Air Taxi Market Report Scope & Overview:

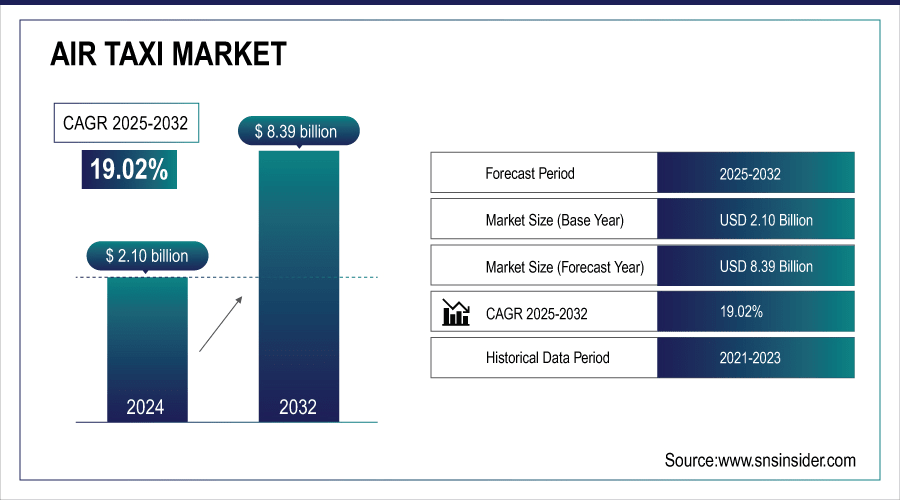

The Air Taxi Market size was valued at USD 2.10 billion in 2024 and is expected to reach USD 8.39 billion by 2032, growing at a CAGR of 19.02% from 2025-2032.

The growth of the Air Taxi Market is fueled by rising urban congestion, increasing demand for faster intracity and intercity mobility, and advancements in electric vertical take-off and landing (eVTOL) technology. Supportive government regulations, growing investments from aerospace companies, and the push toward sustainable, low-emission transportation further accelerate adoption. Additionally, expanding applications in passenger transport, medical evacuation, and cargo movement strengthen market demand, making air taxis a key element of future urban mobility solutions.

According to the Federal Highway Administration's 2023 Urban Congestion Trends report, 65% of the 52 largest metropolitan areas in the United States reported increased congestion levels from 2022 to 2023.

The Texas Department of Transportation's 2024 Advanced Air Mobility Committee Report highlights the potential economic impact of the AAM industry, including cargo transport, and emphasizes the need for infrastructure development and regulatory support.

The U.S. government is accelerating regulatory approvals for Urban Air Mobility, demonstrating strong institutional support, while Morgan Stanley forecasts the eVTOL market could reach USD 1 trillion by 2040, potentially deploying 100,000 vehicles worldwide, underscoring significant long-term growth potential.

To Get More Information On Air Taxi Market - Request Free Sample Report

Air Taxi Market Trends

-

Growing demand for urban air mobility solutions is driving air taxi market expansion.

-

Advancements in electric vertical take-off and landing (eVTOL) aircraft are enhancing efficiency and sustainability.

-

Increasing traffic congestion in metropolitan areas is boosting adoption of aerial transport.

-

Integration of AI, automation, and advanced navigation systems is improving safety and operations.

-

Rising investments from aerospace companies, startups, and venture capital are accelerating development.

-

Supportive government initiatives and regulatory frameworks are shaping commercialization.

-

Collaborations between aviation, mobility service providers, and technology firms are fostering ecosystem growth.

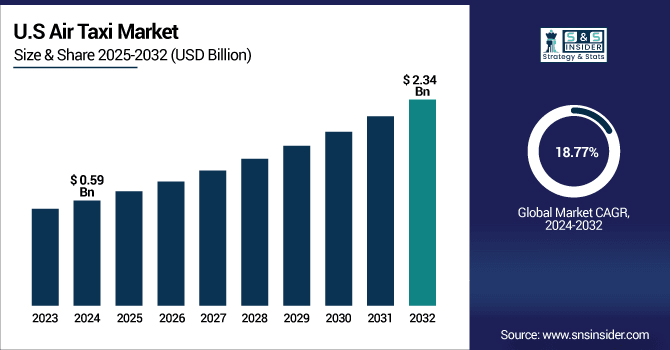

The U.S. Air Taxi Market size was valued at USD 0.59 billion in 2024 and is expected to reach USD 2.34 billion by 2032, growing at a CAGR of 18.77% from 2025-2032.

