Spare Parts Logistics Market Report Scope & Overview:

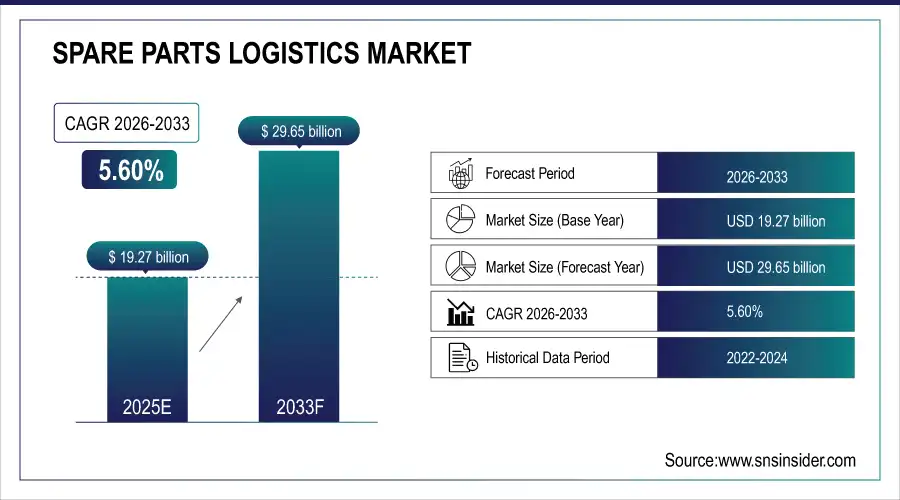

The Spare Parts Logistics Market was valued at USD 19.27 billion in 2025E and is expected to reach USD 29.65 billion by 2033, growing at a CAGR of 5.60% from 2026-2033.

The Spare Parts Logistics Market is witnessing steady growth due to increasing demand for timely and efficient delivery of automotive and industrial spare parts. Expansion of e-commerce platforms, rising aftermarket services, and advancements in warehouse automation and inventory management are driving market adoption. Growing industrialization, fleet expansions, and the need for reduced downtime in manufacturing and transportation sectors further contribute to market growth, supporting a robust compound annual growth rate over the forecast period.

To Get more information on Spare Parts Logistics Market - Request Free Sample Report

|

Region / Country |

Details |

Organization / Investment / |

|

Europe |

Opening a second European parts center in France by summer 2024 to enhance parts availability and complement Amsterdam center. |

MG Motors (SAIC) – Strategic Expansion |

|

Europe |

Developing a 1.3 million sq ft automated food distribution warehouse in Northamptonshire, opening 2029, featuring robotics and automated cranes to improve efficiency and reduce costs. |

Marks & Spencer – USD 432 Million Investment |

|

Europe |

Funding to enhance warehouse automation capabilities, providing autonomous mobile robots for material handling in logistics. |

Vecna Robotics – USD 100 Million Series C Funding |

|

United States |

AI-powered logistics platform for cross-border shipping, order tracking, return management, and inventory forecasting. |

Swap – USD 40 Million Series B Funding |

|

United States |

Acquisition of seven last-mile logistics properties in Australia, targeting e-commerce and retail rapid delivery demand. |

Goldman Sachs – USD 200 Million Investment |

Market Size and Forecast

-

Market Size in 2025: USD 19.27 Billion

-

Market Size by 2033: USD 29.65 Billion

-

CAGR: 5.60% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Spare Parts Logistics Market Trends

-

Rising demand for timely delivery and inventory optimization is driving the spare parts logistics market.

-

Growing adoption in automotive, industrial machinery, aerospace, and electronics sectors is boosting growth.

-

Integration of IoT, AI, and predictive analytics is enhancing supply chain visibility and operational efficiency.

-

Expansion of e-commerce and global aftermarket services is fueling logistics requirements.

-

Focus on reducing lead times, costs, and stockouts is shaping market trends.

-

Advancements in warehouse automation, smart packaging, and real-time tracking are improving service levels.

-

Collaborations between logistics providers, OEMs, and technology firms are accelerating innovation and deployment.

