Glufosinate Ammonium Market Report Scope & Overview:

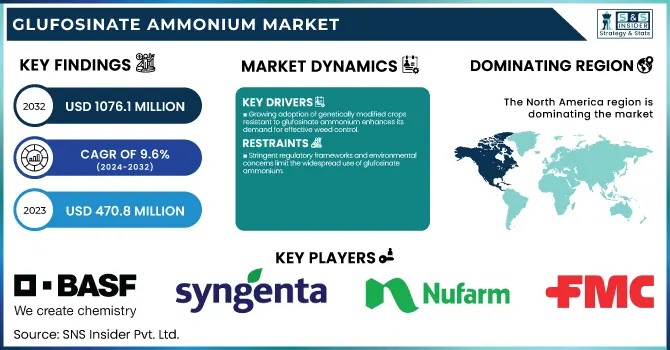

The Glufosinate Ammonium Market Size was valued at USD 470.8 Million in 2023 and is expected to reach USD 1076.1 Million by 2032, growing at a CAGR of 9.6% over the forecast period 2024-2032.

To Get more information on Glufosinate Ammonium Market - Request Free Sample Report

The Glufosinate Ammonium Market Report provides key statistical trends and insights, including global production and consumption volumes to market pricing trends, analysing fluctuation dynamics based on supply chain and regulatory factors. It explores adoption rates for agriculture, including the share of farmland by crop type, and it analyses the regulatory framework, including changing bans and maximum residues limits (MRLs). It also analyzes the competitive landscape, detailing leading manufacturer's market share, and environmental and health hazard studies, evaluation of toxicity levels, and ecological effects. The global glufosinate ammonium market is set to be driven by increasing application of genetically modified crops and growing need for efficient weed management solutions.

Glufosinate Ammonium Market Dynamics:

Drivers

-

Growing adoption of genetically modified crops resistant to glufosinate ammonium enhances its demand for effective weed control.

Growing adoption of genetically modified (GM) crops that are glufosinate ammonium-resistant is contributing to the herbicide market expansion. These GM crops are genetically modified to be tolerant to applications of glufosinate ammonium herbicides, which allows farmers to control a wide range of weeds without damaging the crop of interest. This compatibility also streamlines weed control, lowers labor costs, and increase crop yields. The growing acceptance of herbicide-resistant crops and increasing agricultural labour costs. China has a 45% share of the market and India is at 20% while Australia is at 15%. Soybean planting represented 30% of total glufosinate ammonium consumption in 2023, followed by corn (25%) and fruit orchards (20%). The cotton sector also experienced a 15% increase in demand due to the expansion of herbicide-tolerant varieties. With the rise of green formulations & precision agriculture techniques, significant growth is expected in glufosinate ammonium market in the coming years. Crop types genetically modified for resistance to glufosinate ammonium are one of the other factors driving the growth of the pesticide market. Data analytics, GPS and IoT devices used in precision farming have allowed farmers to deploy far more targeted applications of herbicides. This technique of targeted application reduces both the amount of chemical used and the impact on the environment, and it reflects the global trend of sustainable agriculture. This integration is likely to improve the efficacy of glufosinate ammonium, making it a popular choice of modern farmers.

Restraint:

-

Stringent regulatory frameworks and environmental concerns limit the widespread use of glufosinate ammonium.

In addition, strict regulatory framework and environmental concern are expected to be the key restrain for the growth of glufosinate ammonium market. . In India, the Directorate General of Foreign Trade (DGFT) issued Notification No. 54/2024-25 on January 24, 2025, amending the import policy for glufosinate technical under HS Code 38089390. This amendment extends the Minimum Import Price (MIP) condition for glufosinate and its salts (with a purity of at least 95% w/w) for one year, from January 24, 2025, to January 23, 2026. Imports having a Cost, Insurance, and Freight (CIF) value below ₹1,289 per kilo are categorized as "Restricted," and those at or above this point stay "Free" under this policy. As a result, the agency is taking regulatory action to balance the quality of products on the market and the prices of raw materials and finished products while creating conditions for domestic producers in this segment and compliance with environmental standards. These strict regulations can reduce the availability of lower-cost glufosinate products in the market, which can increase costs for end-users and impact the overall market dynamics. The regulatory scrutiny is increasing, owing to environmental concerns regarding the use of chemical herbicides such as glufosinate ammonium, which has hindered the growth of the market.

