Genome Editing Market Report Scope & Overview:

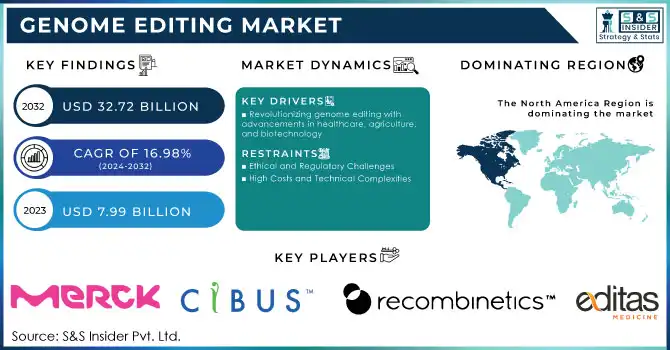

The Genome Editing Market size valued at USD 7.99 billion in 2023 and is expected to reach USD 32.72 billion by 2032 with a growing CAGR of 16.98% during the forecast period of 2024-2032. The genome editing market is witnessing rapid advancements, driven by revolutionary technologies such as CRISPR-Cas9, TALENs, and zinc finger nucleases (ZFNs). Among these, CRISPR-Cas9 has emerged as a game-changer, offering unparalleled precision, efficiency, and cost-effectiveness, making it the preferred choice in research and therapeutic applications. Recent studies report that CRISPR-based technologies dominate over 70% of ongoing genome editing research globally, highlighting their widespread adoption. The increasing burden of genetic disorders and chronic diseases has propelled the demand for genome editing in developing innovative treatments. Early clinical trials for CRISPR-based therapies targeting conditions like sickle cell anemia and certain cancers have shown significant promise, with some patients achieving remission. This progress underscores genome editing’s potential to address unmet medical needs and revolutionize precision medicine.

To Get More Information on Genome Editing Market - Request Sample Report

In agriculture, genome editing plays a critical role in improving crop yield, enhancing pest resistance, and developing nutritionally enriched produce. Research indicates that over 300 genome-edited crops are currently under development, leveraging CRISPR to tackle challenges like climate change and global food security. For example, drought-resistant crops have been engineered to withstand extreme weather conditions, reducing agricultural losses. Beyond healthcare and agriculture, genome editing is gaining traction in synthetic biology and drug discovery. It is increasingly utilized to create accurate disease models for drug testing and target identification, significantly reducing development timelines. Reports suggest that nearly 60% of biopharmaceutical companies now integrate genome editing technologies into their R&D pipelines.

Ethical considerations and evolving regulatory frameworks remain pivotal in shaping the adoption of genome editing technologies. As innovations continue to expand the scope of applications, interdisciplinary collaborations between scientists, policymakers, and industry stakeholders are expected to drive the market’s growth further, ensuring the safe and responsible use of these transformative tools. The trajectory of genome editing signifies a future where precision and innovation converge to redefine biological sciences.

Genome Editing Market Dynamics

Drivers

- Revolutionizing genome editing with advancements in healthcare, agriculture, and biotechnology

The genome editing market is driven by a combination of technological advancements, growing research investments, and expanding applications across healthcare, agriculture, and biotechnology. The emergence of advanced technologies like CRISPR-Cas9, TALENs, and zinc finger nucleases (ZFNs) has revolutionized genome editing by offering unmatched precision, efficiency, and affordability. CRISPR-Cas9, in particular, has simplified genetic modifications, making it accessible for a wide range of applications, from therapeutic development to agricultural improvements.

The rising prevalence of genetic disorders, such as sickle cell anemia and Duchenne muscular dystrophy, is a significant factor fueling demand. Clinical trials leveraging CRISPR-based therapies are demonstrating promising results, particularly in treating previously incurable conditions. The increasing focus on personalized medicine, which relies on precise genetic interventions, further drives the adoption of genome editing technologies.

In agriculture, the growing need for sustainable solutions to enhance crop resilience and productivity amid climate challenges has spurred interest in genome editing. Genetically modified crops, designed for improved pest resistance and nutritional value, are gaining acceptance as key tools to address food security concerns.

