Cognitive Supply Chain Market Report Scope & Overview:

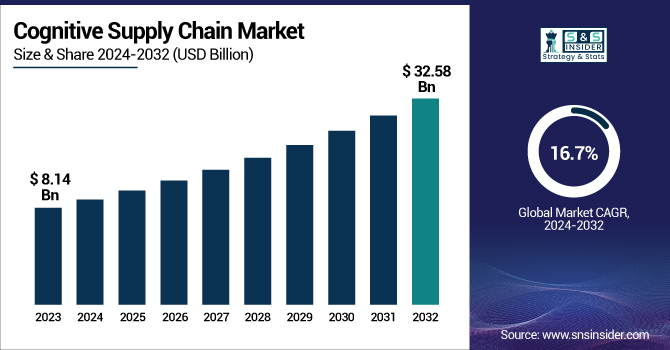

The Cognitive Supply Chain Market Size was valued at USD 8.14 billion in 2023 and is expected to reach USD 32.58 billion by 2032 and grow at a CAGR of 16.7% over the forecast period 2024-2032.

To Get more information on Cognitive Supply Chain Market - Request Free Sample Report

The Market is Changing Rapidly, the Critical Needs of the Operations and Logistics Function for Intelligent Analytics and Decisions. Technologies such as AI, ML, NLP, and real-time analytics are transforming traditional supply chains through predictive insights, automation, and adaptive learning. These facilitate increased efficiency, forecasting, and replenishment, in addition to reducing disruptions! These technologies are being used in back-end operations for key sectors including manufacturing, retail, logistics, and healthcare to improve responsiveness and visibility. With rising investments in cloud and IoT infrastructure as well as growing complexity of global trade and sustainability goals, the need for intelligent, agile supply chain systems continues to grow.

The U.S. Cognitive Supply Chain Market was valued at USD 2.01 billion in 2023 and will reach USD 7.13 billion by 2032, growing at a CAGR of 15.11% during the forecast period 2024-2032.

AI, machine learning, and real-time analytics are automating processes through the U.S. Cognitive Supply Chain Market, its rules, and are driving radical change. These technologies are being deployed to help companies enhance supply chain visibility, optimize demand forecasting, and automate decision-making. As digital adoption is rising and the need for rapid data-driven logistics solutions is becoming a necessity, cognitive tools are proving their worth in industries that include retail, manufacturing, and healthcare.

Cognitive Supply Chain Market Dynamics

Key Drivers:

-

Rising Adoption of AI and Machine Learning in Logistics and Planning Fuels Cognitive Supply Chain Market Growth

The cognitive supply chain market is the increasing usage of artificial intelligence (AI) and machine learning (ML) in logistics, forecasting, and inventory management. Cognitive technologies help businesses to gain predictive insights, automate decisions, and improve operational effectiveness; organizations from various industries like retail, manufacturing, healthcare, and so on are utilizing this upcoming technology. Such intelligent systems provide real-time visibility and responsiveness, eliminating delays while enhancing customer satisfaction.

The shift from traditional supply chains to computer-based solutions allows firms to be more agile and adaptable in uncertain market environments. Moreover, as supply chains become more complex and data-oriented across the world, the demand for cognitive solutions will increase exponentially, thus making AI and ML the weapons of choice in future supply chain planning.

Restrain:

-

Lack of Skilled Workforce and High Implementation Costs Limit Cognitive Supply Chain Market Expansion

Despite the bright potential of cognitive supply chains, the market suffers from a stark lack of qualified professionals as well as high implementation costs. Deploying these cognitive technologies successfully requires expertise in data science, artificial intelligence, machine learning, and cloud computing capabilities that are still inexplicably absent across most of the world and its industries.

Additionally, most of the existing legacy systems require a large capital expense for putting in cognitive solutions, which can be a barrier for small and medium-sized enterprises. Moreover, most companies are also hesitant to risk switching to automated AI models when they do not have the in-house capacity to support automating this step. These challenges were starkly evident in developing economies where the building blocks for digital infrastructure are, at best, nascent. As a result, while the cognitive supply chain market is huge in potential, the constraints are limiting its widespread adoption and are ripe for more investment in teaching employees and lower-cost offering options that can scale.

