Agricultural Equipment Market Report Scope & Overview:

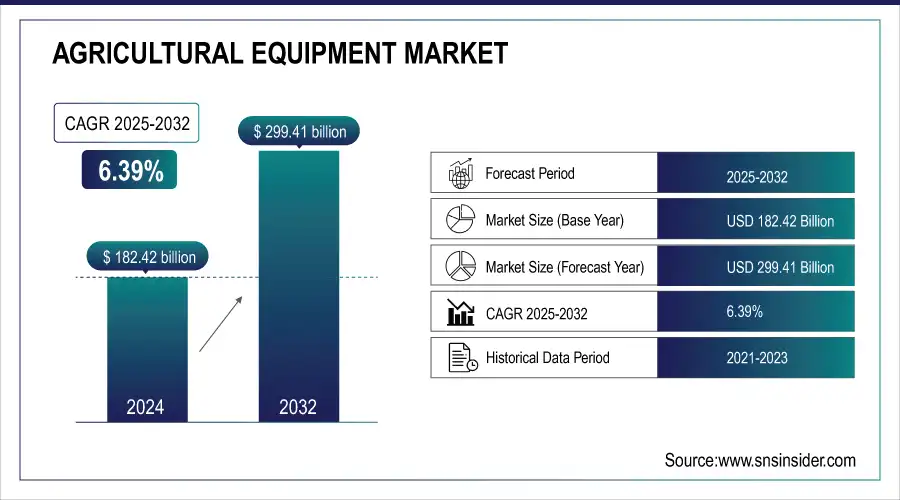

The Agricultural Equipment Market Size was estimated at USD 182.42 billion in 2024 and is expected to arrive at USD 299.41 billion by 2032 with a growing CAGR of 6.39% over the forecast period 2025-2032.

This report provides a unique perspective on the Agricultural Equipment Market by analyzing production trends and market penetration across regions, highlighting shifts in adoption patterns. It evaluates equipment utilization efficiency by type and region, offering insights into operational performance. The study explores R&D and innovation trends, showcasing advancements in automation and smart farming. Additionally, it examines export/import dynamics, mapping global trade movements. To enhance the analysis, the report also covers supply chain disruptions and emerging technologies, such as AI-driven machinery and IoT-enabled solutions.

To Get more information on Agricultural Equipment Market - Request Free Sample Report

Agricultural Equipment Market Size and Forecast:

-

Market Size in 2024: USD 182.42 Billion

-

Market Size by 2032: USD 299.44 Billion

-

CAGR (2025–2032): 6.39%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Agricultural Equipment Market Highlights:

-

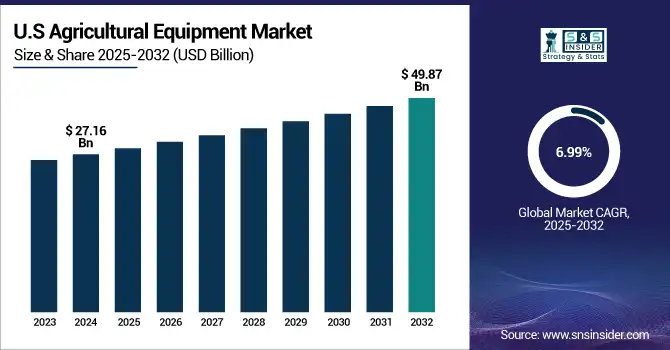

U.S. market projected to grow from USD 27.16B in 2023 to USD 49.87B by 2032 at a CAGR of 6.99%, driven by mechanization and precision farming.

-

Automation and precision technologies (GPS-guided tractors, AI machinery, drones, IoT sensors) are increasing farm efficiency and productivity.

-

Rising adoption of electric and hybrid equipment supports sustainability and reduces carbon footprint.

-

High initial investment costs limit accessibility, especially for small-scale farmers, though subsidies, financing, and leasing models help.

-

Regional trends: North America and Europe dominate; Asia-Pacific and Latin America growing due to mechanization and government support.

-

Future growth will be led by smart farming, digitalization, and continuous technological innovation.

The U.S. agricultural equipment market is set to grow at a CAGR of 6.99% from 2023 to 2032, expanding from USD 27.16 billion in 2023 to USD 49.87 billion by 2032. This steady rise is driven by increasing mechanization, advancements in precision farming, and growing demand for high-efficiency equipment. With continuous innovation in automation, GPS-guided machinery, and sustainable farming practices, the U.S. remains the dominant player in North America’s agricultural equipment sector.

Agricultural Equipment Market Drivers:

-

The Agricultural Equipment Market is rapidly advancing with mechanization and automation, driven by precision farming, GPS-guided tractors, AI-powered machinery, and sustainable solutions, enhancing efficiency and productivity globally.

