Aircraft Fuel Systems Market Key Insights:

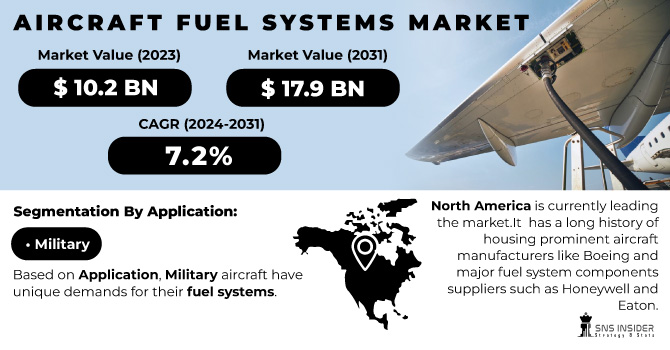

The Aircraft Fuel Systems Market size was valued at USD 10.2 billion in 2023 and is expected to reach USD 19.07 billion by 2032, growing at a CAGR of 7.2% over the forecast period of 2024-2032.

The Increasing in demand for Sustainable Aviation Fuel (SAF) is a prominent factor that drive the market growth. Also, the growth of the commercial aviation industry. For eg. As passenger air travel rebounds from the pandemic, there's an overall increase in demand for new airplanes, which translates to a need for more fuel systems. Also, the rising disposable incomes and economic growth in developing countries are leading to more people traveling by air, which is further fueling the demand for aircraft. There is also immense opportunity like, Manufacturers are actively capitalizing on this opportunity. Airbus offers retrofit packages for its A320 family that include engine upgrades, winglets, and other aerodynamic improvements. These packages can significantly enhance the fuel efficiency of older A320 models, making them more competitive and environmentally friendly. Similarly, Boeing provides similar retrofit options for its 737 family. Their "Boeing 737-800 Passenger-to-Freighter Conversion" program extends the life of older passenger aircraft by converting them to efficient freighters, catering to the growing cargo market.

To get more information on Aircraft Fuel System Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising disposable incomes and growing economies in developing countries are leading to more people traveling by air, further fueling the demand for aircraft.

-

Rising Demand for Sustainable Aviation Fuel (SAF)

The Growing environmental concerns are pushing airlines to adopt cleaner burning fuels this will drive the market growth, for eg. SAF. Advanced aircraft fuel systems are needed to handle these new fuels efficiently. Eg: Airbus successfully completed the first test flight using 100% SAF in one engine of a commercial A320neo aircraft in September 2021.

RESTRAINTS:

-

Fluctuating in Fuel Prices can act as a barrier for the market growth.

Volatile fuel prices can lead airlines to delay fleet upgrades or prioritize short-term cost-saving measures over investments in advanced fuel systems.

OPPORTUNITIES:

-

Development of lighter, more efficient, and reliable fuel system components can enhance aircraft performance and range.

-

Retrofitting Existing Aircraft pose a significant Opportunity for Manufacturers

Replacing older, less efficient engines with newer models incorporating advanced materials and combustion technologies can significantly reduce fuel consumption. For instance, studies show that replacing a Rolls-Royce Trent 700 engine on an Airbus A330 with the latest Trent 7000 engine can lead to a fuel burn reduction of up to 15%. This translates to substantial cost savings for airlines and a smaller environmental footprint.

CHALLENGES:

-

The availability of qualified personnel for designing, installing, and maintaining these advanced systems can be a limiting.

-

Limitation of Infrastructure Challenges

Integrating advanced fuel systems might require modifications to ground fueling infrastructure and maintenance procedures, posing logistical hurdles.

IMPACT OF RUSSIA-UKRAINE WAR

A major consequence is the drastic rise in fuel prices. Disruptions to global oil supplies due to sanctions and export restrictions from Russia, a major oil producer, have pushed jet fuel costs to 14-year highs. This significantly increases operational expenses for airlines, squeezing profit margins already strained by the pandemic. The war has also disrupted supply chains for critical components used in aircraft fuel systems. Russia and Ukraine are both significant players in the metals and manufacturing sectors, and the conflict has caused shortages and delays in obtaining essential materials. This can hinder production and slow down the rollout of new, fuel-efficient aircraft models. Despite the challenges, there could be some unforeseen opportunities. The high fuel prices might incentivize airlines to explore alternative fuels like Sustainable Aviation Fuel (SAF) more seriously. SAF offers a cleaner burning option and could become more attractive as traditional jet fuel prices remain elevated. This could lead to increased demand for fuel system technologies compatible with SAF.

IMPACT OF ECONOMIC SLOWDOWN

During Economic Slowdown, As consumer spending declines, airlines like Delta or Lufthansa may see fewer passengers. This leads to aircraft grounding or reduced flight frequency, which in turn reduces the demand for jet fuel. As a result, orders for Boeing or Airbus, which supply new aircraft, or Safran or Honeywell, which manufacture fuel systems, will decrease and production may slow. Airlines struggling with tight budgets can also delay minor maintenance on existing aircraft, reducing demand for parts and maintenance upgrades from companies like Eaton or Woodward. While some airlines may favor fuel-efficient jet fuels from companies such as Rolls-Royce to minimize operating costs, overall market growth is likely to remain stagnant. The severity of this impact will depend on the depth and duration of the recession, but industry reports point to a possible downward revision of growth forecasts.