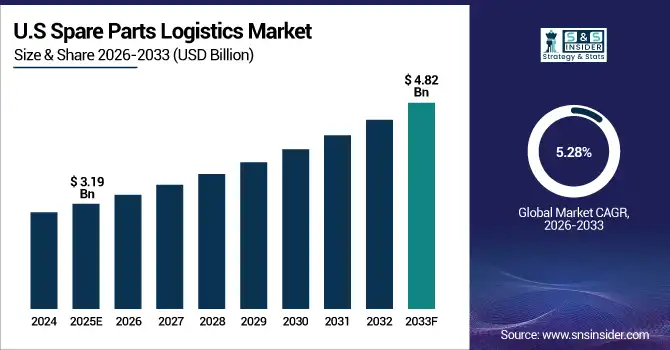

U.S. Spare Parts Logistics Market was valued at USD 3.19 billion in 2025E and is expected to reach USD 4.82 billion by 2033, growing at a CAGR of 5.28% from 2026-2033.

The U.S. Spare Parts Logistics Market is expanding steadily due to increasing demand for automotive aftermarket parts, growth of e-commerce platforms, adoption of advanced inventory management systems, and the implementation of efficient distribution networks, enhancing supply chain reliability and speed.

Spare Parts Logistics Market Growth Drivers:

-

Rising integration of advanced technologies and digitalization in supply chains is accelerating Spare Parts Logistics Market expansion

Digital transformation is enabling companies to manage complex spare parts networks efficiently. Adoption of IoT, AI, and cloud-based logistics platforms allows real-time tracking, demand forecasting, and predictive maintenance. Robotics and automated storage systems reduce human error and operational costs, enhancing supply chain responsiveness. Integration with ERP systems ensures seamless coordination between manufacturers, distributors, and service centers. Growing reliance on technology-driven logistics enhances visibility and agility in spare parts delivery. This technological adoption is accelerating market growth, enabling organizations to streamline operations, reduce downtime, and provide faster, more reliable spare parts services globally.

-

Amazon has deployed over 750,000 mobile robots and tens of thousands of robotic arms in its warehouses, achieving a 25% reduction in order fulfillment costs and projected savings of USD 10 billion annually by 2030.

-

Ascendo AI is transforming spare parts management with AI agents that enable predictive allocation, leveraging real-time insights to optimize spare parts distribution, minimize downtime, and drive operational excellence.

-

SAP Business AI is integrating AI into warehouse logistics, allowing systems to learn, recognize patterns, and proactively support decisions, optimizing processes in real time.

-

Hicron Software emphasizes integrating IoT for real-time monitoring and cloud-based solutions for enhanced collaboration and scalability, improving spare parts management and operational efficiency.

Spare Parts Logistics Market Restraints:

-

Regulatory compliance and cross-border shipment complexities are limiting Spare Parts Logistics Market efficiency

Global spare parts logistics requires adherence to multiple regulatory standards, including import/export regulations, safety certifications, and environmental guidelines. Delays due to customs inspections, documentation errors, or non-compliance can disrupt supply chains. Differing regional standards for hazardous materials, automotive parts, or electronics add complexity. Companies must invest in compliance management systems and train staff to navigate regulatory frameworks. Failure to comply can lead to fines, shipment delays, or reputational damage. These regulatory and cross-border challenges hinder operational efficiency, increase costs, and limit scalability. Ensuring seamless international logistics while meeting legal requirements remains a major market restraint.

Spare Parts Logistics Market Opportunities:

-

Expanding e-commerce and aftermarket services are creating significant opportunities in Spare Parts Logistics Market

The growth of online sales and aftermarket service channels is increasing demand for efficient spare parts delivery. Customers expect fast, accurate, and trackable shipments, encouraging investment in last-mile logistics solutions. Companies can leverage automated warehouses, predictive inventory management, and regional distribution centers to meet rising demand. Growing vehicle fleets, industrial equipment, and electronic devices create recurring spare parts needs. Strategic partnerships with e-commerce platforms and service providers enable wider reach and improved customer satisfaction. These trends present a strong opportunity for logistics providers to expand their services, enhance revenue, and strengthen market presence globally.

|

Company / Organization |

Details |

Investment / Initiative |

|

PALFINGER |

Facility designed to deliver parts faster, reduce equipment downtime, and strengthen service for dealers and customers across U.S., Canada, and Mexico. |

North American Parts Distribution Center – USD 15 Million |

|

Stellantis |

39,200 sq.m facility to strengthen U.S. parts distribution network for Mopar genuine service parts and accessories in the southeastern U.S. |

Automated Mopar Parts Distribution Center – USD 41 Million |

|

Major U.S. Logistics Company |

Implementation reduced unplanned downtime by 73% and saved $1.7 million annually. |

AI-Powered Predictive Maintenance |

|

Walmart |

Investment in autonomous forklifts from Fox Robotics to automate warehouse operations, improve efficiency, and compete with retailers like Amazon. |

Autonomous Forklifts – USD 200 Million |

Spare Parts Logistics Market Segment Highlights

-

By End-use, OEM Parts dominated with ~55% share in 2025; Aftermarket Parts fastest growing (CAGR).

