AI in Gaming Market Report Scope & Overview:

The AI in Gaming Market was valued at USD 4.54 billion in 2025 and is expected to reach USD 81.19 billion by 2035, growing at a CAGR of 33.57% from 2026-2035.

The AI in Gaming Market is growing due to increasing demand for immersive and personalized gaming experiences, AI-powered NPC behavior, and procedural content generation. Rising adoption of AR/VR, cloud gaming, and eSports, combined with advanced analytics, predictive modeling, and real-time player personalization, is accelerating market expansion. Growing investments by game developers and technological advancements in AI further drive rapid global growth and innovation across gaming platforms.

For example, Microsoft Azure supports cloud gaming with AI upscaling in Xbox Cloud, reaching 20 million Game Pass users for predictive personalization, while Roblox leverages generative AI to enable custom experiences for 70 million daily users through its Creator Roadmap updates.

AI in Gaming Market Size and Forecast

-

AI in Gaming Market Size in 2025: USD 4.54 Billion

-

AI in Gaming Market Size by 2035: USD 81.19 Billion

-

CAGR: 33.57% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on AI in Gaming Market - Request Free Sample Report

AI in Gaming Market Trends

-

Rising demand for immersive and personalized gaming experiences is driving the AI in gaming market.

-

Growing adoption of AI for procedural content generation, NPC behavior, and real-time decision-making is boosting market growth.

-

Expansion across console, PC, and mobile gaming platforms is fueling deployment.

-

Increasing focus on player engagement, retention, and adaptive difficulty is shaping adoption trends.

-

Advancements in machine learning, computer vision, and natural language processing are enhancing realism and interactivity.

-

Rising investments by game developers and studios in AI-driven tools are supporting market expansion.

-

Collaborations between AI technology providers, game studios, and cloud gaming platforms are accelerating innovation and global adoption.

U.S. AI in Gaming Market was valued at USD 1.17 billion in 2025 and is expected to reach USD 20.51 billion by 2035, growing at a CAGR of 33.12% from 2026-2035.

The U.S. AI in Gaming Market is growing due to increasing adoption of AI for immersive gameplay, NPC behavior, procedural content generation, and personalization, supported by advanced gaming infrastructure, cloud platforms, AR/VR integration, and rising demand for innovative, engaging player experiences.

For instance, NVIDIA’s ACE suite powers AI-driven NPCs in over 50 U.S.-developed titles, delivering lifelike behaviors with 99% natural language accuracy via cloud inference.

Unity has reported 1.2 million ML-Agents downloads in North America, enabling procedural generation that speeds up level design by 40% in studios like Epic.

Additionally, Google Cloud notes that 90% of surveyed U.S. game developers integrate AI workflows, tripling dynamic content creation through Vertex AI.

AI in Gaming Market Growth Drivers:

-

Increasing integration of AI technologies is enhancing gaming experiences, enabling realistic NPC behavior and personalized player interactions globally

The AI in Gaming Market is driven by the rising demand for immersive and engaging gameplay. AI enables dynamic NPC behavior, procedural content generation, and intelligent game adaptation, enhancing realism. Developers utilize AI for predictive analytics, player personalization, and in-game decision-making. Gamers increasingly seek responsive, adaptive, and interactive experiences. Integration of AI in mobile, console, and PC games improves user engagement, retention, and monetization. The combination of cloud-based solutions, AI-powered analytics, and machine learning is driving innovation and adoption of AI technologies across the global gaming industry.

For example, Microsoft Azure integrates AI upscaling for Xbox Cloud’s 25 million users, enhancing AR/VR immersion and decision-making in eSports, while Epic’s Unreal Engine 5 MetaHuman technology supports hyper-realistic NPCs in over 10 million projects, boosting player retention and engagement.

