Aliphatic Hydrocarbon Market Report Scope & Overview

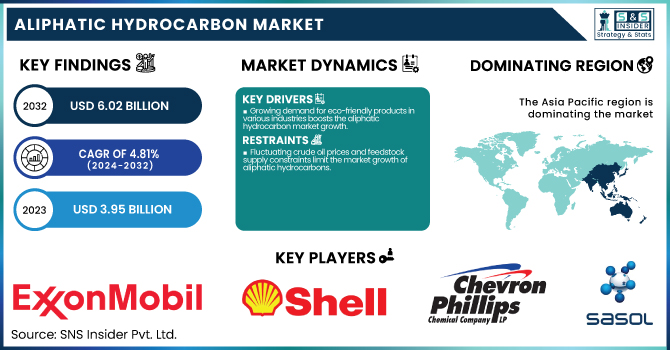

The Aliphatic Hydrocarbon Market size was USD 3.95 billion in 2023 and is expected to reach USD 6.02 billion by 2032 and grow at a CAGR of 4.81% over the forecast period of 2024-2032.

To Get more information on Aliphatic Hydrocarbon Market - Request Free Sample Report

This report on the aliphatic hydrocarbon market delivers comprehensive statistical insights and emerging trends across key areas. It covers 2023 data on production capacity and utilization by country and type, along with a detailed feedstock price analysis. The report evaluates regulatory impacts by nation and product type while also assessing environmental metrics, including emissions, waste management, and sustainability efforts by region. Innovation and R&D trends by hydrocarbon type are highlighted to gauge technological progress. Additionally, the report explores adoption rates of chemicals and materials software, regional compliance with regulations, and key software feature analysis. These insights collectively offer a data-driven understanding of market dynamics and future trajectories.

The U.S. held the largest market share in the aliphatic hydrocarbon market in 2023, primarily due to its robust industrial base and high demand across key end-use sectors such as paints & coatings, adhesives & sealants, and polymer & rubber manufacturing. With a market size of USD 0.85 billion in 2023 and projected to grow at a CAGR of 5.81% to reach USD 1.41 billion by 2032, the U.S. market is driven by strong domestic production capacity, advanced refining infrastructure, and stable feedstock availability from abundant petroleum resources. Additionally, the presence of leading chemical manufacturers and continuous investments in R&D and cleaner formulations have bolstered growth. Regulatory support for low-VOC solvents and the increasing adoption of aliphatic hydrocarbons in eco-friendly formulations have further cemented the U.S.'s dominant position in the global market.

Market Dynamics

Drivers

-

Growing demand for eco-friendly products in various industries boosts the aliphatic hydrocarbon market growth.

The rising emphasis on environmental sustainability across major industries such as paints & coatings, adhesives, and rubber, has significantly increased the demand for eco-friendly aliphatic hydrocarbons. These hydrocarbons are preferred over aromatic alternatives due to their lower toxicity, reduced volatile organic compound (VOC) emissions, and better biodegradability. Governments and regulatory bodies, especially in regions like North America and Europe, are enforcing stricter emission norms and promoting green chemistry, further accelerating the adoption of aliphatic hydrocarbons in industrial formulations. Moreover, companies are investing heavily in cleaner and safer chemical alternatives to meet ESG (Environmental, Social, and Governance) goals and appeal to environmentally conscious consumers. As a result, the demand for aliphatic hydrocarbons in applications requiring low environmental impact continues to grow, positioning it as a crucial driver for market expansion through 2032.

Restrain

-

Fluctuating crude oil prices and feedstock supply constraints limit the market growth of aliphatic hydrocarbons.

The production of aliphatic hydrocarbons is heavily reliant on petrochemical feedstocks derived from crude oil, making the market vulnerable to global oil price fluctuations and supply chain disruptions. These price volatilities can significantly affect production costs and profit margins for manufacturers, especially in regions that depend on imported crude. Geopolitical tensions, OPEC+ output decisions, and shifting energy policies contribute to inconsistent oil availability and pricing, creating uncertainty in procurement and long-term planning. Additionally, sudden shortages in naphtha or other light distillates used in the refining process can disrupt operations. This instability often forces manufacturers to absorb increased costs or pass them on to end-users, potentially reducing competitiveness. As a result, the dependency on oil-derived feedstocks remains a key restraint that challenges consistent growth in the aliphatic hydrocarbon market.