-

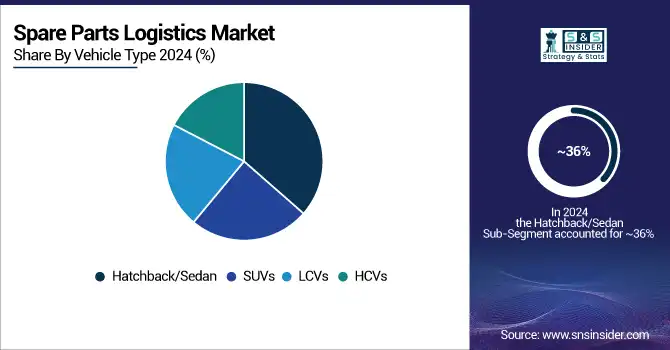

By Vehicle Type, Hatchback/Sedan dominated with ~36% share in 2025; SUVs fastest growing (CAGR).

-

By Service Type, Transportation dominated with ~43% share in 2025; Inventory Management fastest growing (CAGR).

-

By Spare Parts Type, Body & Structural Parts dominated with ~22% share in 2025; Wheels & Accessories fastest growing (CAGR).

-

By Transportation Mode, Roadways dominated with ~59% share in 2025; Roadways fastest growing (CAGR).

Spare Parts Logistics Market Segment Analysis

By Vehicle Type, Hatchback/Sedan dominated in 2025; SUVs projected fastest growth 2026–2033

Hatchback/Sedan segment dominated the Spare Parts Logistics Market with the highest revenue share in 2025 due to mass production and widespread ownership. Frequent replacement needs and extensive service networks make spare parts logistics for these vehicles more consistent, profitable, and easier to manage, supporting steady revenue and market dominance.

SUVs segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing consumer preference and rising production. Expanding road networks and higher replacement demand for parts and accessories contribute to rapid growth, creating significant opportunities for logistics providers in managing SUV spare parts distribution efficiently.

By End-Use, OEM parts led in 2025; aftermarket parts expected fastest growth 2026–2033

OEM Parts segment dominated the Spare Parts Logistics Market with the highest revenue in 2025 due to strong demand from vehicle manufacturers and established supplier networks. Consistent replacement cycles, quality assurance, and OEM partnerships make these parts the preferred choice, ensuring stable logistics operations and revenue generation.

Aftermarket Parts segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising vehicle age and increasing demand for cost-effective replacements. E-commerce platforms and independent repair shops facilitate wider distribution, while flexibility in sourcing and customization options drives rapid adoption, boosting growth in the spare parts logistics market.

By Service Type, Transportation services led in 2025; inventory management expected fastest growth 2026–2033

Transportation segment dominated the Spare Parts Logistics Market with the highest revenue share in 2025 because it ensures timely delivery between manufacturers, distributors, and service centers. Efficient networks, optimized schedules, and reliable supply chains enhance operational efficiency, supporting large-scale logistics operations and consistent revenue growth across the market.

Inventory Management segment is expected to grow at the fastest CAGR from 2026-2033 due to adoption of digital solutions, warehouse automation, and demand forecasting tools. Improved stock control reduces overstock and stockouts, enabling logistics providers to enhance efficiency, lower operational costs, and respond swiftly to market demand, driving rapid segment growth.

By Spare Parts Type, Body & structural parts dominated in 2025; wheels & accessories projected fastest growth 2026–2033

Body & Structural Parts segment dominated the Spare Parts Logistics Market with the highest revenue share in 2025 due to high replacement frequency from collisions, wear, and tear. Essential for vehicle safety and aesthetics, these parts maintain steady demand, ensuring consistent logistics operations and revenue stability within the market.

