AI Shopping Assistant Market Analysis & Overview:

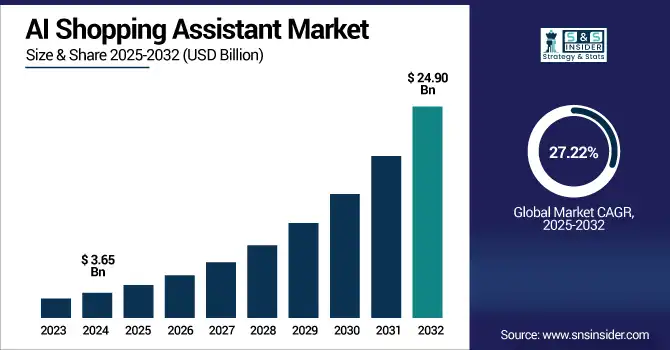

AI Shopping Assistant Market was valued at USD 3.65 billion in 2024 and is expected to reach USD 24.90 billion by 2032, growing at a CAGR of 27.22% from 2025-2032.

To Get more information on AI Shopping Assistant Market - Request Free Sample Report

The AI Shopping Assistant Market is experiencing rapid growth due to increasing consumer demand for personalized and seamless shopping experiences.

-

According to Salesforce, 70% of consumers now expect AI-enhanced personalized retail experiences, and 63% are more likely to purchase from retailers offering them.

Retailers and e-commerce platforms are adopting AI-driven solutions to enhance customer engagement, improve conversion rates, and streamline product discovery through voice, text, and visual interfaces.

-

A McKinsey study shows that AI-driven personalization can boost revenues by up to 40%.

The rise of omnichannel retail, advancements in natural language processing and machine learning, and growing smartphone and internet penetration are further fueling adoption.

-

Salesforce also reports that 36% of retail employees currently use generative AI, with adoption projected to reach 45% by the end of 2025. Additionally, 93% of retailers use AI for personalization, and 81% have dedicated AI budgets.

These capabilities significantly improve ROI, making AI shopping assistants a strategic investment for digital commerce growth.

U.S. AI Shopping Assistant Market was valued at USD 1.00 billion in 2024 and is expected to reach USD 6.73 billion by 2032, growing at a CAGR of 27.00% from 2025-2032.

The U.S. AI Shopping Assistant Market is growing due to rising demand for personalized shopping experiences, increasing adoption of AI by retailers to boost customer engagement, and the widespread use of smartphones and digital channels driving automation and convenience in e-commerce.

AI Shopping Assistant Market Dynamics

Drivers

-

Expanding integration of AI assistants with voice commerce and smart devices is boosting market growth and reshaping digital retail engagement.

As voice-enabled commerce gains momentum, AI shopping assistants integrated with smart speakers, mobile apps, and IoT devices are seeing surging adoption. These integrations offer users a hands-free, conversational shopping experience, allowing them to search, compare, and buy products using voice commands. Retailers are embedding AI into devices like Alexa, Siri, and Google Assistant, bridging the gap between virtual assistance and retail conversion. This seamless, real-time interaction boosts customer convenience and brand loyalty. With the rise in smart home devices and mobile-first shopping behaviors, the relevance and deployment of AI-powered shopping tools are poised to expand substantially.

-

According to Synup, 26% of voice assistant users have made a purchase via voice search, while 43% use voice to research products.

-

Furthermore, 54% of U.S. voice assistant users employ them for retail tasks such as product searches and simple purchases.

-

PwC reports that 71% of users favor voice assistants for quick searches, highlighting the growing demand for hands-free, efficient shopping interactions.

Restraints

-

Concerns over consumer data privacy and ethical use of AI are slowing adoption across regulatory-sensitive markets and user segments.

AI shopping assistants require vast amounts of personal data—ranging from search behavior to purchase history—to function effectively. However, rising concerns over data misuse, surveillance, and non-transparent algorithms have triggered consumer hesitation and legal scrutiny. Stricter regulations like GDPR and CCPA limit how businesses collect and process this data, creating compliance challenges. Users are wary of AI models tracking their digital footprint, and brands risk backlash if privacy breaches occur. These growing apprehensions around data protection may hinder wider acceptance, especially in markets where trust in digital ecosystems remains fragile and regulation enforcement is intensifying.

-

An Omnisend survey of 1,026 U.S. consumers found that 58% were worried about AI's use of their personal data, while 42% believed current AI systems function more as upselling tools than helpful assistants.

-

GDPR enforcement is also tightening in January 2025, Ireland’s Data Protection Commission fined Meta approximately USD 1.31 billion for unlawful data transfers to the U.S., and in 2024, TikTok was fined around USD 377 million for violating children's data privacy rules.