Opportunity

-

Rising adoption of low-voc and high-purity hydrocarbons across developing economies creates strong market opportunities

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid industrialization, urbanization, and infrastructural development, driving the demand for clean and efficient solvents. Aliphatic hydrocarbons, particularly those with low VOC content and high purity, are increasingly being adopted in coatings, cleaning agents, and polymer manufacturing to meet both performance and environmental standards. Governments in these regions are beginning to align with global sustainability frameworks, enforcing stricter pollution controls and promoting green alternatives in industrial applications. Additionally, growing investments from global manufacturers in localized production facilities are making these hydrocarbons more accessible and cost-effective. As industries in these regions modernize and seek to meet international quality benchmarks, the demand for high-grade aliphatic hydrocarbons is expected to surge, presenting significant growth opportunities for market players.

Challenge

-

Stringent environmental regulations and compliance requirements pose a major challenge for market participants globally.

Aliphatic hydrocarbon producers face mounting pressure to comply with an increasingly complex web of environmental and safety regulations across different regions. Regulatory frameworks such as REACH in Europe and the Clean Air Act in the U.S. mandate rigorous testing, emissions controls, and safe handling protocols, especially for solvent-grade hydrocarbons. These requirements not only demand significant investment in compliance infrastructure but also necessitate continuous R&D to reformulate products in line with evolving standards. Smaller manufacturers often struggle to keep up with such mandates, resulting in reduced market competitiveness. Additionally, cross-border trade in these chemicals is complicated by varying national regulations, making global distribution a logistical and legal challenge. As regulatory scrutiny intensifies worldwide, achieving consistent compliance while maintaining profitability remains one of the most pressing challenges for market players.

Segmentation Analysis

By Product

In 2023, saturated aliphatic hydrocarbons accounted for the largest market share, around 64% 2023. It is due to their stability, low toxicity, and high performance in industrial solvents, cleaning agents, and coatings. Due to their primarily composed alkanes, these hydrocarbons are unreactive under normal conditions and can easily be handled and incorporated into a variety of formulations for paints & coatings, adhesives, and polymer applications. Their excellent purity and very low odor make them preferable for both consumer and industrial applications. At the same time, regulatory changes have favored less aromatic and unsaturated and more saturated hydrocarbons. Establishing a firm position for saturated hydrocarbons within a structure of aliphatic hydrocarbons market as a whole led to production driving in developed regions with stable or growing demand and increased consumption in developing and emerging markets.

By Application

Paints & coatings held the largest market share around 34.22% in 2023 as aliphatic solvents are the most commonly used solvents as diluents, thinners, and carriers in decorative as well as industrial coating applications. For example, these hydrocarbons are preferred for their low odor, lower toxicity, and low VOC emissions within compliance of both environmental and safety regulations primarily in North America and Europe. These chemical properties guarantee high spreading, rapid drying, and resin miscibility, making them indispensable in automotive, marine, construction, and other consumer goods coatings. Pair this with the rise of global infrastructure growth and increased demand for high-performance, weather-resistant coatings, helping contribute to the rise in their usage. With the coatings industry gradually moving toward enhanced sustainability and eco-efficiency, aliphatic hydrocarbons will continue to be an integral part of the segment, further consolidating the dominance of this product type in the application.

Regional Analysis

Asia Pacific held the largest market share, around 42%, in 2023. The growing industrial base, booming consuming sectors, and sufficient presence of manufacturing hubs contributed a lot to the expansion of market size. Strong growth in end-use industries such as paints & coatings, adhesives, rubber, and plastics in China, followed by India, Japan, and South Korea, about the extensive use of aliphatic hydrocarbon as a solvent and processing material is the key booster for the industry wear. This area has the advantage of the availability of raw materials, cheap production, and government initiatives favorable to industrial development. Rapid urbanization, infrastructure developments, and automotive production are also raising the consumption of coatings and adhesives, which in turn is fueling demand for aliphatic hydrocarbons. Asia Pacific holds the highest revenue share, having a significant number of leading chemical manufacturers and high specialty chemicals exports.

