School Bus Market Report Scope & Overview:

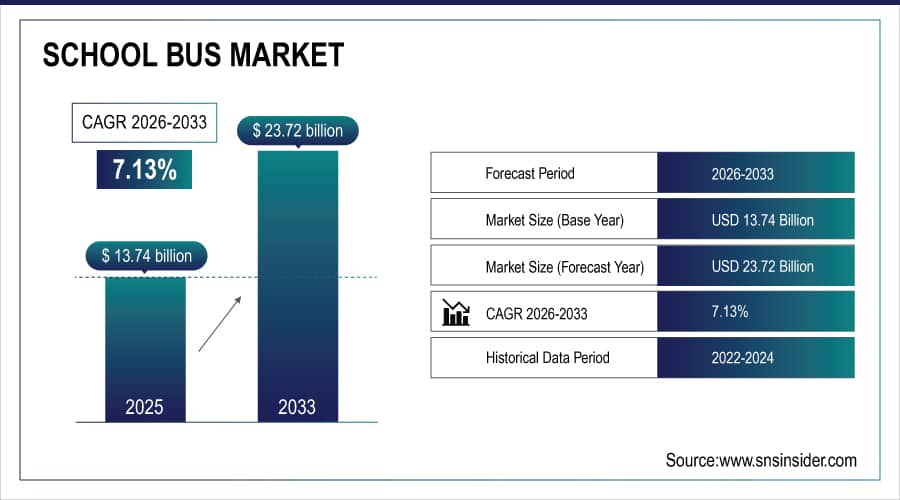

The School Bus Market is valued at USD 13.74 billion in 2025E and is expected to reach USD 23.72 billion by 2033, growing at a CAGR of 7.13% from 2026-2033.

School Bus Market is growing due to increasing student populations, rising emphasis on safe and reliable transportation, and expanding educational infrastructure globally. Adoption of advanced safety features, fuel-efficient and electric buses, and government initiatives promoting student transport are driving demand. Additionally, the push toward sustainable and low-emission school buses, along with rising awareness of transportation safety standards, is further accelerating market growth. Growing urbanization and school enrollment rates continue to support steady market expansion.

In 2024, global school bus demand rose by 6.8%, with electric models accounting for 18% of new purchases; over 70% of governments implemented stricter safety mandates, and student enrollment growth surpassed 3% in key emerging markets.

To Get More Information On School Bus Market - Request Free Sample Report

School Bus Market Size and Forecast

-

School Bus Market Size in 2025E: USD 13.74 Billion

-

School Bus Market Size by 2033: USD 23.72 Billion

-

CAGR: 7.13% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

School Bus Market Trends

-

Rising adoption of electric and alternative-fuel school buses to reduce emissions and support sustainability goals

-

Increasing government initiatives and incentives promoting modernization of school bus fleets and safer transportation

-

Growing demand for smart and connected school buses equipped with GPS, telematics, and safety monitoring systems

-

Expansion of after-sales services and maintenance solutions to improve operational efficiency and reduce total cost of ownership

-

Rising focus on student safety features including advanced braking, collision avoidance, and emergency evacuation systems

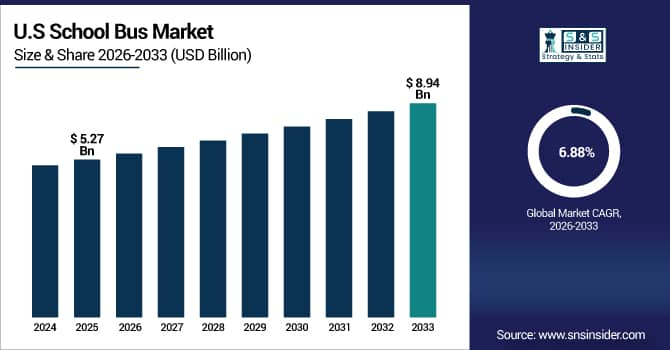

The U.S. School Bus Market is valued at USD 5.27 billion in 2025E and is expected to reach USD 8.94 billion by 2033, growing at a CAGR of 6.88% from 2026-2033.

