Automotive Intelligent Door System Market Report Scope & Overview

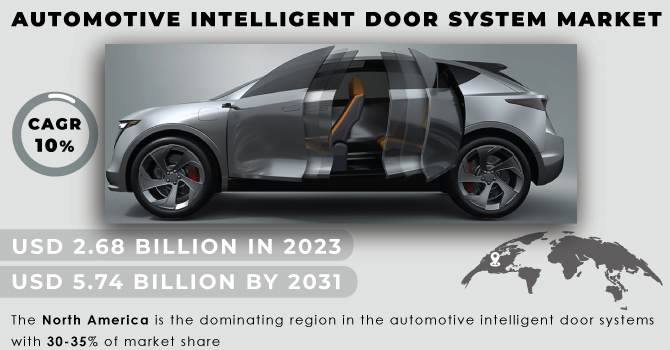

The Automotive Intelligent Door System Market Size was valued at USD 2.68 billion in 2023 and is expected to reach USD 5.74 billion by 2031 and grow at a CAGR of 10% over the forecast period 2024-2031.

The automotive intelligent door system market is poised for significant growth. This technology replaces the traditional car doors with an automated system using sensors and internet of things to detect objects and people, enabling automatic opening and closing. This convenience-driven feature is finding favour in both passenger cars and commercial vehicles, particularly as the demand for connected and luxury vehicles with advanced technology rises. Consumers are increasingly prioritizing comfort and convenience, while stricter global safety regulations are mandating advanced features in cars. Additionally, the growing popularity of automated vehicles and the cost-reduction potential of intelligent door systems are driving market expansion. The increasing adoption of electric vehicles and advanced driver-assistance system fuels the growth of the market.

Get More Information on Automotive Intelligent Door System Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Intelligent Door Systems Enhance Safety and Convenience in Modern Cars

Modern drivers crave technology that elevates both safety and comfort. Features like lane departure warnings, blind spot detection, and auto-braking are becoming commonplace. This trend extends to infotainment systems and adaptive cruise control. Now, innovative intelligent door systems join the ranks, offering automatic operation and improved security, making the driving experience not just safer, but significantly more convenient.

-

Rising popularity of connected, safe self-driving cars fuels need for secure, smart door systems.

RESTRAINTS:

-

High development and installation costs of intelligent door systems limit market growth.

-

Limited availability of skilled labour to install and maintain these complex systems hinders adoption.

OPPORTUNITIES:

-

Growth in the luxury car segment with advanced features presents an ideal market for intelligent door systems offering comfort and convenience.

-

Advancements in technology could lead to more affordable intelligent door systems, broadening their market reach.

CHALLENGES:

-

High installation and maintenance costs hinder wider adoption of automotive intelligent door systems.

Compared to traditional doors, installation and maintenance for these intelligent systems are significantly higher. This stems from the complexity involved. The system relies on expensive hardware components, intricate wiring, and specialized software to function. Furthermore, repairs often require costly equipment just to access the system, adding to the burden. This high cost can create the barrier for wider adoption, especially for budget-conscious consumers.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the growth of the automotive intelligent door system market. It disrupts the supply chain with Russia and Ukraine which are the key players in the neon gas industry, essential for chip production in intelligent door systems. Sanctions and limited supplies force manufacturers to find alternatives, leading to potential delays and a projected 15-20% price increase for these crucial components. This coincides with the war worsening the global chip shortage, impacting car production by an estimated 5-10%. This directly translates to a decline in demand for intelligent door systems, often found in higher-end vehicles with lower production volumes. The uncertainty surrounding the war might prompt car manufacturers to diversify their supplier base away from the region. While this could create new opportunities in the long run, it would likely lead to a reshuffling of production and cause short-term hiccups in the market as new suppliers are established.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can slowdown the growth of the automotive intelligent door system market. Consumer spending becomes more cautious, with a potential 5-10% decline in car sales, especially impacting higher-end vehicles that often feature these intelligent door systems. This directly leads to a decrease in demand for the technology. The economic uncertainty can lead car manufacturers to delay investments in new technologies by 10-15%, potentially including research and development for intelligent door systems. During downturns, car buyers prioritize affordability thus automakers might choose to offer vehicles without these advanced features to stay competitive, sacrificing some innovation for price sensitivity. The slowdown can also disrupt the tiered supplier network, potentially impacting production or causing consolidation among suppliers of components for intelligent door systems. While specific figures are elusive, these disruptions could lead to delays and potentially push intelligent door system prices up in the long run.