North America held a significant market share. It is owing to its matured industrial infrastructure, developed refining capacity, and demand for end-use sectors including paints & coatings, adhesives, automotive, and construction. This is due to the availability of stable crude oil & natural gas, which are the main feedstocks for aliphatic hydrocarbon production, providing manufacturers with the ability to secure supply at low-cost and keep production stable. Stringent environmental regulations in the U.S. and Canada have further boosted the demand for low-VOC and environment-friendly solvents, with aliphatic hydrocarbons gaining a higher preference over aromatic formats. Major chemical companies and R&D and green chemistry investments are also aiding the market. In addition, the demand for high-performance materials in infrastructure and automotive applications ensures continuous consumption, reinforcing the solid position of the North American market on the global scale.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ExxonMobil Corporation (Isopar L, Exxsol D80)

-

Royal Dutch Shell plc (ShellSol D40, Shell GTL Solvent GS190)

-

Chevron Phillips Chemical Company LLC (Soltrol 130, Soltrol 170)

-

Sasol Ltd. (Sasol LPA 210, IsoParaffinic Solvent H)

-

Neste Oyj (Neste MY Renewable Isoalkane, Neste Hydrocarbons)

-

Calumet Specialty Products Partners, L.P. (Penreco Drakeol, Calumet Solvents)

-

TotalEnergies SE (Hydrosol D95, Total Solane)

-

Idemitsu Kosan Co., Ltd. (Idemitsu IP Solvent, Hysol 2000)

-

HCS Group GmbH (Solvent Naphtha SN150, Haltermann Carless Extensol)

-

BASF SE (Naphthenic Solvent ND 150, Solvent 100)

-

LyondellBasell Industries Holdings B.V. (Isopar H, Hydrobrite 380)

-

Nynas AB (NYFLEX 800, NYTEX 4700)

-

Panama Petrochem Ltd. (Mineral Turpentine Oil, Liquid Paraffin Light)

-

Recochem Inc. (Varsol 40, Recochem Mineral Spirits)

-

SK Geo Centric Co., Ltd. (EcoSol H, SK Paraffin Solvent)

-

Aditya Birla Chemicals (Solvent 2440, Birla Sol LPA)

-

JXTG Nippon Oil & Energy Corporation (ENEOS Solvent N, JX Iso Solvent)

-

Ergon, Inc. (HyPrint 200, Ergon Solvent E200)

-

DHC Solvent Chemie GmbH (Solvent DHC N150, Isoparaffin DHC 140)

-

Phillips 66 Company (Soltrol 130, Soltrol 170)

Recent Developments:

-

In 2024, ExxonMobil initiated test operations at its $10 billion petrochemical complex located in Huizhou, Guangdong Province. The site features a 1.6-million-ton-per-year steam cracker and is designed to manufacture high-value petrochemical products.

-

In 2023, Idemitsu Kosan, Oriental Petrochemical (Taiwan) Co., Ltd., and Marubeni Corporation reached an agreement to develop a supply chain for biomass-derived Purified Terephthalic Acid (PTA) using biomass naphtha, with production scheduled to commence in Taiwan in 2024.

-

In 2023, Idemitsu Kosan entered into a strategic partnership MOU with HIF Global to advance the production, practical implementation, and widespread adoption of e-fuels in Japan.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.95 Billion |

| Market Size by 2032 | USD6.02Billion |

| CAGR | CAGR of4.81 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Saturated, Unsaturated) • By Application (Paints & Coatings, Adhesives & Sealant, Polymer & Rubber, Surfactant, Dyes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Phillips Chemical Company LLC, Sasol Ltd., Neste Oyj, Calumet Specialty Products Partners L.P., TotalEnergies SE, Idemitsu Kosan Co. Ltd., HCS Group GmbH, BASF SE, LyondellBasell Industries Holdings B.V., Nynas AB, Panama Petrochem Ltd., Recochem Inc., SK Geo Centric Co. Ltd., Aditya Birla Chemicals, JXTG Nippon Oil & Energy Corporation, Ergon Inc., DHC Solvent Chemie GmbH, Phillips 66 Company |