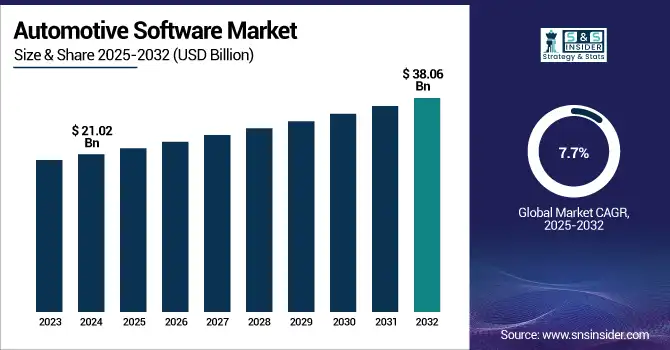

Automotive Software Market Size & Overview:

The Automotive Software Market Size was valued at USD 21.02 billion in 2024 and is expected to reach USD 38.06 billion by 2032 and grow at a CAGR of 7.7% over the forecast period 2025-2032.

Get More Information on Automotive Software Market - Request Sample Report

Automotive software is a collection of programmable data instructions used in computer-based in-vehicle applications to accomplish activities. Automotive software also includes software for embedded systems in vehicles. Automotive Telematics, body control, comfort, communication, advanced driver assistance systems (ADAS), and safety are all examples of computer-based in-vehicle applications. These technological improvements have pushed automakers to develop automobile software solutions that provide greater utility and convenience to their customers.

Automotive software is like the main part of the modern car, controlling everything from safety features to entertainment systems. Advanced driver-assistance systems utilize software for functions like automatic braking and lane departure Waring, making driving more secure and simpler. To keep up with this demand, carmakers are partnering with software developers to create complex ADAS features. As cars get more connected and personalized, technologies like AI and 5G will be crucial. AI is already used for features like voice commands and driver monitoring, and will become even more important in future vehicles. The massive amount of data generated by car software is another reason AI is important. Profound learning, a type of AI, is anticipated to be a major driver of development in the automotive software market. In brief, software is changing the automotive industry, making driving more secure, more successful, and more agreeable.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing Demand for Connected Vehicles and In-Vehicle Infotainment Systems Is Accelerating Automotive Software Adoption Across All Major Vehicle Segments

The surge in demand for connected cars and advanced infotainment is fueling the adoption of automotive software. Consumers are seeking seamless digital experiences, including real-time navigation, voice commands, multimedia features, and smartphone integration within vehicles. Automakers are embedding sophisticated software platforms to enhance user interaction and ensure over-the-air updates. This growing reliance on software-defined functions is transforming traditional vehicles into intelligent, connected systems. Moreover, government mandates for connectivity features and safety applications are further accelerating this trend. As a result, the market is seeing an upsurge in demand for robust automotive software solutions across all major vehicle segments.

RESTRAINTS:

-

Complexity in Standardization and Integration Across Diverse Vehicle Platforms and Systems Hampers Software Interoperability

The lack of universal standards for automotive software development poses a major restraint to market expansion. Different vehicle platforms, hardware architectures, and supplier ecosystems create challenges in software compatibility and integration. As vehicles incorporate more ECUs and software layers, ensuring seamless communication between systems becomes increasingly complex. Interoperability issues can lead to software errors, safety risks, and increased development timelines. Furthermore, aligning with multiple global compliance frameworks adds to the technical burden. This fragmented landscape makes it difficult to scale solutions efficiently and discourages cohesive innovation across the industry.

OPPORTUNITIES:

-

Growing Adoption of Over-the-Air Updates Enables Continuous Feature Enhancement and Unlocks Aftermarket Revenue Streams for Automakers

The integration of over-the-air (OTA) update capabilities is revolutionizing vehicle software management and creating new revenue opportunities. OTA allows automakers to remotely deliver software enhancements, security patches, and new features without requiring dealership visits. This improves customer satisfaction while reducing operational costs. Additionally, it opens pathways for subscription-based services, in-app purchases, and real-time performance improvements. As vehicles become more software-defined, OTA functionality becomes essential. The ability to monetize post-sale software updates enables manufacturers to maintain ongoing customer engagement and develop new business models around digital service delivery in the automotive domain.

