Aircraft Seating Market Report Scope & Overview:

To get more information on Aircraft Seating Market - Request Free Sample Report

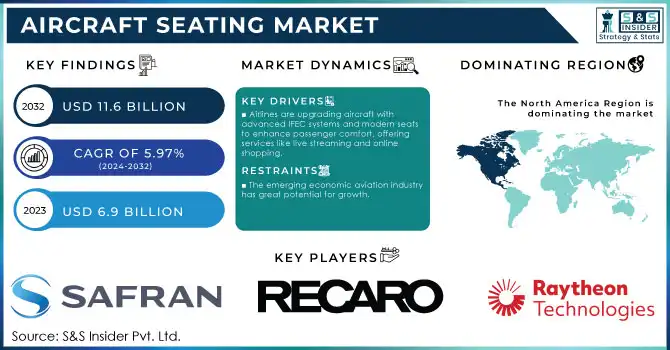

The Aircraft Seating Market was valued at USD 6.9 billion in 2023 and is projected to reach USD 11.6 billion by 2032, registering a CAGR of 5.97% from 2024 to 2032.

Airplanes are specially designed to accommodate the needs of passengers, and they provide functions such as seating and power holes. The seats are made of fire-resistant, durable, durable, lightweight, and durable material. The increase in airline passengers has created lucrative opportunities for airline manufacturers. Currently, passengers are more inclined to travel by airplane compared to road transport to save time. Manufacturers and airlines prefer narrow seats, with smaller and simpler seats currently reducing the range of seats for more passengers on each aircraft.

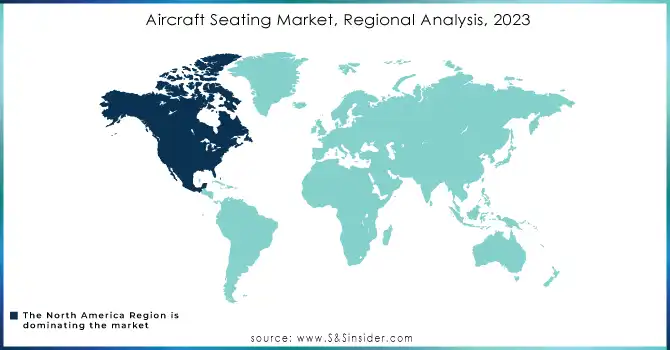

By Air Type, half of the public airlines dominated the global aviation market by 2020, in terms of revenue. With parts and building materials, part of the property of the building receives a high share. In the form of seats, part of the economy class receives the largest share. For the end-user, the OEM part receives its maximum share. Currently, Asia-Pacific imports the highest revenue followed by North America.

MARKET DYNAMICS

Drivers

Existing aircraft are being upgraded with advanced products such as IFEC systems as airlines around the world strive to provide more comfort with accommodation and other services, including in-flight practice and in-flight communication for live streaming and online shopping. Many airlines are upgrading their aircraft seats, as old seats are obsolete. The introduction of high-quality and lightweight cabinet seats has led to the development of existing aircraft seats into new seats. Additionally, most business jet owners own their own cabinet seats, with companies now offering a variety of designs and accessories to customize air cabinet seats. The upgrade helps to reduce costs, as parts of modern aircraft seats such as IFEC systems, actuators, and seat structures are made of lightweight materials, thus reducing the overall weight of the aircraft. With 35-50% of operating costs in fuel, airlines undertake development projects to reduce costs and stay competitive.

Restraints

The emerging economic aviation industry has great potential for growth. However, this ability was not used extensively. Developed countries like the US dominate the airline market where five major airlines — Midwest Airlines, Frontier Airlines, Northwest Airlines, AirTran Airlines, and American Airlines — have merged their business since 2008 to increase profits. The US has also been a major beneficiary of lower oil prices, rising monetary and fiscal policies, and a downturn in the private sector, coupled with its stable labor market that has strengthened its global position. In addition, the country has a high proportion of consumer spending, leading to higher demand for air travel.

Lack of proper infrastructure and additional taxes imposed on the airports of India and African countries have, among other things, led to an increase in airline prices.

OPPORTUNITIES

The rapid pace of technological development has turned the idea of Urban Air Mobility (UAM) into an attractive business proposal. With increasing traffic congestion, especially in large cities, people are constantly looking for better and safer ways to get to work and other places. One of the key features that promote UAM is the emergence of a landing and landing aircraft (eVTOL). Another major pilot is a change in aviation technology, especially Distributed Electric Propulsion (DEP).

The UAM market structure requires a combination of architecture, technology, and business. In this case, the technical aspect plays a major role as it combines system configuration, battery performance, software development, charging technology, and more. Similarly, architecture is also important, as the ports in the sky require a lot of energy, and almost every vertiport is expected to have a charging station. This grows the business in both the power industry and the housing industry.

