ESG Investing Market Report Scope & Overview:

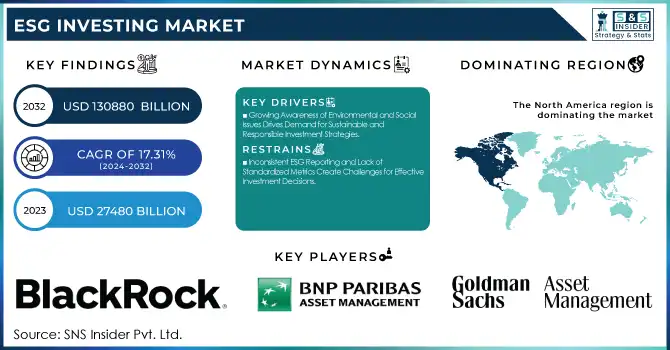

The ESG Investing Market was valued at USD 27,480 billion in 2023 and is expected to reach USD 130,880 billion by 2032, growing at a CAGR of 17.31% from 2024-2032. This growth is fueled by increasing demand for ESG investment funds, with a focus on sustainable and socially responsible practices. Regulatory influence plays a significant role in shaping the market, encouraging transparency and accountability. ESG metrics and scores are becoming integral in evaluating investments, while the adoption rate continues to rise as more investors prioritize sustainability in their portfolios. This report provides an in-depth analysis of these key factors.

To get more information on ESG Investing Market - Request Free Sample Report

ESG Investing Market Dynamics

Drivers

-

Growing Awareness of Environmental and Social Issues Drives Demand for Sustainable and Responsible Investment Strategies.

As environmental and social concerns come to the forefront across the world, individuals and institutions alike are becoming increasingly dedicated to making their financial decisions reflect their values. This is evident in an increasing trend towards investments favoring firms with good environmental responsibility, social commitment, and ethical management. The greater emphasis on sustainability has made investors revisit investment portfolios with the aim of benefiting society alongside creating returns. Increasing demand for responsible investments has caused greater incorporation of ESG considerations in making decisions, causing companies to ramp up their ESG practices. Finally, all this awareness is molding a new paradigm of value-creation-through-investments aimed at long-term value and society's benefit.

Restraints

-

Inconsistent ESG Reporting and Lack of Standardized Metrics Create Challenges for Effective Investment Decisions.

The lack of standardized ESG metrics poses great difficulty for investors seeking to determine and compare the sustainability initiatives of companies. Inconsistent reporting among companies and a lack of widely recognized ESG criteria hinder the ability to measure a company's actual environmental, social, and governance performance. This data variability and reporting heterogeneity create uncertainty that hinders investors from making clear-cut decisions. Consequently, the reputation of ESG investments can be threatened, slowing market expansion and deterring prospective investors looking for unambiguous, credible data. Without standard metrics, investors are confronted with a diversified universe, hindering the mass adoption of ESG-dedicated investment strategies.

Opportunities

-

Technological Innovations in Data Analytics and Reporting Enhance Accuracy and Transparency in ESG Investment Decisions.

Technological innovations in data analytics and ESG reporting systems are driving significant advances in the accuracy and transparency of ESG metrics. With advances in the technologies, they help investors evaluate and compare firms' environmental, social, and governance practices with increased precision. With greater data-driven information, investors are better able to make informed choices, minimizing uncertainty in the ESG investment market. Moreover, the creation of real-time ESG monitoring and reporting platforms is facilitating the process, enabling easier tracking of ESG performance across sectors. These technologies not only increase investor confidence but also enable companies to enhance their sustainability reporting, ultimately leading to growth in the ESG investing market.

Challenges

-

Inconsistent ESG Reporting Standards and Lack of Universal Metrics Create Challenges in Comparing Companies for Investment Decisions.

Different companies having different ESG reporting standards present fundamental challenges for investors when considering evaluating and comparing the sustainability practices of companies. The deficit of common metrics and irregular data reporting make it more difficult to evaluate the actual environmental, social, and governance performance of the companies. Consequently, investors are hindered in making informed decisions, and therefore, they hesitate to adopt ESG investment approaches. This discrepancy not only defeats transparency but also restricts the scope for successful capital allocation in the ESG market. The absence of a uniform method makes it difficult for investors to measure the risks and opportunities of ESG investments, thereby slowing market growth and inhibiting the widespread use of sustainable investing practices.

ESG Investing Market Segment Analysis

By Type

ESG Integration dominated the ESG Investing Market with the highest revenue share of about 40% in 2023 due to the increasing recognition of the long-term value created by incorporating environmental, social, and governance factors into investment strategies. Investors are increasingly adopting ESG integration as a core practice, driven by the growing awareness of its impact on risk management, financial performance, and alignment with sustainability goals.

The Green Bonds segment is expected to grow at the fastest CAGR of about 23.82% from 2024-2032, primarily due to increasing demand for sustainable financing solutions to support climate-related projects. The rise in government and corporate green initiatives, along with regulatory push towards cleaner investments, is fueling the popularity of green bonds. These bonds offer investors a way to support environmental sustainability while achieving competitive returns.

By Investor Types

The Institutional Investors segment dominated the ESG Investing Market with the highest revenue share of about 56% in 2023 due to their significant financial resources and growing commitment to sustainable investment practices. These investors, including pension funds, endowments, and asset managers, are increasingly integrating ESG factors into their portfolios, driven by regulatory requirements, risk management strategies, and the desire to align investments with long-term sustainability goals.