Wheels & Accessories segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising customization trends and replacement demand. Consumer interest in personalization and performance enhancements, along with aftermarket innovations, drives rapid growth in the logistics and distribution of wheels and related accessories, expanding market opportunities.

By Transportation Mode, Roadways led in 2025 and expected fastest growth 2026–2033

Roadways segment dominated the Spare Parts Logistics Market with the highest revenue share in 2025 due to its extensive infrastructure, flexibility, and cost-effectiveness in transporting parts across diverse regions. Well-established road networks and accessibility to urban and rural areas ensure timely deliveries, supporting high-volume logistics operations. It is also expected to grow at the fastest CAGR from 2026-2033, driven by increasing demand for faster, reliable, and last-mile deliveries, coupled with rising vehicle ownership and e-commerce expansion in the automotive sector.

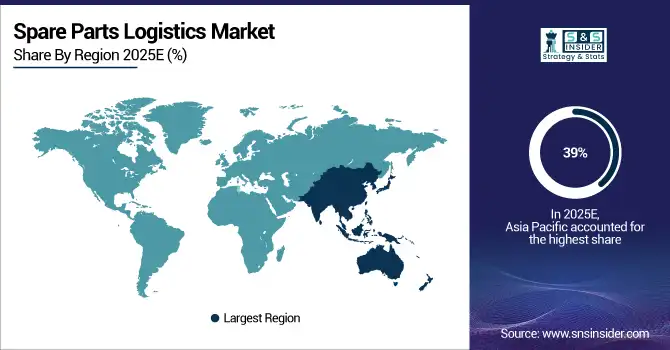

Spare Parts Logistics Market Regional Analysis

Asia Pacific Spare Parts Logistics Market Insights

Asia Pacific dominated the Spare Parts Logistics Market with the highest revenue share of about 39% in 2025 due to rapid industrialization, growing automotive production, and high vehicle ownership rates. Well-established manufacturing hubs, expanding e-commerce networks, and increasing demand for spare parts in both urban and rural areas strengthen logistics infrastructure, enabling efficient distribution and timely deliveries, supporting market dominance and consistent revenue generation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Spare Parts Logistics Market Insights

Europe segment is expected to grow at the fastest CAGR of about 7.25% from 2026-2033 owing to increasing adoption of advanced logistics technologies, stringent regulatory standards, and rising vehicle replacement demand. Investments in smart warehouses, efficient transportation networks, and focus on sustainability enhance operational efficiency, while growing e-commerce penetration and demand for aftermarket and OEM parts drive rapid growth in the spare parts logistics market.

North America Spare Parts Logistics Market Insights

North America holds a significant position in the Spare Parts Logistics Market due to its well-developed transportation infrastructure, advanced supply chain technologies, and high vehicle ownership. Strong presence of OEMs and aftermarket suppliers, coupled with efficient warehousing and distribution networks, ensures timely delivery of spare parts. Growing demand for electric and connected vehicles further drives logistics modernization, enhancing market efficiency, reliability, and overall revenue generation across the region.

Middle East & Africa and Latin America Spare Parts Logistics Market Insights

The Spare Parts Logistics Market in Middle East & Africa and Latin America is driven by expanding vehicle sales, rising demand for replacements, and improving road and transportation infrastructure. Growing investments in logistics networks, warehouse expansion, and e-commerce adoption support efficient distribution and aftermarket growth. Increasing consumer awareness, vehicle maintenance needs, and developing supply chains strengthen market presence, modernize logistics operations, and boost overall regional revenue across both regions.

Spare Parts Logistics Market Competitive Landscape:

Kuehne + Nagel International AG

Kuehne + Nagel, founded in 1890 and headquartered in Schindellegi, Switzerland, is a global logistics and supply chain management company providing air, sea, and contract logistics solutions. The company focuses on industry-specific solutions for automotive, industrial, retail, and healthcare sectors, emphasizing efficiency, digitalization, and sustainability. Kuehne + Nagel’s spare parts logistics operations support global manufacturers by ensuring timely delivery, inventory optimization, and reliable distribution, enhancing operational continuity and customer satisfaction.

-

April 2024: Expanded spare parts logistics operations for BMW at Dingolfing and Bruckberg sites for worldwide dispatch.

-

June 2024: Opened a new contract logistics center for global spare parts distribution.

