Aluminum Extrusion Market Report Scope & Overview:

Get E-PDF Sample Report on Aluminum Extrusion Market - Request Sample Report

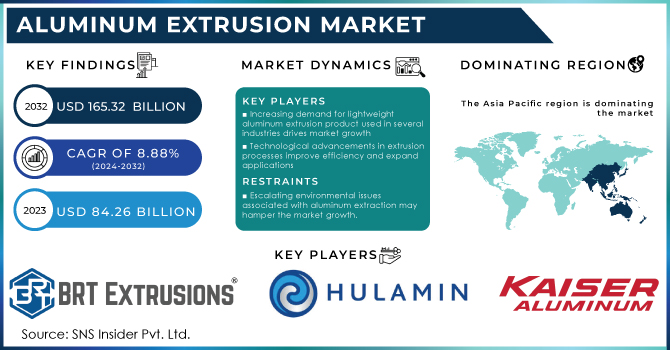

The Aluminum Extrusion Market Size was valued at USD 84.26 billion in 2023 and is expected to reach USD 165.32 billion by 2032 and grow at a CAGR of 8.88% over the forecast period 2024-2032.

One of the main factors driving this market is the automobile industry continued transition to lighter materials. Aluminum extrusions are becoming more and more popular because of their low weight and excellent strength in response to strict worldwide pollution rules and a growing emphasis on fuel efficiency. Aluminum extrusions provide unmatched design flexibility, enabling the production of intricate, integrated shapes appropriate for a range of automotive applications. This adaptability is useful for body panels, crash structures, chassis, and structural elements. Furthermore, aluminum is a great material for heat exchangers and EV battery housing applications due to its exceptional thermal conductivity. Advancements in technology have considerably improved the extrusion technique by providing more accurate manufacturing processes and superior alloys. Aluminum extrusions are being used in the automobile industry increasingly frequently because of their cheaper cost and higher quality.

Moreover, in the US, it's necessary to follow emissions regulations. For instance, between 2021 and 2026, the level of stringency regarding fuel efficiency and CO2 emissions increased by roughly 1.5% to meet NHTSA environmental rules. Aluminum improves vehicle efficiency and performance; thus it's expected that the material's use in automobiles will only grow. Events and developments in the local economy affect the market. Asia-Pacific is a prominent participant in the aluminum extrusion industry, renowned for its robust manufacturing capacities and flourishing automotive sector. Meanwhile, because of their strict emission regulations and rising rates of electric car adoption, North America and Europe are driving demand for these materials. Future growth in the automotive aluminum extrusion market is anticipated because of several factors, including technological developments, and the shifting global automotive landscape.

Drivers

-

Increasing demand for lightweight aluminum extrusion product used in several industries drives market growth

Aluminum extruded products are in rising demand due to its strength-to-weight ratio. Mainly this is better for the large projects and buildings that require extra strength while being lightweight. The increasing demand from the construction, aerospace, and automobile industries is a key driving factor for the aluminum extrusion market due to the material's lightweight properties, which reduce overall weight in applications, enhancing fuel efficiency in automotive and aircraft while enabling easier handling and installation in construction. Additionally, its durability ensures longevity in diverse environments, making it a preferred choice for structural and aesthetic components in these sectors, thus fueling market growth. Along with the aluminum lightweight structure, corrosion resistance stands in any weather conditions and location serving as a significant driver for extruded aluminum products. For instance, Hindalco Industries Ltd. acquired Hydro aluminum extrusions in India. This acquisition helped the company to increase its presence in the Indian market.

-

Technological advancements in extrusion processes improve efficiency and expand applications

With growing developments in extrusion technology, aluminum extrusion is now a highly economical manufacturing technique. This is a critical component since the car industry is always looking for ways to reduce production costs without sacrificing quality. Automakers find aluminum extrusions to be quite appealing because they strike a good mix between performance and price.

Restraint

-

Escalating environmental issues associated with aluminum extraction may hamper the market growth.

The challenge of escalating environmental issues in aluminum extraction involves addressing concerns such as energy-intensive processes, habitat disruption, and greenhouse gas emissions, which can impact the sustainability credentials of aluminum extrusion products. Implementing efficient recycling strategies and adopting cleaner production methods are essential to mitigate these challenges and sustain the market's growth amidst growing environmental consciousness.

Opportunities

-

Growing demand for electric vehicles may create the opportunity

-

Rising research & development increase the opportunity in the market

Market segmentation

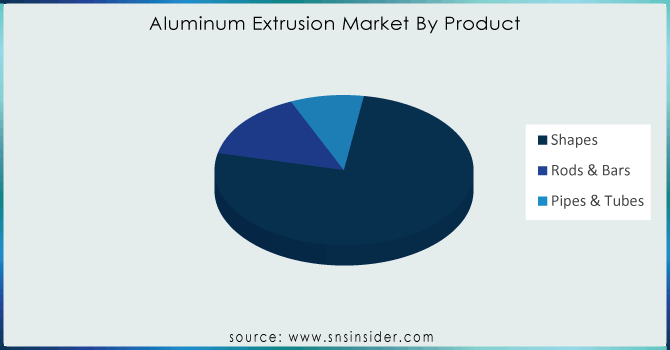

By Product

-

Shapes

-

Rods & Bars

-

Pipes & Tubes

The shapes dominated the aluminum extrusion market with the highest revenue share of more than 76 % in 2023. Because of its exceptional malleability, aluminum can be easily formed into a wide variety of shapes via the extrusion technique. This process involves heating aluminum billets and applying high pressure to them using a hydraulic press or ram against steel dies. Then, aluminum forms are made that exactly replicate the dies' shapes. Aluminum forms are used in a variety of automotive and transportation-related components, including engine blocks, transmission housings, chassis, panels, and roof rails for a broad range of automobiles, trucks, trains, and boats. The goal of reaching reduced weights is driving up demand for structural parts in cars. One prominent example is the Ford F-150 truck model, which uses a lot of aluminum in its construction, and the weight of this vehicle.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