The Agricultural Equipment Market is witnessing a rapid shift towards mechanization and automation, driven by the need for higher efficiency, productivity, and sustainability. Precision farming technologies, including GPS-driven tractors, autonomous equipment, and AI-enabled solutions, are revolutionizing contemporary agriculture by maximizing resource use and minimizing reliance on labor. The use of advanced equipment including drones, robotic harvesters, and IoT-enabled sensors also makes it possible for real-time data feeding and monitoring, thus enhancing crop yield and reducing wastage. The automation of seeding, irrigation, and harvesting is increasing efficiency, resulting in higher adoption across large and small-scale farms. The agricultural sector is also witnessing an increased demand for electric and hybrid equipment, enabling reduction of carbon footprints aligned with global sustainability objectives. The North America and Europe is holding the market, on the other hand, Asia-Pacific and Latin America is witnessing good growth rate owing to surging mechanization in developing countries. The future of agricultural machinery will be led by smart farming and digitalization as innovation will keep on moving ahead.

Agricultural Equipment Market Restraints:

-

High initial investment in advanced agricultural equipment limits accessibility for small-scale farmers, but leasing models, subsidies, and emerging sustainable technologies are easing affordability challenges.

The Agricultural Equipment Market is witnessing significant transformation driven by automation, precision farming, and digitalization. However, initial investment costs are high, which represents an obstacle, especially for small-scale farmers. While advanced technologies like GPS-guided tractors, autonomous harvesters, and AI-integrated machinery can improve efficiency and productivity, they all require significant upfront investment and ongoing upkeep. But you often limit access to modern technology behind high paywalls, particularly in developing regions with low farm incomes. Even with this restraint, the market is booming, notably aided by government subsidies, financing programs, and leasing models that offer farmers solutions to affordability concerns. Also, the industry is heading toward sustainable and electric-powered equipment, which increases capital requirements but can save on costs in the longer term. Robotics, IoT-enabled smart farming, and drone technology are a few of the trends transforming agricultural operations and enhancing yield and resource optimization. With the adoption of technology increasing, partnerships between manufacturers and financial institutions should help address affordability issues.

Agricultural Equipment Market Opportunities:

-

The expansion of emerging markets in agriculture is driving growth through increased mechanization, supported by government incentives, technological adoption, and rising food demand.

The expansion of emerging markets presents a substantial growth opportunity in the Agricultural Equipment Market, driven by increasing mechanization in developing regions. Lands in Asia, Africa, and Latin America are quickly embracing new amenities that are reducing input, increasing output, and raising efficiency. This transition is driven by increasing food demand, sustainable agriculture practices and government regulations providing subsidies and financial support for mechanization. However, in these parts of the world, the advancement of precision farming using technologies like GPS, sensors, and AI is allowing them to improve yield and lower input costs. Moreover, the trend towards agricultural mechanization is being by increased access to rural infrastructure and sources of finance. With the development of these markets, the demand for tractors, harvesters and other advanced farming equipment is also expected to be an area of growth and therefore critical for investment and innovation in the coming years.

Agricultural Equipment Market Segment Analysis:

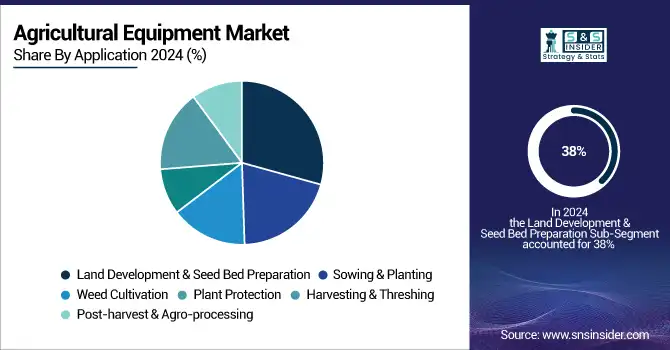

By Application

The land Development & Seed Bed Preparation segment dominated with a market share of over 38% in 2024, owing to the critical function of preparing the land before farming, which facilitates suitable conditions for planting and enhanced production. The Harvesting & Threshing segment holds the largest share of the market, driven by increasing penetration of advanced harvesting technologies such as automated combines and harvesters, which improved efficiency and reduced labor costs over large-scale operations in economically developing countries. Technological innovation, along with demand for mechanized farming and a push for greater productivity in global agriculture, are resulting in rapid growth of these segments.