Opportunity:

-

Development of eco-friendly formulations and integration with precision farming technologies present growth prospects in the glufosinate ammonium market.

The glufosinate ammonium market is poised for significant growth, driven by the development of eco-friendly formulations and the integration of precision farming technologies. The adoption of transgenic crops that are tolerant to the herbicide glufosinate ammonium has significantly supported this expansion. The cultivation area for herbicide-resistant biotech crops, including glufosinate-resistant varieties, reached approximately 98.9 million hectares globally, accounting for about 28% of the total biotech crop area.

There is also a trend toward bio-based herbicides as well as pressure from environmental regulations. This change coincides with a worldwide shift towards sustainable farming, creating a market for products including L-glufosinate ammonium that are seen as less damaging to the environment than classic chemical herbicides. Moreover, the availability of precision farming technologies can help optimize the application of herbicides, which improves overall usage of herbicides in the market and leads to a lesser environmental impact. These innovations are anticipated to create a market for glufosinate ammonium as farmers search for effective and sustainable weed management solutions.

Challenge:

-

Emergence of glufosinate-resistant weed species poses a threat to its long-term efficacy and market sustainability.

The development of weeds resistant to glufosinate represents a substantial threat to sustainable agriculture. Palmer amaranth (Amaranthus palmeri) populations resistant to glufosinate were discovered in Arkansas, with some exhibiting resistance up to 15 times the standard application rate. This development highlights the versatility of weeds and the possibility of resistance to herbicides such as glufosinate. The number of these resistant species is exploding, and they’re threatening crop yields and making weed control more complex. To combat this, experts advocate for integrated weed management practices, including crop rotation, use of multiple herbicide modes of action, and non-chemical control methods. Proactive measures are essential to preserve the efficacy of existing herbicides and ensure long-term agricultural productivity.

Glufosinate Ammonium Market Segmentation:

By Crop

In 2023, the Genetically Modified (GM) Crops segment held the largest share, accounting for 72%, of the glufosinate ammonium market. This significant market share can be attributed to several factors, numerous regulatory approvals, yield improvements, weed resistance management, and mounting global food security concerns. According to the USDA, adoption rates of GM crops have steadily risen over the last two decades, and in 2023 GM crops occupied 94%, 96%, and 92% of soybean, cotton, and corn acreage, respectively, in the United States. This widespread adoption has directly contributed to the increased demand for glufosinate ammonium, as many GM crops are engineered to be resistant to this herbicide. Moreover, the global adoption of glufosinate-resistant GM crops led to expanded approval for glufosinate production in agriculture by government agencies around the world.

By Form

In 2023, the liquid segment accounted for a major share of the glufosinate ammonium market. Ease of Application, Superior Absorption & Efficacy, Compatibility with Precision Agriculture, Storage & Transportation Advantages, and Customization Potential. Liquid herbicides comprise more than 70% of all herbicide applications in the U.S. according to the U.S. Environmental Protection Agency (EPA), indicating their popularity. Liquid formulations of glufosinate ammonium are more preferable among farmers because they are easier to handle and apply compared to non-liquid forms, along with providing better coverage and absorption by essential plant foliage for better weed control. Liquid formulations have also benefited from the upsurge of precision agriculture technologies in line with the European Commission's Farm to Fork Strategy, which includes reducing overall pesticide usage by 50% by 2030.

By Application

The agricultural segment held the largest revenue share of 65% of the glufosinate ammonium market in 2023. Some of the key factors contributing to this significant market share include the rising global agricultural production, the increasing adoption of conservation agriculture, the emphasis on sustainable agriculture as demonstrated by governments supporting it with incentives, growing weed resistance, and labor shortages in agriculture. Global cereal production was 2,790 million tonnes in 2022, up 0.9% from 2021, according to the Food and Agriculture Organization (FAO). The increase in agricultural production is directly linked with the rising demand for effective herbicides like glufosinate-ammonium. According to the FAO, more than 180 million hectares in the world are cultivated using conservation agriculture, in which the crucial no-tillage or reduced tillage system is a cornerstone of this type of agriculture, where glufosinate ammonium plays an essential role.

