IoT Analytics Market Report Scope & Overview:

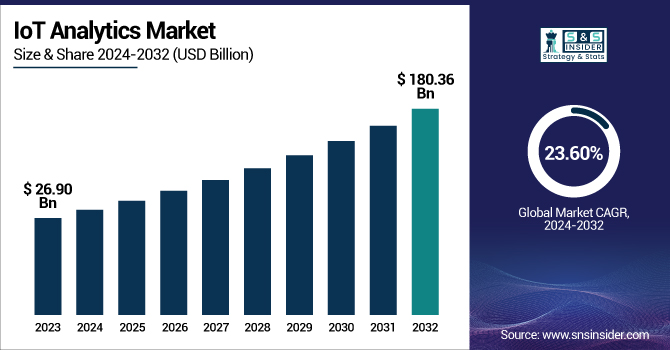

The IoT Analytics Market was valued at USD 26.90 billion in 2023 and is expected to reach USD 180.36 billion by 2032, growing at a CAGR of 23.60% from 2024-2032.

To get more information on IoT Analytics Market - Request Free Sample Report

The IoT Analytics Market is experiencing significant growth, due to the increasing adoption of IoT devices across various industries. As businesses deploy interconnected devices, they generate vast amounts of data, creating a need for advanced analytics to derive actionable insights. These insights enable organizations to optimize operations, improve decision-making, and reduce costs, all critical for maintaining a competitive edge. In manufacturing, 62% of manufacturers have adopted IoT technologies in their processes, while 54% of enterprises leverage IoT to reduce project costs. In October 2024, Honeywell and Google Cloud announced a partnership to integrate AI agents into industrial operations, further enhancing IoT adoption. With industries such as healthcare, agriculture, and transportation increasingly adopting IoT analytics, the market is poised to drive greater operational efficiency, innovation, and value creation across sectors.

This growing demand is further increased by the integration of artificial intelligence and machine learning into IoT analytics platforms, which enhance the accuracy and predictive capabilities of data analysis. AI and ML enable businesses to make real-time decisions, automate processes, and predict future trends with greater precision. This is particularly important for industries focusing on predictive maintenance, asset management, and supply chain optimization, where timely insights can significantly reduce costs and prevent disruptions. In December 2024, Dot Ai launched ZiM, a next-gen IoT tracking technology that integrates edge computing and AI for real-time data collection, optimizing asset tracking in logistics and supply chains. As IoT devices evolve and produce more complex data, the need for advanced analytics solutions to manage and interpret this data becomes even more pressing, accelerating the demand for sophisticated analytics tools.

Looking ahead, the future of the IoT Analytics Market presents a wealth of opportunities, especially with the advent of 5G networks, which will enable faster data transmission and allow for more real-time insights. This increased connectivity will enhance the effectiveness of IoT analytics in areas like smart cities, autonomous vehicles, and connected healthcare systems. In September 2024, Oracle introduced the Intelligent Data Lake, a key component of its Data Intelligence Platform, combining AI, analytics, and data orchestration to streamline data integration and management. As these technologies mature, businesses will increasingly rely on seamless integration of IoT devices with analytics platforms to stay competitive. With growing demand from emerging markets, the IoT analytics sector is poised for substantial growth and promising opportunities in the near future.

IoT Analytics Market Dynamics

DRIVERS

-

Increasing Smart City Initiatives Fuel the Need for IoT Analytics in Urban Management

-

Cloud and Edge Computing Advancements Accelerate Real-Time IoT Data Processing

-

Rapid Expansion of IoT Devices Drives Growing Demand for Advanced Data Analytics Solutions

The growing number of Internet of Things devices significantly increases the volume of data generated, creating a need for advanced analytics tools. As more devices—from smart home gadgets to industrial sensors—connect to the internet, they produce massive amounts of data. To unlock the value of this data, businesses require sophisticated platforms that can process, analyze, and extract actionable insights. With IoT data becoming integral to decision-making, organizations are turning to analytics solutions to identify patterns, optimize operations, and enhance customer experiences. As the demand for real-time, data-driven decisions rises, the role of IoT analytics platforms becomes even more crucial, fueling the continued growth of the market.

