Satellite Communication Equipment Market Report Scope & Overview:

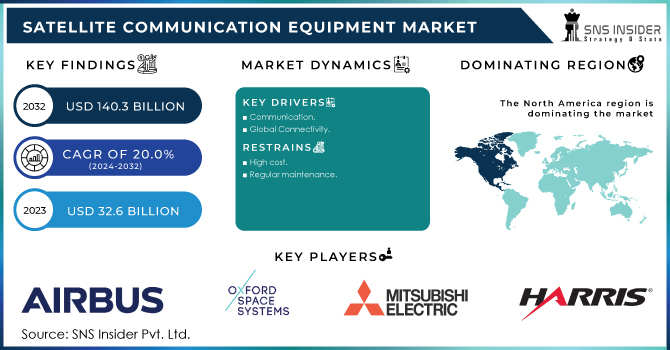

The Satellite Communication Equipment Market Size was valued at USD 32.6 billion in 2023 and is expected to reach USD 140.3 billion by 2031 and grow at a CAGR of 20.0% over the forecast period 2024-2031.

To get more information on Satellite Communication Equipment Market - Request Free Sample Report

Because of the increased launch of satellites in recent years, the worldwide satellite communication equipment market for space is making significant growth. SATCOM equipment includes electronic gear such as amplifiers, space antennas, and transceivers that allow communication with satellites in Earth's orbit or space. Space SATCOM equipment is the backbone of space agencies and commercial space firms, as it manages the space industry's information and communication infrastructure. SATCOM is also used for direct-to-home television broadcasting, communications, digital satellite news gathering, weather tracking, and other purposes.

Satellite communications refers to the application of satellite technology to the field of communication. Satellite communications services include phone and video calling, internet, fax, television and radio channels. Satellite communications can give communication capabilities across large distances and under circumstances or conditions that make other types of communication unworkable. Because of the rising use of satellite antennas in automobiles in the region, the Asia Pacific SATCOM equipment market is predicted to grow at the fastest rate. With recent space exploration missions by space agencies such as the Indian Space Research Organization and the China National Space Administration, the Asia Pacific SATCOM equipment market has seen significant expansion.

MARKET DYNAMICS

KEY DRIVERS

-

Communication

-

Global Connectivity

RESTRAINTS

-

High cost

-

Regular maintenance

-

Boosting up R&D

OPPORTUNITIES

-

High speed

-

Cloud platform

CHALLENGES

-

Cybersecurity Attacks

-

Communication system

THE IMPACT OF COVID-19

Governments around the world have enforced a lockdown to halt the spread of COVID-19, which has a direct influence on the efficiency of space agencies due to a labor scarcity.

SATCOM equipment makers are experiencing supply chain interruption as a result of government measures to limit the COVID-19 epidemic, which is affecting the production process. Due to observatory access constraints due to lockdown, the COVID-19 pandemic is affecting the number and quality of climate monitoring and weather forecasts.

Due to operational challenges caused by travel bans enforced by governments in response to the COVID-19 pandemic, space agencies are compelled to postpone forthcoming satellite launches and space missions.

The COVID-19 pandemic has wreaked havoc on the economies of countries all over the world. SATCOM equipment manufacturing, including systems, subsystems, and components, has also been disrupted. Although SATCOM equipment is vital for a successful satellite mission, supply chain issues have temporarily halted their manufacturing processes. The level of COVID-19 exposure, the level at which industrial operations are functioning, and import-export rules, among other considerations, all influence the resumption of manufacturing activity. While businesses may still accept orders, delivery times may not be fixed.

IMPACT OF UKRAINE & RUSSIA CRISIS

In some parts of eastern Ukraine, Russian proxy interference against Ukrainian military forces conducting anti-terrorist operations involves jamming of VHF, UHF, and GSM signals as well as full network suppression. Tactical communication network targeting has encouraged several armed services across the world, including the US Department of Defense (DoD), to examine other forms of communication in a tactical context. This view might be extremely beneficial to the antenna industry, as militaries aim to modernize their tactical capabilities and achieve higher levels of perfection. SOTM will become a highly feasible, if not vital, tool in such cases.

