Automotive Motors Market Report Size

Get More Information on Automotive Motors Market - Request Sample Report

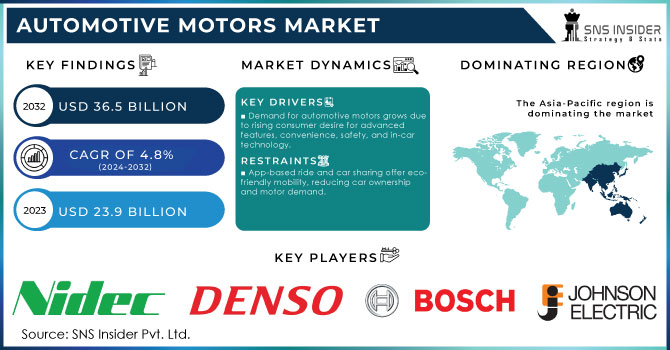

The Automotive Motors Market Size is USD 23.9 billion in 2023 & expected to reach USD 36.5 billion by 2032 with a healthy CAGR of 4.8% by 2024-2032

The global automotive industry is growing due to a confluence of factors. Consumers crave unique features, and affordable skilled labour, strong R&D, and cheap steel fuel production keep costs competitive. Electric vehicles are on the rise, driven by environmental concerns and stricter emission regulations. This shift may increase production costs of electric and efficient diesel engines. The US market benefits from older cars being kept on the road longer, people driving more, and a growing safety focus. Rising disposable income, financing options, and urban growth also contribute. In India, a strong public transport system and logistics network complement the auto industry's expansion, further fueled by the growing desire for electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Motor Type (Brushed Motors, Brushless Motors, Stepper Motors) • by EV Motor Type (Brushed Motors, Brushless Motors, Induction Motors, Traction Motors, Stepper Motors, Others) • by Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle) • by Electric Vehicle Type (Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle, Battery Electric Vehicle, Fuel Cell Electric Vehicle) • by Function (ICE Vehicle) (Performance Motors, Comfort Motors, Safety Motors), By Function (Electric Vehicle) (Performance Motors, Comfort Motors, Safety Motors) • by Application (Electric Water Pump, Radiator Cooling Fan, Electronic Throttle Valve Control, Electronic Variable Gear Ratio Motor, Electric Variable Valve Timing, Electric Power Steering, Variable Nozzle Turbo, Adjustable Pedal, Front Wiper, Starter, EGR, Fuel Pump, Power Antenna, Air Conditioner, Door Mirror, Power Window, Tilt Steering Column, Blower, Power Seat, Electric Sunroof, Door Closer, Adaptive Front Light, Electronic Stability Control, ABS, Brake Assist, Electronic Parking Brake, Cruise Control) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Toyota Motor Corporation, Volkswagen Group, General Motors (GM), Ford Motor Company, Honda Motor Co., Ltd., Tesla, Inc., BMW Group, Mercedes-Benz Group AG, Hyundai Motor Company, Nissan Motor Corporation, Stellantis N.V., Renault Group, Kia Corporation, Suzuki Motor Corporation, Daimler Truck AG, SAIC Motor Corporation Limited, BYD Company Limited, Geely Auto Group, Tata Motors Limited, Subaru Corporation |

Automotive Motors Market Dynamics:

KEY DRIVERS:

-

Demand for automotive motors grows due to rising consumer desire for advanced features, convenience, safety, and in-car technology.

The automotive industry is experiencing the rise in demand for advanced features like power steering and infotainment systems. This drives the require for more engines in vehicles. Consumers, particularly in developed countries, prioritize comfort, security, and consolation. Features like steering wheel controls, heads-up displays, automatic braking systems are becoming popular. This drift towards tech-loaded cars, with advanced security and entertainment features, is anticipated to essentially boost the demand for automotive motors in the coming years.

-

Environmental concerns, rising fuel costs, and electric vehicle growth drive demand for advanced electric motors in the automotive industry.

RESTRAINTS:

-

App-based ride and car sharing offer eco-friendly mobility, reducing car ownership and motor demand.

The App-based ride-sharing and car-sharing are transforming urban mobility. These services offers a stress-free and affordable alternative to car ownership, particularly for those who can't afford a personal vehicle. By enabling better vehicle utilization, they reduce traffic congestion and pollution. This shift towards the shared mobility is expected to decrease car ownership, potentially leading to decline in the demand for automotive motors.

OPPORTUNITIES:

-

Self-driving electric cars use AI, LiDAR, and RADAR for a 3D map and navigation, eliminating the need for a human driver.

-

Despite replacement needs, motor advancements and rising EV demand fueled by environmental concerns and government support will drive market growth.

CHALLENGES:

-

Rising demand for ride-sharing and car-sharing services could reduce overall car ownership and motor demand.

-

Increasing focus on self-driving cars may create a short-term demand surge for motors but regulations and luxury car trends could impact long-term growth.

Automotive Motors Market Segment Analysis:

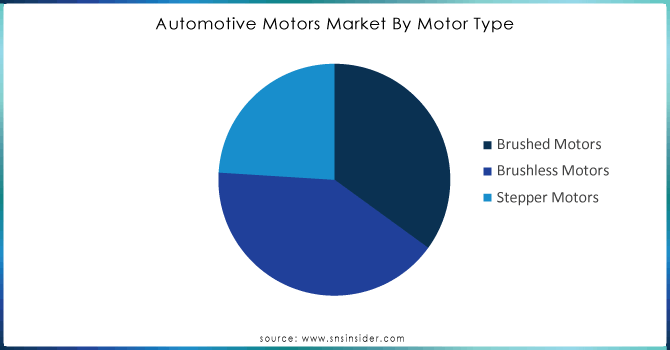

By Motor Type:

Brushless Motors is the dominating sub-segment in the Automotive Motors Market by Motor Type, holding around 50-60% of market share. Brushless motors offers superior efficiency, longer lifespan, and lower maintenance requirements compared to brushed motors. This makes them ideal for modern vehicles, especially electric vehicles, where maximizing range and reliability is crucial.