-

Building & Construction

-

Automotive & Transportation

-

Consumer Good

-

Electrical & Energy

-

Others

The building & construction dominated the market with the highest revenue share of more than 52% in 2023. Due to the wide range of uses in the building industry. Growing investments in the housing industry have had a significant impact on the use of extruded goods in construction operations. With the highest value, China is currently one of the leaders in the building industry. The continued efforts of numerous nations to finance the construction of new homes should support the expansion of this market in the upcoming years.

The automotive and transportation sectors are anticipated to expand at the fastest compound annual growth rate (CAGR) during the projected period. Aluminum extrusions are utilized in many different parts, including engine mounts, tailgate frames, anti-intrusion beams, radiator beams, fuel distribution pipes, longitudinal beams, seat tracks, cross rails, roof rails, and underbody space frame rockers.

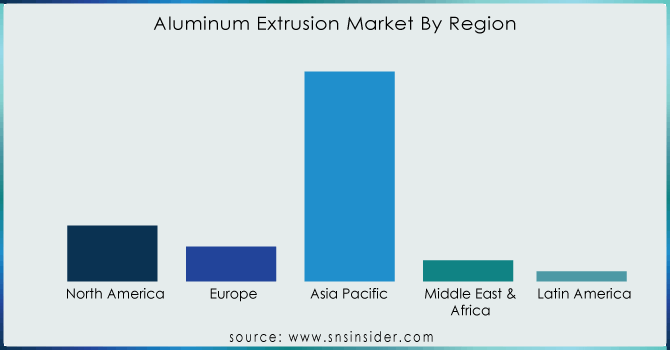

Regional Analysis

Asia Pacific led the aluminum extrusion market with the highest revenue share of approx. 65.22% in 2023. Because of the presence of well-established manufacturing sectors in nations like China, India, Vietnam, Japan, and South Korea, this area is likely to maintain its dominant position during the predicted years. Among these nations, China is expected to be a key engine of industrial growth, driven mostly by its large construction sector. In the near future, market growth is anticipated to benefit from the Chinese government's strategic investments in energy and transportation infrastructure.

For the upcoming projected year, North America's market share has grown at the highest rate. It is anticipated that the COVID-19 pandemic's aftermath and the challenges presented by the recession will aid in market expansion. The likelihood that government initiatives to support economic expansion will aid in the North American market's recovery is growing. In 2021, for example, the US Congress allocated $1 trillion on a bipartisan infrastructure improvement plan that included enhancements to trains, bridges, airports, power, water, and transport networks.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

The Key Players are BRT Extrusions, Inc., Constellium, Kaiser Aluminum, Hulamin Ltd., National Material L.P., Extrudex Aluminum, AMG Advanced Metallurgical Group, Hindalco Industries Ltd., SMS Schimmer, Gulf Extrusions Co. LLC, UAJC Corporation, Norsk Hydro ASA, International Extrusion Corporation, American Aluminum Extrusion LLC & Others.

Kaiser Aluminum-Company Financial Analysis

Recent Development:

-

In January 2024, meeting the growing demand for aluminum is proving to be difficult in North America. Constellium, a French supplier, has shown that using recycled metal can assist in meeting this demand. Impure aluminum has been suggested by Constellium as a possible fix for automakers.

-

In December 2023 Kaiser Aluminum registered a patent application for an aluminum alloy sheet with a minimum of 50 percent recycled content. The production processes for alloy sheets and an aluminum packaging solution are also covered by the patent.

-

In September 2023, Hindalco Industries Limited The largest aluminum rolling and recycling firm in the world, Metra SpA of Italy, which is renowned for its proficiency in creating organized and value-added aluminum extrusions, has partnered with the former in terms of technology.

Constellium-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 84.26 Billion |

| Market Size by 2032 | US$ 165.32 Billion |

| CAGR | CAGR of 8.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product, (Shapes, Roads & Bars, Pipes & Tubes) • By Application (Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Energy, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BRT Extrusions, Inc., Constellium, Kaiser Aluminum, Hulamin Ltd., National Material L.P., Extrudex Aluminum, AMG Advanced Metallurgical Group, Hindalco Industries Ltd., SMS Schimmer, Gulf Extrusions Co. LLC, UAJC Corporation, Norsk Hydro ASA, International Extrusion Corporation, American Aluminum Extrusion LLC & Others. |

| Key Drivers | • Increasing demand for lightweight aluminum extrusion product used in several industries drives market growth. |

| RESTRAINTS | • Escalating environmental issues associated with aluminum extraction may hamper the market growth. |