Decorative Coatings Market Report Scope & Overview:

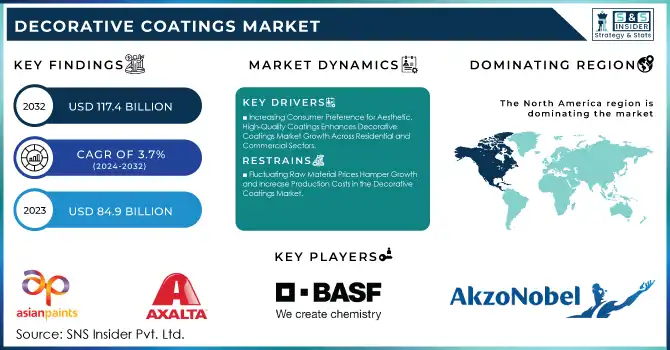

The Decorative Coatings Market Size was valued at USD 84.9 billion in 2023 and is expected to reach USD 117.4 billion by 2032 and grow at a CAGR of 3.7% over the forecast period 2024-2032.

Get More Information on Decorative Coatings Market - Request Sample Report

The Decorative Coatings Market is witnessing significant advancements as companies focus on enhancing product portfolios and regional presence. Rising consumer interest in aesthetics and sustainability is prompting innovations in high-performance, eco-friendly coatings. Companies like PPG Industries and AkzoNobel are leading the charge, leveraging sustainable technologies and expanding production capacities to meet growing demand. In February 2024, PPG Industries completed an expansion of its industrial coatings plant in Vietnam, aimed at meeting rising demand for decorative coatings with a focus on environmentally friendly solutions. This aligns with the growing emphasis on low-VOC, waterborne coatings as environmental regulations tighten. Additionally, in August 2024, AkzoNobel announced a portfolio review, with an emphasis on expanding its decorative coatings offerings in South Asia, a region with rapidly increasing infrastructure projects and urbanization, driving demand for high-quality coatings.

Market competition is also intensifying, with companies aiming for differentiation through innovation and strategic mergers. AkzoNobel's potential expansion of its "Dulux" shade offerings, discussed in October 2024, reflects the industry’s focus on providing extensive, customizable color options. This move seeks to solidify its competitive stance amidst growing rivalry from Grasim Industries, which has entered the decorative paints market with a commitment to disruptive strategies. As of early 2024, Grasim revealed plans for substantial investments in production facilities and a diversified product lineup to capture market share. Additionally, Hempel and other industry leaders are adopting advanced technologies to enhance product quality and improve application efficiency, aligning with customer demand for sustainable, high-quality coatings for both residential and commercial applications. The market dynamics illustrate an evolving landscape, with leading players actively expanding their portfolios, exploring strategic partnerships, and prioritizing environmentally conscious products to cater to the changing needs in the decorative coatings sector.

Decorative Coatings Market Dynamics:

Drivers:

-

Increasing Consumer Preference for Aesthetic, High-Quality Coatings Enhances Decorative Coatings Market Growth Across Residential and Commercial Sectors

Rising consumer demand for high-quality, aesthetically pleasing coatings is driving the decorative coatings market, particularly across residential and commercial sectors. With a growing emphasis on interior and exterior aesthetics, homeowners and businesses are increasingly investing in decorative paints and coatings that provide both visual appeal and enhanced durability. This trend is significantly fueled by urbanization, rising disposable incomes, and the popularity of home remodeling projects. Consumers are now more willing to pay a premium for quality coatings that offer features such as stain resistance, easy maintenance, and long-lasting finishes, which further encourage market expansion. For commercial spaces, decorative coatings are seen as a branding tool, enabling companies to create appealing environments that attract clients and employees alike. This consumer preference for aesthetically driven, high-performance products is expected to sustain demand in the decorative coatings market, as brands continue to innovate and provide options tailored to various design trends.