-

AI and Machine Learning Integration Enhances IoT Analytics for Smarter Ecosystems

The integration of Artificial Intelligence and Machine Learning with IoT analytics revolutionizes the way data is processed and utilized. AI and ML algorithms enable IoT systems to gain predictive insights, automate decision-making processes, and optimize operations in real-time. These technologies allow for the analysis of vast amounts of data while identifying patterns, detecting anomalies, and anticipating future trends, all with minimal human intervention. By enhancing the intelligence of IoT devices, businesses can improve efficiency, reduce costs, and make faster, more accurate decisions. The ability to create smarter, more autonomous IoT ecosystems drives widespread adoption across industries, fostering innovation and expanding the demand for advanced IoT analytics solutions.

RESTRAINTS

-

Data Privacy and Security Concerns Limit Widespread Adoption of IoT Analytics Solutions

The growing volume of sensitive data generated by IoT devices presents significant privacy and security concerns that could restrain the IoT analytics market. With vast amounts of personal, financial, and operational data being collected and transmitted by IoT systems, the risk of data breaches, cyberattacks, and unauthorized access becomes a pressing issue. Businesses and consumers alike are becoming more cautious about the security of their data, which could delay the adoption of IoT analytics solutions. As companies increasingly rely on data-driven insights, the need to ensure secure data storage, processing, and transmission becomes critical. Without robust security measures and clear privacy frameworks, potential users may hesitate to invest in or fully adopt IoT analytics platforms, limiting the market's growth.

-

High Implementation Costs Limit IoT Analytics Adoption, Especially for Smaller Businesses

The high initial costs associated with implementing IoT analytics systems pose a significant restraint for market growth, particularly for smaller businesses. Setting up these systems requires substantial investment in infrastructure, software, and the recruitment of skilled professionals to manage and analyze the data. Additionally, the cost of maintaining and scaling IoT analytics platforms over time can be prohibitive for companies with limited budgets. For smaller enterprises, this financial burden can prevent them from adopting IoT analytics solutions, limiting their ability to leverage the benefits of data-driven decision-making. Although the return on investment from IoT analytics can be significant, the upfront costs remain a major barrier for many organizations, particularly in industries where budget constraints are more pronounced. This challenge could slow the widespread adoption of IoT analytics in the market.

IoT Analytics Market Segment Analysis

By Component

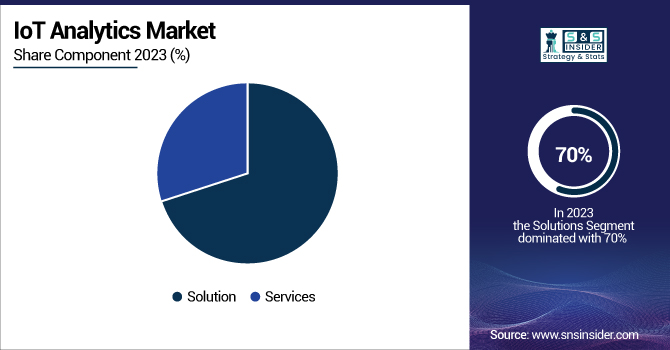

In 2023, the Solutions segment dominated the IoT Analytics market, capturing a substantial revenue share of approximately 70%. This dominance is primarily attributed to the increasing reliance on IoT analytics solutions by businesses to optimize operations, improve decision-making, and enhance customer experiences. With a growing need to process and analyze vast amounts of real-time data, organizations are investing heavily in advanced software and infrastructure, making the Solutions segment a key driver in the market.

The Services segment is expected to experience the fastest CAGR of about 25.60% from 2024 to 2032. This rapid growth can be attributed to the rising demand for ongoing support, integration, and consulting services as businesses adopt more complex IoT analytics solutions. As organizations seek to maximize the value of their IoT investments, the need for expert guidance, system integration, and tailored solutions to address specific business challenges becomes increasingly crucial, fueling the demand for services in the market.

By Organization Size

In 2023, the Large Enterprises segment dominated the IoT Analytics market, accounting for approximately 69% of the total revenue. This dominance is driven by the substantial resources and advanced technological infrastructure that large organizations can allocate to IoT initiatives. With vast networks of connected devices and a higher volume of data to manage, these enterprises leverage IoT analytics to gain deeper insights, optimize operations, and improve decision-making, solidifying their position as market leaders.

The Small & Medium Enterprises segment is expected to grow at the fastest CAGR of about 26.13% from 2024 to 2032. This rapid growth is fueled by the increasing accessibility of cost-effective IoT analytics solutions and cloud-based platforms, allowing SMEs to tap into data-driven insights previously out of reach. As SMEs recognize the potential for improved efficiency, customer experiences, and competitive advantage, their adoption of IoT analytics is poised to accelerate, making this segment one of the most dynamic in the market.