Opportunities:

-

Increasing Integration of IoT Devices Presents Major Opportunities for Cognitive Supply Chain Market Growth

The cognitive supply chain solutions are the rising use of Internet of Things (IoT) devices across supply chains. End-to-end and real-time streaming of data by sensors, embedded into vehicles, warehouses, and factories, overcomes this lack through IoT, giving each part of the supply chain clear visibility. Analyzing and processing these data through AI and cognitive analysis helps in utilizing these data well, optimizing business performance, reducing downtime, and making proactive decisions.

Increasingly, enterprises in the SAP, Oracle and Honeywell mold are layering an IoT functionality over their supply chain solutions to facilitate a greater degree of connectivity and responsiveness. With the exponential increase in internet connected devices, the convergence of IoT with cognitive supply chains is expected to create intelligent systems that can learn to respond dynamically to changes in demand and supply conditions.

Challenge:

-

Data Privacy Concerns and Cybersecurity Threats Challenge the Growth of Cognitive Supply Chain Solutions

An emerging issue of data privacy & cybersecurity. What makes the cognitive applications highly reliant on data, there are real-time data streams that are collected from multiple digital sources, where a lot of sensitive customer and business data is captured. This reliance renders them sweet targets for data breaches and cyberattacks that may threaten operational continuity and affect your brand reputation. As more organizations begin to leverage cloud computing, IoT devices, and AI models, the supply chain attack surface has grown significantly. Well-publicized instances of ransomware attacks and data breaches in both the logistics and manufacturing industries have heightened regulatory pressure and prompted firms to rethink their cybersecurity infrastructure. Ongoing investment in next-gen security and compliance solutions is needed to provide data protection without compromising the efficiency and interoperability of cognitive systems. The challenge is to strike a balance between innovation and security, which requires both vendors and businesses to position a robust cybersecurity framework at the top of their priorities in their digital transformation agenda.

Cognitive Supply Chain Market Segments Analysis

By Industry Verticals

In 2023, the manufacturing industry led the Cognitive Supply Chain Market, accounting for 30% of the industry’s revenue. This is due to the industry leading the way in the use of AI-driven solutions to maximize productivity, demand forecasts, and inventory control and monitoring. Industries have come out with solutions that deploy AI and machine learning to innovate the manufacturing processes. Moreover, Oracle's integration of generative AI functionalities into its supply chain solutions aids manufacturers in automating repetitive tasks and improving decision-making processes. These applications allow manufacturers to quickly respond to disruptions in the market, reduce operational costs and boost productivity, thus securing a place among the cognitive supply chain actors.

The Cognitive Supply Chain Market is anticipated to represent the fastest growth in terms of transportation and logistics, which is projected to expand with a CAGR of 20.3%. This is because of increased demand for real-time tracking, route optimization, and efficient fleet management. A great example of this trajectory is Alphabet's spin-off Chorus, which offers AI-powered solutions to ensure real-time visibility and condition monitoring of in-flight goods. These advances reduce cargo loss and increase delivery efficiency. Moreover, enterprises are investing in automation in logistics operations with the combination of AI and IoT.

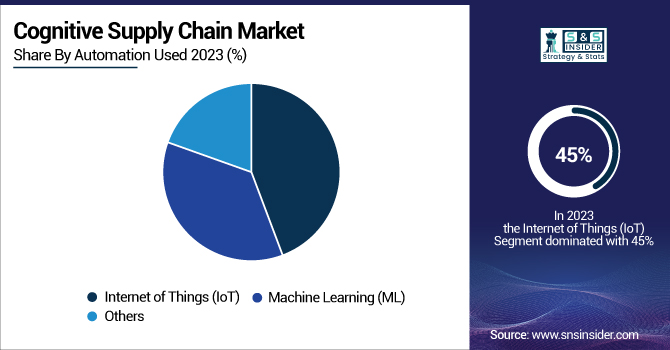

By Automation Used

The IoT segment accounts for the highest 45% market revenue in the Cognitive Supply Chain Market in 2023. IoT devices facilitate real-time monitoring and data collection across the supply chain, providing better visibility and operational efficiency. There are also battery-free IoT sensors or IoT Pixels, such as those created by Wiliot, among others, that track the location and condition of products throughout the supply chain. These technologies help businesses proactively mitigate issues like spoilage or delays, reduce inventory levels, and improve customer satisfaction. The proliferation of IoT technologies underscores their essential function in revolutionizing supply chain processes.