The Retail Investors segment is expected to grow at the fastest CAGR of about 20.89% from 2024-2032, driven by increasing awareness and demand for ethical investment options among individual investors. As millennials and Gen Z prioritize sustainability, more retail investors are opting for ESG-aligned investments. The growing availability of ESG-focused investment products and platforms is also making it easier for retail investors to participate in this market.

By Application

The Environmental segment dominated the ESG Investing Market with the highest revenue share of about 34% in 2023 due to increasing global awareness of climate change and environmental degradation. Investors are focusing on companies that prioritize sustainable practices, such as reducing carbon emissions, conserving resources, and promoting renewable energy. Additionally, regulatory pressures and the growing demand for green technologies have significantly boosted investment in environmentally responsible initiatives.

The Integrated ESG segment is expected to grow at the fastest CAGR of about 20.65% from 2024-2032, driven by the rising need for a comprehensive approach that incorporates all ESG factors into investment decisions. Investors are increasingly seeking integrated ESG strategies to better assess risks, opportunities, and long-term value, recognizing that combining environmental, social, and governance elements offers a more holistic investment approach.

Regional Analysis

North America dominated the ESG Investing Market with the highest revenue share of about 38% in 2023, driven by strong regulatory frameworks, increased investor awareness, and the integration of ESG factors into investment strategies. Major institutional investors, such as pension funds, endowments, and asset managers, are actively incorporating sustainability considerations into their portfolios. Additionally, the region's focus on climate-related policies, corporate transparency, and green financing initiatives has created a robust ESG ecosystem, making it a leader in the market.

Asia Pacific is expected to grow at the fastest CAGR of about 21.03% from 2024-2032, fueled by rapid economic growth, rising awareness of environmental issues, and increasing adoption of sustainable investment practices. Governments across the region are introducing ESG-friendly regulations and green finance initiatives, encouraging companies to prioritize sustainability. Moreover, the growing middle class and young, environmentally-conscious consumers in countries like China and India are driving demand for ESG-aligned products and investments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BlackRock (iShares ESG Aware MSCI USA ETF, BlackRock U.S. Equity ESG ETF)

-

BNP Paribas Asset Management (BNP Paribas Easy ECPI Global ESG Sustainable Equity, BNP Paribas Sustainable Investment Strategy)

-

Goldman Sachs Asset Management (GSAM Global ESG Enhanced Equity Fund, Goldman Sachs ESG Global Impact Fund)

-

J.P. Morgan Asset Management (JPMorgan Sustainable Equity Fund, JPMorgan ESG International Equity Fund)

-

Morgan Stanley Investment Management (Morgan Stanley Sustainable Equity Fund, MSIM Global Impact Fund)

-

Northern Trust Asset Management (Northern Trust Global ESG Equity Fund, Northern Trust ESG Fixed Income Fund)

-

PIMCO (PIMCO ESG Income Fund, PIMCO Total Return ESG Fund)

-

State Street Global Advisors (SPYG ESG ETF, State Street Global Advisors ESG Global All Cap Equity Fund)

-

UBS Group (UBS Sustainable Global Equity Fund, UBS ESG Global Equity Fund)

-

Vanguard Group (Vanguard ESG U.S. Stock ETF, Vanguard FTSE Social Index Fund)

-

Blackstone (Blackstone ESG Impact Fund, Blackstone Green Energy Fund)

-

Franklin Templeton (Franklin Templeton Sustainable Global Equity Fund, Franklin LibertyShares Sustainable Global Dividend ETF)

-

Invesco (Invesco MSCI Sustainable Future ETF, Invesco ESG Global Equity Fund)

-

T. Rowe Price (T. Rowe Price Global Impact Equity Fund, T. Rowe Price Sustainable Strategy Fund)

-

Amundi (Amundi MSCI World ESG ETF, Amundi SRI Global Equity Fund)

-

Citi Private Bank (Citi Sustainable Impact Fund, Citi Global ESG Equity Fund)

-

Schroders (Schroders Global Sustainable Growth Fund, Schroders Sustainable Equity Fund)

-

Legg Mason (Legg Mason ClearBridge Sustainable Growth Fund, Legg Mason Western Asset ESG Fund)

-

Dimensional Fund Advisors (Dimensional U.S. Sustainability Core 1 ETF, Dimensional Global Sustainability Fund)

-

Robeco (Robeco Global Sustainable Equities Fund, RobecoSAM Sustainable Development Goals Impact Equities Fund)

Recent Developments:

-

In 2023, Goldman Sachs committed to deploying USD 750 billion in sustainable finance initiatives, supporting clients in accelerating the transition to a low-carbon economy and promoting inclusive growth.

-

In 2024, J.P. Morgan's ESG Insights platform continues to support clients by providing data, research, and firmwide expertise to navigate sustainable investment opportunities, helping accelerate the transition to a low-carbon future.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27,480 Billion |

| Market Size by 2032 | USD 130,880 Billion |

| CAGR | CAGR of 18.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds, Others) • By Investor Types (Institutional Investors, Retail Investors, Corporate Investors) • By Application (Environmental, Social, Governance, Integrated ESG) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BlackRock, BNP Paribas Asset Management, Goldman Sachs Asset Management, J.P. Morgan Asset Management, Morgan Stanley Investment Management, Northern Trust Asset Management, PIMCO, State Street Global Advisors, UBS Group, Vanguard Group, Blackstone, Franklin Templeton, Invesco, T. Rowe Price, Amundi, Citi Private Bank, Schroders, Legg Mason, Dimensional Fund Advisors, Robeco |