Digital Twin Market Report Scope & Overview:

Get more information on Digital Twin Market - Request Sample Report

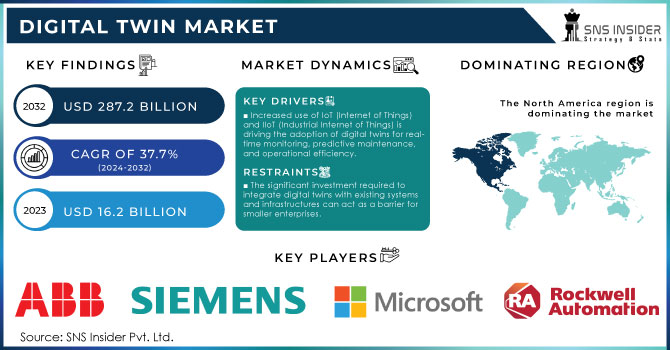

Digital Twin Market Size was valued at USD 16.2 Billion in 2023 and is expected to reach USD 287.2 Billion by 2032, growing at a CAGR of 37.7 % over the forecast period 2024-2032.

Digital twin technology is becoming increasingly popular as it fills the gap between the physical and virtual worlds. The adoption of the Internet of Things and big data analytics and the need for efficient operations, process optimization, and reduced time-to-market are driving growth. In addition, advancements in virtual and augmented reality are further expanding the market. An increasing number of countries, such as the U.S., India, Brazil, and Saudi Arabia, are investing in digital transformation to promote digitization. Increasing public and private sector recognition is also driving the trend. Cloud-based digital twin solutions are in high demand, as they offer cost-effective and flexible customer solutions. In addition, the development of digital twin systems is likely to drive market growth because of emerging technologies such as cloud computing, artificial intelligence, and the Internet of Things. Digital twin technology has become increasingly important in the age of Industry 4.0, where automation and data-driven decision-making.

Several collaborations have recently been announced to boost digital twin solution deployment. For instance, In February 2024, Matterport announced a collaboration with Arcadus to provide digital twin services for U.S. government agencies. It enabled organizations to remotely manage their operations and ensured compliance with federal regulations. Manufacturing, automotive, aerospace, and defense companies as end-user industries have promoted digital twin adoption. Enhanced communication, system productivity, and reduced energy consumption are further reaching trends that are expected to continue driving market growth with further technological development.

Market Dynamics

Drivers

-

Increased use of IoT (Internet of Things) and IIoT (Industrial Internet of Things) is driving the adoption of digital twins for real-time monitoring, predictive maintenance, and operational efficiency.

-

The need to reduce operational downtime and maintenance costs has spurred the use of digital twins to predict equipment failures and improve asset utilization.

-

Integration of AI and ML with digital twin technology enables better data analysis, predictions, and decision-making, boosting market growth.

-

The healthcare sector is leveraging digital twins for personalized medicine, patient monitoring, and virtual simulations of treatments, driving market expansion.

-

Rapidly growing adoption of 3D Simulation and 3D Printing Software Drive Market Growth

-

The rise of smart cities and urban planning projects use digital twin technology for infrastructure management, environmental monitoring, and urban development.

The integration of the Internet of Things and the Industrial Internet of Things is the leading factor pushing the development of the digital twin market. Digital twins are real-time monitoring, simulation, and optimization of physical assets and processes, making IoT and IIoT critical enablers of this technology. Nowadays, the number of connected devices is increasing exponentially, and the manufacturing, energy, healthcare industries, and smart cities are eager to integrate the digital twin technology to increase their efficiency, reduce downtimes, and enhance predictive maintenance IoT Analytics 2023. The report by IoT Analytics 2023 states the number of total global IoT connections surpassed 14.4 billion in 2022, which was 18% more Y-o-Y, and it will reach over 30 billion by 2025 IoT Analytics 2023. Furthermore, the same report also indicates that the share of the manufacturing industry among those who implemented industrial IoT solutions was the highest, and this year, around 35% of all factories use IoT to optimize their production lines IoT Analytics 2023. Similarly, IIoT plays a crucial role in enabling digital twins by facilitating real-time data collection and analysis from machines, equipment, and processes.

