Aircraft After Market Report Scope & Overview:

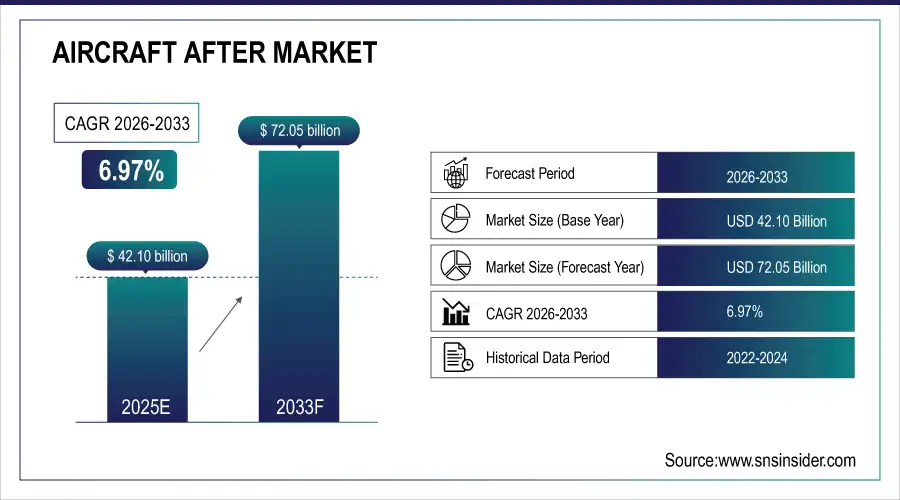

The Aircraft After Market size was valued at USD 42.10 Billion in 2025E and is projected to reach USD 72.05 Billion by 2033, growing at a CAGR of 6.97% during 2026-2033.

The Aircraft After Market analysis highlights the growing demand for maintenance, repair, and overhaul (MRO) services driven by aging fleets, increased air travel, and technological advancements in avionics and engine systems. Commercial aviation dominates, while military and general aviation show strong growth. Key trends include predictive maintenance, digital integration, and supply chain optimization, supported by leading global MRO providers and component manufacturers.

By 2025, over 65% of commercial aircraft in service will be more than 15 years old, significantly increasing demand for heavy maintenance checks and component replacements across global MRO networks.

Market Size and Forecast:

-

Market Size in 2025E: USD 42.10 Billion

-

Market Size by 2033: USD 72.05 Billion

-

CAGR: 6.97% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Aircraft After Market - Request Free Sample Report

Aircraft After Market Trends

-

Airlines increasingly implement predictive maintenance solutions using IoT and AI to reduce downtime, optimize fleet performance, and lower operational costs.

-

Advanced digital twin technology enables real-time simulation of aircraft components, enhancing maintenance accuracy, reliability, and proactive failure detection.

-

Airlines outsource MRO services to specialized providers, reducing in-house costs and improving efficiency in fleet management and repairs.

-

Growth in electric aircraft and hybrid propulsion drives demand for specialized components, including batteries, avionics, and thermal management solutions.

-

Increasing air travel in Asia-Pacific and Latin America fuels aftermarket demand, including MRO services, component replacements, and overhaul solutions.

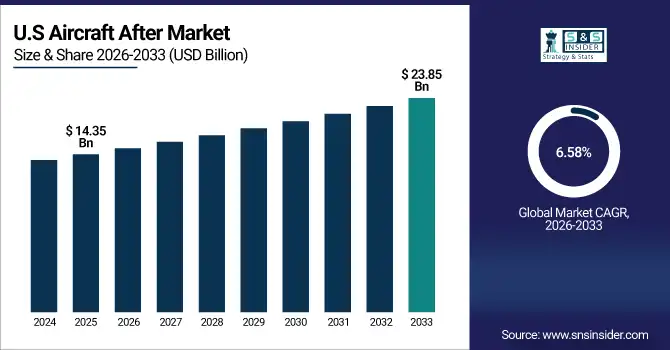

The U.S. Aircraft After Market size was valued at USD 14.35 Billion in 2025E and is projected to reach USD 23.85 Billion by 2033, growing at a CAGR of 6.58%during 2026-2033. Aircraft After Market growth is driven by increasing commercial and military fleet expansions, rising demand for MRO services, adoption of predictive maintenance technologies, and modernization of avionics and engine systems.