CHALLENGES:

-

Ensuring Cybersecurity and Data Privacy in Connected and Autonomous Vehicles Presents a Persistent Technical and Regulatory Challenge

The increasing connectivity of modern vehicles exposes them to significant cybersecurity and data privacy risks. As vehicles become integrated with cloud systems, smartphones, and external networks, vulnerabilities can be exploited by malicious actors. Automotive software must safeguard user data, ensure secure communication between ECUs, and prevent unauthorized access to control systems. The complexity intensifies with autonomous vehicles that rely on vast data flows. Regulatory pressure is also mounting, demanding compliance with data protection laws such as GDPR. Developing secure yet flexible software architectures remains a key challenge for automakers and tech suppliers alike.

SEGMENT ANALYSIS

By Application

ADAS and safety systems dominate the automotive software market due to increasing regulatory mandates for vehicle safety and rising consumer demand for enhanced driver assistance features. Functions like adaptive cruise control, lane-keeping assist, emergency braking, and collision warning are becoming standard across various vehicle classes. Automakers are prioritizing software integration to meet safety ratings and compliance standards. The focus on reducing road fatalities and improving driving conditions continues to push the adoption of sophisticated safety software, solidifying this segment’s leading position in the global automotive software market.

Autonomous driving is the fastest-growing segment in the automotive software market, fueled by rapid advancements in artificial intelligence, sensor fusion, and real-time data processing technologies. The push toward Level 3 and Level 4 autonomy has increased demand for high-performance software that enables perception, decision-making, and control. Continuous investment in R&D, partnerships between automotive and tech companies, and expanding pilot programs are accelerating innovation in autonomous functions. As vehicles move toward full autonomy, this segment is experiencing the highest CAGR, transforming mobility with safer, smarter, and more efficient driving capabilities.

By Software Type

Application software leads the automotive software market due to its critical role in enabling infotainment, ADAS, navigation, and telematics functions. Consumers demand rich digital experiences, pushing automakers to invest in feature-rich applications that enhance comfort, connectivity, and safety. These applications run on vehicle infotainment units and mobile integrations, offering flexibility and customization. With over-the-air updates and cloud integration becoming standard, application software continues to be the most widely adopted and revenue-generating segment in the automotive software ecosystem.

Operating systems are the fastest-growing segment in the automotive software market due to rising demand for secure, real-time, and scalable platforms. Modern vehicles rely on operating systems to manage everything from autonomous driving algorithms to sensor data processing and ECU communication. As vehicles evolve into complex, software-defined platforms, robust OS architectures are essential for performance and safety. Growth is further accelerated by increased adoption of Linux-based and custom OS solutions, along with the rise of centralized computing and domain controllers in next-generation vehicle architectures.

By Vehicle Type

Passenger cars dominate the automotive software market due to their high production volumes and rapid integration of advanced features like infotainment, ADAS, and connectivity solutions. Automakers are prioritizing software development to enhance user experience, safety, and vehicle performance in this segment. Growing consumer demand for smarter, safer, and connected vehicles continues to drive software adoption in passenger cars, making it the largest and most influential vehicle category within the global automotive software ecosystem.

Electric vehicles are the fastest-growing segment in the automotive software market, driven by the industry's shift toward sustainable mobility and software-defined architectures. EVs require complex software for battery management, powertrain optimization, autonomous capabilities, and vehicle-to-grid communication. Automakers and tech companies are investing heavily in EV platforms, pushing innovation and accelerating deployment. The increasing availability of government incentives, rising consumer interest, and continuous advancements in EV infrastructure further amplify software demand, resulting in exponential growth and the highest CAGR within the automotive software market.

By Deployment Type

On-board vehicle software dominates the automotive software market because of its integral role in managing real-time vehicle functions like braking, steering, engine control, and infotainment. This software is deeply embedded in electronic control units (ECUs), enabling ultra-low latency and high reliability. With increasing complexity in vehicle electronics and rising safety standards, automakers prioritize robust on-board systems for regulatory compliance and user safety. Its unmatched performance and direct hardware integration continue to make it the most adopted deployment model globally.

Hybrid deployment models are the fastest growing in the automotive software market, combining on-board, cloud, and edge processing for greater flexibility. As vehicles require real-time decisions alongside cloud-based analytics and over-the-air (OTA) updates, hybrid architectures enable seamless functionality across environments. This approach supports connected services, autonomous driving, and vehicle-to-everything (V2X) communication. Automakers are rapidly adopting hybrid models to enhance scalability, ensure continuous updates, and improve system efficiency—making it the most promising deployment strategy in the transition to software-defined vehicles.