Glufosinate Ammonium Market Regional Outlook:

North America held the highest market share of 38% in the global glufosinate ammonium market in 2023. This dominance can be attributed to the region's high adoption rate of genetically modified crops and advanced agricultural practices. In 2023, more than 90% of corn, soybeans, and cotton acres in the United States were planted with GM crops, according to the USDA. The regional market is also benefiting as in 2021, the U.S. Environmental Protection Agency (EPA) approved the release of certain varieties of glufosinate-resistant crops.

Asia-Pacific is expected to register the highest CAGR during the forecast period. It is being fueled by growing agricultural activities, increasing food demand, and government initiatives to enhance agricultural productivity. China’s 14th Five-Year Plan (2021–2025) highlights agricultural modernization and securing food, indirectly supporting the glufosinate ammonium market. The government of India (GoI), as an example, has introduced a programme on, "Per Drop More Crop", which is intended to boost crop intensity by 7% with efficient water use in the agricultural sector, thereby potentially stimulating the demand for herbicides.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Key Service Providers/Manufacturers

-

Bayer AG

-

BASF SE

-

Nufarm Limited

-

FMC Corporation

-

Adama Agricultural Solutions Ltd.

-

UPL Limited

-

Zhejiang YongNong BioSciences Co., Ltd.

-

Jiangsu Huangma Agrochemicals Co., Ltd.

-

Jiangsu Sevencontinent Green Chemical Co., Ltd.

-

Zhejiang Xinan Chemical Industrial Group Co., Ltd.

-

Shandong Weifang Rainbow Chemical Co., Ltd.

-

Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

-

Jiangsu Huifeng Agrochemical Co., Ltd.

-

Jiangsu Yangnong Chemical Co., Ltd.

-

Shandong Cynda Chemical Co., Ltd.

-

Jiangsu Changqing Agrochemical Co., Ltd.

-

Zhejiang Wynca Chemical Industry Group Co., Ltd.

Recent Developments:

-

In March 2024, Bayer CropScience launched a superior performing liquid soluble formulation of glufosinate ammonium with beneficial environmental characteristics. According to the company, this new formulation supports the sustainability ambitions of the European Union through the European Green Deal.

-

in January 2024, The approval of three new glufosinate-resistant soybean varieties by The Chinese Ministry of Agriculture and Rural Affairs could lead to higher demand of glufosinate ammonium in the country.

Glufosinate Ammonium Market Report Scope:

Report Attributes Details Market Size in 2023

USD 470.8 Million

Market Size by 2032

USD 1076.1 Million

CAGR

CAGR of9.6% From 2024 to 2032

Base Year

2023

Forecast Period

2024-2032

Historical Data

2020-2022

Report Scope & Coverage

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

Key Segments

• By Crop (Non-GM Crops, Genetically Modified (GM) Crops)

• By Form (Liqid, Dry)

• By Application (Non-Agricultural, Agricultural)Regional Analysis/Coverage

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America)

Company Profiles

UPL Limited, Zhejiang YongNong BioSciences Co., Ltd., Jiangsu Huangma Agrochemicals Co., Ltd., Lier Chemical Co., Ltd., Jiangsu Sevencontinent Green Chemical Co., Ltd., Zhejiang Xinan Chemical Industrial Group Co., Ltd., Shandong Weifang Rainbow Chemical Co., Ltd., Jiangsu Good Harvest-Weien Agrochemical Co., Ltd., Jiangsu Huifeng Agrochemical Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd., Shandong Cynda Chemical Co., Ltd., Jiangsu Changqing Agrochemical Co., Ltd., Zhejiang Wynca Chemical Industry Group Co., Ltd., Dow AgroSciences LLC..