Automotive IoT Market Size & Overview:

Get More Information on Automotive IoT Market - Request Sample Report

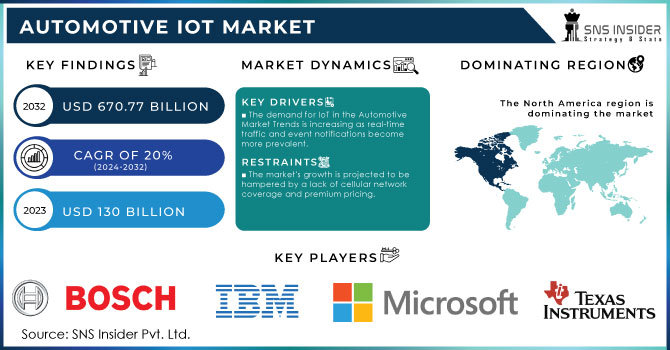

The Automotive IoT Market Size was valued at $130 billion in 2023 and is expected to reach $670.77 billion by 2032 and grow at a CAGR of 20% by 2024-2032

The Internet of Things (IoT) idea is gaining a lot of traction. These are one-of-a-kind schemes for managing consumer interactions and collaborating with objects to create new applications. In the automobile business, the Internet of Things is helping to develop the industry and redefine its goals and on-field operations. The automobile sector is undergoing a four-phase transformation with the help of IoT.

The most visible and well-known example of the Internet of Things is connected automobiles. The Internet of Things (IoT) is a network of networked computing devices, both digital and mechanical, that allows for data transfer independently. The debut of the automotive IoT industry has also increased the demand for automated devices that can evaluate real-time data on vehicle users and fleet operators. It's also linked to the smart automotive internet, which divides communications into three categories: in-vehicle, vehicle-to-vehicle, and vehicle-to-infrastructure.

The Automotive IoT market is all set to boom on account of fast-growing developments in the world of connected vehicle technology and an ever-increasing demand for smart transportation solutions. The most prominent trend is that as the IoT becomes increasingly integrated into vehicle systems, this enhances the safety, efficiency, and overall user experience. Today, as many as 78% of automakers are integrating IoT solutions with their vehicles to enhance its real-time monitoring capabilities and predictive maintenance. Other key trends included the take-up of Vehicle-to-Everything (V2X) communication, in which around 62% of vehicles will be equipped with V2X capabilities by 2025, thereby improving traffic management and lowering accident rates.

Also, the demand for self-driving is aggressively pushing for IoT deployment and it is anticipated to support nearly 45% of the new cars in the following years that will be equipped with Level 2 or Level 3 autonomy depending upon IoT sensors and communication systems.

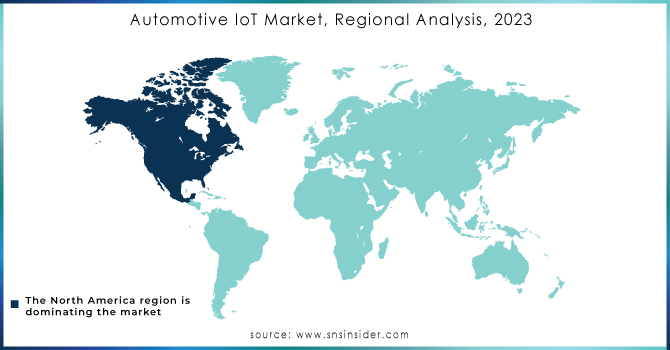

Regional Trends A regional trend concerning IoT-enabled vehicles is that nearly 55% of global sales are located in North America and Europe because of supportive regulatory and enabling infrastructure. Automotive IoT continues to mature, and as such, cybersecurity is gaining attention. Currently, 34% of connected vehicle manufacturers increased their investment in securing IoT networks and prevention of data breaches against safe vehicle operation.

MARKET DYNAMICS:

KEY DRIVERS:

-

The demand for IoT in the Automotive Market Trends is increasing as real-time traffic and event notifications become more prevalent.

-

The number of telematics mandates issued by governments of various economies is also increasing.

-

There is a significant surge in demand for both aided and automated driving.