Aircraft After Market Growth Drivers:

-

Rising Fleet Growth and Demand for MRO Services Fuel Aircraft After Market Expansion

The Aircraft After Market is primarily driven by the increasing number of commercial and military aircraft worldwide. Aging fleets require regular maintenance, repair, and overhaul (MRO) services to ensure safety and operational efficiency. Additionally, technological advancements in avionics, engines, and predictive maintenance tools are enhancing aircraft reliability and performance. The growing air travel demand globally further accelerates aftermarket requirements, prompting airlines and MRO providers to expand their capabilities and service offerings.

By 2025, the global commercial aircraft fleet is projected to exceed 35,000 units, with over 45% requiring heavy maintenance checks annually due to aging airframes and extended service cycles.

Aircraft After Market Restraints:

-

High Costs and Stringent Regulatory Compliance Limit Aircraft After Market Expansion

High operational costs, including expensive replacement parts, specialized labor, and complex maintenance procedures, restrict market growth. Strict regulatory compliance from authorities like FAA and EASA increases certification and inspection requirements, slowing service delivery. Additionally, prolonged aircraft downtime during maintenance or overhaul impacts airline revenue. These financial and regulatory challenges limit the adoption of aftermarket services, particularly for smaller airlines and operators in emerging regions, restraining overall market growth despite rising fleet sizes.

Aircraft After Market Opportunities:

-

Technological Advancements and Emerging Markets Offer Growth Opportunities in Aircraft After Market Services

The Aircraft After Market has significant opportunities from the adoption of predictive maintenance, digital twins, and IoT-enabled monitoring systems that enhance fleet reliability. Emerging markets in Asia-Pacific, Latin America, and the Middle East present high demand for MRO services due to expanding commercial aviation fleets. Airlines increasingly outsource maintenance to specialized providers, offering growth potential for independent MROs. Integration of advanced materials and electrification in aircraft components further boosts aftermarket prospects globally.

Independent MRO providers are projected to capture 45% of the global commercial maintenance outsourcing market by 2025, up from 35% in 2022, driven by cost pressures and fleet expansion.

Aircraft After Market Segment Analysis

-

By Components: Airframe Parts led the Aircraft After Market with a 50.60% share in 2025, while Avionics & Electrical Systems registered the fastest growth with a CAGR of 8.50%.

-

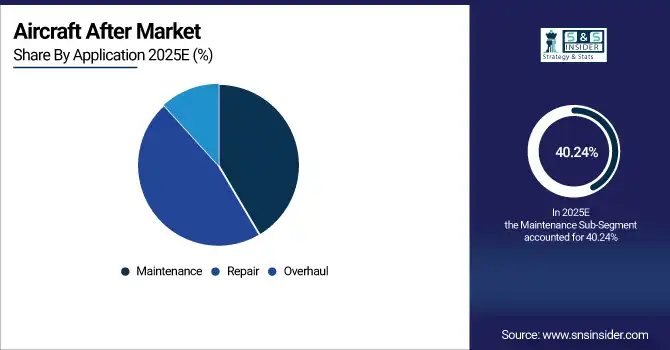

By Application: Maintenance dominated the market with a 40.24% share in 2025, whereas Overhaul is the fastest-growing application segment, growing at a CAGR of 9.10%.

-

By Type: Engine Components led the market with a 35.71% share in 2025, while Airframe components are the fastest-growing type, recording a CAGR of 7.50%.

-

By End-User: Commercial Aviation held the largest share at 60.55% in 2025, while Military Aviation is the fastest-growing end-user segment with a CAGR of 6.52%.

By Components, Airframe Parts Leads Market While Avionics & Electrical Systems Registers Fastest Growth

Airframe Parts lead the Aircraft After Market due to high replacement and repair demand for fuselage, wings, and landing gear. These components require regular inspections and maintenance, ensuring continuous market dominance. Meanwhile, Avionics & Electrical Systems are the fastest-growing segment, driven by the integration of advanced electronics, digital flight control systems, and IoT-based monitoring solutions. Technological advancements and modernization of aircraft fleets significantly accelerate the adoption of avionics-related aftermarket services.