The IoT helps produce and store the data that is the foundation of digital twins. As the result of the integration of these three technologies, companies can enjoy the virtual simulations of any of their products or processes, helping leave significant savings of around 25-30% on running costs and extending the product life by 10-15% IoT Analytics 2023. Industries such as automotive, aerospace, and smart infrastructure are rapidly adopting this combination to stay competitive in an increasingly digital world.

Restraints

-

The significant investment required to integrate digital twins with existing systems and infrastructures can act as a barrier for smaller enterprises.

-

Digital twins involve the transfer of sensitive data, which raises concerns about cybersecurity risks, data breaches, and compliance with privacy regulations.

-

The absence of industry-wide standards for digital twin technology creates compatibility issues between different platforms and tools, hindering widespread adoption.

In some developing economies, limited awareness and understanding of the benefits of digital twin technology are slowing down its adoption and growth potential. A significant restraint to the digital twin market is data security and privacy concerns. The digital twins primarily function by creating a virtual replica of physical assets, systems, or processes. This copy often gathers real-time data, just like the actual systems, and therefore functions in a mirrored fashion of the world. Since the data is critical to the functioning of the twin, it tends to have an array of sensitive and proprietary types of information.

The transfer, storage, and processing of these large volumes of sensitive data can result in significant vulnerabilities to cyber-attacks, data breaches, and unauthorized access. For example, the manufacturing, healthcare, and energy industries have begun to utilize digital twins for everyday operations, meaning that any breach of this data would result in operational halts, financial damages, or safety hazards. Furthermore, the presence of data privacy and protection laws, such as the GDPR or the HIPAA, require organizations to ensure that their twin usage strictly adheres to the laws. This can require large amounts of encryption, data storage, and access control constraints.

Market Segmentation:

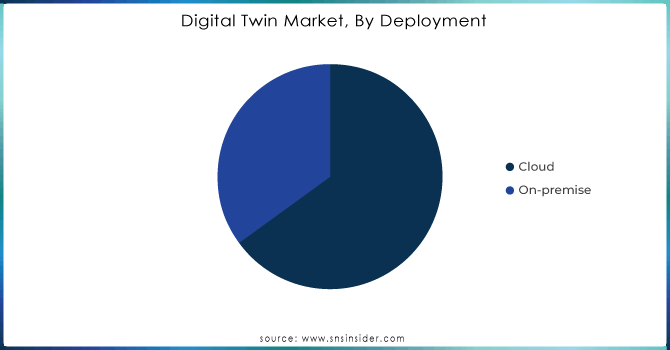

By Deployment

The on-premise deployment segment held the highest revenue share more than 61% in 2023. Large enterprises are adopting this emerging technology at a faster rate which optimizes security and compliance with government regulations. On-premise solutions allow large companies to have complete ownership and control of their vital systems. However, the demand for on-premise solutions is expected to slow down during the forecast period, as consumer preferences shift toward cloud-based alternatives.

The cloud-based deployment segment is projected to grow with the highest compound annual growth rate during 2024 and 2032. Cloud deployment offers businesses higher flexibility and cost-efficiency by eliminating the need for physical infrastructure and reducing maintenance costs. The growing interest in cloud-based deployment solutions by consumers has encouraged firms to create better cloud-native digital twin technologies. For instance, In November 2022, Dassault Systèmes shifted its digital twin operations to the cloud to provide independent cloud services. Cloud operations directly integrate with the core of customers’ companies to unlock value at various levels.

