Aircraft Nacelle and Thrust Reverser Market Report Scope & Overview:

The Aircraft Nacelle and Thrust Reverser Market Size was valued at USD 4.66 billion in 2023 and is expected to reach USD 7.49 billion by 2031 and grow at a CAGR of 6.1% over the forecast period 2024-2031.

The global demand for air travel continues to rise, prompting airlines to expand their fleets with new aircraft. This directly translates to demand for nacelles and thrust reversers. Manufacturers like Boeing and Airbus regularly launch new aircraft programs with advanced engine technology. These new aircraft incorporate the latest nacelle and thrust reverser designs for better efficiency. In Nov 2023, Rolls-Royce reached a major milestone in aeronautical innovation by successfully operating its UltraFan technology demonstrator at maximum power at its facility in Derby, UK. It is worth noting that during the initial phase of this milestone test, 100% Sustainable Aviation Fuel (SAF) was used, in line with the industry's sustainability objectives.

To get more information on Aircraft Nacelle and Thrust Reverser Market - Request Free Sample Report

Airlines and manufacturers heavily prioritize reducing fuel consumption to cut costs and meet environmental regulations. Advanced nacelles with composite materials and aerodynamically optimized designs significantly improve fuel efficiency. Stricter noise regulations around airports necessitate the development of quieter nacelles with noise-dampening technologies. As fleets grow and age, the MRO sector becomes more significant. This drives demand for replacement nacelle and thrust reverser components and related services.

In Nov 2023, At the Dubai Airshow 2023, Saudia, the national flag carrier of Saudi Arabia, entered into a significant agreement with Safran Nacelles. This agreement is centered around providing comprehensive support for the nacelles of Saudia's 35 Airbus aircraft from the A320neo family. These aircraft are powered by the CFM International* LEAP-1A turbofan engines.

Technological advancements in materials (like composites) and additive manufacturing (3D printing) could transform the industry's future. For example, GE Additive is using 3D printing technologies to create lighter and more complex nacelle components, contributing to improved performance and weight reduction.

Market Dynamics

Drivers

-

The rising demand for air travel globally is driving the demand for new aircraft

The continued growth of both commercial and private air travel leads to a higher demand for aircraft, directly increasing the need for nacelles and thrust reversers.

-

The need to upgrade older aircraft with modern, more efficient nacelles and thrust reversers to meet environmental standards and improve performance is generating demand for aftermarket products and services.

-

The expansion of defense budgets in various countries is leading to increased procurement of military aircraft

A significant portion of a nation's defense budget is often allocated toward acquiring new military aircraft, including fighter jets, bombers, transport aircraft, and helicopters. This direct funding allows for purchasing the latest technologies and replacing aging aircraft fleets. Existing military aircraft might require upgrades and modifications to keep them operational and competitive. Increased defense budgets can also fund these modernization programs, which often involve acquiring new nacelles, thrust reversers, and other advanced components for existing aircraft. For example, The U.S. has consistently maintained the world's largest defense budget, with a significant portion allocated to the Air Force for acquiring new fighter jets like the F-35 and upgrading existing aircraft like the B-52 bomber. China has been rapidly expanding its military capabilities, with a growing focus on its air force. This includes increased procurement of advanced fighter jets like the J-20 and development of its own carrier-borne aircraft program. In 2024, China announced a 7.2% increase in its defense budget, worth $231.36 billion.

Restraint

-

High Manufacturing Costs Associated with the Nacelle and Thrust Reverser

-

Limited Reusability of composite-based components

Opportunities

-

The growing aviation sector in emerging economies presents significant opportunities for market expansion

-

The increasing adoption of lightweight composite materials in nacelle and thrust reverser manufacturing

-

The expanding market for maintenance, repair, and overhaul (MRO) services

Challenges

-

Rapid advancements in propulsion technologies, including electric propulsion and alternative fuels, pose a risk of rendering existing nacelle and thrust reverser designs obsolete, requiring continuous investment in research and development to stay competitive.

-

Meeting stringent regulatory requirements for safety, emissions, and noise regulations adds complexity to the design and certification process of nacelles and thrust reversers.