Growth in the U.S. School Bus Market is driven by rising student enrollment, increasing focus on safe and reliable transportation, and adoption of fuel-efficient and electric buses. Government initiatives, stricter safety regulations, and growing awareness of sustainable transportation solutions are further supporting market expansion.

School Bus Market Growth Drivers:

-

Increasing enrollment in schools and rising awareness of student safety are driving demand for school buses across urban and semi-urban regions globally

The growth of the global student population, coupled with rising enrollment rates in primary and secondary education, has increased the demand for safe and reliable school transportation. Parents and educational institutions are emphasizing the importance of secure, organized transport systems to ensure student safety. This trend is particularly strong in urban and semi-urban regions, where commuting distances are longer and traffic conditions require dedicated school buses. Governments and private schools are actively investing in school bus fleets to address these needs, fueling overall market growth and modernizing student transport infrastructure.

In 2024, global school enrollment grew by 3.2%, with over 65% of parents in urban and semi-urban areas prioritizing safe, dedicated school transport sparking a 7% rise in school bus procurement worldwide.

-

Government initiatives and funding programs to modernize school transport infrastructure encourage the adoption of new and safer buses

Many governments worldwide are implementing policies, subsidies, and funding schemes to improve school transportation services. These initiatives promote the replacement of old buses with modern, safer, and more environmentally friendly vehicles. Funding support enables schools to invest in newer fleets equipped with advanced safety features, including seat belts, GPS tracking, and emergency communication systems. Such initiatives not only enhance student safety but also stimulate demand for school bus manufacturers. As governments focus on modernizing public education infrastructure, the market for new school buses continues to expand steadily, especially in emerging economies.

In 2024, over 50 countries allocated dedicated funding for school bus modernization, with government programs covering up to 40% of procurement costs driving a 25% increase in safer, compliant bus deployments globally.

School Bus Market Restraints:

-

High acquisition and maintenance costs of school buses limit affordability for private schools and small districts, restricting overall market growth

The initial investment required to purchase new school buses is substantial, particularly for private institutions and small school districts. Additionally, ongoing maintenance, insurance, and operational expenses further increase the total cost of ownership. High costs can discourage fleet expansion or replacement, especially in budget-constrained regions. As a result, some schools rely on older buses or alternative transport solutions, limiting market demand. The combination of high purchase prices and recurring maintenance expenses remains a key restraint, slowing adoption rates and restricting the growth potential of the school bus market globally.

In 2024, 60% of private schools and small districts cited high upfront costs—often exceeding USD100,000 per bus—and ongoing maintenance expenses as key barriers, leading many to defer fleet upgrades or rely on aging vehicles.

-

Fluctuating fuel prices and rising operational expenses increase total cost of ownership, discouraging new purchases and long-term investments in school buses

Fuel costs account for a significant portion of operational expenditure for school bus fleets. Volatility in global fuel prices directly impacts running costs, making long-term budgeting and fleet planning challenging for schools. Maintenance, driver salaries, and insurance premiums further contribute to operational expenses. These financial pressures reduce the willingness of institutions to invest in new buses or upgrade existing fleets. Consequently, high and unpredictable operating costs serve as a major restraint, limiting school bus purchases, particularly in regions where institutions face tight budgets and must prioritize other educational expenses.

In 2024, volatile fuel prices and rising maintenance costs pushed the total cost of ownership for school buses up by 18%, causing 55% of operators to delay new purchases and extend the use of aging fleets.

School Bus Market Opportunities:

-

Growing adoption of electric and hybrid school buses offers opportunities to reduce emissions and meet sustainability targets in urban transport

Increasing environmental awareness, stricter emission regulations, and government incentives for green transportation are driving interest in electric and hybrid school buses. These vehicles reduce greenhouse gas emissions, lower fuel costs, and contribute to sustainable urban mobility. Schools and municipalities seeking to meet climate goals and modernize fleets are investing in alternative propulsion technologies. Advancements in battery performance, charging infrastructure, and total cost of ownership make electric and hybrid buses increasingly viable. Manufacturers can capitalize on this trend by developing eco-friendly models, offering incentives, and tapping into the growing demand for sustainable school transport solutions.

In 2024, electric and hybrid school buses accounted for 22% of new deployments globally, with urban districts reporting a 30% reduction in emissions and 25% lower fuel costs compared to diesel counterparts.