By Application, Maintenance Dominate While Overhaul Shows Rapid Growth

Maintenance dominates the Aircraft After Market, reflecting the ongoing requirement for routine servicing to ensure operational efficiency and safety. Regular inspections, minor repairs, and preventive checks keep aircraft functional and compliant with aviation regulations. Overhaul, however, is the fastest-growing application segment, driven by aging fleets and the need for comprehensive refurbishment of engines, airframes, and interiors. Airlines increasingly invest in overhauls to extend aircraft lifespan and optimize performance.

By Type, Engine Components Lead While Airframe Registers Fastest Growth

Engine Components lead the market, representing the highest-value and most critical parts requiring frequent replacement or repair. Aircraft engines demand specialized maintenance to ensure safety, efficiency, and regulatory compliance. Airframe components are the fastest-growing type segment due to increasing fleet size and rising air travel, which necessitate structural upgrades, repairs, and modernizations. This growth is further supported by advanced materials, lightweight designs, and enhanced durability in airframe parts.

By End-User, Commercial Aviation Lead While Military Aviation Grow Fastest

In 2025, Commercial aviation leads the Aircraft After Market, driven by the expansion of airline fleets and increasing passenger air travel. Rising demand for maintenance, repair, and overhaul (MRO) services supports sustained growth in this segment. Military aviation is the fastest-growing end-user segment due to defense modernization programs, procurement of advanced aircraft, and increasing budgets for operational readiness. Both sectors continue to propel demand for aftermarket parts, services, and technological upgrades.

Aircraft After Market Regional Analysis:

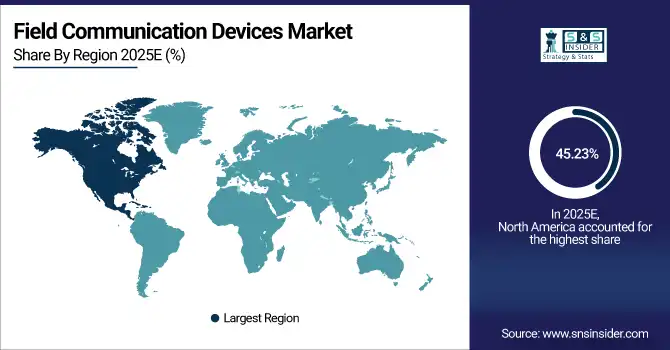

North America Aircraft After Market Insights

In 2025 North America dominated the Aircraft After Market and accounted for 45.23% of revenue share, this leadership is due to the high demand from commercial airlines and military fleets. Advanced technologies such as predictive maintenance and avionics upgrades support market growth. Aircraft require regular MRO services to ensure FAA compliance. The U.S. serves as a hub for OEMs and independent MRO providers. Stable market dynamics and technological adoption maintain North America’s leadership position globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Aircraft After Market Insights

The U.S. leads North America due to its extensive commercial airline and defense fleet. Strong demand exists for engine, avionics, and airframe maintenance and replacement. Adoption of predictive maintenance, digital twins, and IoT-based monitoring accelerates aftermarket services.

Asia-pacific Aircraft After Market Insights

Asia-pacific is expected to witness the fastest growth in the Aircraft After Market over 2026-2033, with a projected CAGR of 7.65% due to rapid growth in commercial aviation and increasing airline fleets. Rising air travel and urbanization drive higher demand for maintenance, repair, and overhaul (MRO) services. Technological adoption in predictive maintenance and digital solutions enhances aftermarket efficiency.

China Aircraft After Market Insights

China holds a leading share in Asia-Pacific due to rapid fleet expansion and growing domestic airline operations. MRO services and component replacement are increasing to support aging aircraft. Government initiatives to modernize fleets and boost defense aviation further enhance aftermarket demand.

Europe Aircraft After Market Insights

In 2025, Europe represents a mature market with significant commercial aviation activity and well-established MRO infrastructure. Countries like Germany, France, and the UK drive aftermarket demand through regular fleet maintenance. Compliance with EASA regulations ensures high-quality service and component replacement standards. Investments in fleet modernization and regional airlines continue to fuel MRO activities.