The ML is expected to grow with the Fastest CAGR of 19.1% for the Cognitive Supply Chain Market. ML algorithms transform the management of supply chains by allowing predictive analytics, demand forecasting, and anomaly detection. ML, for instance, is employed by the Luminate Cognitive Platform of Blue Yonder to deliver insights and suggestions in real-time, allowing businesses to make rapid decisions. These features enable reduced operational costs, more accurate forecasting, and elevated responsiveness to market dynamics, driving rapid expansion of the segment.

By Deployment

The Cognitive Supply Chain Market's revenue share is dominated by the on-premises deployment method, which is expected to reach 66% in 2023. This is due to the interest of organizations in having greater control of their infrastructure and data, especially in areas where regulatory compliance enhances the need. While on-premises solutions offer higher security and customization potential, they also come at a higher cost, making them more suited to larger, more complex supply chain operations. The top stands with the segment thanks to the continuing spend on on-premises systems by firms to keep data sovereignty, and due to industry regulations.

Cloud deployment model will continue to grow with the highest CAGR of 18.1% in the Cognitive Supply Chain Market. Cloud solutions are highly scalable, flexible, and cost-saving, and thus, attractive for organizations of all sizes. One example is Oracle building generative AI functionality into its cloud-based supply chain software, enabling enterprises to optimize business processes and enhance decision-making. Cloud technologies enable real-time collaboration, information sharing, and access to high-end analytics, driving the strong growth of the segment.

By Enterprise Size

In 2023, 68% of revenue in the Cognitive Supply Chain Market comes from large businesses. They have cash to burn on sophisticated technologies and are typically early adopters of cognitive products to simplify their complex supply chains. Companies like Microsoft, through its alliance with Blue Yonder, offer platforms that use AI and machine learning to enhance visibility and optimize supply chains. This segment holds a substantial market share as major corporations concentrate on digital transformation to establish a competitive edge.

The SMEs segment is projected to grow at the highest CAGR of 18.8% in the Cognitive Supply Chain Market. Small and medium-sized enterprises (SMEs) are increasingly adopting cognitive technologies to boost operational efficiency, reduce costs, and improve customer satisfaction. Cloud-based offerings and cost-effective AI solution-based tools have enabled SMEs to establish advanced supply chain management systems. This democratization of technology has made it possible for SMEs to come on par with the big organizations, thus making the segment High high-growth driven segment.

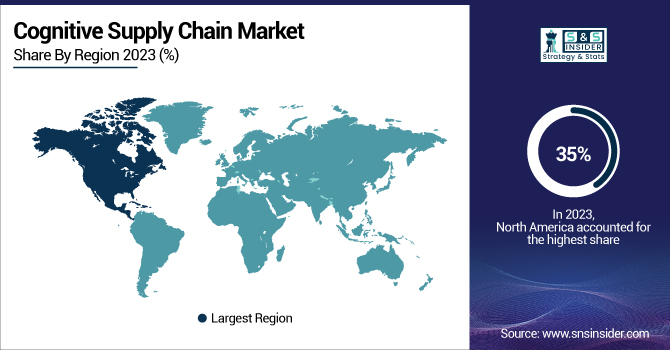

Regional Analysis

North America dominated the Cognitive Supply Chain Market, accounting for around 35% of the market revenue share in 2023. This dominance is due to the region’s early adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), which are at the heart of cognitive supply chain solutions. Companies such as IBM, Oracle, and Microsoft that are based in North America have emerged as significant growth contributors for this market with their advanced cognitive supply chain platforms.