Additionally, genome editing’s applications in drug discovery and synthetic biology are expanding rapidly. Pharmaceutical companies are integrating these technologies to accelerate drug development processes and improve disease modeling. Coupled with increasing private and public funding for genomic research, and favorable regulatory advancements, these drivers collectively contribute to the robust growth and transformative potential of the genome editing market.

Restraints

- Ethical and Regulatory Challenges

Concerns over the ethical implications of genetic modifications and varying regulatory frameworks across regions hinder the widespread adoption of genome editing technologies.

- High Costs and Technical Complexities

Despite advancements, the high costs of genome editing tools and the need for specialized expertise remain significant barriers, particularly for small-scale research and applications.

Key Segmentation

By Application

Genetic engineering was the dominant application of genome editing technologies, particularly in 2023, accounting for a significant share of the market. This dominance can be attributed to the growing demand for genetically modified organisms (GMOs) across various sectors such as agriculture, biotechnology, and healthcare. In agriculture, genome editing technologies like CRISPR are used to create crops with improved traits, such as pest resistance, drought tolerance, and enhanced nutritional profiles. In biotechnology, genetic engineering is instrumental in producing biopharmaceuticals, biofuels, and other synthetic biology applications. The application of genome editing in genetic engineering accounted for approximately 50% of the total market share in 2023.

The clinical applications segment is the fastest-growing area of genome editing, driven by advancements in gene therapies and personalized medicine. In 2023, the clinical applications segment experienced rapid growth, fueled by promising clinical trials utilizing CRISPR-based therapies for genetic disorders like sickle cell anemia and Duchenne muscular dystrophy. This growth is primarily driven by the increasing need for precision medicine and the potential for genome editing to cure previously untreatable genetic diseases. The clinical applications segment is expected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years, making it the fastest-expanding application.

By Technology

CRISPR/Cas9 dominated the genome editing market in 2023, accounting for the largest share due to its unmatched precision, efficiency, and affordability. The ease of use and broad applicability of CRISPR/Cas9 across various sectors—including healthcare, agriculture, and biotechnology—has positioned it as the preferred technology for genome editing. It is used extensively in research to create genetically modified organisms, develop gene therapies, and improve crop traits. CRISPR/Cas9 technology accounted for 55% of the total market share in 2023, making it the leader in the field.

TALENs/MegaTALs While CRISPR/Cas9 remains the leader, TALENs (Transcription Activator-Like Effector Nucleases) and MegaTALs are the fastest-growing technologies in genome editing. This growth is driven by their high precision and ability to target specific genes with minimal off-target effects, making them ideal for therapeutic applications where accuracy is critical. TALENs and MegaTALs are gaining traction in gene therapy, especially in areas where CRISPR/Cas9's off-target effects are a concern. This segment is projected to grow at a CAGR of around 22% in the coming years.

By Delivery Method

Ex-vivo delivery methods dominated the genome editing market due to their higher efficiency and control over edited cells. In this method, cells are genetically altered outside the body and then reestablished in the patient. It is commonly used in clinical applications, especially for blood-related genetic disorders such as sickle cell anemia. In 2023, ex-vivo accounted for approximately 65% of the delivery method market share, driven by the high success rate in clinical trials and the ability to isolate and modify specific cells before reintroduction.

In-vivo The in-vivo delivery method is the fastest-growing segment in the genome editing market. This approach, where genetic material is directly delivered into the patient’s body, is gaining significant attention due to its potential to treat a broader range of diseases, particularly those that require systemic interventions. Recent advancements in delivery techniques, including nanoparticles and viral vectors, have improved the effectiveness of in-vivo methods, making them a promising avenue for gene therapies. This segment is growing rapidly with a projected CAGR of 30% over the next few years.

Genome Editing Market Regional Analysis

In 2023, North America held the largest share of the genome editing market, driven by a well-established research and development ecosystem, significant investments in biotechnology, and strong government support for genetic research. The United States, in particular, has been a global leader in genome editing applications, especially in healthcare and agriculture, supported by regulatory frameworks that encourage innovation. This region remains a key hub for clinical trials and advancements in gene therapies, further strengthening its dominance in the global market.

Europe also held a substantial share, with countries like Germany, the UK, and France leading the way in both academic research and clinical applications. Europe’s strong emphasis on biotechnology and genomics, along with its regulatory and ethical frameworks, supports the growth of genome editing technologies. European countries are increasingly adopting genome editing for agricultural innovations and gene therapy developments, positioning the region as a significant player in the global market.