Need any customization research/data on Digital Twin Market - Enquiry Now

By Application

The predictive maintenance segment led the market and held the highest revenue share in 2023. Digital twin technology allows engineers to predict and conduct maintenance on a predetermined schedule. The approach to preventive maintenance helps prevent machine failures as issues are taken care of according to designated needs but not fixed schedules. As a result, downtime is reduced, and businesses do not under or over-invest in vital resources, leading to optimal performance.

Meanwhile, product design and development is expected to be the fastest-growing at a compound annual growth rate over the forecast period. The growing demand for this segment’s digital twin solutions is due to the assistance of engineers and designers in visualizing design concepts more effectively. By using digital twins, teams can test the impact of designs in simulations as well as review manufacturing processes with the help of computer-aided manufacturing (CAM) software, and refine designs in real time. These benefits make digital twin technology increasingly essential for enhancing product design and development.

By End-use

The automotive and transport segment was the largest revenue-generating segment in 2023, estimated to account for nearly 22% of the total revenue. This can be attributed to the increasing adoption of the digital twin technology owing to several advantages, such as cost optimization and enhanced vehicle safety and productivity. The technology offers improved means for the transfer of information with manufacturers and operators adopting the method to make informed decisions in areas such as vehicle design, operation, and maintenance. Through the application of digital twins, clients can realize improved orders, and demand forecasting experiences this technology offers real-time data for better decision-making and supply chain efficiency. Moreover, the technology offers real time vehicle health monitoring and predictive maintenance scheduling.

The telecommunications segment is expected to grow at the fastest compound annual growth rate from 2024 to 2032. With the adoption of digital twin technology in the telecom sector, operators can monitor their systems and networks to capture warnings of potential issues and prevent downtime. The benefits of the technology to customers and facility managers include reduced costs, improved experience, enhanced efficiency, and optimized network design. Real time data includes factors such as the level of demand for a service or a product in a given location at a specific time. Engineers, network managers, and service providers use the data to make informed decisions and develop and deliver personalized solutions to their clients.

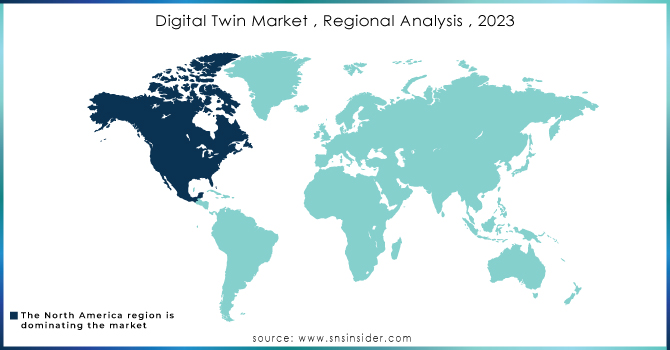

Regional Insights

North America dominated the digital twin market in 2023, accounting for approximately 33% of the total revenue share. Growth is attributed to the emerging of technologies, such as robotic process automation (RPA), virtual reality, and internet of things, which are increasingly influencing the digital twin industry. Leading U.S. companies, including International Business Machines Corporation, Microsoft Corporation, and General Electric, are actively focused on developing new products and enhancing the existing solutions, in order to attract more customers and increase the overall market share.

The digital twin market is expected to expand throughout the Asia-Pacific region between 2024 and 2032. The projected compound annual growth rate is primarily an outcome of the increasing digital infrastructure, growing manufacturing output, and rising technological adoption rates. Increased demand is also fuelled by the use of digital twins in smart city projects and the general government initiatives promoting digitalization. Growth is expected to be particularly high in China, which is facilitating the creation of digital industrial clusters, primarily focusing on Integrated Circuits and Artificial Intelligence. The potential of the country to cater to the global market is remarkable. In Japan, the digital twin market is also expected to expand greatly, particularly due to the vast improvements in the field of robotics. Japanese companies and research institutions are leaders in this area since they focus on the development of AI-driven robots for all key fields. Social and companion robots, which come in various forms and can interact with humans, are in high demand and are expected to support Japanese digital twin market expansion.

