Albumin Market Size Analysis:

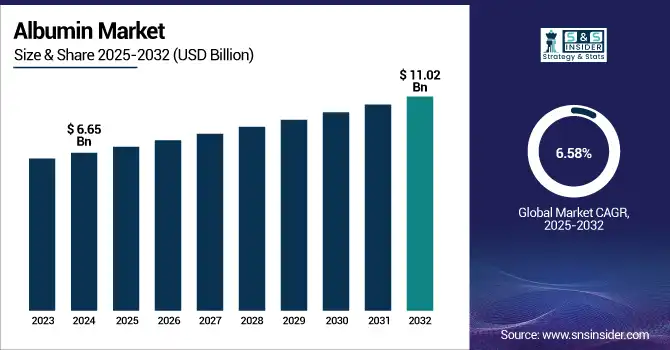

The Albumin Market size was valued at USD 6.65 billion in 2024 and is expected to reach USD 11.02 billion by 2032, growing at a CAGR of 6.58% over the forecast period of 2025-2032.

The global albumin market is growing significantly due to the increasing use of albumin in therapeutics, diagnostics, and biotechnology studies. Market expansion is being driven by a growing prevalence of liver disorders, burns, and hypoalbuminemia, along with an expanding number of plasma collection centers and recombinant technologies. The trending recombinant albumin, along with developing clinical indications, is coupled with supportive healthcare spending and biopharmaceutical R&D expenditures.

To Get more information on Albumin Market - Request Free Sample Report

The U.S. albumin market size was valued at USD 4.35 billion in 2024 and is expected to reach USD 6.97 billion by 2032, growing at a CAGR of 6.13% over the forecast period of 2025-2032. The North American albumin market share is dominated by the U.S., which contributed to around 87% of the regional demand in 2024 due to the well-developed biopharma landscape, established plasma collections, and high investment in healthcare infrastructure. Owing to the high R&D activity and favorable regulatory scenario for plasma-derived therapies.

Global Albumin Market Dynamics:

Drivers

-

Market growth is driven by the Increasing Occurrence of Liver and kidney Disorders.

Liver disease, such as cirrhosis, hepatitis, and liver failure, diminishes the body's ability of the body. Similarly, kidney conditions such as nephrotic syndrome result in loss of albumin via urine. Because albumin is essential to oncotic pressure and blood fluid driving, patients with such conditions usually need albumin replacement therapy. The increasing global prevalence of these lifestyle ematosally related to more health issues, which includes an aging population and larger exposure to toxins, has led to a rise in the demand for therapy albumin merchandise.

Liver causes more than 2 million deaths every year, which corresponds to around 4% of global deaths. Metabolic dysfunction-associated steatohepatitis (MASH), which is a severe form of fatty liver disease, is common in developed countries. MASH affects an estimated 30% to 40% of U.S. adults, with about 3% to 12% having the most advanced stage.

More than 850 million people globally suffer from chronic kidney disease (CKD), an incidence that has been shown to affect as much as 10% of the global population. Growing CKD and acute kidney injury (AKI) cases would require efficient therapy and, therefore, propel albumin-based therapies in the future.

-

Ongoing Developments in Recombinant Albumin Technologies Drive the Market Growth.

Current albumin production relies on plasma donations, making the supply limited and exposing potential contamination with infectious agents and shortages of supply. Recent advancements in biotechnology have made it possible to produce synthetic albumin using genetic engineering in a controlled environment known as recombinant albumin. Anticipated benefits include greater consistency and scalability of supply, decreased reliance on human donors, and improved safety profiles. Recombinant albumin, on the other hand, is versatile and finds applications in pharmaceutical formulations and regenerative medicine, thereby fuelling the market growth.

Novel baker's yeast strains developed for high purity, high recovery at low-scale recombinant albumin production. This allows for the accessibility of various grades and types of albumin that can be used for both novel and established uses without over-characterizing.

Restraint

-

High Production Costs are Restraining the Market from Growing

Production of albumin, especially human serum albumin (HSA), is a complicated and expensive process. This entails drawing plasma from donors, followed by a range of purification and fractionation stages to ensure that the albumin is pure, safe, and efficacious. These processes demand high-end technologies and stringent quality-control practices to avoid contamination and ensure adherence to health regulations. That leads to expensive production costs. Consequently, albumin products are expensive, thus limiting accessibility, particularly in developing countries with limited healthcare budgets. The cost barrier limits widespread use and slows down market growth in some areas.