KEY MARKET SEGMENTS:

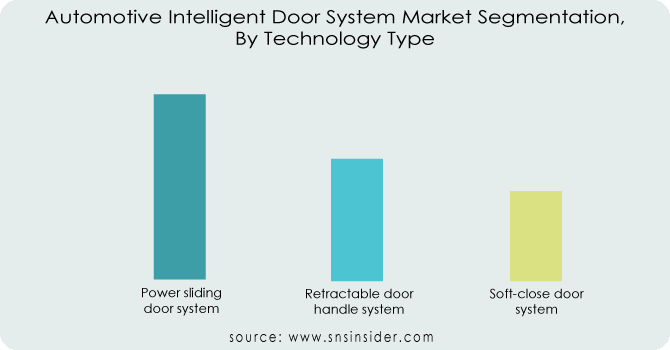

By Technology Type:

-

Power sliding door system

-

Retractable door handle system

-

Soft-close door system

The Power Sliding Door System is the dominating sub-segment for the Automotive Intelligent Door System Market by technology type holding around 50-55% of the market share. Power sliding doors offers comfort and ease of access for travellers in the rear seats. This makes them a popular choice for minivans, SUVs, and a few luxury cars.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

Passenger Cars is the dominating sub-segment for the Automotive Intelligent Door System Market by vehicle type holding about 65-70% of market share. Passenger cars account for the majority of vehicle sales globally, leading to a higher demand for intelligent door systems in this segment. The growing focus on comfort and safety features in passenger car is driving the adoption of these systems.

By Sales Channel:

-

OEM

-

Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment for the Automotive Intelligent Door System Market by sales channel holding about 80-85% of market share. Intelligent door systems are typically pre-integrated into vehicles during the manufacturing process. This ensures compatibility and optimal performance within a car's specific safety and convenience features.

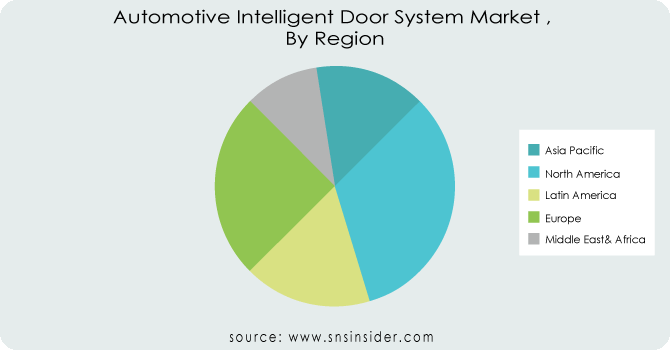

REGIONAL ANALYSES

The North America is the dominating region in the automotive intelligent door systems with 30-35% of market share, capitalizing on its robust automotive sector prioritizing advanced safety features (ADAS) and advanced technology adoption. Stringent regulations mandating ADAS features, often including intelligent door systems, further solidify their dominance. Europe is the second highest region in this market holding around 25-30% of market share with a well-established, innovation-driven automotive industry focused on premium car segments that frequently incorporate these systems for enhanced convenience and safety. They also experience a growing demand for luxury vehicles with advanced features. The Asia Pacific region experiences the fastest growth with 12-15% annually due to a significant rise in passenger and commercial vehicle production, increasing disposable income leading to a demand for safety features, and government initiatives promoting ADAS adoption, which often includes intelligent door systems.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Johnson Electric (Hong Kong), Brose Fahrzeugteile GmbH & Co. KG (Germany), Continental AG (Germany), Huf Hülsbeck & Fürst GmbH & Co. KG (Germany), Kiekert AG (Germany), SMARTRAC N.V. (Amsterdam), WITTE Automotive (Germany) and other key players.

Johnson Electric (Hong Kong)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In April 2024: Force Motors is launching a refreshed Gurkha series, including a 5-door model to compete with Mahindra Thar's upcoming 5-door version. The new Gurkha boasts a modernized cabin with a digital instrument cluster and a larger infotainment screen. Expect subtle design tweaks like a stretched wheelbase for extra doors and new alloy wheels.

-

In Dec. 2023: Tesla is reviving its iconic Roadster with a complete redesign. This all-new electric two-door coupe boasts a sleek aerodynamic design, a supposed four-seater layout and a sportier look with 19-inch wheels, exceeding the original's style and performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.68 Billion |

| Market Size by 2031 | US$ 5.7 Billion |

| CAGR | CAGR of 10% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology Type (Power sliding door system, Retractable door handle system, Soft-close door system) • by Vehicle Type (Passenger cars, LCV, HCV) • by Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Johnson Electric (Hong Kong), Brose Fahrzeugteile GmbH & Co. KG (Germany), Continental AG (Germany), Huf Hülsbeck & Fürst GmbH & Co. KG (Germany), Kiekert AG (Germany), SMARTRAC N.V. (Amsterdam), and WITTE Automotive (Germany) |

| Key Drivers | • Vehicle safety concerns increase demand for innovative automotive technologies. • Manufacturers are more concerned about convenience and safety. • The automotive intelligent door system business will benefit from increased demand for automated vehicles. |

| RESTRAINTS | • Consumer purchasing capacity for autos will remain low due to dwindling work opportunities. • The growing demand for electric and driverless vehicles will drive growth in the intelligent door system industry |