Get Customized Report as per your Business Requirement - Request For Customized Report

By EV Motor Type:

Traction Motors is the dominating sub-segment in the Automotive Motors Market by EV motor type holding around 40-50% of market share. Traction motors are the primary drivers in electric vehicles, responsible for propelling the car. Their power and performance directly impact the vehicle's acceleration, top speed, and overall driving experience.

By Vehicle Type:

Passenger Car is the dominating sub-segment in the Automotive Motors Market by vehicle type holding around 60-65% of market share. Passenger cars translates to a higher demand for motors used in passenger vehicles, including various comfort, safety, and performance motors.

By Electric Vehicle Type:

Battery Electric Vehicle is the dominating sub-segment in the Automotive Motors Market by electric vehicle type holding around 20-25% of market share. With growing environmental concerns and government incentives, BEVs are experiencing significant growth. This surge in BEV sales will drive the demand for motors specifically designed for battery-powered electric vehicles.

Automotive Motors Market Regional Overview:

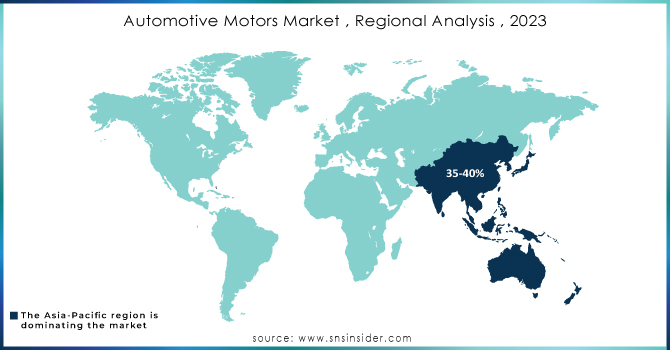

The Asia-Pacific is the dominating region in the automotive motors market with 35-40% share due to its growing car production, particularly passenger cars. Government support for electric vehicles and a growing middle class with rising disposable income further strengthen Asia's dominance.

Europe follows is the second highest region with 25-30% of market share with its rich history in auto manufacturing and focus on advanced technology. European carmakers prioritize safety and fuel efficiency, driving the market for innovative motors that support these features.

North America boasts the fastest growth with 15-20% of market share and 6-8% of CAGR due to its rapidly increasing electric vehicle market. Growing environmental awareness and government incentives are fueling the adoption of electric vehicles, which require specialized motors.

Key Players in Automotive Motors Market

key players in Global Automotive Motors Market as per following

-

Toyota Motor Corporation (Passenger cars, SUVs, Hybrids, EVs)

-

Volkswagen Group (Passenger cars, SUVs, EVs, Luxury cars)

-

General Motors (GM) (Passenger cars, SUVs, EVs, Trucks)

-

Ford Motor Company (Passenger cars, SUVs, Pickup trucks, EVs)

-

Honda Motor Co., Ltd. (Passenger cars, Motorcycles, EVs)

-

Tesla, Inc. (Electric vehicles, Energy storage solutions)

-

BMW Group (Luxury cars, SUVs, EVs)

-

Mercedes-Benz Group AG (Luxury cars, SUVs, EVs, Commercial vehicles)

-

Hyundai Motor Company (Passenger cars, SUVs, EVs, Hydrogen vehicles)

-

Nissan Motor Corporation (Passenger cars, SUVs, EVs)

-

Stellantis N.V. (Passenger cars, SUVs, Commercial vehicles, EVs)

-

Renault Group (Passenger cars, SUVs, EVs)

-

Kia Corporation (Passenger cars, SUVs, EVs)

-

Suzuki Motor Corporation (Compact cars, Motorcycles, Small SUVs)

-

Daimler Truck AG (Commercial vehicles, Heavy trucks, Buses)

-

SAIC Motor Corporation Limited (Passenger cars, EVs, SUVs)

-

BYD Company Limited (Electric vehicles, Buses, Energy storage solutions)

-

Geely Auto Group (Passenger cars, EVs, SUVs)

-

Tata Motors Limited (Passenger cars, Commercial vehicles, EVs)

-

Subaru Corporation (Passenger cars, SUVs, Off-road vehicles)

RECENT DEVELOPMENTS:

-

In May 2022: ZF showcases advancements in electric vehicle technology with a modular silicon carbide inverter architecture, hairpin electric motor, and eWorX accessories, offering flexibility, efficiency, and power for various electric vehicle applications.

-

In April 2022: BluE Nexus, Aisin, and Denso collaborated on e-Axles for Toyota's electric SUV, bZ4X. These come in 3 types for front-wheel and all-wheel drive, offering high torque, extended power, and improved efficiency through motor design and heat management

| Report Attributes | Details |

| Market Size in 2023 | US$ 23.9 Bn |

| Market Size by 2032 | US$ 36.5 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Demand for automotive motors grows due to rising consumer desire for advanced features, convenience, safety, and in-car technology. • Environmental concerns, rising fuel costs, and electric vehicle growth drive demand for advanced electric motors in the automotive industry. |

| Opportunities | • Self-driving electric cars use AI, LiDAR, and RADAR for a 3D map and navigation, eliminating the need for a human driver. • Despite replacement needs, motor advancements and rising EV demand fueled by environmental concerns and government support will drive market growth. |