KEY MARKET SEGMENTS:

By Application

-

Military

-

Commercial

-

UAV

Based on Application, Military aircraft have unique demands for their fuel systems. They focuses on reliability, safety measures, and the performance in odd environments. This segment includes fighter jets, bombers, transport aircraft, and helicopters. Leading companies in this segment include Honeywell, Parker Hannifin, and Collins Aerospace.

Commercial, this segment caters to the fuel systems of passenger airplanes and cargo planes operated by airlines. Here, the focus is on efficiency, optimizing fuel consumption for long-haul flights. Major players in this space are Safran, Eaton, and UTC Aerospace Systems (UTAS).

The UAV segment is a growing market with diverse applications, from commercial drones for photography to military surveillance vehicles. Fuel system needs for UAVs vary based on size, range, and endurance. Companies like AeroVironment and Leonardo DRS are prominent in this segment.

By Engine Type

-

UAV Engine

-

Jet Engine

-

Helicopter Engine

-

Turboprop Engine

Based on Engine Type, Jet Engine is Dominating the market, this segment holds the largest market share, likely exceeding 50% due to the dominance of commercial air travel and the high fuel consumption of jet engines. Companies like Safran and Honeywell cater heavily to this segment.

The UAV segment is the fastest growing due to the increase in commercial drone applications and increase military use. While its current market share might be less than 10%, its growth potential is significant.

By Component

-

Piping

-

Pump

-

Valve

-

Gauges

-

Inserting Systems

-

Filters

By Technology

-

Gravity Feed

-

Fuel Feed

-

Fuel Injection

REGIONAL ANALYSES

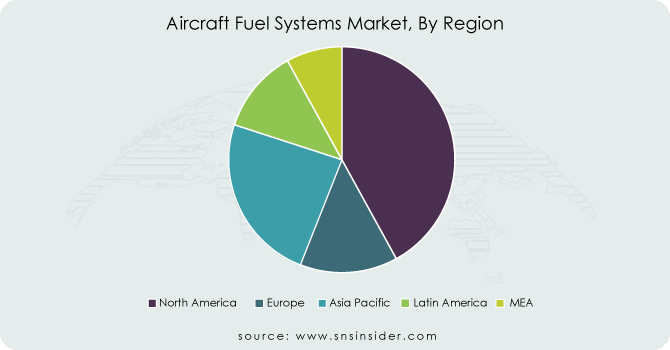

North America is currently leading the market, It has a long history of housing prominent aircraft manufacturers like Boeing and major fuel system components suppliers such as Honeywell and Eaton. this strong industry ecosystem fosters the innovation and drives market growth. Major airlines like Delta, American Airlines, and United Airlines operate massive fleets, requiring frequent maintenance and upgrades to their fuel systems, which creates a consistent demand for parts and services. The US military, a global leader in defense spending, utilizes a vast fleet of aircraft with complex fuel systems, further bolstering the North American market.

The Asia Pacific is the fastest growing region in the forecasted year 2024-2031The Asia-Pacific region is densely populated, and the number of people who can now afford to fly is growing. It is the driving force behind the largest airlines in the region. In fact, most of the aircraft production should be in Asia. The economic boom in countries like China and India is fueling a rise in air travel, leading to significant demand for new commercial aircraft and their fuel systems. The proliferation of low-cost carriers in the region necessitates fuel-efficient aircraft, driving demand for advanced fuel system technologies. also, Several Asian governments are actively promoting domestic aircraft manufacturing, which creates opportunities for the regional fuel system market to grow alongside the aviation sector.

Need any customization research on Aircraft Fuel System Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Eaton Corporation PLC, GKN Aerospace Services Limited., Honeywell International Inc., Parker Hannifin Corporation, Collins Aerospace, Safran S.A., Triumph Group, Inc., Crane Company, Woodward, Inc., Secondo Mona SpA. Meggitt PLC, and, GKN plc, and other key players.

United Technologies Corporation-Company Financial Analysis

RECENT DEVELOPMENT

In August 2021, Honeywell International Inc. (US) secured a contract with Copa Airlines (Panama) to supply Air Separation Module (ASM) kits for their Boeing 737 fleet. These kits are crucial for efficient fuel delivery and management in modern aircraft

In September 2022, Parker-Hannifin Corporation (US) completed the acquisition of Meggitt Plc (UK) for $7.24 billion. Meggitt is a major player in aerospace components, including fuel system components for commercial and military aircraft.

In November 2022, GKN Aerospace Services Limited (UK) collaborated with Fabrum (New Zealand) and Filton Systems Engineering (UK) to design and develop next-generation fuel systems for aircraft. This collaboration focuses on systems for fuel, air, hydraulics, fuel tank storage, and even hydrogen fuel systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.2 Billion |

| Market Size by 2032 | US$ 19.07 Billion |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Military, Commercial, UAV) • By Engine Type (UAV Engine, Jet Engine, Helicopter Engine, Turboprop Engine) • By Component (Piping, Pump, Valve, Gauges, Inserting Systems, Filters) • By Technology (Gravity Feed, Fuel Feed, Fuel Injection) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eaton Corporation PLC, GKN Aerospace Services Limited., Honeywell International Inc., Parker Hannifin Corporation, Collins Aerospace, Safran S.A., Triumph Group, Inc., Crane Company, Woodward, Inc., Secondo Mona SpA. Meggitt PLC, and, GKN plc |

| Key Drivers | • Rising disposable incomes and growing economies in developing countries are leading to more people traveling by air, further fueling the demand for aircraft. • Rising Demand for Sustainable Aviation Fuel (SAF) |

| Restraints | • Fluctuating in Fuel Prices can act as a barrier for the market growth. |