-

December 2024: Opened 37 new sites worldwide, adding 569,000 square meters to strengthen spare parts logistics capabilities.

DB Schenker

DB Schenker, headquartered in Essen, Germany, is a leading global logistics provider offering land transport, air and ocean freight, and contract logistics services. The company supports diverse industries with integrated solutions for supply chain optimization, including EV battery logistics and spare parts distribution. DB Schenker emphasizes innovation, sustainability, and operational efficiency, leveraging digital tools and green transport solutions to enhance global logistics performance and reduce environmental impact.

-

December 2024: Appointed by Geely to handle end-to-end contract logistics for spare parts and EV battery storage in Australia for the EX5 electric vehicle launch.

-

October 2024: Deutsche Bahn approved the sale of DB Schenker to DSV for €14.3 billion, to focus on railway infrastructure and debt reduction.

CEVA Logistics

CEVA Logistics, headquartered in Marseille, France, is a global contract logistics and freight management company serving industries including automotive, industrial, and retail. CEVA focuses on sustainable supply chain solutions, advanced digitalization, and operational efficiency. Its services include contract logistics, freight management, and specialized spare parts distribution, supporting manufacturers and distributors in improving service levels, reducing emissions, and optimizing supply chain performance worldwide.

-

May 2025: Strengthened partnership with Magneti Marelli Parts & Services, enhancing spare parts logistics.

-

July 2025: Participated in a two-year pilot program in France using low-carbon trucks for terminal-to-terminal relay networks to decarbonize long-distance freight.

DSV A/S

DSV, headquartered in Hedehusene, Denmark, is a global transport and logistics provider offering air, sea, and road freight, as well as contract logistics solutions. The company focuses on innovation, digitalization, and supply chain efficiency, supporting spare parts management and predictive maintenance solutions. DSV leverages technology and partnerships to automate procurement, optimize inventory, and deliver tailored logistics solutions, maintaining above-market growth and enabling clients to improve operational continuity and sustainability.

-

2024: Partnered with Augury to provide a Parts as a Service (PaaS) solution, connecting machine health insights with inventory management to automate replacement part procurement.

XPO Logistics

XPO Logistics, headquartered in Greenwich, Connecticut, USA, is a global provider of supply chain solutions specializing in transportation, last-mile delivery, and contract logistics. The company serves multiple industries, offering services such as freight brokerage, spare parts logistics, and inventory management. XPO leverages digital tools, predictive analytics, and automated systems to optimize supply chains, reduce downtime, and enhance maintenance processes for industrial and transportation clients worldwide.

-

2024–2025: Provided downloadable parts lists for truckload and trailer manufacturing services, supporting spare parts logistics and maintenance.

Key Players

Some of the Spare Parts Logistics Market Companies

-

DHL Supply Chain

-

Kuehne + Nagel International AG

-

DB Schenker

-

CEVA Logistics

-

UPS Supply Chain Solutions

-

DSV A/S

-

XPO Logistics

-

FedEx Supply Chain

-

Rhenus Logistics

-

Dachser

-

Yusen Logistics

-

Hellmann Worldwide Logistics

-

Geodis

-

Nippon Express

-

Kintetsu World Express

-

Sinotrans

-

Kerry Logistics

-

Expeditors International

-

Panalpina (now part of DSV)

-

Groupe Charles André

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 19.27 Billion |

| Market Size by 2033 | USD 29.65 Billion |

| CAGR | CAGR of 5.60% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transportation Mode (Airways, Railways, Roadways, Waterways) • By Service Type (Warehouse Services, Transportation, Inventory Management, Administration & Supplies) • By Vehicle Type (Hatchback/Sedan, SUVs, LCVs, HCVs) • By End-use (OEM Parts, Aftermarket Parts) • By Spare Parts Type (Body & Structural Parts, Brake System Parts, Powertrain Components, Suspension & Steering, Engine & Cooling, Exhaust System, Wheels & Accessories, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | DHL Supply Chain, Kuehne + Nagel International AG, DB Schenker, CEVA Logistics, UPS Supply Chain Solutions, DSV A/S, XPO Logistics, FedEx Supply Chain, Rhenus Logistics, Dachser, Yusen Logistics, Hellmann Worldwide Logistics, Geodis, Nippon Express, Kintetsu World Express, Sinotrans, Kerry Logistics, Expeditors International, Panalpina , Groupe Charles André |