Germany Aircraft After Market Insights

Germany dominates Europe with a strong aviation sector and advanced fleet maintenance capabilities. High demand exists for MRO services on aging commercial and business aircraft. Engine, avionics, and airframe components are frequently serviced to maintain operational efficiency and compliance.

Latin America (LATAM) and Middle East & Africa (MEA) Aircraft After Market Insights

The Aircraft After Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing demand for MRO services. Brazil, Mexico, South Africa, and the UAE contribute significantly to regional fleet growth. Infrastructure development and increasing air travel drive demand for component replacement, repairs, and servicing. Adoption of digital maintenance tools is rising but remains lower than in mature markets. Combined, LATAM & MEA offer opportunities for global MRO providers to expand services and support fleet modernization.

Aircraft After Market Competitive Landscape:

Lufthansa Technik AG is a leading global MRO provider offering comprehensive aircraft maintenance, repair, and overhaul services. It serves commercial, VIP, and freighter aircraft, specializing in engines, airframe, and components. Advanced digital tools and predictive maintenance solutions enhance efficiency. Strong global presence ensures widespread service availability and customer support.

-

In February 2025, Lufthansa Technik and Hanwha Phasor signed a multi-year agreement to design and supply fuselage-mounted airborne satellite communications radomes, enhancing in-flight connectivity for commercial aircraft.

GE Aviation provides engines, components, and aftermarket solutions for commercial and military aircraft worldwide. Its services include predictive maintenance, MRO, and spare parts supply. Continuous R&D in engine efficiency, digital monitoring, and advanced materials strengthens market position. GE Aviation’s extensive service network ensures reliable support for airline and defense fleets.

-

In September 2025, GE Aerospace and BETA Technologies announced a strategic partnership and equity investment to co-develop a hybrid-electric turbogenerator, advancing hybrid electric aviation for defense and civil applications.

Rolls-Royce delivers engine manufacturing and comprehensive aftermarket services, including MRO, component repair, and overhaul programs. The company focuses on commercial, business, and defense aircraft engines. Predictive maintenance and digital analytics improve operational efficiency. Rolls-Royce maintains strong global presence, providing long-term support and reliability for airline and military operators worldwide.

-

In August 2025, Rolls-Royce Power Systems launched the mtu Series 2000 G06 engine in China, produced at the MTU Yuchai Power joint venture, marking a milestone in their localization strategy.

AAR Corp. specializes in aircraft MRO, supply chain management, and component support services. Its offerings include airframe, engine, and avionics maintenance for commercial and military aircraft. Strategic partnerships with OEMs and airlines enhance service quality. AAR’s global network and technical expertise position it as a key player in the aftermarket services industry.

-

In September 2025, AAR Corp. acquired American Distributors Holding Co. for $146 million, expanding its parts distribution segment with additional product lines and OEM relationships.

Aircraft After Market Key Players:

Some of the Aircraft After Market Companies are:

-

Lufthansa Technik AG

-

GE Aviation

-

Rolls-Royce Holdings plc

-

AAR Corp.

-

ST Engineering

-

MTU Aero Engines AG

-

Bombardier Inc.

-

Honeywell International Inc.

-

Parker Hannifin Corporation

-

StandardAero

-

HAECO

-

Turkish Technic

-

Embraer S.A.

-

Collins Aerospace (Raytheon Technologies)

-

Safran Group

-

General Electric Company

-

Lockheed Martin Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 42.10 Billion |

| Market Size by 2033 | USD 72.05 Billion |

| CAGR | CAGR of 6.97% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Engines & Engine, Airframe Parts, Avionics & Electrical Systems and Interior Components), • By Application (Maintenance, Repair and Overhaul) • By Type (Engine Components, Airframe, Avionics, Interiors and Others) • By End-User Commercial Aviation, Military Aviation and General Aviation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lufthansa Technik AG, GE Aviation, Rolls-Royce Holdings plc, AAR Corp., ST Engineering, MTU Aero Engines AG, Bombardier Inc., Honeywell International Inc., Parker Hannifin Corporation, StandardAero, HAECO, Turkish Technic, Embraer S.A., Collins Aerospace (Raytheon Technologies), Safran Group, General Electric Company, Lockheed Martin Corporation, Raytheon Technologies Corporation, Boeing, Air France Industries KLM Engineering & Maintenance |