Asia-Pacific emerged as the fastest-growing region for genome editing technologies. Countries such as China, Japan, and India are making considerable advancements in genome editing for both therapeutic and agricultural applications. China, in particular, is rapidly expanding its use of CRISPR technology for agriculture and gene therapies, driving significant growth in the region. The increasing investment in research and development, coupled with government-backed initiatives, is propelling the region's adoption of genome editing technologies.

Do You Need any Customization Research on Genome Editing Market - Enquire Now

Key Players

-

Merck KGaA - CRISPR-Cas9 Gene Editing Platform

-

Cibus Inc. - Rapid Trait Development System (RTDS)

-

Recombinetics - Gene Editing for Animal Health and Agricultural Biotechnology

-

Sangamo Therapeutics - Zinc Finger Nucleases (ZFNs)

-

Editas Medicine - EDIT-101 (CRISPR-based Gene Therapy)

-

Precision BioSciences - Arcus Gene Editing Platform

-

CRISPR Therapeutics - CTX001 (CRISPR-based Therapy for Genetic Disorders)

-

Intellia Therapeutics, Inc. - NTLA-2001 (CRISPR-based Therapeutic)

-

Caribou Biosciences, Inc. - CRISPR-Cas12a and CRISPR-Cas9 Technologies

-

Cellectis S.A. - TALEN Gene Editing System

-

AstraZeneca - CRISPR Gene Editing Research Initiatives

-

Takara Bio Inc. - Gibson Assembly and CRISPR/Cas9 Systems

-

Horizon Discovery Ltd. (Revvity, Inc.) - GENESIS Gene Editing Services

-

Danaher Corporation - EditR (Gene Editing Platform)

-

Transposagen Biopharmaceuticals, Inc. - Transposon-based Gene Editing Technologies

-

Genscript Biotech Corp - CRISPR Gene Editing Kits and Services

-

New England Biolabs - CRISPR Enzymes and Tools

-

OriGene Technologies, Inc. - CRISPR/Cas9 Gene Editing Tools

-

Bluebird Bio, Inc. - LentiGlobin (Gene Therapy for Genetic Disorders)

-

Lonza - Lonza’s Genome Editing Services

-

Thermo Fisher Scientific, Inc. - GeneArt CRISPR Nuclease Kits and Services

Recent Developments

In November 2024, Precision BioSciences, Inc., a clinical-stage gene editing company utilizing its proprietary ARCUS platform, recently announced its participation in several upcoming investor conferences. The company is focused on advancing in vivo gene editing therapies for complex genetic modifications.

In Oct 2024, South Africa amended its national health research guidelines to explicitly allow heritable human genome editing, positioning the country as the first to permit genetic modifications of embryos for creating genetically modified children. This controversial decision has sparked significant ethical debate due to its potential societal and eugenic implications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.99 Billion |

| Market Size by 2032 | US$ 32.72 Billion |

| CAGR | CAGR of 16.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Genetic Engineering (Cell Line Engineering, Animal Genetic Engineering, Plant Genetic Engineering, Others), Clinical Applications (Diagnostics, Therapy Development)] • By Technology ((CRISPR)/Cas9, TALENs/MegaTALs, ZFN, Meganuclease, Others) • By Delivery Method (Ex-vivo, In-vivo) • By End-use (Biotechnology and Pharmaceutical Companies, Academic and Government Research Institutes, Contract Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, Cibus Inc., Recombinetics, Sangamo Therapeutics, Editas Medicine, Precision BioSciences, CRISPR Therapeutics, Intellia Therapeutics, Inc., Caribou Biosciences, Inc., Cellectis S.A., AstraZeneca, Takara Bio Inc., Horizon Discovery Ltd. (Revvity, Inc.), Danaher Corporation, Transposagen Biopharmaceuticals, Inc., Genscript Biotech Corp, New England Biolabs, OriGene Technologies, Inc., bluebird bio, Inc., Lonza, Thermo Fisher Scientific, Inc. |

| Key Drivers | • Revolutionizing genome editing with advancements in healthcare, agriculture, and biotechnology |

| Restraints | •Ethical and Regulatory Challenges • High Costs and Technical Complexities |