AI in Gaming Market Restraints:

-

High implementation costs and technical complexity are limiting adoption of AI technologies across small and medium-sized game development studios

Integrating AI in gaming requires advanced infrastructure, skilled developers, and substantial investment in software and hardware. Smaller studios often lack resources to deploy AI solutions effectively, limiting adoption. Complex algorithm integration, machine learning model training, and cross-platform compatibility add technical challenges. Cost of cloud-based AI platforms and ongoing maintenance further constrain budget-conscious developers. Additionally, balancing performance optimization with AI functionality can be difficult for multi-platform games. These financial and operational barriers restrict the widespread deployment of AI technologies, slowing growth in segments dominated by smaller or mid-sized game development studios.

For example, Unity reports that ML-Agents setups demand GPU clusters costing over USD 10,000 annually for training complex NPC models, posing challenges for studios with fewer than 10 developers.

Similarly, NVIDIA’s ACE cloud inference starts at USD 0.50/hour per instance, totaling more than USD 50,000 yearly for mid-sized procedural projects, making it unaffordable for 70% of indie studios.

AI in Gaming Market Opportunities:

-

Expansion of cloud gaming and streaming platforms provides opportunities for AI technologies to enhance real-time player experiences

Cloud gaming adoption is growing, creating opportunities for AI to deliver seamless, adaptive, and personalized gaming experiences. AI can optimize graphics rendering, latency management, and dynamic content generation on cloud platforms. Real-time analytics powered by AI enable personalized challenges, NPC interactions, and in-game recommendations. Developers can also leverage AI to monitor player behavior, prevent cheating, and enhance multiplayer experiences. The convergence of AI and cloud gaming allows for scalable, high-quality gameplay across devices, opening significant opportunities for developers, service providers, and platform operators globally to innovate and attract new gamer segments.

For example, NVIDIA GeForce Now integrates ACE to enable cloud-based NPC conversations across 100+ games with 99% response accuracy over 1 billion hours streamed, while Amazon Luna uses AWS AI for predictive matchmaking, increasing retention by 30% in multiplayer sessions.

AI in Gaming Market Segment Highlights

-

By Game, Mobile Games dominated with ~42% share in 2025; AR/VR Games fastest growing (CAGR).

-

By Platform, Mobile dominated with ~50% share in 2025; Console fastest growing (CAGR).

-

By Application, NPC Behavior Modeling dominated with ~21% share in 2025; Procedural Content Generation fastest growing (CAGR).

AI in Gaming Market Segment Analysis

By Platform, Mobile segment dominates the Market, Console segment is expected to grow fastest

Mobile segment dominated the AI in Gaming Market in 2025 due to its large user base, wide accessibility, and seamless compatibility with AI-driven features. AI enhances gameplay through predictive behavior, personalization, and real-time analytics, improving engagement and retention. The convenience of mobile platforms continues to drive adoption and maintain market leadership globally.

Console segment is expected to grow fastest from 2026-2035 due to advanced gaming hardware, AI-powered realistic graphics, and increasing demand for immersive gameplay experiences. Developers integrate AI for adaptive challenges, dynamic environments, and personalized interactions. Rising popularity of high-performance consoles and premium gaming content accelerates AI adoption, positioning console gaming as a rapidly expanding segment worldwide.

By Application, NPC Behavior Modeling segment dominates the Market, Procedural Content Generation segment is expected to grow fastest

NPC Behavior Modeling segment dominated the AI in Gaming Market in 2025 as developers leverage AI to create intelligent, adaptive, and realistic in-game characters that respond dynamically to player actions. This enhances engagement, immersion, and game complexity, making AI-driven NPCs crucial for modern gameplay and maintaining high user retention across various gaming platforms.

Procedural Content Generation segment is expected to grow fastest from 2026-2035 due to increasing demand for AI-powered dynamic, scalable, and personalized game environments. Developers use AI to generate unique levels, assets, and scenarios automatically, enhancing replayability and immersion. Rising adoption in mobile, console, AR/VR, and cloud-based games fuels rapid expansion and innovation in this segment globally.