The U.S. Air Taxi Market is growing due to rising urban air mobility initiatives, strong government support, technological advancements in eVTOL aircraft, and increasing demand for faster, sustainable transportation solutions to reduce traffic congestion in major metropolitan areas.

Air Taxi Market Growth Drivers:

-

Growing advancements in electric vertical take-off and landing (eVTOL) technologies supported by heavy investments from aerospace and mobility companies

Growing advancements in electric vertical take-off and landing (eVTOL) technologies are significantly driving the expansion of the air taxi market. These innovations enable quieter, more efficient, and eco-friendly flight operations, reducing reliance on traditional fuel-based aircraft. Global aerospace leaders, startups, and investors are heavily funding research and commercialization of next-generation eVTOLs, making the technology more viable and cost-effective. Governments and regulatory bodies are also creating favorable frameworks to fast-track testing and deployment. With increasing scalability, improved safety features, and declining production costs, eVTOL development continues to strengthen air taxi adoption across passenger, cargo, and emergency applications.

| Company | Development |

|---|---|

|

Joby Aviation |

Record certification progress: As of Q4 2024, Joby advanced in Stage 4 of FAA certification. Type Inspection Authorization (TIA) flight testing expected within 12 months. |

|

Defense & flight test fleet strengthening: Delivered a second eVTOL aircraft to the U.S. Air Force; operates five aircraft in test fleet, including a hydrogen-hybrid variant. |

|

|

First passenger plans & funding: Testing to be completed in Dubai by mid-2025; aims for first passenger operations late 2025/early 2026, backed by over USD 1 billion in commitments. |

|

|

Final certification milestone: Joby’s first conforming aircraft entered final assembly, moving into the final FAA type certification stage. |

|

|

Initial TIA testing underway: Began first FAA TIA testing with FAA-conforming hardware, starting final certification flight tests. |

|

|

Hyundai (Supernal) |

Dedicated AAM division: Hyundai Motor Group formed Supernal, an Advanced Air Mobility division to develop eVTOLs and infrastructure. |

|

Strategic partnerships: Partnered with Korean Air to accelerate eVTOL design and ecosystem development in Korea. |

|

|

Component innovation: Supernal, Hyundai WIA, and Mecaer Aviation Group collaborating on landing gear innovation for safety and scalability. |

|

|

Concept unveiled: Supernal revealed its S-A2 eVTOL concept at CES 2024, showcasing design and technology roadmap. |

Air Taxi Market Restraints:

-

High infrastructure development costs and limited availability of vertiports restricting large-scale adoption and operational scalability of air taxi services

High infrastructure development costs and limited availability of vertiports act as a major restraint for the air taxi market. Establishing a reliable air mobility ecosystem requires advanced facilities such as vertiports, charging stations, and air traffic management systems. These infrastructures demand significant investments, which many regions are not yet prepared to fund. Moreover, delays in urban planning and regulatory clearances further slow deployment. Without sufficient take-off and landing hubs, air taxi services cannot achieve large-scale operations, thereby limiting passenger accessibility. This financial and logistical challenge hampers widespread commercialization despite rising demand and technological advancements.

-

Port San Antonio, Texas – Real-World Case Study: The Port has already invested USD 13.6 million in site preparation and planning for a vertiport. However, the estimated total cost could climb to USD 102.5 million, contingent on federal and state funding. This substantial investment emphasizes the economic challenge of building a single high-capacity vertiport.

-

Rolls-Royce recently withdrew from eVTOL investments, citing major cost increases and delays, affecting startups like Vertical Aerospace and overall industry sentiment.

-

The Texas Department of Transportation (TxDOT) has proposed a grant program to support the development of vertiports across Texas, with funding ranging from USD 50 million to 100 million over 4–6 years, depending on the required surveillance hardware.

