All-wheel Drive Market Report Scope & Overview:

To get more information on All-wheel Drive Market - Request Free Sample Report

The All-wheel Drive Market was valued at USD 39.4 Billion in 2023 and is expected to reach USD 83.3 Billion by 2032, growing at a CAGR of 8.70% from 2024-2032.

The AWD market has experienced significant growth due to the rising demand for vehicles that provide increased levels of safety, performance, and comfort in a variety of road conditions. AWD distributes power across all four wheels which improves traction and stability and is especially helpful when weather conditions are poor, For instance, in conditions where the pavement is wet, snowy, or icy, AWD vehicles are particularly in demand, making them especially popular in colder regions like North America and Europe. One of the significant factors responsible for the growth of the all-wheel drive market is the increasing demand for SUVs and crossovers among consumers, which are commonly offered with an all-wheel drive system as standard or an option. More than 40% of new vehicle sales in North America were SUVs in 2024, with many models available with AWD. Plus, the awareness of the advantages of AWD, including improved handling, off-road performance, and resale values, led to a rapid adoption rate.

Technological advances have also proven to be the foundation of the growth of the market. AWD systems are being developed to be more fuel-efficient and weigh less, such as systems that use electric motors to drive one or two wheels. For example, the 2024 Ford Mustang Mach-E features an electric AWD system for improved performance and energy efficiency compared to conventional AWD systems. Further, the increasing penetration of AWD in EVs is driving the market growth. As the number of electric vehicles (EVs) on the road continues to rise, manufacturers are incorporating a variety of AWD systems to enhance the power and performance of their electric models. A great example is the tri-motor AWD setup in the Tesla Model S Plaid, allowing for fast acceleration and impressive handling that will appeal to the performance consumer market for EVs.

|

Aspect |

Improvement with AWD |

Percentage Improvement |

|

Traction & Stability |

Better grip on slippery surfaces |

25-30% |

|

Handling |

Enhanced cornering and stability at high speeds |

15-20% |

|

Off-Road Capability |

Improved performance on rugged or uneven terrain |

35-40% |

|

Comfort |

Smoother ride in adverse conditions |

20-25% |

|

Safety |

Reduced risk of skidding and loss of control in wet or icy conditions |

30-40% |

Market Dynamics

Drivers

-

Enhanced safety features provided by AWD systems, reducing the risk of skidding and loss of control on slippery roads.

The safety improvement associated with All-Wheel Drive (AWD) systems is one of the major factors promoting the growth of the AWD market. All-wheel drive (AWD) systems send power to all four wheels of a vehicle, increasing traction and stability, especially on loose or uneven surfaces. It makes this traction able to help avoid skidding, loss of control, and accidents, especially when the road is wet, rainy, snowy, or icy. AWD is gaining appreciation in parts of North America and Europe that experience extreme weather, where icy or wet roads are common — AWD helps maintain vehicle stability while improving handling. AWD systems can engage all four wheels, improving vehicle grip on slippery surfaces and reducing the chances of wheel spin, which in turn enables smoother acceleration and braking. This is especially useful for drivers who have to drive on difficult roads, like icy interstate roads or snow-covered city streets.

AWD systems provide safety advantages, so they are now increasingly used on everything from SUVs and crossovers to sedans and even EVs. In markets with severe weather conditions, buyers are increasingly realizing the added safety that comes with AWD. Because consumers want more secure, more dependable automobiles, automobile manufacturers are placing AWD systems under more designs. The rise of consumer preference to equip cars with all-wheel drive (AWD)—combined with consumer's growing emphasis on safety—plays an important role in expanding the AWD market.

-

Increased consumer preference for SUVs and crossovers, which commonly feature AWD systems for enhanced performance.

-

Growing demand for AWD vehicles in regions with harsh weather conditions like snow, ice, and rain, for improved traction and stability.

Restraints

-

AWD systems increase the overall cost of vehicles, making them less affordable for some consumers.

In price-sensitive markets, the added cost of AWD systems can be a deciding factor, influencing whether a consumer makes a purchase or opts out. AWD system adds components like a transfer case, more drivetrain hardware, and more complex suspensions. These additional components drive up both the cost of producing the vehicle and its MSRP. Consequently, cars with all-wheel drivetrain systems typically cost more than their 2WD equivalents, so they can be out of reach for price-oriented customers. To consumers, the advantages of AWD might not be worth the higher upfront cost, especially if they are in a region where a 2WD vehicle would do. Though AWD can provide benefits such as enhanced traction, handling, and the perception of safety when the weather turns bad, not all buyers see the value. The additional cost of AWD systems can be a major hurdle for consumers in markets where fuel consumption and lower purchase prices are important purchase considerations.

The complexity and additional components of AWD systems also can increase maintenance and repair costs, which may deter some potential buyers. This is especially important in developing markets or first-time buyers who may be more concerned about initial purchase prices and lifetime running costs.

Consequently, even though AWD systems enjoy widespread acceptance in regions with extreme climates, the high cost of AWD systems continues to hold them back from widespread market penetration, especially in segments where cost sensitivity is a primary consideration.

-

The added components of AWD systems increase the weight of the vehicle, potentially reducing fuel efficiency and performance.

-

AWD vehicles tend to consume more fuel compared to two-wheel drive vehicles due to the additional power needed to drive all four wheels.

