Bio-based Polycarbonate Market Size & Overview:

Get More Information on Bio-based Polycarbonate Market - Request Sample Report

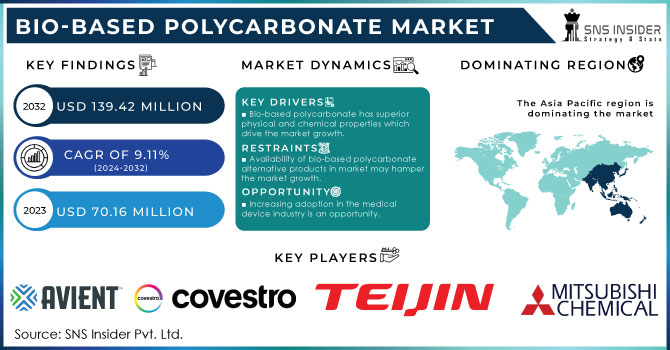

The Bio-based Polycarbonate Market Size was valued at USD 70.16 million in 2023 and is expected to reach USD 139.42 million by 2032 and grow at a CAGR of 9.11% over the forecast period 2024-2032.

The bio-based polycarbonate market is growing on the trend of increasing environmental consciousness. As consumer preferences shift towards eco-friendly products, bio-based polycarbonates, derived from renewable resources, provide a perfect solution. Moreover, stricter environmental regulations worldwide are driving the demand for cleaner alternatives, and bio-based polycarbonates. While still a relatively new technology, bio-based polycarbonates can offer performance characteristics comparable to traditional options in some areas, making them a viable and future-proof choice for various applications.

Additionally, the growing focus on sustainability across industries like electronics, automotive, and packaging aligns perfectly with the benefits of bio-based polycarbonates. And some regions are providing incentives for the use of bio-based materials through tax breaks or subsidies, further greasing the wheels of market growth.

For example, the US market for bio-based polycarbonate is expected to rise as a result of the Department of Energy's and other organizations' increased involvement. For example, the United States Department of Agriculture published an Economic Impact Analysis of the U.S. Bio-based Products Industry in July 2021. According to the findings, the bio-based sector contributes significantly to economic growth and employment creation while also having a favorable impact on the environment.

Moreover, a confluence of factors is propelling bio-based polycarbonate toward widespread adoption in the production of optical products. Breakthroughs in bio-based manufacturing technologies, coupled with the growing availability of sustainable feedstocks, are creating a fertile ground for the market's expansion. This eco-friendly alternative perfectly aligns with the increasing demand for sustainable solutions, making it a compelling choice for applications like glasses, cameras, and LED/LCD lighting. Furthermore, bio-based polycarbonate boasts excellent optical properties, including high transparency and scratch resistance essential qualities for these applications.

Market Dynamics

Drivers

-

Bio-based polycarbonate has superior physical and chemical properties which drive the market growth.

Bio-based Polycarbonate has an imposing array of physical and chemical properties, making them highly sought-after for a wide range of applications. In terms of strength and durability, bio-based polycarbonates can match their traditional counterparts, proving their mettle in demanding environments. They also exhibit excellent thermal resistance, withstanding high temperatures without succumbing to degradation. For applications that require exceptional clarity, certain bio-based polycarbonates shine with superior optical properties, making them ideal for lenses and other optical components. Additionally, their resistance to specific chemicals and solvents enhances their versatility and allows them to thrive in diverse settings. Moreover, bio-based polycarbonates can be surprisingly lightweight compared to traditional options, offering a weight reduction benefit in certain applications. This engaging combination of superior physical and chemical properties, coupled with their eco-friendly nature, positions bio-based polycarbonates as the best choice for manufacturers seeking sustainable solutions without compromising on performance.

Restrain

-

Availability of bio-based polycarbonate alternative products in market may hamper the market growth.

The burgeoning availability of other bio-based alternatives in the marketplace presents a double-edged foil which hampers the market growth. While it signifies progress towards a more sustainable future, it also introduces an element of competition. These alternatives may boast distinct properties, functionalities, or cost advantages, potentially enticing customers away from bio-based polycarbonates. Furthermore, a marketplace brimming with various bio-based options can create a conundrum for consumers and businesses. Selecting the most suitable material for their specific requirements can become a daunting task, potentially hindering the adoption rate of bio-based polycarbonates.

Opportunity

-

Increasing adoption in the medical device industry is an opportunity.

The medical device industry's growing emphasis on sustainability presents a significant opportunity for bio-based polycarbonate. Driven by regulatory pressures and consumer demand for eco-friendly products, manufacturers are increasingly seeking alternatives to traditional petroleum-based materials. Bio-based polycarbonate's compatibility with medical applications, coupled with its renewable origin, positions it as a prime candidate to replace conventional materials, thus driving market growth.