In addition to veteran players like Boeing and Airbus, young people with the right technical knowledge seem to be gaining the likes of Uber, Joby Aviation, and Kitty Hawk. Dubai, Singapore, the US, and China are key pioneers of UAM that create demand and attraction in this market. Dubai has already launched test aircraft in 2017 and is trying to launch commercial operations for its Autonomous Aerial Taxi Service in the forecast period. In addition, the Uber Elevate project was expected to be launched in Los Angeles, Dallas, and Melbourne by 2023 before the impact of the Covid-19. Uber Elevate will offer two business models - Uber Air and Uber Copter. The emergence of the UAM airport is expected to create a new market opportunity for the aviation industry

CHALLENGES

The outbreak of COVID-19 has led to serious economic problems and challenges in the aviation industry. Since the outbreak, the aviation industry has been among the most affected sectors in the world. The International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA) actively monitor the economic impact of the aviation industry and regularly publish reports and forecasts. According to a recent report published by IATA, below is a financial impact on the aviation sector, nationally, as a result of the COVID-19 epidemic.

The outbreak of COVID-19 has led to serious economic problems and challenges in the aviation industry. Since the outbreak, the aviation industry has been among the most affected sectors worldwide. The International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA) are actively monitoring the economic impact of the aviation industry and regularly publishing reports. and predictions. According to a recent report published by IATA, below is a financial impact on the aviation sector, nationally, as a result of the COVID-19 epidemic.

The Impact of Covid-19 on the Market

The COVID-19 crisis is creating market uncertainty, a sharp decline in supply chain values, a slowdown in business confidence, and increasing panic among consumers. Governments in various regions have already announced the closure and temporary closure of factories, thus having a negative impact on total production and sales. Temporary closures of various projects, developments, and production facilities reduce market growth. The global economic downturn focused on fighting the epidemic will have a devastating effect on market demand.

The Lockdown situation is due to an increase in COVID-19 charges that temporarily cut off various activities in the aviation industry such as manufacturing, raw material supply, and aviation delivery, among others.

The number of domestic airlines has been returning to pre-epidemic levels, especially in developing countries such as China and Russia.

The airline market includes major players Safran (Zodiac Aeropsace), Collins Aerospace, Geven S.p.A., RECARO Aircraft Seating, and HAECO. These players have spread their business to various countries including North America, Europe, Asia Pacific, the Middle East, Africa and South America. COVID-19 has had an impact on their businesses. Industry experts believe that COVID-19 could affect aircraft production and production by 7–10% worldwide by 2020

KEY MARKET SEGMENTATION

By Seat

-

Economy Class

-

Premium Economy

-

Business Class

-

First Class

By End-Use

-

OEM

-

MRO

-

Aftermarket

By Seat Type

-

9G

-

16G

By Component

-

Seat Actuators

-

Foams

-

Fittings

-

Others

By Aircraft Type

-

Civil aircraft

-

UAM

By Components & Materials

-

Cushion & Filling Material

-

Structure Material

-

Upholsteries & Seat Cover

-

Seat Actuators

-

Others

REGIONAL COVERAGE

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Need any customization research on Aircraft Seating Market - Enquiry Now

Key Players

The Key Players are Raytheon Technologies Corporation, Recaro Aircraft Seating GmbH , Safran, Swire Pacific Limited, The Aviation Industry Corporation of China, Ltd.,Geven S.p.a., Jamco Corporation, Acro Aircraft Seating Ltd, Airbus S.A.S., Aviointeriors S.p.A.& Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | USD 6.9 Billion |

| Market Size by 2030 | USD 11.6 Billion |

| CAGR | CAGR of 5.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Seat (Economy Class, Premium Economy, Business Class, First Class) • By End-Use (OEM, MRO, Aftermarket) • By Seat Type (9G,16G) • By Component (Seat Actuators, Foams, Fittings, Others) • By Aircraft Type (Civil aircraft, Helicopters, UAM) • By Components & Materials (Cushion & Filling Material, Structure Material, Upholsterer & Seat Cover, Seat Actuators, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Raytheon Technologies Corporation, Recaro Aircraft Seating GmbH & CO. KG, Safran, Swire Pacific Limited, The Aviation Industry Corporation of China, Ltd.,Geven S.p.a., Jamco Corporation, Acro Aircraft Seating Ltd, Airbus S.A.S., Aviointeriors S.p.A. |

| Key Drivers | • Existing aircraft are being upgraded |

| RESTRAINTS | • The emerging economic aviation industry has great potential for growth. |