Segmentation Analysis

By Vehicle

In 2023, the passenger vehicle segment dominated the market and represented a significant revenue share of more than 62%. The all-wheel drive systems offer additional traction and stability — especially when the weather takes a turn for the worse and rain, snow and ice are present — making them very appealing to drivers looking for more control and assurance behind the wheel. Moreover, the growing adoption of sport utility vehicles (SUVs) and crossovers, where many come standard or offered with all-wheel drive, has bolstered passenger all-wheel drive market share. The right combination of comfort, utility, and rugged capabilities make them desirable for any consumer group from urban to adventure enthusiasts. In addition, improved technologies for all-wheel drive have created far simpler and lighter systems which has allowed for lowered fuel usage. This has contributed to making them more practical for everyday applications, which is also a factor in their increased adoption in the passenger vehicle market. and upkeep, delivering a dependable service that serves the urban commuter.

The commercial vehicle segment is expected to register the fastest CAGR during the forecast period, The rapid growth of commercial all-wheel vehicles mirrors changing commercial needs and demands. AWD systems have become clearer of benefit as businesses and industries aim to optimize operational efficiency and facilitate reliable transport over various terrains. Ultimate traction, optimal stability, and robust off-road approach—these are key conditions for commercial all-wheel drive vehicles indispensable for industries and processes such as construction, logistics, and agriculture, which commonly operate in adverse conditions. Demand for all-wheel drive vans and trucks capable of cruising through both urban and rural landscapes has continued to rise on the back of the e-commerce and last-mile delivery growth trend which has emphasized the need for timely and effective goods deliveries.

By Propulsion

ICE segment dominated the market in 2023 with a revenue share of more than 69%, In 2023, manufacturers have spent considerable energy on optimizing ICE hallmark all-wheel drive, and that means improved mileage coupled with superior performance and overall vehicular integrity. ICE all-wheel drive vehicles are proven and convenient and remain a good fit for many, whether the buyer needs something to hit the trails with or just wants to ensure traction in wet weather.

The electric segment is expected to register the fastest CAGR during the forecast period, owing to the technological advancements in electric vehicle (EV) technology and the increasing consumer preference towards sustainable transportation solutions. In addition, increasing environmental concerns, tightening emission rules, and fierce investments by leading automobile manufacturers in EV technology are also supporting the electric all-wheel drive market. Recent innovations in battery technology, as well as electric drivetrains, have also made electric all-wheel drive vehicles considerably more range, performance, and reliability than ever before. Regenerative braking, advanced battery management systems, and precise placement of high-performance electric motors at each axle all help augment vehicle dynamics and driving experience.

Regional Analysis

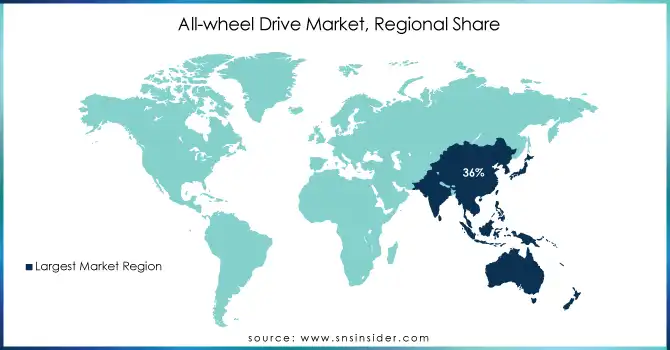

In 2023, Asia Pacific dominated the market with a revenue share of more than 36% of the market. Urbanization trends, increasing disposable income, and the rising automotive industry are driving rapid growth of the all-wheel drive vehicle market. China, Japan, and India are leading this growth, where consumers are opting for all-wheel drive vehicles due to their powerful and safety characteristics. The wide range of climatic challenges across the Asia Pacific region, between monsoons and mountainous regions, has driven demand for all-wheel drive systems.

North America is expected to grow at the fastest CAGR during the forecast period. Widespread snow and rain have made consumer demand for all-wheel drive vehicles popular in many parts of the region That would not typically prioritize traction and stability. The emergence of new All-wheel Drive technology is a significant contributing factor to growth in the market as manufacturers are now providing more efficient and responsive all-wheel drive solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS:

Bosch Group, Magna International Inc., ZF Friedrichshafen AG, GKN Automotive, Aisin Seiki Co., Ltd., Dana Incorporated, BorgWarner Inc., Delphi Technologies, JTEKT Corporation, Toyota Motor Corporation, Ford Motor Company, General Motors (GM)

RECENT DEVELOPMENTS:

-

In August 2024, Ford introduced the 2025 Maverick Hybrid with an optional AWD system. This model offers improved fuel efficiency and towing capacity, catering to the growing demand for hybrid pickup trucks.

-

In November 2024, Jeep launched the Avenger 4xe Hybrid SUV in the UK, featuring a smart AWD system that adjusts power distribution based on driving conditions. This vehicle combines off-road capabilities with affordability, appealing to a broader market segment.

|

Report Attributes |

Details |

|---|---|

|

CAGR |

CAGR of 8.70% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2022-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Vehicle (Passenger Vehicle, Commercial Vehicle) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Bosch Group, Magna International Inc., ZF Friedrichshafen AG, GKN Automotive, Aisin Seiki Co., Ltd., Dana Incorporated, BorgWarner Inc., Delphi Technologies, JTEKT Corporation, Toyota Motor Corporation, Ford Motor Company, General Motors (GM) |

|

Key Drivers |

• Increased consumer preference for SUVs and crossovers, which commonly feature AWD systems for enhanced performance. |

|

RESTRAINTS |

• The added components of AWD systems increase the weight of the vehicle, potentially reducing fuel efficiency and performance. |