By Game, Mobile Games segment dominates the Market, AR/VR Games segment is expected to grow fastest

Mobile Games segment dominated the AI in Gaming Market in 2025 due to widespread smartphone adoption, low entry barriers, and high accessibility among global users. Developers utilize AI to provide personalized experiences, real-time in-game analytics, adaptive gameplay, and enhanced engagement. The convenience of mobile platforms and large user base drives consistent revenue and market dominance.

AR/VR Games segment is expected to grow fastest from 2026-2035 as immersive technologies, AI-driven realistic environments, and interactive gameplay attract gamers. Increasing investment in AR/VR hardware, rising popularity of immersive experiences, and AI-powered procedural content generation enhance engagement. Growing adoption across entertainment, education, and training applications fuels rapid expansion in this segment globally.

AI in Gaming Market Regional Analysis

North America AI in Gaming Market Insights

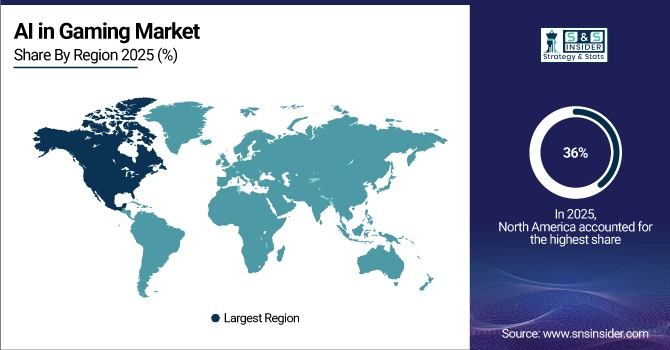

North America dominated the AI in Gaming Market with the highest revenue share of about 36% in 2025 due to advanced technological infrastructure, high internet penetration, and strong presence of major gaming companies. The region’s extensive adoption of AI in mobile, console, and PC games, coupled with investments in cloud gaming, eSports, and AR/VR technologies, drives market dominance. Consumers’ demand for immersive, high-quality gaming experiences further supports widespread integration of AI-powered features across various platforms and game genres.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific AI in Gaming Market Insights

Asia Pacific segment is expected to grow at the fastest CAGR of about 35.03% from 2026-2035 due to rapid digital adoption, increasing smartphone penetration, and growing interest in gaming and eSports. Rising investments in AI technologies, AR/VR, and cloud gaming infrastructure, combined with a large, tech-savvy population, are accelerating AI integration. The region’s expanding mobile gaming market, government support for digital innovation, and increasing popularity of immersive AI-driven experiences are fueling rapid market growth and adoption.

Europe AI in Gaming Market Insights

Europe in the AI in Gaming Market is witnessing steady growth due to widespread adoption of AI technologies across mobile, console, and PC gaming. Strong presence of established gaming companies, focus on digital transformation, and investments in AR/VR and cloud gaming drive demand. Increasing interest in eSports, AI-powered NPCs, and personalized gameplay experiences further supports market expansion, making Europe a significant contributor to global AI gaming adoption.

Middle East & Africa and Latin America AI in Gaming Market Insights

The Middle East & Africa and Latin America AI in Gaming Market are growing steadily due to rising digital adoption, increasing internet penetration, and expanding gaming communities. Adoption of AI for personalized gameplay, NPC behavior, and procedural content generation is accelerating. Investments in mobile and cloud gaming, along with growing interest in eSports and immersive experiences, are driving market growth, creating opportunities for developers and AI solution providers in these regions.

AI in Gaming Market Competitive Landscape:

Roblox Corporation

Roblox is an online platform that allows users to create, share, and play immersive experiences. Its ecosystem empowers developers with tools for game design, scripting, and monetization, fostering a global creator community. Roblox emphasizes user-generated content, interactive experiences, and now AI integration to automate asset creation, coding, and animation, improving workflow efficiency and enabling richer, more personalized gaming environments. Its AI initiatives focus on supporting creators while enhancing the platform’s scalability and immersive engagement.