Opportunities

-

Rising consumer preference for 24/7 virtual shopping support offers a significant opportunity to expand AI assistant adoption across global retail sectors.

Consumers increasingly expect round-the-clock assistance, especially in online retail environments. AI shopping assistants can deliver this continuous support, providing instant responses, troubleshooting, and personalized suggestions anytime. This capability not only enhances customer satisfaction but also reduces dependency on human agents, lowering operational costs for businesses. Retailers can deploy AI to manage high volumes of queries during peak sales seasons or across different time zones. As more customers value immediate, consistent support in their shopping journey, the potential to embed AI assistants across diverse retail formats and regions continues to grow significantly.

-

According to Zendesk, 62% of customer experience (CX) leaders admit they’re behind in offering the instant support customers now expect, while 51% of consumers say they prefer interacting with bots over humans when needing immediate service.

-

More than 50% of consumers expect businesses to offer 24/7 availability, with AI chatbots addressing this demand.

-

Klarna’s AI assistant managed 2.3 million conversations roughly two-thirds of all customer chats in its first month, handling the equivalent workload of 700 full-time agents and resolving issues in under 2 minutes compared to 11 minutes previously.

Challenges

-

Challenges in standardizing AI performance across different retail platforms hinder consistent consumer experiences and brand cohesion.

Retailers use various tech stacks, APIs, and customer data systems, making it difficult to deploy a unified AI shopping assistant experience across platforms. Inconsistencies in response quality, visual interface, or product recommendations across mobile apps, websites, and social media channels can confuse users and damage brand trust. Moreover, maintaining synchronized inventory, pricing, and personalization across multiple touchpoints requires seamless integration. Without standardization, businesses face difficulty scaling AI solutions across regions or brands. Achieving a consistent, reliable AI assistant experience remains a significant operational and technological hurdle in the market's broader adoption.

AI Shopping Assistant Market Segmentation Analysis

By Offering

The Solution segment dominated the AI Shopping Assistant Market in 2024 due to growing enterprise adoption of proprietary AI tools for personalized product recommendations, virtual try-ons, and customer engagement. Retailers prefer integrated platforms offering scalability, advanced analytics, and seamless omnichannel support. These standalone or embedded AI solutions drive efficiency, elevate user experience, and generate higher ROI, making them the top revenue-generating segment in the market landscape.

The Services segment is projected to grow at the fastest CAGR of 28.72% from 2025 to 2032 owing to rising demand for AI consulting, deployment, training, and support services. Businesses seek tailored service models to integrate AI tools effectively across customer touchpoints. Service providers assist in real-time optimization, reduce deployment friction, and help non-tech-savvy retailers adopt AI shopping assistants, especially in developing markets and mid-sized enterprises.

By End-use

The Retail & E-Commerce segment dominated the AI Shopping Assistant Market in 2024 with a 48% revenue share, driven by surging online shopping volumes and digital transformation in retail. E-commerce leaders are investing heavily in AI-powered product recommendations, virtual assistants, and dynamic pricing engines to improve customer satisfaction and retention. The growing consumer expectation for real-time, personalized experiences also accelerates adoption in this sector more than any other.

The Healthcare segment is expected to grow at the fastest CAGR of 29.80% from 2025 to 2032 as healthcare providers increasingly adopt AI shopping assistants for recommending products like supplements, insurance plans, wellness tools, and medication reminders. AI aids in streamlining patient self-service, reducing wait times, and enhancing retail pharmacy operations. Personalized health product suggestions based on user data fuel demand for AI tools in digital healthcare commerce.

By Technology

The Natural Language Processing (NLP) segment dominated the AI Shopping Assistant Market in 2024 with a 39% revenue share due to its ability to interpret user intent, support multilingual conversations, and enhance query accuracy. NLP empowers chatbots and voice assistants to deliver human-like interaction, enabling seamless and contextual responses. Its maturity and integration across platforms make it the foundation of most AI shopping experiences today.

The Computer Vision (CV) segment is expected to grow at the fastest CAGR of 30.43% from 2025 to 2032 as retailers leverage visual AI to power virtual try-ons, product search by image, and in-store analytics. With growing demand for immersive and visual shopping experiences, CV technologies enhance decision-making and user engagement. Its application in AR/VR shopping environments drives future adoption in both digital and physical retail.