-

With the help of IoT, people want their digital lifestyles to expand into their cars.

-

Cars with smartphone features are also becoming more popular. All of this promotes market expansion.

Increasing vehicle sales, where interior systems form a prime application area for vehicles, will be one of the key drivers for the Automotive IoT Market. The current innovations relating to making the inside passenger experience both cozy and convenient, such as advanced infotainment systems, smart climate control, and bespoke in-car services, are primarily the mainstay of key players in the business. Industry experts explain that around 60% of automotive OEMs are shifting focus to a passenger-centric approach, wherein comfort and connectivity features come first. In particular, the passenger vehicles will lead during the forecast period, with 75% of OEMs focused on IoT-driven technologies aimed at passenger vehicles.

The trend has been supported by CEOs of major OEMs, who mentioned that these smart solutions shall improve customer experience-this includes frictionless device integration capability to autonomous driving. The second major integrating factor that is going to improve the safety aspect of vehicles and reduce operation costs is the incorporation feature of the incorporation of the Internet of Things. Some 40 percent of new car models, embedded in cars, are IoT-enabled safety systems. This hints at the fact that the automotive industry of the future will be dictated by more passenger comforts and complex interior systems. Key players will innovate further by further using IoT to produce highly connected and efficient vehicles that will respond to changing consumer demands.

RESTRAINTS:

-

Security and Data privacy in the IoT are important roadblocks to the market's global expansion.

-

The market's growth is projected to be hampered by a lack of cellular network coverage and premium pricing.

The high cost pressures because of the economic turndowns will be the growth obstructing factor which will be faced by the OEMs during the forecasted period. The companies should also monitor their overall profitability during the forecasted period. As per the analysis done by the SNS Insider, the dawn of high costs will be the real threat for the OEMs in the present and future scenario.

OPPORTUNITIES:

-

For future-generation, the government is extending financing for vehicle-to-vehicle and vehicle-to-infrastructure availability of cars.

-

Automobiles with smartphone capabilities are also becoming increasingly popular.

CHALLENGES:

-

Differences in internet availability & speed around the world. As a result, adoption is projected to be slow with poor internet penetration.

-

High costs are a major impediment to the growth of the Automotive IoT industry.

-

Risk of unanticipated technical faults due to ongoing re-modeling.

-

Security has become a major concern as the number of linked cars grows.

Impact of Russia Ukraine War:

The war in Ukraine has thrown a wrench into the already pre-strained automotive IoT market. A key ripple effect came from Ukraine's significant role in supplying wire harnesses, crucial for connecting a car's electrical systems. This disruption caused a 400,000 unit drop in global car production in 2023, translating to a missed opportunity of reaching a potential 93 million in sales. The chip shortage, further exacerbated by the war, only compounded the problem. This supply-side squeeze, coupled with rising material costs due to sanctions and global instability, has pushed new car prices up by an estimated 8-10%. The impact is likely to linger as the conflict continues, forcing automakers to navigate a landscape of high demand, limited supply, and inflated costs for IoT components in the automotive sector.

Impact of Economic Slowdown:

The ongoing war and potential for a wider economic slowdown cast a shadow over the automotive industry's love affair with the Internet of Things (IoT). With global chip shortages pushing car prices up 12% in 2023, consumer demand for feature-rich, IoT-laden vehicles may take a backseat. Automakers, facing potential recessionary pressures, might prioritize production of lower-priced models with less complex in-car tech, further hampering the near-term growth of the $22 billion automotive IoT market, which was projected to reach $41 billion by 2027 as per SNS Insider. This slowdown could force IoT vendors to innovate and offer cost-effective solutions to entice automakers to integrate connected features without significantly inflating vehicle prices.

Market Segmentation Analysis:

By Offerings:

In by offerings segment the software segment will be having the highest CAGR growth rate, as the software segment is been further divided into two major sub segments which include semicondictors components and Connectivity ICs. The share of 48% will be held by the software segment. If we focus on the other sub-segments Services will be holding the highest CAGR growth rate. As many OEMs have started to invest heavily in this segment.