By Deployment

In 2023, the Cloud segment dominated the IoT Analytics market, securing around 69% of the total revenue share. This dominance can be attributed to the scalability, flexibility, and cost-efficiency that cloud-based solutions offer. As organizations increasingly rely on large volumes of data generated by IoT devices, cloud platforms provide the necessary infrastructure to process and store data without the significant upfront costs of on-premises systems, driving widespread adoption across industries.

The On-Premises segment is expected to grow at the fastest CAGR of about 25.08% from 2024 to 2032. This growth is fueled by organizations’ increasing concerns over data security, privacy, and regulatory compliance. With sensitive data often being handled internally, many businesses prefer on-premises solutions to maintain full control over their data storage and analytics processes. As these concerns continue to rise, more companies are opting for on-premises IoT analytics systems, contributing to the segment's rapid growth in the coming years.

By End Use

In 2023, the Manufacturing segment dominated the IoT Analytics market, accounting for approximately 30% of the total revenue share. This dominance is driven by the industry's increasing adoption of IoT technologies to streamline operations, enhance production efficiency, and reduce downtime. By utilizing IoT sensors and analytics platforms, manufacturers gain real-time insights into machine performance, supply chain logistics, and quality control, leading to significant cost savings and operational improvements, making it the leading segment in the market.

The Healthcare & Life Sciences segment is poised to grow at the fastest CAGR of about 27.03% from 2024 to 2032. This rapid growth is fueled by the growing need for real-time monitoring, personalized treatment, and improved patient care. As IoT devices become more prevalent in healthcare, including wearable devices and remote monitoring tools, the demand for advanced analytics to process this data and support clinical decision-making continues to rise. The increasing focus on healthcare optimization and data-driven patient outcomes is driving the segment’s expansion in the coming years.

By Type

In 2023, the Descriptive Analytics segment dominated the IoT Analytics market, capturing approximately 37% of the total revenue share. This dominance stems from the foundational role descriptive analytics plays in summarizing historical data and providing insights into past performance. Organizations widely use these tools to identify trends, detect patterns, and evaluate operational efficiency, making descriptive analytics an essential part of IoT data processing for decision-making and performance evaluation.

The Prescriptive Analytics segment is expected to grow at the fastest CAGR of about 25.64% from 2024 to 2032. This growth is driven by the increasing demand for actionable, data-driven recommendations to optimize operations and enhance decision-making. As businesses look to IoT data not just to understand what has happened, but also to predict future outcomes and prescribe optimal actions, the value of prescriptive analytics in providing real-time, actionable insights becomes more critical, fueling its rapid adoption in various industries.

By Application

In 2023, the Predictive Maintenance segment dominated the IoT Analytics market, accounting for about 30% of the total revenue share. This dominance is driven by the widespread adoption of IoT-enabled predictive maintenance solutions across industries such as manufacturing, energy, and transportation. By utilizing IoT sensors to monitor equipment conditions in real-time, companies can predict potential failures and perform maintenance only when necessary, reducing operational downtime and maintenance costs, making predictive maintenance a key contributor to market growth.

The Asset Management segment is expected to grow at the fastest CAGR of about 26.77% from 2024 to 2032. This rapid growth can be attributed to the increasing need for organizations to track, manage, and optimize their assets using IoT technologies. As businesses seek to improve asset utilization, reduce inefficiencies, and extend asset lifecycles, the demand for IoT-powered asset management solutions continues to rise, positioning this segment for substantial growth in the coming years.

REGIONAL ANALYSIS

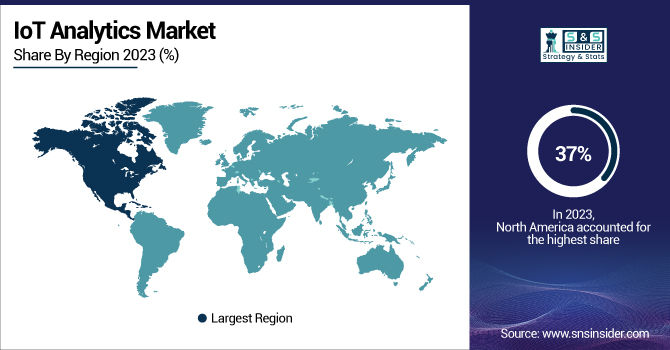

In 2023, North America dominated the IoT Analytics market, capturing approximately 37% of the total revenue share. This leadership is driven by the region's strong technological infrastructure, high adoption of IoT technologies, and the presence of key industry players across sectors like manufacturing, healthcare, and automotive. The increasing demand for real-time data analytics, coupled with substantial investments in smart technologies, positions North America as the dominant force in the market.

