Smart Government Market Report Scope & Overview:

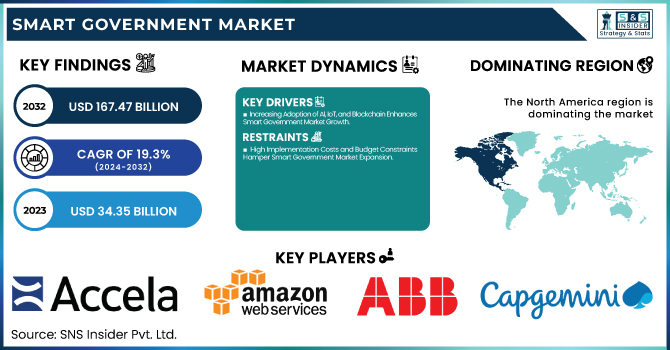

The Smart Government Market Size was valued at USD 34.35 Billion in 2023 and is expected to reach USD 167.47 Billion by 2032 and grow at a CAGR of 19.3% over the forecast period 2024-2032.

To Get more information on Smart Government Market - Request Free Sample Report

The market is driven by digital transformation, automation, and data-driven decision-making in public administration. Governments are adopting AI, blockchain, IoT, and big data analytics to enhance efficiency, transparency, and service delivery. Cloud computing enables seamless data exchange, while cybersecurity solutions safeguard sensitive information. Key initiatives include e-governance portals, AI-powered chatbots, and automated permitting systems. Investments in smart cities, 5G, and edge computing are fueling innovations like real-time traffic management and digital identity verification. Public-private partnerships play a vital role in modernizing government infrastructure, fostering innovation, and ensuring sustainable urban development.

Smart Government Market Dynamics

Key Drivers:

-

Increasing Adoption of AI, IoT, and Blockchain Enhances Smart Government Market Growth

Governments worldwide are increasingly integrating artificial intelligence (AI), the Internet of Things (IoT), and blockchain into public administration to enhance operational efficiency and transparency. AI-driven solutions enable predictive analytics, improving decision-making and resource allocation, while IoT facilitates real-time monitoring of infrastructure, public safety, and smart city initiatives. Blockchain ensures secure, tamper-proof transactions, enhancing trust in digital governance. Additionally, cloud-based platforms streamline interdepartmental communication and public service delivery. The growing demand for e-governance solutions, AI-powered citizen engagement tools, and automated workflows is accelerating digital transformation in the public sector, and driving market growth.

Restrain:

-

High Implementation Costs and Budget Constraints Hamper Smart Government Market Expansion

Despite the benefits, high costs associated with deploying smart government solutions hinder market expansion. Governments face budget constraints, especially in developing economies, where funding is prioritized for essential services. The integration of AI, IoT, and blockchain requires substantial initial investment in infrastructure, software, and workforce training. Additionally, maintaining cybersecurity and ensuring compliance with evolving regulatory frameworks add to financial burdens. Smaller municipalities and local governments often struggle to adopt smart technologies due to limited technical expertise and funding, slowing overall market adoption.

Opportunities:

-

Rising Investments in Smart City Initiatives Create Lucrative Opportunities for the Smart Government Market

Governments globally are investing in smart city projects, driving opportunities for smart governance solutions. These initiatives focus on sustainable urban development, intelligent transportation systems, and digital citizen services. Increased funding for smart infrastructure, including AI-driven traffic management, public safety solutions, and digital identity verification, is propelling market growth. Public-private partnerships (PPPs) are also expanding, enabling cost-effective technology adoption. As urbanization accelerates, smart city projects will continue to fuel demand for integrated governance platforms, creating lucrative opportunities in the market.

Challenges:

-

Data Privacy and Cybersecurity Threats Pose Major Challenges to the Smart Government Market

The increasing digitization of government services exposes sensitive data to cyber threats, hacking attempts, and data breaches. Smart governance relies on cloud platforms, IoT devices, and AI-powered analytics, making systems vulnerable to ransomware attacks, identity theft, and unauthorized access. Governments must implement strict data protection laws, advanced encryption, and multi-layered cybersecurity measures to mitigate risks. Additionally, compliance with global regulations such as GDPR and data sovereignty laws adds complexity to implementation. Without robust cybersecurity frameworks, concerns over data privacy and security vulnerabilities may hinder the widespread adoption of smart government technologies.