By Product

The tractors dominated with a market share of over 32% in 2024, due to their critical role in various fundamental farming tasks such as plowing, tilling, and harvesting. To fulfill these farming functions, tractors can be coupled with various types of implements. From traditional farming practices to modern precision agriculture, their high adoption rates across different regions and farming systems assure them in the marketplace. Moreover, innovations in tractor technology, like GPS systems, automation, and fuel-efficient engines, have improved their productivity, which has also aided in solidifying their market share. Tractors find extensive usage across several agriculture processes, and hence, the application as the leading product segment in agricultural equipment would continue, further propelled by the ceaseless demand.

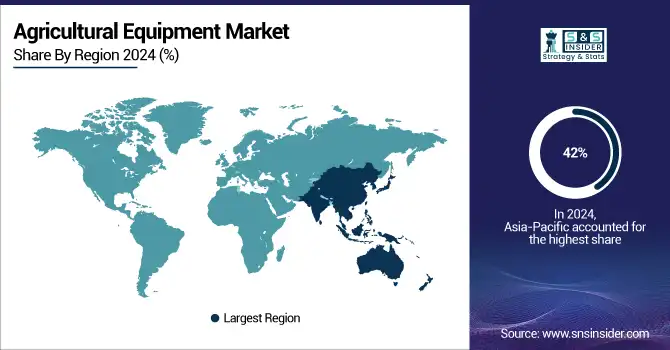

Agricultural Equipment Market Regional Analysis:

Asia-Pacific Agricultural Equipment Market Trends:

The Asia-Pacific region dominated with a market share of over 42% in 2024, due to its vast agricultural base and growing demand for mechanization. In developing countries such as China and India, where a substantial portion of the population is engaged in farming and agricultural sectors are continually growing, there is a broad trend towards modern farming techniques. To with the growing demand for labor to increase efficiency in production agriculture, such as tractors, harvesters and equipment. In addition, the government's subsidies and mechanization financial support policies significantly promote equipment adoption. Asia-Pacific dominates the market for agricultural equipment, mainly because of the focus of the region on increasing efficiency in agriculture and also due to distinct requirements for catering food to an increasing population.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Agricultural Equipment Market Trends:

North America is the fastest-growing region, owing to the growing adoption of advanced technologies like precision farming and automation. In recent times, the region has experienced a boom in GPS-guided machinery, automation of tractors, and the use of drones to make farming more efficient, reduce labor costs, and make other aspects of farming easier. Additionally, the government must support the effort through policies and subsidies or grants that promote sustainable farming practices and the purchase of environmentally friendly equipment. North America will be a potential Rapid growth in Agricultural Machinery with innovative and technology-led solutions for the farmers to increase their productivity with minimum impact on the environment.

Europe Agricultural Equipment Market Trends:

Europe represents a significant share of the agricultural equipment market, driven by high mechanization rates, strict sustainability regulations, and advanced technological adoption. Farmers in countries such as Germany, France, and Italy are increasingly using precision farming tools, automated tractors, and advanced harvesting machinery. The European Union’s Common Agricultural Policy (CAP) provides strong financial backing, grants, and subsidies to promote the adoption of eco-friendly and energy-efficient equipment. Demand for specialized equipment, such as hay and forage machinery, also continues to grow due to the region’s livestock sector. Europe maintains steady growth, supported by innovation and regulatory emphasis on sustainable farming.

Latin America Agricultural Equipment Market Trends:

Latin America is experiencing robust growth in the agricultural equipment market, fueled by its large-scale farming operations, especially in Brazil and Argentina. The region’s strong exports of soybeans, corn, and sugarcane create a continuous need for modern tractors, planters, and harvesters to improve yield efficiency. Government-backed programs, rising foreign investments, and increasing adoption of mechanization by medium and small-scale farmers are contributing factors. However, volatility in agricultural commodity prices and economic fluctuations pose challenges. Still, the region shows promising opportunities, particularly in precision farming and irrigation equipment adoption.

Middle East & Africa Agricultural Equipment Market Trends:

The Middle East & Africa market is growing steadily, driven by the urgent need to enhance food security and improve agricultural productivity in arid and semi-arid regions. Countries such as South Africa, Nigeria, and Egypt are adopting mechanized farming to meet rising food demand. In the Middle East, nations like Saudi Arabia and the UAE are investing in modern farming technologies, including irrigation systems and greenhouse farming, supported by government initiatives to reduce dependency on food imports. The region’s market is highly influenced by government subsidies, infrastructure development, and international partnerships. Despite challenges like water scarcity and limited arable land, mechanization adoption is expected to rise.