By Propulsion Type

Internal Combustion Engine (ICE) vehicles dominate the automotive software market because they still make up the majority of global vehicle production and active fleets. Mature manufacturing ecosystems, well-established fueling infrastructure, and cost advantages in emerging economies contribute to their widespread adoption. Automakers continue upgrading ICE models with advanced software features such as ADAS, infotainment, and diagnostics to stay competitive, further solidifying this segment’s dominant position despite the growing momentum of electric mobility solutions.

Battery Electric Vehicles (BEVs) are the fastest-growing segment in the automotive software market due to the global shift toward sustainable transportation and zero-emission goals. BEVs rely heavily on software for battery management systems, range optimization, autonomous functions, and connected services. Governments worldwide are offering incentives, setting emission targets, and investing in EV infrastructure, accelerating adoption. As BEVs become increasingly software-defined, the demand for robust and intelligent software platforms is rapidly expanding, making this segment the most dynamic and fastest-evolving in the automotive ecosystem.

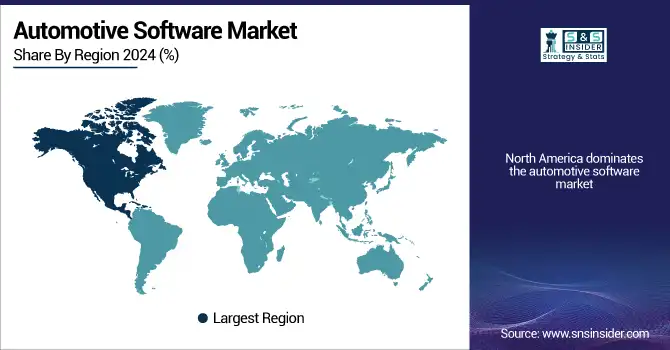

REGIONAL ANALYSES

North America dominates the automotive software market owing to its robust automotive ecosystem, early adoption of autonomous and connected vehicle technologies, and strong R&D investments. Major automakers and tech firms in the U.S. and Canada are pioneering software-defined vehicle innovations, including ADAS, infotainment, and cybersecurity. The region’s regulatory push for vehicle safety and emissions compliance also drives software integration. This established infrastructure and innovation-led market landscape make North America the global leader in automotive software adoption.

Asia Pacific is the fastest-growing region in the automotive software market, driven by rising electric vehicle adoption, urbanization, and government-led smart mobility programs. Countries like China, Japan, and South Korea are heavily investing in software-defined vehicles and autonomous driving technologies. The region’s strong manufacturing base, expanding middle class, and digital transformation trends fuel the demand for advanced automotive software. With favorable regulations and infrastructure support, Asia Pacific is experiencing accelerated growth, positioning it as a key future hub for automotive software innovation.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

The major key players are Robert Bosch (Germany), Green Hills Software (US), Wind River Systems, Renesas Electronics (Japan), Airbiquity (US), BlackBerry (Canada), NVIDIA (US), Autonet Mobile, Inc. (USA), Elektrobit (US), NXP (Netherlands) and other key players.

RECENT DEVELOPMENTS:

-

In January 2024, Green Hills became the first embedded software provider certified to the ISO/SAE 21434 automotive cybersecurity standard for INTEGRITY‑178 RTOS, enhancing its standing in security-critical SDV applications.

-

In January 2025, NVIDIA announced that several automakers (Toyota, Aurora, Continental) adopted the DRIVE AGX Orin platform running DriveOS for advanced driving assistance and autonomous functions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 21.01 Billion |

| Market Size by 2032 | US$ 38.06 Billion |

| CAGR | CAGR of 7.7 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch (Germany), Green Hills Software (US), Wind River Systems, Renesas Electronics (Japan), Airbiquity (US), BlackBerry (Canada), NVIDIA (US), Autonet Mobile, Inc. (USA), Elektrobit (US), NXP (Netherlands) |

| Key Drivers | • A growing desire for vehicles with internet connectivity. • Advancements in ADAS features, requiring complex software, are fueling growth in the Automotive Software Market. |

| RESTRAINTS | • High development costs associated with complex automotive software delay wider adoption. • Cyber-security concerns regarding data privacy and hacking vulnerabilities in connected cars slow down market growth. |