-

Growing Focus on Low-VOC and Eco-Friendly Coatings Propels Demand in the Decorative Coatings Market

Environmental regulations and increasing consumer awareness of sustainable practices are driving demand for eco-friendly, low-VOC (volatile organic compound) decorative coatings. Traditional solvent-based coatings are known for their environmental impact, particularly in contributing to indoor air pollution and harming ecosystems. As a result, consumers and regulatory bodies alike are advocating for the use of waterborne and low-VOC coatings that are less harmful to health and the environment. This trend has pushed manufacturers to develop sustainable formulations that comply with regulations while maintaining the performance and durability of traditional coatings. Companies like AkzoNobel and PPG Industries have already begun expanding their portfolios to include eco-friendly options, addressing consumer demand while meeting stringent environmental standards. The shift toward sustainable coatings is expected to fuel the decorative coatings market, as both individual and institutional consumers increasingly prioritize products with a lower environmental footprint.

Restraint:

-

Fluctuating Raw Material Prices Hamper Growth and Increase Production Costs in the Decorative Coatings Market

The decorative coatings market faces challenges due to the volatility of raw material prices, impacting overall production costs. Key ingredients used in decorative coatings, such as resins, pigments, and additives, are often subject to price fluctuations driven by supply chain constraints, environmental regulations, and geopolitical factors. For instance, disruptions in the supply of petrochemicals, a significant component of many resins, can lead to increased prices, which in turn affects the cost of coatings production. These rising costs can limit manufacturers’ profitability and pose a challenge for companies striving to maintain competitive pricing while meeting quality standards. Smaller players, in particular, may struggle to absorb these costs, potentially leading to consolidation within the industry. As companies navigate the complexities of raw material pricing, they may need to adopt strategies such as sourcing alternative materials or investing in innovations that reduce dependency on volatile inputs to ensure sustained market growth.

Opportunity:

-

Expansion in Emerging Markets with Rising Urbanization Presents Strong Growth Potential for Decorative Coatings Market

Emerging markets with high rates of urbanization and infrastructure development present significant growth opportunities for the decorative coatings market. Regions like Asia-Pacific, Latin America, and parts of the Middle East are experiencing rapid urbanization, driving demand for residential and commercial construction projects. As urban populations grow, the need for housing, offices, retail spaces, and infrastructure increases, creating a substantial market for decorative coatings used in interior and exterior applications. Additionally, as consumer preferences evolve in these regions, there is a noticeable shift towards higher-quality, durable, and environmentally friendly coatings, mirroring trends seen in more developed markets. Manufacturers have the opportunity to expand their presence by catering to these growing demands with tailored products, investing in localized production facilities, and leveraging strategic partnerships. This expansion potential in emerging economies offers lucrative prospects for the decorative coatings market, enabling companies to secure new revenue streams and market share.

Challenge:

-

Intense Competition Among Key Market Players Pressures Pricing and Margins in the Decorative Coatings Market

The decorative coatings market is characterized by intense competition among leading players, pressuring companies to balance competitive pricing with profitability. With numerous well-established brands like AkzoNobel, PPG Industries, and Sherwin-Williams vying for market share, there is a constant push to innovate and differentiate products while maintaining attractive pricing. This competitive environment poses a challenge, especially as customers become more price-sensitive and aware of the variety of options available. Additionally, new entrants, including local brands in emerging markets, add to the pressure by offering comparable products at lower prices, further intensifying competition. Companies must continually invest in research and development, marketing, and sustainability efforts to retain market share, often at the expense of profit margins. Balancing these factors requires strategic agility, and companies that can effectively innovate while controlling costs will be better positioned to navigate this challenging landscape.

Decorative Coatings Market Segments

By Product Type

In 2023, Emulsion Paints dominated the Decorative Coatings Market, accounting for a 45% of the market share. This product type is widely preferred for its superior durability, ease of application, and quick drying time, making it ideal for both interior and exterior applications. Emulsion paints are also favored for their low VOC content and environmental benefits, aligning with the growing consumer preference for eco-friendly products. For example, companies like Asian Paints and Sherwin-Williams have expanded their emulsion paint offerings to cater to the rising demand for residential and commercial use, further reinforcing their market dominance in this segment.

By Resin Type

In 2023, the Acrylic resin type segment dominated the decorative coatings market with a market share of 40%. Acrylic resins are widely preferred due to their excellent weather resistance, superior adhesion properties, and long-lasting finish, making them suitable for both interior and exterior coatings. For example, PPG Industries has focused heavily on acrylic-based coatings for both residential and commercial applications, capitalizing on their ability to perform well under varying climatic conditions. This demand for durable and versatile coatings drives the strong market position of acrylic resin-based products.