Impact of Russia-Ukraine War:

Russia is a major supplier of titanium, a crucial material for nacelle construction due to its strength and lightweight properties. Modern aircraft like the Boeing 787 and Airbus A350XWB rely heavily on advanced composite materials, and titanium alloys are essential for structural components. It's worth emphasizing that titanium comprises 15% of the Boeing 787's airframe and 14% of the Airbus A350XWB. Sanctions and export restrictions have significantly disrupted the titanium supply chain, leading to potential production slowdowns for nacelle manufacturers. The war has also caused fluctuations in the prices of other raw materials like aluminum and steel, used in thrust reverser components. This can increase production costs for nacelle and thrust reverser manufacturers. Sanctions on the Russian aviation industry have crippled domestic aircraft production, reducing demand for new nacelles and thrust reversers. The overall economic uncertainty caused by the war can lead to airlines delaying or canceling new aircraft orders, further impacting nacelle and thrust reverser demand. The war has caused a ripple effect in the global MRO sector. Airlines worldwide might face delays or difficulties in obtaining nacelle and thrust reverser MRO services due to these disruptions.

Impact of Economic Downturn:

During economic downturns, airlines face reduced passenger demand and tighter budgets. This often leads to them delaying or canceling new aircraft orders. This directly translates to a decline in demand for nacelles and thrust reversers, as these components are primarily needed for new aircraft production. Even if airlines have existing orders for new aircraft, economic downturns might cause them to push back delivery timelines. This defers the need for nacelle and thrust reverser components, impacting market growth. In 2020, due to the economic fallout from the COVID-19 pandemic, Boeing reportedly faced over 150 cancellations for its 737 MAX aircraft. This significantly impacted the demand for nacelles and thrust reversers specifically designed for that model. Airlines often prioritize cost-cutting measures during economic downturns. This can lead to them delaying non-critical nacelle and thrust reverser maintenance procedures. This reduces the demand for MRO services in the market.

Market segmentation

By Material

-

Composites

-

Alloys

-

Stainless Steel

By Product

-

Thrust Reverser

-

Aircraft Nacelle

-

Engine Build-up Unit

Exhaust System held the highest revenue share of more than 30% in 2023 and is expected to grow significantly from 2024-2031. Exhaust systems play an essential role in channeling hot exhaust gases from the engine core, aiding in thrust generation and reducing noise pollution. Their design is intricate, involving complex components like mixers, nozzles, and thrust reversers. Stringent environmental regulations and a focus on reducing operational costs are pushing airlines towards more fuel-efficient aircraft. Advanced exhaust systems play a crucial role in achieving these goals by optimizing engine performance and reducing fuel burn. Airport noise restrictions are becoming increasingly stringent. Exhaust system manufacturers are continuously innovating noise reduction technologies, such as advanced mixers and chevrons, to meet these regulations. This spurs investment in research and development, driving market growth. As the global aircraft fleet expands, the demand for replacement exhaust system parts and maintenance services is expected to rise. This aftermarket growth will be a significant contributor to the overall market revenue.

By Engine Type

-

Turbofan

-

Turboprop

-

Turboshaft

The Turbofan segment dominated the engine type segment of the Aircraft Nacelle and Thrust Reverser Market with the highest revenue share of more than 40% in 2023. Turbofans offer a superior balance of power, fuel efficiency, and noise reduction compared to other engine types like turboprops. This versatility makes them suitable for a wide range of commercial aircraft, from short-haul regional jets to long-haul wide-body airliners. The commercial aviation sector is experiencing significant growth, driven by factors like increasing globalization and rising passenger demand. As a result, the demand for new commercial aircraft, primarily powered by turbofan engines, continues to climb. This directly translates to a surge in nacelle and thrust reverser requirements for this engine type.

The Airbus A320neo family, one of the best-selling aircraft families globally, utilizes highly efficient turbofan engines. This program significantly contributes to the demand for nacelles and thrust reversers catering to turbofan engines.

Another prominent example is the Boeing 787 Dreamliner, a long-haul aircraft known for its fuel efficiency and powered by advanced turbofan engines. This aircraft program also drives the market for turbofan nacelles and thrust reversers.