Albumin Market Segmentation Analysis:

By Product

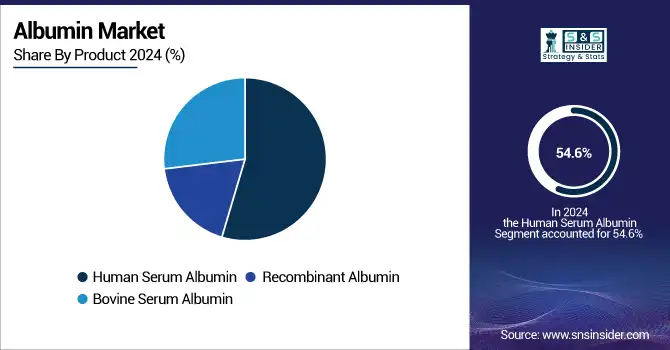

In 2024, the albumin market was dominated by the human serum albumin segment with a 54.6% market share due to its wide range in critical therapeutic applications such as hypoalbuminemia, burns, liver cirrhosis, and shock. Following human plasma, it is the most clinically preferred type of albumin and has been widely used for intravenous injection for its biocompatibility and safety. In addition to the above-mentioned elements, the strength of the plasma collection infrastructure in the U.S. and Europe, along with regulatory approvals and established reimbursement pathways that support the clinical application of this segment in hospitals and emergency care settings, can be attributed to this dominance.

The bovine serum albumin segment is estimated to hold the fastest CAGR over the forecast period due to its widespread applications in diagnostics, pharmaceutical research, and cell culture media. Bovine serum albumin (BSA) is a cheap and stable protein that has been extensively used in biochemical assays, vaccine production, and laboratory R & D. Key trend for growth is the increasing requirement for high-purity proteins from biotechnology and pharmaceutical industries, which along with development of recombinant BSA production is expected to drive growth of the target market.

By Application

In 2024, the albumin market share was dominated by the therapeutics segment with a 68.10% market share due to the extensive usage of albumin in the treatment of various critical conditions, including liver cirrhosis, nephrotic syndrome, trauma, burns, and shock. Human serum albumin (HSA) is an important therapeutic agent used in clinical practices as a volume expander and oncotic pressure keeper. The global demand for albumin used for therapeutic purposes is also propelled by the increasing incidence of chronic liver diseases as well as the growing surgical and emergency interventions. Moreover, increasing healthcare investments and the government-funded plasma-derived therapies supported this segment to dominate the global market.

The Diagnostics segment is projected to be the fastest-growing segment in the forecast years due to an increased use of albumin in diagnostic assays and tests. Serum albumin is a major biomarker in clinical diagnostics for renal disease, diabetes, and cardiovascular diseases. Increasing acceptance of point-of-care testing, growing technology development in the area of diagnostic platforms, and rising awareness about early diagnosis of disease will accelerate the market for reagents based on albumin. In addition, the increasing awareness regarding health care has increased the number of diagnostic laboratories, research institutions in the developing market that are expected to boost the growth of this particular segment.

By End-User

In 2024, the hospitals & clinics segment dominated the albumin market and holds 82.2% market share, due to albumin usage, reflecting the greatest care & support provided, along with emergency care, surgery, and inpatient care. These facilities will have trained personnel and infrastructure to administer the intravenous albumin and hence would be the most appropriate and prompt users. Besides, funding of public healthcare along with the insurance reimbursementshave for albumin therapies in the developed regions has also been stronghold well established segment.

The Pharmaceutical & Biotechnology Industry segment is expected to grow fastest during the forecast period due to a rising consumption of albumin in drug formulation, vaccine development, and biopharmaceutical research. Albumin is one of the most broadly used stabilisers, carrier molecules, and culture media components in R&D and manufacturing processes. The increasing demand for biologics, recombinant protein therapies, and personalized medicine is broadening the applications of albumin in sophisticated drug and gene delivery systems. In addition, innovations in recombinant albumin production coupled with increasing life science investments in emerging economies would further drive their end-use penetration.

Regional Insights:

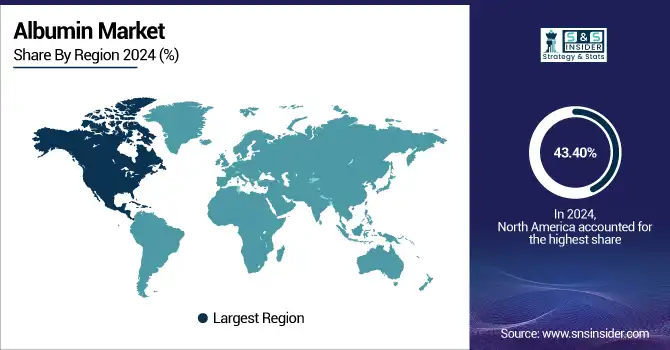

North America dominated the albumin market with a 43.40% market share in 2024, attributable to the well-established healthcare infrastructure in the region, increased awareness about albumin-based therapies, and the presence of leading biopharmaceutical companies. It is characterized as a leading region in advanced technologies for plasma collection and fractionation, strong regulatory frameworks that ensure the safety and efficacy of products, and government support for the development of therapeutic proteins. Among those countries globally, we could see the U.S. has the highest rate of albumin consumption through the nature, also in innovation, because it has a large population of patients need album, and for some diseases such as liver cirrhosis, burn and shock, again it keep high in albumin market in the globe.