Air Taxi Market Opportunities:

-

Rising integration of air taxis into smart city projects and mobility-as-a-service ecosystems creating new pathways for urban transportation innovation

Rising integration of air taxis into smart city projects offers significant opportunities for the market. Governments and city planners are increasingly embedding advanced air mobility into long-term infrastructure strategies to enhance connectivity. Integration with mobility-as-a-service (MaaS) platforms enables seamless travel experiences by connecting air taxis with ground transport options like ride-hailing, buses, or metros. This alignment not only improves urban mobility efficiency but also attracts private-public partnerships. As urbanization accelerates, leveraging air taxis within smart city ecosystems can unlock broader adoption, creating sustainable and technologically advanced mobility frameworks across high-density regions worldwide.

| Region / Authority | Initiative / Event | Details | Date |

|---|---|---|---|

|

Dubai – Roads & Transport Authority (RTA) |

First aerial taxi test flight |

Conducted in collaboration with Joby Aviation and Skyports; included dedicated vertiport, hangar, flight monitoring systems, and electric charging, integrated with city's multimodal transport network |

June 2025 |

|

Indonesia – Nusantara Capital City Authority |

Integrated AAM service demonstration |

Hyundai Motor Group and Kia partnered to demonstrate “Shucle,” a demand-responsive Advanced Air Mobility solution |

July 2024 |

Los Angeles, USA – LADOT |

MaaS integration |

Integrating the city's taxi fleet into the Mobility-as-a-Service system to create a connected and efficient urban mobility network |

Ongoing |

|

Michigan, USA – Advanced Air Mobility Initiative |

State-level AAM initiative |

Executive directive by Governor Gretchen Whitmer to scale AAM capabilities; allocated over USD 4.1 million for research and infrastructure to support safe integration |

2025 |

Air Taxi Market Segment Highlights

-

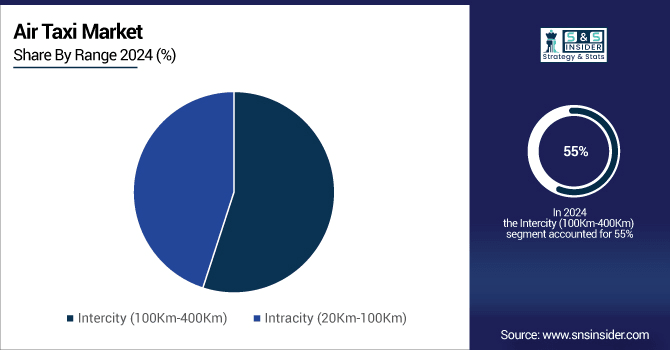

By Range, Intercity (100Km–400Km) dominated with ~55% share in 2024; Intracity (20Km–100Km) fastest growing (CAGR).

-

By Mode of Operation, Piloted dominated with ~70% share in 2024; Autonomous fastest growing (CAGR).

-

By Application, Passenger Transportation dominated with ~50% share in 2024; Cargo Transportation fastest growing (CAGR).

-

By Propulsion Type, Electric dominated with ~65% share in 2024; Electric fastest growing (CAGR).

-

By End User, Commercial dominated with ~65% share in 2024; Commercial fastest growing (CAGR).

Air Taxi Market Segment Analysis

By Range, Intercity dominated the Air Taxi Market in 2024, while Intracity is projected to grow fastest

The intercity segment dominated the Air Taxi Market in 2024 due to increasing demand for faster, time-saving travel across medium distances. It offers a practical alternative to congested roads and short-haul flights, making it highly attractive for business travelers and commuters seeking reliable, efficient, and convenient intercity mobility solutions.

The intracity segment is expected to grow fastest from 2025 to 2032 driven by rapid urbanization, rising traffic congestion, and the demand for efficient city-based transportation. Short-distance routes within densely populated areas are ideal for eVTOL deployment, providing quick connectivity while reducing travel times, making intracity mobility a transformative growth driver.

By Mode of Operation, Piloted air taxis led in 2024, with Autonomous operations expected to grow fastest

The piloted segment dominated the Air Taxi Market in 2024 as passengers and regulators continue to prefer human-operated aircraft for safety and trust. The presence of skilled pilots enhances confidence, ensures smoother adoption during early commercialization, and overcomes public hesitation toward autonomous technology, making piloted services the preferred operational choice.