-

2023: Roblox announced generative AI tools, including Code Assist and Material Generator, to automate coding and asset creation in Roblox Studio, simplifying immersive experience development.

-

2024: Roblox released an enhanced generative AI suite for creators, improving animation, scripting, and texture workflows, enabling more efficient development of immersive experiences.

-

2025: At Roblox Developers Conference, Roblox unveiled AI, monetization, and performance innovations, supporting creators with enhanced AI tools and creator economy enhancements.

Microsoft Corporation

Microsoft, through its Xbox and Research divisions, develops gaming platforms, AI tools, and cloud services. It focuses on improving game development, player experiences, and interactive entertainment with AI-powered tools. Microsoft integrates generative AI to assist with game prototyping, visual creation, and controller actions, accelerating development cycles and expanding creative possibilities. Its initiatives, such as Muse and WHAMM, demonstrate the company’s commitment to reshaping gaming workflows, interactive storytelling, and real-time gameplay experiences using advanced AI technologies.

-

2025: Microsoft released Muse, a generative AI model for gameplay ideation, producing visuals and controller actions to help developers prototype games and empower creative workflows.

-

2025: Microsoft showcased WHAMM, a real-time generative AI model playable online, generating interactive gameplay visuals and demonstrating AI’s potential to reshape gaming experiences.

Ubisoft Entertainment SA

Ubisoft is a global video game publisher and developer known for franchises like Assassin’s Creed and Far Cry. The company focuses on innovative gameplay, immersive storytelling, and interactive experiences. Ubisoft integrates AI to enhance non-player character (NPC) behavior, adapt gameplay dynamically, and improve player engagement. Its generative AI initiatives, including the “Teammates” project, aim to create companions that respond intelligently to speech, mood, and gameplay, reflecting Ubisoft’s commitment to evolving AI-driven interactive experiences and immersive game worlds.

-

2025: Ubisoft announced “Teammates,” a generative AI initiative evolving prior AI NPC technology to deliver adaptive companions reacting to speech, moods, and gameplay dynamics.

AI in Gaming Market Key Players

Some of the AI in Gaming Market Companies

-

Electronic Arts Inc.

-

NVIDIA Corporation

-

Unity Technologies

-

Epic Games Inc.

-

Google LLC

-

Ubisoft Entertainment SA

-

Sony Interactive Entertainment

-

Tencent Holdings Ltd.

-

Activision Blizzard Inc.

-

Amazon Web Services (AWS)

-

Valve Corporation

-

Take-Two Interactive Software Inc.

-

Bandai Namco Entertainment Inc.

-

Square Enix Holdings Co., Ltd.

-

Konami Holdings Corporation

-

NetEase Games

-

Riot Games

-

Roblox Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.54 Billion |

| Market Size by 2033 | USD 45.88 Billion |

| CAGR | CAGR of 33.68% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Mobile, Console, PC) • By Application (Non-Player Character (NPC) Behavior Modeling, Game Testing & Quality Assurance Automation, Procedural Content Generation, Speech & Voice Recognition for Commands, Cheat Detection & Fraud Prevention, Player Behavior Prediction & Personalization, Others) • By Game (Mobile Games, PC Games, Console Games, AR/VR Games, Cloud Games/Streaming Games, eSports & Competitive Multiplayer Games) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Electronic Arts Inc., NVIDIA Corporation, Unity Technologies, Epic Games Inc., IBM Corporation, Google LLC, Ubisoft Entertainment SA, Sony Interactive Entertainment, Tencent Holdings Ltd., Activision Blizzard Inc., Amazon Web Services (AWS), Valve Corporation, Take-Two Interactive Software Inc., Bandai Namco Entertainment Inc., Square Enix Holdings Co., Ltd., Konami Holdings Corporation, NetEase Games, Riot Games, Roblox Corporation |