-

Integration of advanced safety, telematics, and connectivity solutions provides opportunities for school bus manufacturers to offer value-added services and attract institutional buyers

The demand for enhanced student safety and fleet management is driving adoption of connected technologies in school buses. Advanced telematics, GPS tracking, real-time monitoring, and driver assistance systems improve operational efficiency and ensure student security. Schools and fleet operators are willing to invest in buses equipped with these technologies to minimize accidents and enhance accountability. Manufacturers that integrate safety and connectivity solutions can differentiate their products, attract institutional clients, and offer premium services. This creates a significant growth opportunity in the school bus market, particularly in regions prioritizing student safety and fleet optimization.

In 2024, over 60% of new school buses included advanced safety and telematics systems, with features like real-time GPS tracking and AI-powered driver alerts boosting institutional procurement by 28% globally.

School Bus Market Segment Highlights

-

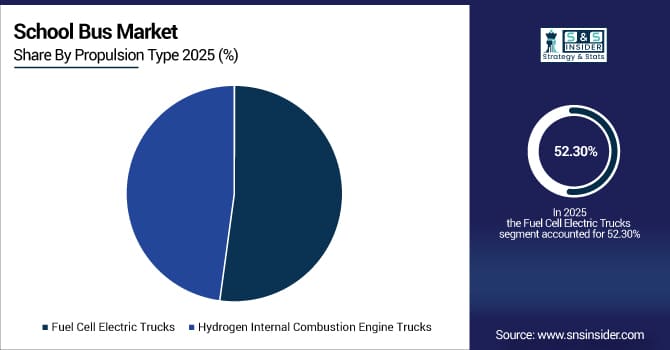

By Propulsion Type: Fuel Cell Electric Trucks led with 52.3% share, while Hydrogen Internal Combustion Engine Trucks is the fastest-growing segment with CAGR of 10.2%.

-

By Vehicle Type: Heavy-Duty Trucks led with 45.8% share, while Medium-Duty Trucks is the fastest-growing segment with CAGR of 9.85%.

-

By Application: Long-Haul Transportation led with 38.9% share, while Short-Haul / Urban Delivery is the fastest-growing segment with CAGR of 10.1%.

-

By End-User: Logistics & Freight Companies led with 42.7% share, while E-commerce & Retail Transport is the fastest-growing segment with CAGR of 10.4%.

School Bus Market Segment Analysis

By Propulsion Type: Fuel Cell Electric Trucks dominate the market, while Hydrogen Internal Combustion Engine Trucks grow fastest.

Fuel Cell Electric Trucks hold a significant share due to high efficiency, zero-emission operation, and scalability across medium- and heavy-duty fleets. These trucks benefit from established fuel cell technology, reliable performance, and faster refueling compared to battery-electric alternatives. Fleet operators prefer them for predictable routes, long-haul operations, and regulatory compliance with stringent emission norms. Strong OEM focus, government incentives, and expanding hydrogen refueling infrastructure reinforce their adoption in commercial trucking applications globally.

Hydrogen Internal Combustion Engine Trucks are experiencing rapid growth as manufacturers explore cost-effective alternatives to fuel cells. They leverage existing ICE architecture with minimal modifications, offering a lower entry barrier for fleet operators. Rapid prototyping and lower upfront costs drive adoption, particularly in developing regions. This segment benefits from increasing interest in sustainable mobility solutions and innovations in hydrogen storage and combustion efficiency, positioning these trucks for strong market expansion in the coming years.

By Vehicle Type: Heavy-Duty Trucks hold the largest share, with Medium-Duty Trucks leading in growth.

Heavy-duty trucks account for a large share of the market due to their extensive use in long-haul freight and logistics operations, where hydrogen’s long-range capabilities and fast refueling are critical. High payload capacity and frequent operational hours make these trucks advantageous compared to battery-electric alternatives. OEMs focus on heavy-duty hydrogen truck development, supported by fleet demand and government incentives. This category remains vital as heavy-duty vehicles form the backbone of global freight and industrial transportation.