MARKET ESTIMATIONS

By Solution

Based on the solution, the product market is expected to lead the SATCOM equipment market from 2024 to 2031. This is due to the increasing demand for segmented antenna systems on aircraft and marine platforms, high-speed data connection on aircraft, high demand. -Data washing data in rough and private areas and weather protection areas that protect SATCOM sticks. Comtech Telecommunications Corp. received a contract from NASA's Glenn Research Center for the Ka- / S-band antenna system and a Radome to be installed at its new Aerospace Communications facility in Cleveland, OH, supporting high bandwidth space and aeronautics communications. research. Thales received its third delivery order to provide US troops with an upgraded AN / PRC-148D multiband inter / intra team radio. IMBITR radio order number was over 6,100.

By Platform

Based on the platform, the SATCOM aerial segment is projected to lead the SATCOM equipment market from 2024 to 2031 and is expected to grow steadily due to the growing demand for high definition, surveillance, and re-intelligence (ISR) technology, as well as the growing number of videos. connected. commercial aircraft, the growth of UAV adoption and a growing number of private airlines around the world that support market growth. French Airforce has improved its Airborne Satellite communication capabilities through new Thales technology. The French defense agency has awarded Thales a contract to design and build the next generation of Syracuse satellite communications system.

By Vertical

Based on the vertical position, the commercial sector is expected to lead the SATCOM equipment market from 2024 to 2031. This is due to the growing demand for uninterrupted access to broadband in remote and remote regions, information dissemination and entertainment, the widespread use of small satellites for commercial purposes. and data transfer, technological advances in the transport and goods network, and the growing need for broadband connectivity and VSAT connectivity., the Digital Communications Commission accepted a sector regulator's invitation to allow VSAT operators to provide satellite-based mobile connectivity to telcos to ensure uninterrupted broadband coverage in remote and remote areas.

By End-Use

The SATCOM equipment market is divided into portable SATCOM equipment, land mobile SATCOM equipment, maritime SATCOM equipment, airborne SATCOM equipment, and land fixed SATCOM equipment based on end-use.

KEY MARKET SEGMENTATION

By Solution

-

Products

-

Services

By Technology

-

SOTM/COTM

-

SOTP

By Platform

-

Portable

-

Land Mobile

-

Land Fixed

-

Airborne

-

Maritime

By Application

-

Navigation

-

Scientific Research

-

Communication

-

Remote Sensing

-

Others

By End Use:

-

Commercial

-

Government

-

Military

REGIONAL ANALYSIS

Based on the region, North America is expected to lead the SATCOM equipment market from 2024 to 2031. The US is a highly profitable market for SATCOM equipment in the North American region. The US government is increasingly investing in the SATCOM sector to improve the quality and effectiveness of satellite communications. Increasing investment in SATCOM equipment to improve defense and security capabilities, modernization of existing battlefields, and critical infrastructure, and law enforcement agencies are increasingly using SATCOM equipment to be the key drivers of the SATCOM commodity market in North America. the US Special Operations Command awarded Cubic Mission Solutions for a follow-up, single award, unlimited delivery/quantity worth USD 174 million. The contract is for the delivery of SATCOM terminals with inflatable Ground Area Transmit Receive and baseband communications equipment to support the special needs of Special Operations Forces.

Need any customization research on Satellite Communication Equipment Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The Major Players are Space B.V., Airbus SE, Harris Corporation, Oxford Space Systems, Mitsubishi Electric Corporation, Antwerp Space, Maxar Technologies, Ball Aerospace & Technologies Corporation, General Dynamics Corporation, Honeywell International Inc. and Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 32.6 Billion |

| Market Size by 2031 | US$ 140.3 Billion |

| CAGR | CAGR of 20.0% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Products, Services) • By Technology (SOTM/COTM, SOTP) • By Application (Navigation, Scientific Research, Communication, Remote Sensing, Others) • By Platform (Portable, Land Mobile, Land Fixed, Airborne, Maritime) • By End Use (Commercial, Government, Military) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Innovative Solutions in Space B.V., Airbus SE, Harris Corporation, Oxford Space Systems, Mitsubishi Electric Corporation, Antwerp Space, Maxar Technologies, Ball Aerospace & Technologies Corporation, General Dynamics Corporation, Honeywell International Inc. |

| DRIVERS | • Communication • Global Connectivity |

| RESTRAINTS | • High cost • Regular maintenance • Boosting up R&D |