By Technology

In 2023, Waterborne technology dominated the decorative coatings market with a market share of 50%. This segment has been growing rapidly due to increasing environmental awareness and regulatory pressures on VOC emissions, as waterborne coatings contain fewer volatile organic compounds than solvent-borne alternatives. Leading companies like AkzoNobel have been focusing on developing waterborne coatings, offering environmentally friendly solutions for both residential and commercial uses. The demand for sustainable and low-emission coatings is driving the dominance of waterborne technologies in the market.

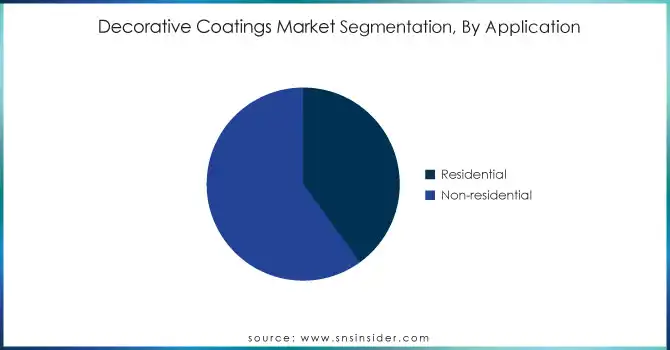

By Application

Residential applications dominated the Decorative Coatings Market in 2023, holding a market share of 40%. This growth is driven by rising disposable incomes and the increasing trend of home renovations and interior design upgrades. Homeowners are investing in high-quality coatings for both aesthetic appeal and protection, particularly for interiors. For example, Asian Paints and Dulux have tapped into this growing residential demand with their range of color and finish options, targeting consumers seeking customization and durability in home coatings.

Get Customized Report as per your Business Requirement - Request For Customized Report

Decorative Coatings Market Regional Analysis

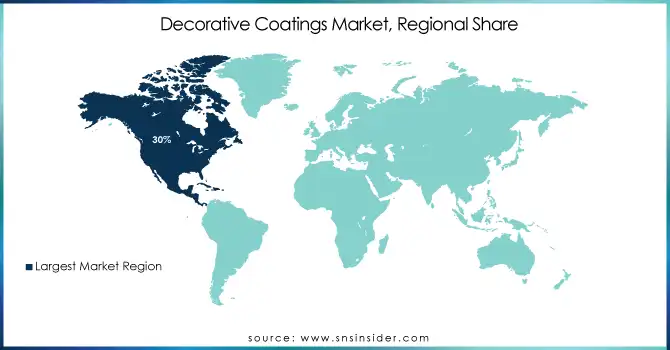

In 2023, North America dominated the Decorative Coatings Market, accounting for 30% of the total market share. This region’s dominance is largely driven by the increasing demand for premium and eco-friendly paints in both residential and commercial applications. The U.S., as the leading market in North America, has witnessed consistent demand for high-quality, durable, and aesthetically appealing coatings, particularly in home renovations and commercial real estate development. For example, Sherwin-Williams, one of the largest players in the region, reported strong performance in the U.S. market due to the growing adoption of sustainable and low-VOC paints. Additionally, PPG Industries has expanded its presence by developing innovative waterborne coatings tailored to the preferences of environmentally conscious consumers. Canada also contributes significantly to the market with increased demand for coatings in the residential housing sector, especially in urban centers like Toronto and Vancouver, where new housing projects and renovations continue to thrive. The demand for coatings in North America is further driven by regulatory trends promoting low-emission products, which have accelerated the growth of waterborne and acrylic-based coatings in the region.

Moreover, the Asia-Pacific region emerged as the fastest-growing in the Decorative Coatings Market in 2023, with a CAGR of 7.5%. This rapid growth can be attributed to the rising urbanization, infrastructure development, and growing middle-class population in countries such as China, India, and Indonesia. In China, the world's largest market for decorative coatings, demand for eco-friendly and high-performance coatings is driven by the booming construction sector, both residential and commercial. The government’s push for energy-efficient buildings and infrastructure projects has further accelerated the adoption of sustainable coating solutions. India is another key market where the increasing disposable income, expanding urban population, and an upward trend in home renovations have created a surge in demand for decorative paints. Companies like Asian Paints and Berger Paints have benefitted from this trend, offering innovative product solutions that cater to both aesthetic preferences and sustainability. In Indonesia, the decorative coatings market is also experiencing significant growth, primarily driven by the real estate boom and growing demand for quality coatings in both residential and commercial spaces. Additionally, the growing trend toward DIY (Do-It-Yourself) home improvement projects, particularly in India and China, has driven a shift toward more decorative and customizable coatings, making this region an attractive hub for market expansion. The rise of environmentally-conscious consumers in these countries has prompted companies to introduce waterborne and low-VOC products to meet local demand for sustainable solutions.