The autonomous segment is expected to grow fastest from 2025 to 2032 due to advancements in automation, AI-driven navigation, and reduced operational costs. Autonomous air taxis promise scalability, efficiency, and affordability, while eliminating pilot dependency. Growing regulatory developments and technology validation further drive adoption, making autonomous solutions a key future growth area.

By Application, Passenger transportation held the largest share in 2024, while Cargo transportation is anticipated to grow fastest

The passenger transportation segment dominated the Air Taxi Market in 2024 as rising demand for quick, on-demand urban and intercity travel drives adoption. Business commuters, tourists, and city dwellers increasingly seek faster alternatives to ground transport, positioning passenger air mobility as the most widely adopted and revenue-generating application.

The cargo transportation segment is expected to grow fastest from 2025 to 2032 owing to increasing demand for rapid, cost-effective, and flexible logistics solutions. Air taxis provide faster deliveries in congested cities and remote areas, enhancing e-commerce, healthcare, and supply chain efficiency. Expanding applications in time-critical cargo movement further accelerate growth.

By Propulsion Type, Electric air taxis dominated in 2024 and are set to grow fastest

The electric segment dominated the Air Taxi Market in 2024 and is set to grow fastest from 2025 to 2032 due to the global push for sustainable transportation, rapid adoption of eVTOL aircraft, and continuous improvements in battery efficiency. Electric propulsion ensures quieter operations, lower maintenance, and reduced emissions compared to conventional systems, making it the preferred choice for urban air mobility. Strong policy support, coupled with heavy investments from aerospace and technology companies, continues to boost this segment, driving both dominance and accelerated growth.

By End User, Commercial users led the market in 2024, and this segment is projected to grow fastest

The commercial segment dominated the Air Taxi Market in 2024 and is projected to grow fastest from 2025 to 2032 owing to rising demand for efficient passenger transportation across urban and intercity routes. Growing adoption by business travelers, corporate mobility services, and tourism sectors highlights its widespread application. Strategic collaborations between aerospace manufacturers, operators, and urban planners are enhancing scalability. Additionally, increasing regulatory support and private investments are enabling broader adoption, positioning the commercial segment for sustained dominance and the fastest growth ahead.

Air Taxi Market Regional Analysis

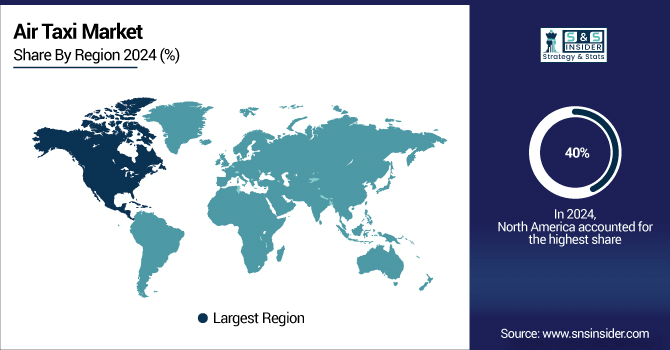

North America Air Taxi Market Insights

North America dominated the Air Taxi Market in 2024 with about 40% revenue share due to advanced aviation infrastructure, strong regulatory support, and early adoption of innovative air mobility solutions. High investments from aerospace companies, pilot programs, and urban air mobility initiatives have strengthened the region’s leadership, enabling faster commercialization and widespread acceptance of air taxi services across major cities.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Air Taxi Market Insights

Asia Pacific is expected to grow fastest from 2025 to 2032 driven by rapid urbanization, rising traffic congestion, and increasing investments in eVTOL aircraft. Government incentives, smart city developments, and growing adoption of innovative transportation solutions are fueling demand. Expanding infrastructure and supportive policies position the region for accelerated growth, making it a key market for future air taxi operations.

Europe Air Taxi Market Insights

Europe held a significant position in the Air Taxi Market in 2024 due to well-developed aviation infrastructure, strong environmental regulations, and growing investments in sustainable urban mobility solutions. Early adoption of eVTOL technology, supportive government initiatives, and pilot programs in major cities like London, Paris, and Berlin have driven market growth, positioning Europe as a key player in air taxi commercialization.

Middle East & Africa and Latin America Air Taxi Market Insights

The Middle East & Africa held a notable share in the Air Taxi Market in 2024 due to investments in smart city projects, advanced eVTOL adoption, and supportive government initiatives, driving urban mobility development and market growth across key cities.