Agricultural Equipment Market Key Players:

-

AGCO Corporation (Tractors, Harvesters, Sprayers)

-

Fliegl Agro-Center GmbH (Trailers, Slurry Tankers)

-

Agromaster (Seed Drills, Fertilizer Spreaders)

-

Amazone Inc. (Plows, Sprayers, Fertilizer Spreaders)

-

APV GmbH (Seeder Technology, Crop Care Equipment)

-

Bellota Agrisolutions (Plow Discs, Harrow Tines)

-

CLAAS KGaA mbH (Combines, Forage Harvesters)

-

CNH Industrial N.V. (Tractors, Balers, Combine Harvesters)

-

Deere & Company (Tractors, Planters, Sprayers)

-

Escorts Limited (Tractors, Implements)

-

HORSCH Maschinen GmbH (Cultivators, Seeders, Sprayers)

-

ISEKI & Co., Ltd. (Compact Tractors, Mowers)

-

J C Bamford Excavators Ltd. (Backhoe Loaders, Telehandlers)

-

Quivogne CEE GmbH (Kiwon RUS LLC) (Harrows, Subsoilers)

-

Rostselmash (Combine Harvesters, Forage Equipment)

-

KUBOTA Corporation (Tractors, Rice Transplanters)

-

KUHN SAS (Balers, Hay and Forage Equipment)

-

Mahindra & Mahindra Ltd. (Tractors, Rotavators)

-

Maschio Gaspardo S.p.A. (Plows, Sprayers, Planters)

-

SDF S.p.A. (Tractors, Combine Harvesters)

Suppliers for (tractors, combines, precision agriculture technology, and construction equipment.) on Agricultural Equipment Market

-

John Deere

-

CNH Industrial

-

AGCO Corporation

-

Kubota Corporation

-

Mahindra & Mahindra

-

CLAAS KGaA mbH

-

Yanmar Co., Ltd.

-

Argo Tractors

-

Same Deutz-Fahr (SDF)

-

Kverneland Group

Agricultural Equipment Market Competitive Landscape:

Mahindra Group’s Swaraj Tractors, established in 1974, is a leading Indian tractor brand known for its reliable and robust agricultural machinery tailored to diverse farming needs. A subsidiary of Mahindra & Mahindra, Swaraj has built a strong reputation among farmers by offering tractors that combine durability, affordability, and performance. With a wide product portfolio ranging from small utility tractors to higher horsepower models, the company focuses on enhancing farm productivity and mechanization across rural markets.

-

In June 2023: Mahindra Group’s Swaraj Tractors introduced the Swaraj Target, a lightweight compact tractor designed to deliver unmatched performance and first-in-class features, incorporating cutting-edge technology to meet the unique needs of Indian farmers.

AMAZONE, established in 1883, is a German agricultural machinery manufacturer renowned for its innovation in seeding, fertilization, and crop protection technology. The company recently unveiled new products within its precision farming portfolio, emphasizing efficiency, sustainability, and reduced input costs. With a strong focus on digital solutions and automation, AMAZONE continues to support farmers globally by offering advanced equipment that enhances yield, optimizes resource use, and aligns with modern sustainable agriculture practices.

-

In May 2023: AMAZONE unveiled new products within its precision seeders range, including the advanced trailed models Precea 12000-TCC and 9000-TCC, designed specifically for large-scale farms and contractors.

J C Bamford Excavators Ltd. (JCB), founded in 1945, is a UK-based global leader in construction and agricultural machinery. The company recently revealed plans to launch its next-generation equipment range, focusing on sustainability, alternative fuels, and advanced automation. With a strong presence across tractors, telehandlers, and backhoe loaders, JCB continues to innovate by integrating eco-friendly technologies and digital solutions, aiming to boost productivity while reducing environmental impact for farmers and contractors worldwide.

-

In June 2023: JCB revealed plans to launch its first electric wheeled loader, featuring zero-emission and low-noise capabilities. The loader offers options for wide or narrow wheels and tires, making it suitable for both agricultural and industrial use.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 182.42 Billion |

| Market Size by 2032 | USD 299.41 Billion |

| CAGR | CAGR of 6.39% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Tractors [Less than 40 HP, 41 to 100 HP, More than 100 HP], Harvesters, Combine Harvesters, Forage Harvesters, Planting Equipment [Row Crop Planters, Air Seeders, Grain Drills, Others], Irrigation & Crop Processing Equipment, Spraying Equipment, Hay & Forage Equipment, Others) •By Application (Land Development & Seed Bed Preparation, Sowing & Planting, Weed Cultivation, Plant Protection, Harvesting & Threshing, Post-harvest & Agro-processing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGCO Corporation, Fliegl Agro-Center GmbH, Agromaster, Amazone Inc., APV GmbH, Bellota Agrisolutions, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Limited, HORSCH Maschinen GmbH, ISEKI & Co., Ltd., J C Bamford Excavators Ltd., Quivogne CEE GmbH (Kiwon RUS LLC), Rostselmash, KUBOTA Corporation, KUHN SAS, Mahindra & Mahindra Ltd., Maschio Gaspardo S.p.A., SDF S.p.A. |