Recent Developments

-

February 2024: Asian Paints' ColourNext launched its "Colour of the Year," named Terra, which focused on themes of soil and sustainability. The company also presented forecast stories that explored concepts like deep Indofuturism and "goblin mode," reflecting contemporary cultural trends. This initiative aimed to inspire consumers and designers in color choices for the upcoming year.

-

February 2024: Birla Opus projected its revenue to exceed ₹10,000 crores in three years, with a production capacity surpassing market leaders, as stated by Grasim's KM Birla.

-

April 2023: AkzoNobel announced the acquisition of Sherwin-Williams’ Chinese decorative paints business, aiming to expand its footprint in the growing Chinese market.

-

April 2023: Sherwin-Williams signed an agreement to sell its China architectural paint business to Nippon Paint Holdings Co., Ltd. for approximately $1.2 billion. The divestiture allowed Sherwin-Williams to focus on its core business and growth opportunities in other markets.

Key Players:

-

AkzoNobel N.V. (Dulux, Sikkens, Levis)

-

Asian Paints Limited (Royale, Tractor Emulsion, Apex)

-

Axalta Coating Systems Ltd. (Imron, Centari, PercoTop)

-

BASF Coatings GmbH (Glasurit, Norbin, Suvinil)

-

Benjamin Moore & Co. (Aura, Regal Select, Ben)

-

Berger Paints India Ltd. (Silk Breathe Easy, Weathercoat Long Life, Luxol)

-

DAW SE (Caparol, Alpina, Alligator)

-

Hempel A/S (Hempalin, Hempacore, Hempathane)

-

Jotun A/S (Majestic, Fenomastic, Lady)

-

Kansai Paint Co., Ltd. (Ales Shiquy, Ecodan, Reflecto)

-

Masco Corporation (Behr Premium, Marquee, KILZ)

-

Nippon Paint Holdings Co., Ltd. (Odour-Less, Weatherbond, Satin Glo)

-

PPG Industries, Inc. (Timeless, Manor Hall, Pure Performance)

-

RPM International, Inc. (Rust-Oleum, Zinsser, Varathane)

-

The Chemours Company (Teflon Coatings, Ti-Pure, Krytox)

-

The Sherwin-Williams Company (Emerald, Duration, SuperPaint)

-

Tiger Coatings GmbH & Co. KG (Tiger Drylac, Tiger Shield, Color Powder)

-

Tikkurila Oyj (Joker, Luja, Feelings)

-

Valspar Corporation (Signature, Reserve, Simplicity)

-

Wacker Chemie AG (Silres, Flexirub, Elastosil)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 84.9 Billion |

| Market Size by 2032 | USD 117.4 Billion |

| CAGR | CAGR of 3.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Emulsion Paints, Enamels, Wood Coatings, Others) •By Resin Type (Acrylic, Alkyd, Vinyl, Epoxy, Polyurethane, Others) •By Technology (Waterborne, Solvent-borne, Powder Coatings, Others) •By Application (Residential, Non-residential [Commercial Buildings, Industrial Buildings, Institutional Buildings]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Sherwin-Williams Company, Masco Corporation, PPG Industries, Inc, RPM International, Inc, AkzoNobel N.V., BASF Coating GMBH, Kansai Paint Co., Ltd, Jotun A/s, Asian Paints Limited, Benjamin Moore & Co. and other key players |

| Key Drivers | •Increasing Consumer Preference for Aesthetic, High-Quality Coatings Enhances Decorative Coatings Market Growth Across Residential and Commercial Sectors •Growing Focus on Low-VOC and Eco-Friendly Coatings Propels Demand in the Decorative Coatings Market |

| RESTRAINTS | •Fluctuating Raw Material Prices Hamper Growth and Increase Production Costs in the Decorative Coatings Market |