Furthermore, the amount of investments in digital infrastructure and automation technology in the U.S. and Canada has further elevated the region's strong market position. The extensive supply chain complexity across sectors such as retail, automobile, and manufacturing in North America is also driving advanced supply chain demand, further cementing the prominence of the region in the industry.

The Asia Pacific (APAC) region is expected to grow at the highest rate in the Cognitive Supply Chain Market, reporting a CAGR of around 19.4% during the forecast period. This explosive growth is being fuelled by a surge in digital transformation projects taking place in some of the region's largest economies, such as China, India, and Japan. As companies in the APAC region seek to optimize their supply chains for cost savings and efficiency, adoption of cloud computing, IoT, and AI technologies is gaining traction.

Moreover, the region has several manufacturing and logistics hubs, making it an attractive region for implementing cognitive supply chain solutions to optimize processes. APAC companies, including Alibaba Group and Tata Consultancy Services (TCS), are heavily investing in and implementing cognitive supply chain technologies, driving the rapid development of this market. In addition to this, increasing emphasis on e-commerce, volume expansion in cross-border trade, and the need for real-time supply chain visibility are driving the market in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM Corporation (IBM Sterling Supply Chain Suite, IBM Watson Supply Chain Insights)

-

Oracle (Oracle Fusion Cloud Supply Chain Management, Oracle Supply Chain Planning Cloud)

-

Amazon Web Services (AWS) (AWS Supply Chain, Amazon Forecast)

-

Accenture plc (Accenture Intelligent Supply Chain Platform, myConcerto Supply Chain Suite)

-

Intel Corporation (Intel Supply Chain Optimization Tools, Intel AI for Supply Chain Analytics)

-

NVIDIA Corporation (NVIDIA AI Enterprise, NVIDIA Omniverse for Logistics)

-

Honeywell International Inc. (Honeywell Forge Supply Chain Suite, Honeywell Connected Logistics)

-

C.H. Robinson Worldwide, Inc. (Navisphere Vision, Navisphere Optimizer)

-

Panasonic (Panasonic Supply Chain Solutions, Panasonic Logiscend System)

-

SAP SE (SAP Integrated Business Planning, SAP Digital Supply Chain)

-

Microsoft (Dynamics 365 Supply Chain Management, Azure AI for Supply Chain)

-

Kinaxis (Kinaxis RapidResponse, Kinaxis Maestro)

-

Anaplan (Anaplan Supply Chain Planning, Anaplan Demand Planning)

-

Infor (Infor Supply Chain Planning, Infor Nexus)

-

Manhattan Associates (Manhattan Active Supply Chain, Manhattan Demand Forecasting)

Recent Trends

-

In January 2025, Matt Garman, CEO of Amazon Web Services (AWS), discussed the company's strategic investments in artificial intelligence (AI) to enhance its cloud infrastructure, aiming to support generative AI workloads. This initiative is part of AWS's broader effort to integrate AI capabilities into various services, including supply chain management, to improve efficiency and decision-making processes.

-

In March 2024, Oracle announced the integration of generative AI features into its cloud-based software offerings, including supply chain management. These features are designed to assist in tasks such as report generation, data summarization, and drafting job descriptions, aiming to enhance productivity and decision-making in supply chain operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.14 Billion |

| Market Size by 2032 | US$ 32.58 Billion |

| CAGR | CAGR of 16.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Cloud, On-Premise) • By Enterprise Size (SMEs, Large Enterprises) • By Automation Technology Used (Internet of Things (IoT), Machine Learning (ML), Others) • By Industry Vertical (Manufacturing, Retail & E-Commerce, Logistics and Transportation, Healthcare, Food and Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Oracle, Amazon Web Services (AWS), Accenture plc, Intel Corporation, NVIDIA Corporation, Honeywell International Inc., C.H. Robinson Worldwide, Inc., Panasonic, SAP SE, Microsoft, Kinaxis, Anaplan, Infor, Manhattan Associates. |