Aviation Software Market Report Scope & Overview:

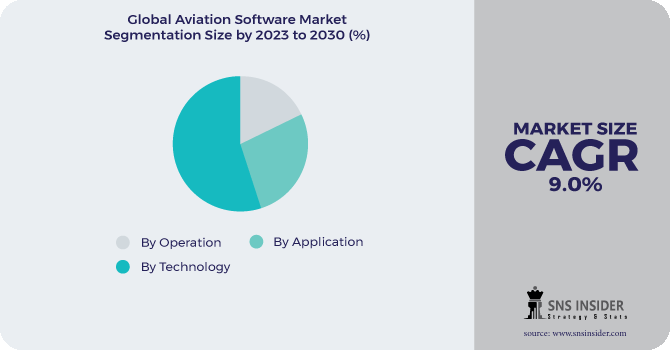

The Aviation Software Market Size is expected to reach USD 6.01 Bn by 2030 and grow at a CAGR of 9% over the forecast period 2023-2030.

Aviation enterprise and airline software manages maintenance, repair, and operations. Aircraft systems are used by airlines and aviation maintenance businesses to make purchases, manage parts inventories, track all repair operations, and manage their personnel. For all maintenance and aircraft service tasks, aviation software includes tools for order administration, inventory control, shipping, and scheduling.

.png)

To get more information on Aviation Software Market - Request Sample Report

These systems also include workforce management capabilities, such as training and on boarding new employees and tracking hours worked. Aircraft software is frequently linked with accounting software, although it can also be purchased separately or as part of a broader aviation ERP suite. With the aviation business expanding at a rapid pace, and airlines want software that will enhance productivity and maintain operations up to date. software oversees the maintenance process and provides solutions to improve efficiency and end-user satisfaction.

Market Dynamics:

Key Drivers:

-

Demand For Digital Aviation Maintenance Software Is Increasing

-

Demand From Emerging Economies Such As India And China Increase

Restraints:

-

Aviation Regulations Are Strict

-

Adoption Of The Integrated Mro Software Suite On A Limited Budget

THE IMPACT OF COVID-19

The (COVID-19) discharge increase has the greatest impact on the aviation industry. This is a direct effect of the guideline techniques against the COVID-19 pandemic, resulting in the overall voyager transporter's entire assistance reaching its maximum. Of course, freight air transportation was not severely impacted; rather, it coincided with a breakthrough in total modern-day progress.

It is uncertain how long the business areas will need to recover in the post-COVID era. The COVID epidemic created a huge meta-weakness for the overall economy, and its assets have the potential to modify the possible accommodation of our pre-COVID monetary institutions.

Aviation software refers to software used in the aviation sector for various operations such as land side, terminal side, and air side. Aviation software providers are introducing numerous technological advancements to keep up with hardware upgrades in the aviation business. Most aviation software providers are working on the full suite for airports and airlines, which will integrate multiple products under a unified suite. The airlines deal with thousands of clients and have a big fleet strength, thus in order to keep the numerous operations running smoothly, the airlines use various aviation software that handles MRO, fleet management, roster management, and so on.

Other factors expected to fuel bargains growth in the genuine market include rapid advancement in the flying business and rising income for cutting-edge engines. Various engine manufacturers are in need of collecting useful and sensible engines for new task forces. The rise of renovated and used parts in engine and non-engine maintenance is one of the important enhancements in this space.

KEY MARKET SEGMENTATION

By Operation

-

Aeronautical

-

Non-Aeronautical

By Application

-

Land Side

-

Terminal Side

-

Air Side

By Technology

-

Security System

-

Communication System

-

Passenger

-

Cargo & Baggage handling

-

Others

Need any customization research on Aviation Software Market - Enquiry Now

REGIONAL ANALYSIS

Asia-Pacific will generate the most demand.During the forecast period, Asia-Pacific is expected to have the most interest in the plane engine. Demand growth is typically caused by increased transporter traffic, which increases the area's plane turns of events.

Plane executives are putting plans in place to build their organisation. Furthermore, non-modern countries' rising military spending plans are assisting the advancement of plane life extension plans, which will, in turn, encourage interest for a short time.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Key Players are SIA Engineering Company, Air France Industries KLM Engineering and Maintenance, MTU Aero Engines, ST Aerospace, Delta Tech-Ops, Rolls-Royce, Pratt and Whitney, GE Aviation, Lufthansa Technik, Safran Aircraft Engines & Other Players.

MTU Aero Engines-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | - |

| Market Size by 2030 | US$ 6.01 Billion |

| CAGR | CAGR of 6.01 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Operation (Aeronautical, Non-Aeronautical)

• by Application (Land Side, Terminal Side, Air Side) • by Technology (Security System, Communication System, Passenger, Cargo & Baggage handling, ATC, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, Experimental Aircraft Association Inc., Usaa, Usaig |

| DRIVERS | • Construction of New Airports • Rising Insurance Claim Frequency and Cost |

| RESTRAINTS | • Government norms and regulations for passenger safety are being strengthened. • The Asset Recovery Risk of Airline Bankruptcy |