competitive benefits across industries. This includes everything from trade shows to product launches and networking events to client meetings. In 2025, almost 45% of small and medium enterprises (SMEs) in the European Union observed an increase in travel budgets allocated to marketing to enhance exports and expand international market presence in the EU as per the European Commission. This increase correlates with increased competition and the need for a more personal touch in every interaction to win the trust and fidelity of clients. This segment is also being boosted by governments from developing regions. In ASEAN, for example, several incentives have been introduced, such as lower tariffs and subsidies to companies at international trade fairs and exhibitions.

By Industry

The corporate sector was the largest contributor to the business travel market in 2025, capturing 65% of the total revenue. This dominance is primarily due to the global growth of MNCs, which depend on international business travel to continue operating, establish new partnerships, and execute mergers and acquisitions. The sector relied on face-to-face meetings to ensure collaborative decision-making across borders, with corporate employees making up 72% of all business travel in 2025, according to the International Labour Organization (ILO). Industries such as IT, finance, and consulting are particularly dependent on frequent interregional and international travel, given their need to maintain close communication with clients and stakeholders. Similarly, governments of developed nations also encourage corporate travel with tax deductions and subsidies for expenses related to cross-border business transactions. As an example, the UK grants tax relief for companies engaged in export-oriented business, clearly appreciating that a continued presence of corporate travel creates benefits for the economy.

Business Travel Market Regional Analysis:

Asia Pacific Business Travel Market Insights

The Asia-Pacific market will be dominated with a 34% market share in 2025. However, in countries such as China and India the growing economy, urbanization, and the development of small and medium-sized enterprises (SMEs) have promoted business travel. Data from China’s Ministry of Culture and Tourism indicates that corporate travel in the country increased by 22% in 2023, reflecting its role as a global manufacturing and business hub. The business travel segment in India also saw a good amount of growth as several government policies were supporting this area of work such as rendering assistance through export promotion schemes and infrastructure improvements. With the emergence of many economies and supportive policies, Asia-Pacific is a cornerstone of growth in the business travel market. On the other hand, the global business travel market is growing with the fastest CAGR during the forecast period 2026-2035. Is primarily due to a well-established corporate ecosystem, a high frequency of business travel, and large investments in infrastructure made in the region. Business travel expenditures increased 14% in the U.S. in 2025 amid a strong economy and growing in-person events and meetings this year, according to the U.S. Travel Association. In much the same way, corporate travel in Canada also grew as a result of their trade agreements, with the business side of the country being active in global markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Business Travel Market Insights

In North America, the business travel market is highly developed and dominated by corporate travel demand across consulting, IT, finance, and multinational sectors. Organizations are increasingly adopting advanced travel management platforms, integrating real-time risk monitoring, safety alerts, and cost optimization tools. Growing focus on employee well-being, compliance with duty-of-care regulations, and digital travel solutions is reshaping corporate travel strategies. The U.S. leads regional growth due to a mature corporate ecosystem and extensive adoption of technology-driven travel solutions.

Europe Business Travel Market Insights

Europe’s business travel market is driven by multinational corporations, financial hubs, and consulting services. Companies are prioritizing travel risk management, real-time alerts, and sustainable travel practices to ensure employee safety and compliance. Adoption of digital platforms for bookings, reporting, and expense management is increasing. Countries such as Germany, the U.K., and France lead in corporate travel technology integration. Regulatory frameworks emphasizing duty-of-care obligations and environmental responsibility further support growth and modernization of business travel operations across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Business Travel Market Insights

In LATAM and MEA, the business travel market is expanding due to rising corporate activity, regional trade, and multinational operations. Companies are gradually adopting digital travel management solutions and travel risk monitoring tools to address safety, health, and geopolitical concerns. Brazil, Mexico, Saudi Arabia, and UAE are key contributors to regional growth. Increasing corporate travel volumes, investments in employee safety technologies, and focus on duty-of-care compliance are expected to drive further adoption of advanced travel platforms over the next decade.

Competitive Landscape for Business Travel Market:

Spotnana Technology, Inc is a cloud‑native business travel platform that simplifies corporate travel management by unifying booking, payments, and traveler support. It leverages modern technology to offer real‑time visibility, policy compliance, and integrated travel risk features, enabling companies to streamline operations, enhance traveler safety, and reduce costs in the evolving business travel landscape.

-

In March 2024, Spotnana Technology, Inc. released a next-gen corporate travel tool with customizable travel windows, travel policies, forms of payment, and more to further enhance services to customers

MakeMyTrip is a leading online travel company offering end-to-end business travel solutions, including flight, hotel, and corporate bookings. Its platform integrates expense management, policy compliance, and real-time travel updates, enabling organizations to streamline operations, enhance traveler safety, and improve efficiency while supporting digitalization and cost optimization in the business travel market.

-

Jan 2024, MakeMyTrip with this Philosophy partnered with the solution provider Zoho to manage the Air travel and Expense management seamlessly catering to the business with the right set of offerings.

Business Travel Market Key Players:

-

Amadeus IT Group (Amadeus Cytric Travel, Amadeus Altéa)

-

SAP Concur (Concur Expense, Concur Travel)

-

Egencia (Egencia Travel Suite, Egencia Analytics Studio)

-

TravelPerk (FlexiPerk, GreenPerk)

-

Spotnana Technology, Inc. (Corporate Travel Tool, Booking Management System)

-

Carlson Wagonlit Travel (CWT) (CWT MyCWT, CWT AnalytIQs)

-

Booking.com for Business (Booking.com Platform, Business Travel Solutions)

-

Expedia Group (Expedia Partner Solutions, Egencia Integrations)

-

American Express Global Business Travel (Amex GBT) (Neo Travel Platform, GBT Insights)

-

Sabre Corporation (GetThere, Sabre Red 360)

-

MakeMyTrip

|

Report Attributes |

Details |

|---|---|

| Market Size in 2025 | USD 1622.84 Billion |

| Market Size by 2035 | USD 3703.19 Billion |

| CAGR | CAGR of 8.6% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Traveler (Solo, Group) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Amadeus IT Group, SAP Concur, Egencia, TravelPerk, Spotnana Technology, Inc., Carlson Wagonlit Travel (CWT), Booking.com for Business, Expedia Group, American Express Global Business Travel (Amex GBT), Sabre Corporation |