Smart Government Market Segments Analysis

By Services

The Professional Services segment led the Smart Government Market in 2023, capturing 61% of the revenue share, driven by the rising demand for consulting, integration, and training services in digital governance. Governments increasingly rely on IT service providers to implement cloud solutions, AI-driven citizen engagement platforms, and cybersecurity frameworks. Microsoft introduced Cloud for Sovereignty, designed to help governments maintain compliance and security in cloud-based operations. The segment’s dominance is further reinforced by smart city projects, e-governance initiatives, and regulatory reforms that require specialized expertise for implementation. As public sector agencies continue their shift toward digitalization, professional services firms play a crucial role in streamlining technology adoption, ensuring smooth integration, and offering cybersecurity training to enhance data protection and operational efficiency.

The Managed Services segment is projected to grow at the highest CAGR during the forecast period, fueled by government demand for outsourced IT solutions, cloud-based infrastructure management, and real-time cybersecurity monitoring. Amazon Web Services (AWS) and IBM expanded their managed cloud services for government agencies, with AWS launching AWS GovCloud updates for enhanced data sovereignty, and IBM introducing AI-driven managed security solutions to protect critical infrastructure.

Additionally, Cisco unveiled its Managed Detection and Response (MDR) service for public sector cybersecurity, helping agencies counter increasing cyber threats. The growing reliance on smart governance tools, predictive analytics, and AI-powered decision-making is driving demand for managed services.

By Solutions

The Government Resource Planning System segment led the Smart Government Market in 2023, capturing 32% of the revenue share, driven by the increasing adoption of centralized resource management, automation, and data-driven governance solutions. GRP systems help governments streamline budgeting, procurement, financial management, and human resources, ensuring efficient service delivery launched Oracle Cloud ERP for Public Sector, providing AI-powered analytics and automation to improve financial transparency and compliance. SAP introduced S/4HANA for the Government, enabling agencies to optimize their resource planning and improve efficiency. Additionally, Microsoft expanded its Dynamics 365 for the Public Sector, integrating AI-driven insights to enhance decision-making and operational efficiency.

The Remote Monitoring segment is set to grow at the highest CAGR in the forecast period, fueled by the increasing demand for real-time surveillance, predictive maintenance, and AI-powered monitoring systems in smart governance. Governments are leveraging IoT sensors, AI-driven analytics, and cloud-based platforms to monitor critical infrastructure, environmental conditions, and public safety. Cisco introduced AI-enhanced Smart City Monitoring Solutions, allowing real-time traffic and environmental tracking. Huawei launched its Intelligent Remote Monitoring System, utilizing 5G and edge computing for smart governance. IBM expanded its Watson IoT for the Public Sector, enabling predictive analytics for urban infrastructure and emergency response.

By Deployment

The Cloud segment led the Smart Government Market in 2023, driven by the increasing adoption of cloud-based digital governance solutions, scalable infrastructure, and AI-driven public service applications. Governments worldwide are migrating to cloud platforms to enhance data accessibility, interdepartmental collaboration, and cybersecurity resilience while reducing infrastructure costs.

AWS expanded its GovCloud platform, enhancing secure cloud storage and AI-based analytics for smart city initiatives. Microsoft introduced Cloud for Sovereignty, offering secure and compliant cloud solutions for government agencies handling sensitive data.

The On-Premise segment is projected to grow at the highest CAGR during the forecast period, driven by rising concerns over data sovereignty, security regulations, and mission-critical government applications. Many government agencies, particularly in defense, law enforcement, and public administration, require on-premise infrastructure to maintain full control over sensitive citizen data and national security systems. Palantir introduced on-premise AI analytics platforms for real-time decision-making in the security and defense sectors. As cybersecurity threats and regulatory compliance concerns rise, governments are increasingly investing in on-premise infrastructure, driving its high growth rate in the Smart Government Market.

Regional Analysis

North America led the Smart Government Market in 2023, accounting for an estimated market share of over 37%, driven by strong investments in digital governance, AI-powered public services, and cybersecurity initiatives. The U.S. and Canada have been at the forefront of smart city projects, e-governance solutions, and cloud adoption in public administration. For example, the U.S. federal government expanded its FedRAMP (Federal Risk and Authorization Management Program) initiative, ensuring secure cloud adoption across agencies.