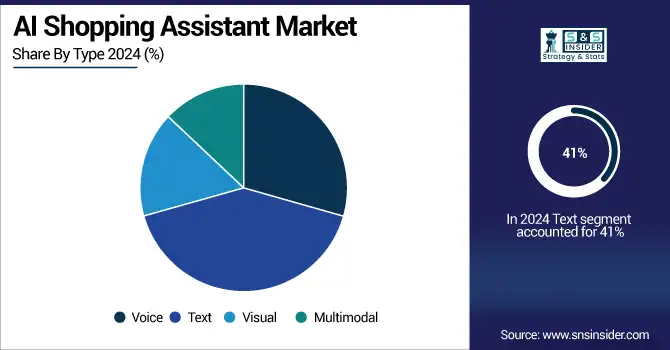

By Type

The Text segment dominated the AI Shopping Assistant Market in 2024 with a 41% revenue share due to its widespread use in chatbots, recommendation systems, and customer support tools. Text-based interactions remain cost-effective, language-flexible, and easy to deploy across web and mobile platforms. The reliability of text interfaces, especially in customer acquisition and problem resolution, has ensured sustained dominance in user-facing AI tools.

The Multimodal segment is projected to grow at the fastest CAGR of 30.53% from 2025 to 2032 as brands shift toward richer customer engagement involving voice, text, images, and gestures. Multimodal assistants improve personalization and comprehension by processing multiple data types simultaneously, creating more intuitive and natural interactions. Rising consumer expectations for seamless cross-modal shopping experiences fuel investment in these advanced AI capabilities across platforms.

AI Shopping Assistant Market Regional Analysis

North America dominated the AI Shopping Assistant Market in 2024 with a 38% revenue share due to its strong technological infrastructure, high digital adoption rates, and early investment by major retail and tech companies. The presence of leading AI developers, mature e-commerce ecosystems, and consumer readiness for personalized digital experiences further contributed to the region's market leadership in deploying AI-based retail and customer engagement solutions.

The United States is dominating the AI Shopping Assistant Market due to advanced AI adoption, strong retail infrastructure, and high consumer demand for personalized experiences.

Asia Pacific is projected to grow at the fastest CAGR of 29.84% from 2025 to 2032 driven by rapid smartphone penetration, expanding e-commerce platforms, and increasing digital literacy among consumers. Emerging markets like India, China, and Southeast Asia are seeing heavy investment in AI-driven retail innovation. Local businesses and global players are leveraging AI shopping assistants to tap into the region’s large, youthful, and digitally engaged consumer base.

China is dominating the AI Shopping Assistant Market in Asia Pacific due to massive e-commerce scale, advanced AI integration, and strong government support for digital innovation.

Europe is experiencing steady growth in the AI Shopping Assistant Market, driven by rising e-commerce adoption, digital transformation in retail, and increasing consumer demand for personalized shopping. Countries like the UK, Germany, and France are leading in AI integration and deployment.

The United Kingdom is dominating the AI Shopping Assistant Market in Europe due to strong e-commerce growth, AI innovation, and high digital consumer engagement.

The Middle East & Africa and Latin America are emerging markets in the AI Shopping Assistant sector, driven by growing smartphone usage, expanding online retail, and rising interest in automation. Local retailers are gradually adopting AI to enhance customer engagement and efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Alibaba Group Holding Limited, Shopify Inc., Salesforce, Inc., eBay Inc., Google LLC, Amazon.com, Inc., Meta Platforms, Inc., Microsoft Corporation, Adobe Inc., IBM Corporation, Perfect Corp., Sherpa.ai, The Yes, Outfittery, Caper AI, Uniphore, Manifest AI, Constructor, Yalo, SleekFlow.

Recent Developments:

-

2025: Alibaba Cloud unveiled upgraded AI models (Qwen-Max, QWQ-Plus, QVQ-Max, Qwen2.5-Omni-7b) with enhanced PAI platform, PolarDB in-database inference, and Model Studio integration for international generative AI customers.

-

2024: Alibaba made these 10 AI tools available to all Taobao and Tmall merchants; during 11.11, they were used 1.5 billion+ times, increasing AI-enhanced image click-through rates by 25%.

-

2023: Taobao and Tmall launched 10 AI-powered tools including Wenwen, Ali Xiaomi chatbot, and Business Advisor in October 2023, aimed at enhancing product discovery, personalization, and merchant analytics through generative AI.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.65 Billion |

| Market Size by 2032 | USD 24.90 Billion |

| CAGR | CAGR of 27.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Services) • By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision (CV), Others) • By Type (Voice, Text, Visual, Multimodal) • By End-use (BFSI, Retail & E-Commerce, Healthcare, Travel & Hospitality, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Alibaba Group Holding Limited, Shopify Inc., Salesforce, Inc., eBay Inc., Google LLC, Amazon.com, Inc., Meta Platforms, Inc., Microsoft Corporation, Adobe Inc., IBM Corporation, Perfect Corp., Sherpa.ai, The Yes, Outfittery, Caper AI, Uniphore, Manifest AI, Constructor, Yalo, SleekFlow |