Medium-duty trucks are expanding rapidly as hydrogen adoption grows in regional and urban logistics fleets. These trucks balance payload and efficiency for short-to-medium-range deliveries, including commercial distribution and service operations. Technological advances in compact fuel cells and modular storage systems enable cost-effective deployment. Rising e-commerce demand, sustainability mandates, and fleet electrification initiatives accelerate adoption, positioning medium-duty hydrogen trucks for substantial market growth in the near term.

By Application: Long-Haul Transportation is the dominant application, whereas Short-Haul / Urban Delivery shows the fastest growth.

Long-haul transportation applications have a significant market share because hydrogen trucks overcome battery-electric limitations in extended-distance operations. Fuel cells provide quick refueling and sustained range for cross-country freight, making them ideal for heavy logistics operators. Regulatory incentives targeting emission reductions in long-distance transport encourage adoption. Established hydrogen infrastructure along major highways and increasing fleet replacement programs further strengthen deployment in long-haul operations globally.

Short-haul and urban delivery applications are growing rapidly due to increasing e-commerce demand and municipal sustainability initiatives. Hydrogen trucks reduce urban emissions while supporting predictable, high-frequency delivery routes. Technological improvements in compact fuel cells and lightweight storage tanks improve operational efficiency in city environments. Governments and private operators are adopting hydrogen vehicles to replace diesel fleets in urban centers, accelerating expansion. Growth is further supported by the development of localized refueling infrastructure.

By End-User: Logistics & Freight Companies lead the market, with E-commerce & Retail Transport growing fastest.

Logistics and freight companies constitute a large share of the end-user market, as hydrogen trucks meet the need for high-capacity, long-range, zero-emission transportation. Fleet operators benefit from reduced environmental impact, lower operating costs over time, and compliance with strict regulations. Hydrogen refueling infrastructure along major freight corridors enhances operational efficiency. OEMs prioritize deployment to large fleets, making this category a primary contributor to hydrogen truck market revenue worldwide.

E-commerce and retail transport applications are experiencing rapid growth due to the surge in online deliveries and urban distribution demand. Hydrogen trucks offer flexible range, faster refueling, and lower emissions for high-frequency delivery operations. Retailers and logistics companies are increasingly replacing diesel fleets with hydrogen trucks in last-mile operations. Integration with smart fleet management systems and urban sustainability programs accelerates adoption, positioning this segment for strong expansion in the hydrogen truck market in the coming years.

School Bus Market Regional Analysis

North America School Bus Market Insights:

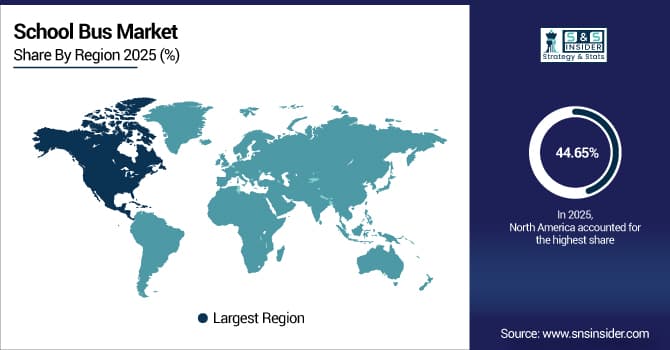

North America dominated the School Bus Market with a 44.65% share in 2025 due to the high number of public and private schools, well-established transportation infrastructure, and strong government regulations supporting student safety. Growing adoption of electric and alternative fuel school buses further strengthened the region’s leadership in the market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific School Bus Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 9.58% from 2026–2033, driven by increasing student population, expanding school networks, and rising government initiatives to improve student transportation. Growing awareness of safety standards, adoption of eco-friendly buses, and investment in modern school transport infrastructure are accelerating regional market growth.

Europe School Bus Market Insights

Europe held a notable share in the School Bus Market, supported by well-established education systems, stringent safety regulations, and strong adoption of electric and low-emission buses. Investments in sustainable transportation, government incentives for modernizing school fleets, and growing awareness of environmental benefits are driving steady growth, particularly in Western European countries with large public and private school networks.

Middle East & Africa and Latin America School Bus Market Insights

Middle East & Africa and Latin America (combined) are experiencing gradual growth in the School Bus Market, fueled by increasing school enrollment, infrastructure development, and government initiatives to ensure safe and sustainable student transport. Adoption of modern buses, investments in alternative fuel and electric fleets, and rising awareness of student safety standards are supporting market expansion across both regions.