Asia Pacific is speculated to be the fastest growing region in the Albumin Market with a 7.41% CAGR due to the rapid rise in ageing and population groups, a rapid increase in healthcare spending, along with rising investments in the arenas of biotechnology and plasma fractionation. The production and consumption of albumin are significantly increasing in countries such as China and India, mainly because of increasing incidences of liver diseases, trauma cases, and surgical procedures. In addition, the region's fast growth in the market is also due to China's largest consumer and producer of albumin in the world, advantageous government policy, and the growing products produced by domestic manufacturers.

The albumin market in Europe is anticipated to expand over the forecast period due to the strong healthcare infrastructure, increasing burden of chronic diseases, and high global presence of leading pharmaceutical and biotechnology companies. Germany is maintaining its lead as the number-one country in Europe, followed by the UK and France. The regional growth is boosted by increased efforts for healthcare reform, awareness pertaining to albumin-based therapies, and extensive investments in research and developmental activities.

Additionally, positive regulatory reforms and measures, particularly the removal of restrictions on the use of UK donor plasma for albumin production, are pushing the growth of the albumin market. The rising emphasis on personalized medicine and regenerative therapies is also boosting the demand for albumin in Europe.

The albumin market in Latin America and the Middle East & Africa (MEA) is expected to grow moderately due to improving healthcare infrastructure, increasing awareness, and adoption of plasma-derived therapies across the region. Latin America will also grow, driven by a strengthened healthcare infrastructure, complemented by an increased adoption of albumin for both therapeutic and research applications. Additionally, mounting chronic diseases demand albumin-based treatments, which in turn drive the growth of the region's market, along with increasing healthcare expenditure.

Gradual expansion of the albumin market in the MEA region, due to investments in healthcare infrastructure, along with a rising burden of chronic diseases, is also another driver for the growth of the albumin market. Demand for albumin is rising with the treatment of liver disease, burns, and cancer, driving albumin growth in countries such as Saudi Arabia, the United Arab Emirates, and South Africa. Increasing medical awareness & attempts to increase access to healthcare are also propelling the growth of the regional market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Albumin Market Key Players

CSL Limited, Grifols S.A., Octapharma AG, Baxter International Inc., Takeda Pharmaceutical Company Limited, China Biologic Products Holdings Inc., Kedrion Biopharma Inc., Hualan Biological Engineering Inc., Biotest AG, Shanghai RAAS Blood Products Co. Ltd., and other players.

Recent Developments in the Albumin Market

-

June 18, 2024 – Haier Group completed its strategic investment in Shanghai RAAS Blood Products Co., Ltd. successfully, a key milestone for its foray into the healthcare sector. Shanghai RAAS is now a part of Haier Group's healthcare ecosystem officially, operating under the Incaier brand.

-

July 2023 – Grifols S.A., a world leader in plasma-derived biotherapeutics, announced that it had completed its PRECIOSA Phase 3 clinical trial that assessed the long-term safety and efficacy of albumin-based therapy through its proprietary Albutein product.

-

2022 – Kedrion Biopharma marked a significant milestone by obtaining the first-ever approval for a Bio Products Laboratory (BPL) product in China. This regulatory approval allows the company to start routine shipments to China. The importance of this accomplishment is highlighted by the fact that China is the biggest human albumin market in the world, with a demand of 627 tons, out of a total global demand of 1,368 tons in 2021.

Albumin Market Report Scope:

Report Attributes Details Market Size in 2024 USD 6.65 Billion Market Size by 2032 USD 11.02 Billion CAGR CAGR of 6.58% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Human Serum Albumin, Recombinant Albumin, Bovine Serum Albumin)

• By Application (Therapeutics, Diagnostics, Research)

• By End-user (Hospitals & Clinics, Pharmaceutical & Biotechnology Industry, Research Institutes)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles CSL Limited, Grifols S.A., Octapharma AG, Baxter International Inc., Takeda Pharmaceutical Company Limited, China Biologic Products Holdings Inc., Kedrion Biopharma Inc., Hualan Biological Engineering Inc., Biotest AG, Shanghai RAAS Blood Products Co. Ltd., and other players.