Additionally, Microsoft and AWS have enhanced their cloud-based solutions for public sector clients, supporting AI-driven citizen engagement and digital infrastructure. Cities like New York, San Francisco, and Toronto are heavily investing in IoT-based traffic monitoring, AI-powered emergency response systems, and blockchain-enabled government transactions, reinforcing North America’s leadership in the market.

Asia-Pacific is the fastest-growing region, expected to expand at an estimated CAGR of over 20.5% due to rapid urbanization, rising government digitization initiatives, and increasing smart city investments. Countries like China, India, Japan, and South Korea are implementing large-scale e-governance projects, AI-driven surveillance, and cloud-based government services.

For example, China’s Digital China initiative focuses on AI, big data, and blockchain-powered governance, while India’s Digital India program is promoting cloud-based service delivery for citizens.

Additionally, Huawei and Alibaba Cloud are launching AI-driven cloud solutions for public sector applications, while Singapore has integrated blockchain-based identity verification in government services. The region’s increasing focus on cybersecurity, IoT-based public infrastructure, and AI-powered governance solutions is fueling its high growth rate, making Asia-Pacific the most dynamic and rapidly expanding market for smart government technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Government Market are:

-

Accela (Accela Civic Platform, Accela Permitting & Licensing)

-

Amazon Web Services, Inc. (AWS GovCloud, AWS Lambda for Government)

-

ABB Ltd. (ABB Ability Smart Cities, ABB Intelligent Transportation Systems)

-

Capgemini S.A. (Capgemini Smart City Solutions, Capgemini Government Digital Services)

-

CivicPlus (CivicEngage, CivicRec)

-

Cisco Systems, Inc. (Cisco Kinetic for Cities, Cisco Smart+Connected Digital Platform)

-

Entrust Datacard Corporation (Entrust IdentityGuard, Entrust Public Sector Security Solutions)

-

Google LLC (Google Cloud for Government, Google Public Data Explorer)

-

Hughes Identification Devices Global Corporation (HID Citizen ID Solutions, HID Government Smart Cards)

-

Huawei Technologies Co., Ltd. (Huawei Smart City Solutions, Huawei Cloud for Government)

-

IBM Corporation (IBM Intelligent Operations Center, IBM Cloud for Government)

-

Imex Systems, Inc. (iGov Smart City Platform, iCity Digital Government Solutions)

-

Microsoft Corporation (Microsoft Azure Government, Microsoft Dynamics 365 for Public Sector)

-

Nokia Corporation (Nokia Smart City Solutions, Nokia Public Safety LTE)

-

OpenGov (OpenGov Budgeting & Planning, OpenGov Reporting & Transparency)

-

Oracle Corporation (Oracle Cloud for Government, Oracle Public Sector Compliance & Regulation)

-

Palantir Technologies (Palantir Gotham, Palantir Foundry for Government)

-

Salesforce, Inc. (Salesforce Government Cloud, Salesforce Public Sector Solutions)

-

Snowflake Inc. (Snowflake Data Cloud for Government, Snowflake Secure Data Sharing)

Recent Trends

-

January 2025: AWS announced plans to invest approximately $11 billion in Georgia to enhance its cloud computing and AI infrastructure. This expansion aims to support the growing demand for advanced data centers for AI-driven innovations and cloud services, aligning with broader industry trends in AI infrastructure development.

-

February 2025: ABB partnered with Indore Smart City Development Limited (ISCDL) to deploy next-generation digital technology, enabling a continuous electricity supply to homes and businesses in Indore, India. This collaboration positions Indore as a model for smart city projects across India.

-

December 2024: Accela announced the continuation of its Regional User Group Program for 2025, aiming to connect government agencies nationwide. Building on the success of previous events, the program fosters collaboration and innovation among public sector professionals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34.35 Billion |

| Market Size by 2032 | US$ 167.47 Billion |

| CAGR | CAGR of 19.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services (Professional Services, Managed Services) •By Solutions (Analytics, Security, Government Resource Planning System, Remote Monitoring, Network Management, Others) •By Deployment (On-Premise, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accela, Amazon Web Services, Inc., ABB Ltd., Capgemini S.A., CivicPlus, Cisco Systems, Inc., Entrust Datacard Corporation, Google LLC, Hughes Identification Devices Global Corporation, Huawei Technologies Co., Ltd., IBM Corporation, Imex Systems, Inc., Microsoft Corporation, Nokia Corporation, OpenGov, Oracle Corporation, Palantir Technologies, Salesforce, Inc., Snowflake Inc. |