School Bus Market Competitive Landscape:

Tata Motors Ltd.

Tata Motors Ltd., part of the Tata Group, is one of India’s leading automotive manufacturers, known for its wide range of commercial and passenger vehicles, including school buses. The company focuses on innovation, fuel efficiency, and safety, producing durable and cost-effective vehicles suitable for diverse terrains. Tata Motors has a strong domestic and international presence, exporting vehicles to multiple countries. Its school buses are designed to meet global safety standards while incorporating modern features such as ergonomic seating and telematics for efficient fleet management.

-

2024, Tata Motors launched India’s first purpose-built electric school bus, the Starbus School+ Electric, designed specifically for student transportation.

Yutong Bus Co., Ltd.

Yutong Bus Co., Ltd., headquartered in Zhengzhou, China, is one of the world’s largest bus manufacturers, specializing in school, city, and coach buses. Renowned for its advanced technology, energy-efficient designs, and safety features, Yutong serves both domestic and international markets. The company emphasizes sustainable solutions, offering electric and hybrid school buses. With a focus on innovation, reliability, and customer satisfaction, Yutong has established a strong reputation for quality, delivering buses that combine safety, comfort, and operational efficiency.

-

2023, Yutong introduced the “SafeKid Pro”, a next-generation school bus platform with enhanced safety, comfort, and smart monitoring for global markets (including Latin America, Middle East, and ASEAN).

Ashok Leyland Ltd.

Ashok Leyland Ltd., based in India, is a prominent commercial vehicle manufacturer with a strong portfolio of trucks, buses, and specialty vehicles, including school buses. The company is recognized for its robust engineering, durability, and high-performance vehicles designed to meet varying road conditions. Ashok Leyland emphasizes safety, comfort, and fuel efficiency, catering to both domestic and international markets. Its school buses feature modern designs, ergonomic seating, and advanced safety systems, making them a preferred choice for fleet operators and educational institutions.

-

2025, Ashok Leyland launched the “Boss School Bus”, the first school bus in India certified under Bharat NCAP (New Car Assessment Program) with a 4-star safety rating.

School Bus Market Key Players

Some of the School Bus Market Companies are:

-

Tata Motors Ltd.

-

Yutong Bus Co., Ltd.

-

Ashok Leyland Ltd.

-

Thomas Built Buses, Inc.

-

IC Bus LLC

-

Blue Bird Corporation

-

Eicher Motors Ltd.

-

Mahindra & Mahindra Ltd.

-

GreenPower Motor Company Inc.

-

The Lion Electric Co.

-

REV Group Inc.

-

Trans Tech Bus

-

Collins Bus Corporation

-

Forest River, Inc.

-

Marcopolo S.A.

-

King Long Motor Group

-

Daimler Truck AG

-

Scania AB

-

Zhongtong Bus Holding Co., Ltd.

-

Beiqi Foton Motor Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.74 Billion |

| Market Size by 2033 | USD 23.72 Billion |

| CAGR | CAGR of 7.13% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Propulsion Type (Fuel Cell Electric Trucks, Hydrogen Internal Combustion Engine Trucks) • By Vehicle Type (Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks) • By Application (Long-Haul Transportation, Short-Haul / Urban Delivery, Construction & Mining Logistics, Refrigerated Transport) • By End-User (Logistics & Freight Companies, E-commerce & Retail Transport, Manufacturing & Industrial Transport, Government & Municipal Transport) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tata Motors Ltd., Yutong Bus Co., Ltd., Ashok Leyland Ltd., Thomas Built Buses, Inc., IC Bus LLC, Blue Bird Corporation, Eicher Motors Ltd., Mahindra & Mahindra Ltd., GreenPower Motor Company Inc., The Lion Electric Co., REV Group Inc., Trans Tech Bus, Collins Bus Corporation, Forest River, Inc., Marcopolo S.A., King Long Motor Group, Daimler Truck AG, Scania AB, Zhongtong Bus Holding Co., Ltd., Beiqi Foton Motor Co., Ltd. |