Market Segmentation

By Type

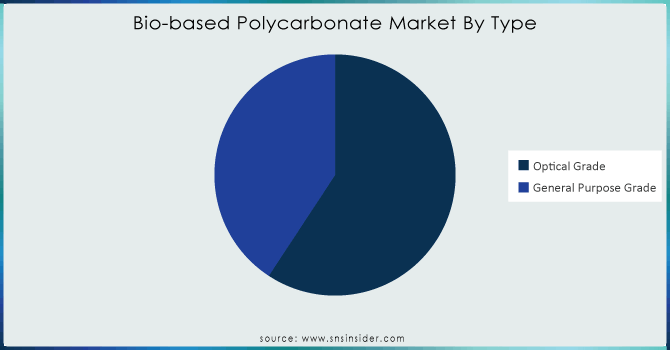

The optical grade held the largest market share around 59.26% in the type segment in 2023. Bio-based polycarbonate is emerging as a clear frontrunner due to its exceptional optical clarity, making it a sustainable champion across various applications. This remarkable transparency translates perfectly to superior performance in optical components and eyeglass lenses. The booming demand for products like bullet-proof glass, helmets, sunglasses, safety glasses, and sports goggles creates a fertile ground for bio-based PC's continued growth in these areas. Furthermore, the rise of 3D printing presents another exciting frontier. Bio-based polycarbonate compatibility with this technology is expected to be a key driver of market expansion.

General purpose grade type demand is also growing in the market and will hold the largest market share in the forecast year. Bio-based is finding increasing application in a wide range of end-use industries, including automotive, consumer electronics, building & construction, and even aerospace. The possibilities extend further, with applications in building & construction encompassing skylights, wall panels, and roof domes. Even the aerospace industry is recognizing the potential of bio-based polycarbonate, with its use in elements like cabin linings and mobile front panels. This versatility, coupled with its eco-friendly nature, positions bio-based polycarbonate as a true game-changer across various sectors.

Need any customization research on Bio-based polycarbonate Market - Enquiry Now

By End-use

The transportation segment held the largest revenue share in the end-user bio-based polycarbonate market which is around 36% in 2023. A lighter future is taking root in the automotive industry with the surging adoption of bio-based polycarbonate. This innovative material boasts a game-changing characteristic a significantly lighter weight compared to traditional options used in car parts. As a result, vehicles constructed with bio-based polycarbonate shed pounds overall, leading to a double environmental victory. On the other hand, improved fuel efficiency due to the lighter weight translates to a substantial reduction in greenhouse gas emissions from vehicles. These eco-friendly advantages, combined with its weight-saving properties, are propelling bio-based polycarbonate's widespread adoption within the automotive industry.

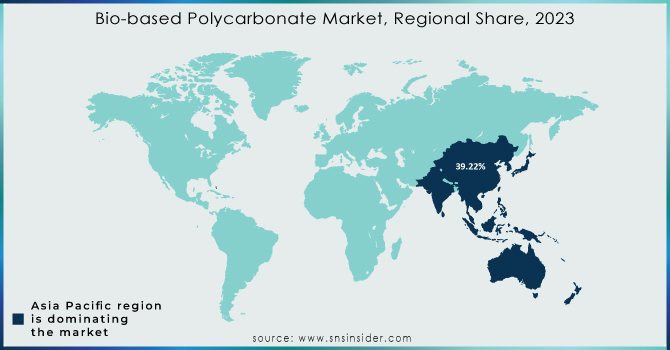

Regional Analysis

Asia Pacific dominated the market and held the largest market share around 39.22% in 2023. The bio-based polycarbonate market in this region is experiencing a perfect example of growth factors. On the one hand, stricter government regulations are cracking down on plastic waste, while on the other hand, public environmental consciousness is reaching new heights. This potent combination is creating a fertile ground for the adoption of sustainable alternatives like bio-based polycarbonate. Furthermore, developed economies within the region, like Japan and China, are hubs of technological innovation. They possess advanced capabilities and well-established infrastructure, creating an ideal environment for the development and implementation of bio-based polycarbonate solutions across various industries.

Furthermore, the region boasts a strategic advantage in terms of production. The abundance of raw materials necessary for bio-based polycarbonate production, coupled with a readily available and cost-effective labor force, makes this region a magnet for manufacturers. This allows them to establish production facilities and capitalize on the burgeoning demand for bio-based polycarbonate.

Key Players

Covestro AG, Teijin Limited, Mitsubishi Chemical Corp, SABIC, Palram Industries Ltd., Avient Corporation, Teysa Technology Limited, Roquette, Trinseo, Asahi Kasei Corporation, and others.

Recent Development:

-

In 2024, Fortum announced to establishment of a new biorefinery in India in Assam. This refinery is a Joint venture of Indian oil refinery company Numaligarh Refinery Limited, Fortum, and Chempolis.

-

In February 2023, Mitsubishi Gas Chemical Company, Inc. as part of their efforts to become carbon neutral by 2050. It stated that they manufactured and marketed biomass polycarbonate resin. It will be utilized in the manufacturing of PC IupilonTM as a monomer feedstock.

-

In June 2023, Origin Materials increased its expansion and developed the first commercial CMF plant. This expansion helped the company to increase its production and provide more products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 70.16 Million |

| Market Size by 2032 | US$ 139.42 Million |

| CAGR | CAGR of 9.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Optical Grade, General Purpose Grade) •By End-Use (Transportation, Medical, Packaging, Optical Media, Building and Construction, and Electrical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alterra Energy, Neste, Plastic2oil, BRADAM Group, LLC, Agilyx Inc., Covestro AG, TEIJIN LIMITED, Mitsubishi Chemical Corp, SABIC, Palram Industries Ltd., Avient Corporation, Teysa Technology Limited, Roquette, Trinseo, Asahi Kasei Corporation, and others. |

| Key Drivers | • Bio-based Polycarbonate has Superior Physical and Chemical Properties which drive the market growth. |

| RESTRAINTS | • Availability of bio-based polycarbonate alternative products in market may hamper the market growth. |