By Aircraft Type

-

Fixed Wing

-

Military Aviation

-

Rotary Wing

By End-User

-

Original Equipment Manufacturer (OEM)

-

Aftermarket

Regional Analysis

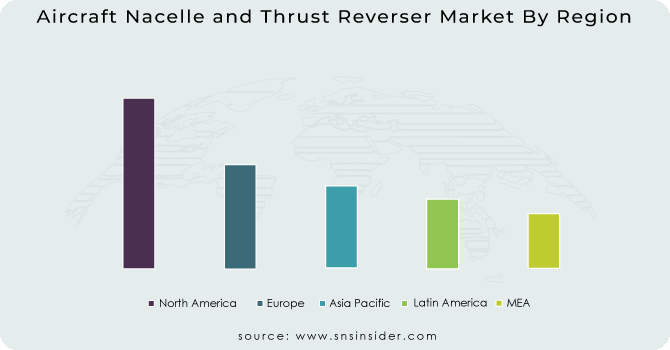

North America led the Aircraft Nacelle and Thrust Reverser Market with the highest revenue share of more than 38% in 2023. North America is home to numerous industry leaders in nacelle and thrust reverser manufacturing, such as Safran Nacelles, Spirit AeroSystems, Collins Aerospace, and Triumph Group. These companies contribute to both OEM and MRO markets. One of the world's largest aircraft manufacturers, Boeing houses its primary operations and manufacturing facilities in the United States. It drives considerable demand for nacelles and thrust reversers due to both new aircraft production and MRO requirements for its existing fleet. The U.S. boasts one of the world's largest active aircraft fleets, including commercial, military, and general aviation aircraft. This translates to a substantial installed base requiring nacelle and thrust reverser maintenance, repairs, and replacements.

North American companies invest heavily in research and development to produce advanced nacelle and thrust reverser technologies focused on fuel efficiency, noise reduction, and lightweight materials. Government initiatives and funding often support aerospace research and development activities in North America.

In March 2024, Spirit AeroSystems, a major U.S. aerostructures manufacturer, has secured significant contracts for producing nacelle components for new Boeing aircraft programs, including the 737 MAX and 777X.

In Feb 2020, Collins Aerospace Systems, a subsidiary of United Technologies Corp. and Lufthansa Technik AG have entered into a licensing agreement for nacelle Maintenance Repair & Overhaul (MRO) services on A320neo aircraft. Collins Aerospace, the leading manufacturer of the A320neo PW1100G nacelle, has over 1,100 nacelles in operation on this aircraft platform.

Need any customization research on Aircraft Nacelle and Thrust Reverser Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Key Players are Safran, Spirit AeroSystems, FACC AG, Barnes Group Inc, Woodward, Aernnova Aerospace S.A., Collins Aerospace, GKN Aerospace, The NORDAM Group, Magellan Aerospace Corporation, Boeing, & Other Players.

Woodward-Company Financial Analysis

Recent Development:

-

In February 2021, Boeing announced an expansion of its proposed nacelle changes for Pratt & Whitney-powered 777s, now including thrust reverser modifications.

-

In July 2021, Spirit AeroSystems, Inc., and Fiber Materials, Inc., subsidiaries of Spirit AeroSystems Holdings, Inc., along with Albany Engineered Composites, a subsidiary of Albany International Corp., have formally entered into a technical collaboration agreement. This partnership aims to leverage its unique capabilities to provide a range of specialized technical and industrial solutions to support hypersonic program developments more efficiently.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.66 Billion |

| Market Size by 2031 | US$ 7.49 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Composites, Alloys, Stainless Steel) • By Product (Thrust Reverser, Aircraft Nacelle, Engine Build-up Unit, and Exhaust System) • By Engine Type (Turbofan, Turboprop, and Turboshaft) • By Aircraft Type (Fixed Wing, Military Aviation, and Rotary Wing) • By End-User (Original Equipment Manufacturer (OEM) and Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Safran, Spirit AeroSystems, FACC AG, Barnes Group Inc, Woodward, Aernnova Aerospace S.A., Collins Aerospace, GKN Aerospace, The NORDAM Group, Magellan Aerospace Corporation, Boeing, & Other Players. |

| Key Drivers | • The rising demand for air travel globally is driving the demand for new aircraft • The need to upgrade older aircraft with modern, more efficient nacelles and thrust reversers to meet environmental standards and improve performance is generating demand for aftermarket products and services. • The expansion of defense budgets in various countries is leading to increased procurement of military aircraft |

| RESTRAINTS | • High Manufacturing Costs associated with the Nacelle and Thrust Reverser • Limited Reusability of composite-based components |