Key Players

-

ABB Group (ABB Ability™ Digital Twin, ABB Ability™ Remote Condition Monitoring)

-

Amazon Web Services, Inc. (AWS IoT TwinMaker, AWS IoT SiteWise)

-

ANSYS, Inc. (ANSYS Twin Builder, ANSYS Discovery Live)

-

Autodesk Inc. (Autodesk Revit, Autodesk BIM 360)

-

Oracle Corporation (Oracle IoT Cloud, Oracle Digital Twin Hub)

-

Accenture plc (Accenture Digital Twin Services, Accenture myConcerto)

-

Hitachi Ltd. (Hitachi Lumada Digital Twin, Hitachi Smart Manufacturing)

-

AVEVA Group plc (AVEVA Predictive Analytics, AVEVA Asset Performance Management)

-

Capgemini (Capgemini Digital Twin Solutions, Capgemini IoT Solutions, Capgemini Digital Manufacturing)

-

Bentley Systems Inc. (Bentley iTwin, Bentley OpenBuildings Designer)

-

Dassault Systèmes (3DEXPERIENCE® Platform, CATIA Digital Twin)

-

General Electric (GE Digital Twin, Predix Platform)

-

Hexagon AB (Hexagon Digital Twin Solutions, Intergraph Smart 3D)

-

IBM Corporation (IBM) (IBM Maximo, IBM Watson IoT)

-

Microsoft Corp. (Microsoft Azure Digital Twins, Microsoft IoT Central)

-

PTC Inc. (PTC ThingWorx, PTC Vuforia)

-

Robert Bosch (Bosch IoT Suite, Bosch Digital Twin Solutions)

-

Rockwell Automation Inc. (Rockwell FactoryTalk, Rockwell Automation Digital Twin)

-

SAP SE (SAP Digital Twin, SAP Leonardo IoT)

-

Siemens AG (Siemens

and others in final Report.

Recent development

-

In June 2024, the collaboration of Siemens and KU Leuven to study digital twins pertaining to smart and sustainable products. Its main objective is to support research methodology, encourage innovation with industrial relevance, disseminate research results, and add educational value to digital twin topics.

-

In 2023, Rockwell Automation implemented the Robotic Supervision System for TotalEnergies. Thanks to a digital twin tool, the systems include IoT, gamification, manage industrial robots, and monitor the operation and performance of these tools.

| Report Attributes | Details |

| Market Size in 2023 | USD 16.2 Bn |

| Market Size by 2032 | USD 287.2 Bn |

| CAGR | CAGR of 37.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Component, Process, System) • By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs) • By Deployment (Cloud, On-premise) • By Application (Product Design & Development, Predictive Maintenance, Business Optimization, Others) • By End-use (Manufacturing, Agriculture, Automotive & Transport, Energy & Utilities, Healthcare & Life Sciences, Residential & Commercial, Retail & Consumer Goods, Aerospace, Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Group, Amazon Web Services, Inc., ANSYS, Inc., Autodesk Inc., Oracle Corporation, Accenture plc, Hitachi Ltd., AVEVA Group plc, Capgemini, Bentley Systems Inc., Dassault Systemes, General Electric, Hexagon AB, International Business Machines Corp., Microsoft Corp., PTC Inc., Robert Bosch GmbH, Rockwell Automation, SAP SE, Siemens AG |

| Key Drivers | • Increased use of IoT (Internet of Things) and IIoT (Industrial Internet of Things) is driving the adoption of digital twins for real-time monitoring, predictive maintenance, and operational efficiency. • The need to reduce operational downtime and maintenance costs has spurred the use of digital twins to predict equipment failures and improve asset utilization. |

| Market Opportunities | • Digital twins involve the transfer of sensitive data, which raises concerns about cybersecurity risks, data breaches, and compliance with privacy regulations. |