The Asia Pacific region is expected to grow at the fastest CAGR of about 26.08% from 2024 to 2032. This growth is fueled by rapid urbanization, expanding industrial sectors, and growing government support for smart city initiatives. As businesses and governments in the region invest heavily in IoT solutions to drive efficiency and innovation, the demand for IoT analytics platforms continues to rise, positioning Asia Pacific as the fastest-growing market for the technology in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

LATEST NEWS-

-

In July 2024, Accenture completed the acquisition of Openstream Holdings and its subsidiaries, Open Stream and Neutral, to enhance its cloud, AI, and IoT capabilities. This acquisition added approximately 1,000 digital experts to Accenture's teams, aiming to support clients in system modernization and the adoption of advanced technologies.

-

In November 2024, Microsoft is leading the cloud AI sector, outpacing Amazon and Google. Microsoft captured 45% of cloud AI case studies, particularly excelling in generative AI, due to its partnership with OpenAI.

-

In January 2025, Synaptics partnered with Google to enhance Edge AI for IoT, integrating Google's machine learning with Synaptics' Astra hardware to develop AI devices that process vision, voice, and sound data.

KEY PLAYERS

-

Accenture (myConcerto, Accenture Intelligent Platform Services)

-

Aeris (Aeris IoT Platform, Aeris Mobility Suite)

-

Amazon Web Services, Inc. (AWS IoT Core, AWS IoT Analytics)

-

Cisco Systems, Inc. (Cisco IoT Control Center, Cisco Kinetic)

-

Dell Inc. (Dell Edge Gateway, Dell Technologies IoT Solutions)

-

Hewlett Packard Enterprise Development LP (HPE IoT Platform, HPE Aruba Networks)

-

Google (Google Cloud IoT, Google Cloud BigQuery)

-

OpenText Web (OpenText IoT Platform, OpenText AI & IoT)

-

Microsoft (Azure IoT Suite, Microsoft Power BI)

-

Oracle (Oracle IoT Cloud, Oracle Analytics Cloud)

-

PTC (ThingWorx, Vuforia)

-

Salesforce, Inc. (Salesforce IoT Cloud, Salesforce Einstein Analytics)

-

SAP SE (SAP Leonardo IoT, SAP HANA Cloud)

-

SAS Institute Inc. (SAS IoT Analytics, SAS Visual Analytics)

-

Software AG (Cumulocity IoT, webMethods)

-

Teradata (Teradata Vantage, Teradata IntelliCloud)

-

IBM (IBM Watson IoT, IBM Maximo)

-

Siemens (MindSphere, Siemens IoT 2040 Gateway)

-

Intel (Intel IoT Platform, Intel Analytics Zoo)

-

Honeywell (Honeywell IoT Platform, Honeywell Forge)

-

Bosch (Bosch IoT Suite, Bosch Connected Industry)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 26.90 Billion |

| Market Size by 2032 | USD 180.36 Billion |

| CAGR | CAGR of 23.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytics) • By Component (Solution, Services) • By Organization Size (Small & Medium Enterprises, Large Enterprises) • By Deployment (On-Premises, Cloud) • By Application (Energy Management, Predictive Maintenance, Asset Management, Inventory Management, Remote Monitoring, Others) • By End Use (Manufacturing, Energy & Utilities, Retail & E-commerce, Healthcare & Life Sciences, Transportation & Logistics, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Aeris, Amazon Web Services, Inc., Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, Google (Alphabet Inc.), OpenText Web, Microsoft, Oracle, PTC, Salesforce, Inc., SAP SE, SAS Institute Inc., Software AG, Teradata, IBM, Siemens, Intel, Honeywell, Bosch |

| Key Drivers | • Rapid Expansion of IoT Devices Drives Growing Demand for Advanced Data Analytics Solutions • AI and Machine Learning Integration Enhances IoT Analytics for Smarter Ecosystems |

| RESTRAINTS | • Data Privacy and Security Concerns Limit Widespread Adoption of IoT Analytics Solutions • High Implementation Costs Limit IoT Analytics Adoption, Especially for Smaller Businesses |