Aircraft Insurance Market Report Scope & Overview:

To get more information on Aircraft Insurance Market - Request Free Sample Report

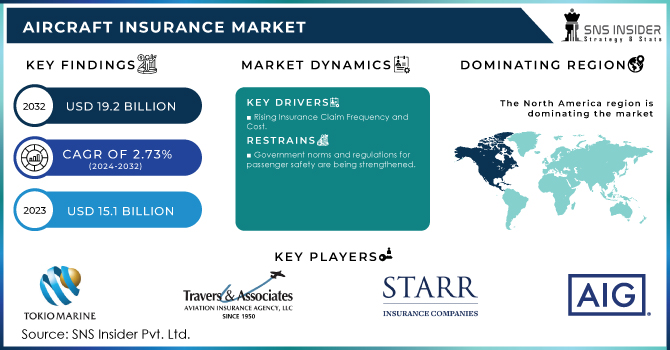

The Aircraft Insurance Market Size was valued at USD 15.1 billion in 2023 and is forecasted to grow to USD 19.2 billion by 2032, representing a CAGR of 2.73% over the forecast period of 2024-2032.

Aviation insurance is a non-life insurance policy that often covers physical damage to the aircraft as well as legal liabilities stemming from its ownership and operation. Furthermore, specialist insurance are offered to protect airport owners' legal liabilities deriving from the operation of hangars or the selling of various aviation items. These insurance are analogous to other kinds of liability contracts. Furthermore, the rise in air passenger traffic and the increase in government rules and regulations for passenger safety have a favorable impact on the expansion of the aviation insurance business. However, concerns such as high aviation insurance premiums and an increase in the frequency and expense of claims are constraining industry expansion. On the contrary, growing spending on international airlines is likely to provide lucrative chances for market expansion during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

Construction of New Airports

-

Rising Insurance Claim Frequency and Cost

RESTRAINTS

-

Government norms and regulations for passenger safety are being strengthened.

-

The Asset Recovery Risk of Airline Bankruptcy

OPPORTUNITIES

-

The number of travelers choosing air travel has expanded dramatically in the market.

-

Increase in the number of foreign carriers

THE IMPACT OF COVID-19

The COVID-19 epidemic has had a substantial impact on the growth of the aviation insurance sector, owing to huge, well-documented claims from aerospace Original Equipment Manufacturers (OEMs). Furthermore, since the COVID-19 impact, there has been a constant and large increase in passenger traffic. Government norms and regulations for passenger safety have also increased. Furthermore, as growing nations seek to expand their current airport terminals, globalization has increased the demand for airline services. Furthermore, COVID-19 has significantly impacted the travel business. For example, with about 19.2 million visitors in 2020, tourist arrivals in Spain fell by 78 percent.

This stifles the expansion of the aviation insurance business. However, in such circumstances, insurance companies can create fresh tailored offers for customers. Furthermore, the reduced airline activity had a significant influence on aviation insurance, as airline premiums are often assessed based on hours flown; global aviation premiums collected were anticipated to be 25% lower in 2019 than in 2018. Furthermore, claims for weather and ground impact damage, such as specific occurrences of hail and wind damage to sitting aircraft, continued to be filed. For example, in 2020, five airports in the United States were directly hit by tornadoes, resulting in $125 million in insured damage. As a result, a number of such advancements around the world are expected to present attractive potential for the growth of the aviation insurance market.

Because of the high hull values and high liability limitations connected with aviation insurance policies, most insurance providers must obtain insurance to help spread the risk, preventing any single claim from bankrupting a company. However, due to increased demand for travel and tourism with airlines and an expanding number of skydiving institutions, the general and business aviation insurance industry is predicted to grow the fastest in the future years.

Passenger liability insurance is predicted to gather a considerable aviation insurance market size during the forecast period, owing to severe government rules that make it mandatory to obtain passenger liability insurance to safeguard passengers from losses. Furthermore, businesses are concentrating their efforts on developing new chances for growth and income generation, which is growing the popularity of AI and advanced machine learning algorithms across industries. However, the in-flight insurance market is predicted to develop at the fastest rate throughout the projection period, owing to an increase in airline accidents caused by a variety of factors such as bird collisions, bad weather, engine failure, and others.

The market is divided into two applications: private aircraft insurance and commercial aviation. Commercial Aviation leads the global Aircraft Insurance Market and is expected to grow at the quickest rate over the estimated period. The market is expected to grow due to increased commercial aircraft development to accommodate rising air passenger traffic. Among these, the passenger liability industry is likely to grow the fastest over the forecast period.

The market is divided into three segments based on end-user industry: service providers, airport operators, and others. Airport operators have a monopoly on the market. The development of smart airports in countries like as China and India, greater airport refurbishment activities, and the expensive cost of expanding airports are expected to drive the category's growth.

KEY MARKET SEGMENTATION

By Insurance Type

-

Public liability insurance

-

Passenger liability insurance

-

Combined Single Limit

-

In-flight Insurance

-

Others

By Application

-

Commercial Aviation Insurance

-

General and Business Aviation Insurance

-

Others

By End User

-

Service Providers

-

Airport operators

-

Others

REGIONAL ANALYSIS

Because of the existence of significant insurance carriers such as Berkshire Hathaway Inc. and American International Group, Inc., the North American region was expected to dominate the industry. Furthermore, due to the presence of important aircraft manufacturers such as Airbus SAS in the region, the European region is expected to drive the Aircraft Insurance Market.

Aside from that, the Asia-Pacific regional market is expected to grow at the fastest rate during the study period. This region is growing as a result of increased air passenger traffic in nations such as India and China. as well as

The Middle East Africa region is driving market expansion due to the increased development of new airports in countries such as the UAE and the region's growing manufacturing of UAVs. Furthermore, aircraft OEMs such as Embraer SA contribute to the growth of the Aircraft Insurance Market in the rest of the world.

Need any customization research on Aircraft Insurance Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Key Players are Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, Experimental Aircraft Association Inc., USAA, USAIG & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 15.1 Billion |

| Market Size by 2030 | US$ 19.2 Billion |

| CAGR | CAGR of 2.73% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End User (Service Providers, Airport operators, Others) • By Insurance Type (Public Liability Insurance, Passenger Liability Insurance, Combined Single Limit (CSL), In-Flight Insurance, and Others) • By Application (Commercial Aviation, General & Business Aviation and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, Experimental Aircraft Association Inc., USAA, USAIG |

| DRIVERS | • Construction of New Airports • Rising Insurance Claim Frequency and Cost |

| RESTRAINTS | • Government norms and regulations for passenger safety are being strengthened. • The Asset Recovery Risk of Airline Bankruptcy |