Latin America contributed to the Air Taxi Market in 2024 as rising urban congestion, smart city projects, and growing aviation infrastructure investments boosted adoption, creating opportunities for efficient urban and intercity air transportation solutions.

Air Taxi Market Competitive Landscape:

Joby Aviation

Joby Aviation, founded in 2009, is a leading player in the Air Taxi Market, specializing in eVTOL aircraft for urban air mobility. The company focuses on electric, piloted air taxis designed for safe, quiet, and efficient transportation. With significant investments, strategic partnerships, and regulatory approvals, Joby Aviation is advancing commercial operations, positioning itself as a key innovator driving the adoption and growth of air taxi services globally.

-

2024: Unveiled FAA-authorized ElevateOS software suite including pilot app, operations core, and rider app for managing high-tempo, on-demand air taxi operations.

-

2025: Virgin Atlantic partners with Joby to launch air taxi services in the UK, offering 8-minute flights at ride-share-like prices.

-

2025: Secured a USD 1 billion framework with Abdul Latif Jameel to deliver 200 aircraft, maintenance, MRO, and pilot training in Saudi Arabia; aiming for Dubai services by 2026.

-

2025: Joby Aviation Conducted the first piloted eVTOL flight between two U.S. public airports (Marina to Monterey, CA), showcasing vertical takeoff, controlled airspace integration, and 12-minute operations.

Vertical Aerospace

Vertical Aerospace, founded in 2016, is a prominent player in the Air Taxi Market, focusing on developing electric eVTOL aircraft for sustainable urban air mobility. The company emphasizes zero-emission, low-noise, and efficient flight operations. With ongoing prototype testing, advanced battery systems, and regulatory progress, Vertical Aerospace is positioned to lead innovation and commercialization in the global air taxi sector.

-

2023: Vertical Aerospace Completed unmanned test flight of the VX4 eVTOL prototype in the UK; hover, fly, and land demonstration with newer battery-powered and quieter propeller systems.

-

2025: Vertical Aerospace Performed its first piloted hover flight tests of the VX4 prototype, advancing toward low-speed maneuver trials in eVTOL certification progress.

Volocopter

Volocopter, founded in 2011, is a leading developer in the Air Taxi Market, specializing in electric eVTOL aircraft for urban air mobility. The company focuses on safe, quiet, and sustainable transportation solutions, targeting both passenger and cargo applications. With strategic collaborations and extensive flight testing, Volocopter is advancing the commercialization of scalable urban air mobility services globally.

-

2023: Volocopter Executed the first eVTOL test flights in Saudi Arabia’s NEOM region in collaboration with NEOM and GACA, setting foundations for scalable electric urban air mobility.

Key Players

Some of the Air Taxi Market Companies

-

Airbus

-

Uber Technologies Inc.

-

Dassault Systèmes

-

Hyundai Motor Company

-

Wisk Aero

-

Volocopter GmbH

-

Sarla-Aviation Private Limited

-

Joby Aviation

-

Archer Aviation Inc.

-

BETA Technologies

-

Eve Air Mobility

-

Lilium

-

EHang

-

Vertical Aerospace

-

Textron eAviation / Bell

-

Pipistrel

-

Overair

-

Supernal

-

SkyDrive

-

Xpeng AeroHT

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.10 Billion |

| Market Size by 2032 | USD 8.39 Billion |

| CAGR | CAGR of 19.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Range (Intercity (100Km–400Km), Intracity (20Km–100Km)) • By Mode of Operation (Autonomous, Piloted) • By Propulsion Type (Electric, Gasoline, Hybrid) • By Application (Passenger Transportation, Medical Evacuation, Search and Rescue, Cargo Transportation, Others) • By End User (Commercial, Government & Military) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Airbus, Uber Technologies Inc., Dassault Systèmes, Hyundai Motor Company, Wisk Aero, Volocopter GmbH, Sarla-Aviation Private Limited, Joby Aviation, Archer Aviation Inc., BETA Technologies, Eve Air Mobility, Lilium, EHang, Vertical Aerospace, Textron eAviation / Bell, Pipistrel, Overair, Supernal, SkyDrive, Xpeng AeroHT |