By Communication:

The by communication segment is studied in three sub segments, and the analysis done by the SNS Insider In-Vehicle Communication will be the segment which will holding the share of approximately 42%. Other segments will be having the highest CAGR growth during the forecasted period. The major reason why the other segments growth is obstructed is mainly becasue of the rising cyberthreats.

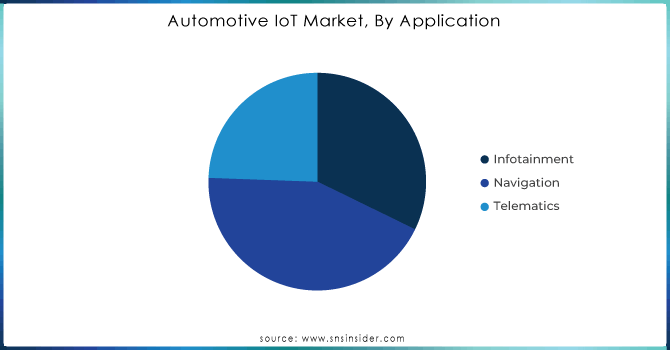

By Application:

Infotainment will be the segment which will be holding the share of 52% during the forecasted period. The other segments which include the navigation and telematics will be holding the highest CAGR growth rate during the forecasted period.

To Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

North America Automotive IoT remains highly promising with the growth of adoption of connected vehicles, advanced driver-assistance systems, and smart infrastructure solutions. More than 80% of new vehicles in the region have some form of IoT integration, such as telematics or V2X communication. The spread of 5G technology has accelerated the adoption of IoT in vehicles further, especially in the United States, where 60% of connected vehicles use 5G networks to boost performance. Also, the influence of electric vehicles markets boosts the adoption of IoT within this region as almost 70% of EV manufacturers were employing the use of IoT for battery performance monitoring and optimization of charging and overall management.

In fact, the IoT-based traffic management system is being deployed in almost 45% of North America's urban areas in a bid to reduce congestion and ensure increased road safety. More than 55% of fleet operators in the region are also using IoT solutions for real-time diagnostics on their vehicles to reduce downtime, for example. North America has a sound regulatory framework and the demand for such connected services among customers will further increase in the Automotive IoT market over the next couple of years.

KEY PLAYERS:

Texas Instruments Inc. (U.S.), Intel Corporation (U.S.), NXP Semiconductors N.V. (Netherlands), Microsoft Corp. (U.S.), TOMTOM N.V. (Netherlands), IBM, Corporation (U.S), Apple Inc. (U.S.), Cisco Systems Inc. (U.S.), Thales SA (France), AT&T Inc. (U.S.), Vodafone Group (U.K.), Robert Bosch GmbH (Germany), General Motors (U.S.), Google Inc. (U.S.), Audi AG (Germany), Ford Motor Company (U.S.).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 130 Billion |

| Market Size by 2032 | US$ 670 Billion |

| CAGR | CAGR of 20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | by Offering (Software, Services, Hardware), by Communication (In-Vehicle Communication, Vehicle-to-Vehicle Communication, Vehicle-to-Infrastructure Communication), by Connectivity (Embedded, Tethered, Integrated), by Application (Infotainment, Navigation, Telematics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments Inc. (U.S.), Intel Corporation (U.S.), NXP Semiconductors N.V. (Netherlands), Microsoft Corp. (U.S.), TOMTOM N.V. (Netherlands), IBM, Corporation (U.S), Apple Inc. (U.S.), Cisco Systems Inc. (U.S.), Thales SA (France), AT&T Inc. (U.S.), Vodafone Group (U.K.), Robert Bosch GmbH (Germany), General Motors (U.S.), Google Inc. (U.S.), Audi AG (Germany), Ford Motor Company (U.S.). |

| Key Drivers | The demand for IoT in the Automotive Market Trends is increasing as real-time traffic and event notifications become more prevalent. The number of telematics mandates issued by governments of various economies is also increasing. |

| RESTRAINTS | Security and Data privacy in the IoT are important roadblocks to the market's global expansion. The market's growth is projected to be hampered by a lack of cellular network coverage and premium pricing. |