Ambient Lighting Market Report Scope & Overview:

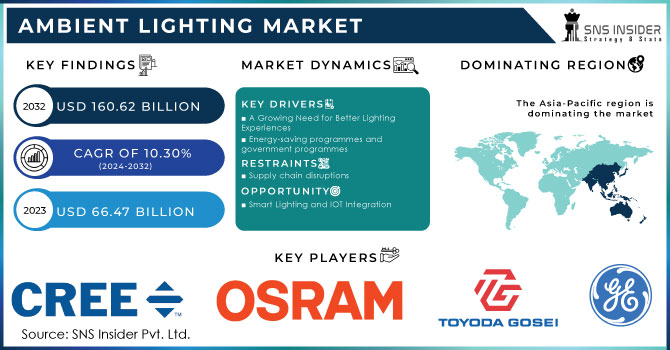

The Ambient Lighting Market size was valued at USD 70.26 billion in 2023 and is expected to reach USD 155.11 billion by 2032 and grow at a CAGR of 9.20% over the forecast period 2024-2032.

Get More Information on Ambient Lighting Market - Request Sample Report

The ambient lighting market is experiencing significant growth, driven by the increasing demand for energy-efficient and innovative solutions. LEDs, which consume 25%-80% less energy and last 3-25 times longer than traditional bulbs, are a major factor behind this expansion. Additionally, the proliferation of smart lighting systems, including those from Philips Hue and Samsung SmartThings, is fueling the market's growth. By 2025, LED A-type lamps are expected to achieve 56% market penetration. Innovations like Zigbee's ambient sensing technology and AI-powered, app-controlled lighting systems are transforming the industry, allowing lights to serve multiple functions, such as motion detection, and enhancing user experience. These advancements, coupled with rising consumer preferences for personalized, energy-efficient solutions and government regulations focusing on climate change, are propelling the market forward. Furthermore, the growing applications of ambient lighting in both residential and commercial sectors are broadening the market's reach, offering new opportunities for adoption. This expansion is expected to drive sustained growth, with providers tapping into a larger customer base to address evolving needs across various industries.

Market Dynamics

Drivers

-

Integration of Ambient Lighting in Entertainment and Energy Efficiency

The increasing demand for ambient lighting solutions is significantly driven by their integration with entertainment systems, particularly in gaming, movies, and home theaters. These systems allow dynamic lighting to synchronize with audio-visual content, enhancing the overall user experience. The development of advanced LED technologies and connected systems is making lighting more customizable and immersive. Additionally, ambient lighting contributes to energy efficiency, particularly by managing display backlighting, which consumes 30%-40% of a device's power. Ambient Lighting Systems (ALS) offer up to 64 colour choices for extensive personalization and improve power savings. The automotive industry is also benefiting from ambient lighting, with innovative LED and OLED technologies in vehicles, like those in Mercedes' future E-Class models, elevating the user experience while maintaining energy efficiency.

Restraints

-

Challenges in Integrating Advanced Ambient Lighting Systems with Entertainment and Smart Devices

The integration of sophisticated lighting systems, such as Zigbee-based ambient sensing and AI-powered smart lighting, into entertainment setups and smart homes presents considerable challenges. Ensuring seamless synchronization of lighting with audiovisual content demands a high level of technical expertise, particularly with real-time responsiveness across diverse devices. Major companies like Philips Hue and Lutron are leading the way, but significant hurdles remain, such as overcoming signal interference, maintaining system compatibility, and addressing the complexities of system calibration. These issues grow with the integration of technologies like OLED displays in vehicles and residential lighting, which add layers of complexity to design and deployment. As connected smart lighting systems become more advanced, the need for specialized engineering solutions increases, driving up both costs and complexity. The demand for personalized, responsive lighting systems that interact with entertainment environments underlines both the potential and the challenges in the ambient lighting market.

Segment Analysis

By Offering

In 2023, the hardware segment dominates the ambient lighting market, accounting for approximately 60% of the total market share. This dominance is primarily driven by the increasing demand for physical components such as LED bulbs, controllers, and sensors, which are integral to implementing ambient lighting systems. The growth of smart home ecosystems and automotive applications further boosts the demand for these hardware solutions. With advancements in LED technology, manufacturers are offering more efficient, customizable, and cost-effective hardware, allowing consumers to create personalized lighting experiences across various environments, from homes to vehicles. This expansion is expected to continue as both residential and commercial sectors increasingly adopt ambient lighting technologies.

The software & services segment is the fastest-growing segment in the ambient lighting market from 2024 to 2032. This growth is driven by increasing demand for integrated smart lighting solutions, powered by advanced software platforms that enable greater control, personalization, and automation. The rise of IoT and AI technologies is enhancing the capabilities of ambient lighting, allowing for real-time adjustments based on environmental factors or user preferences. Software platforms that manage lighting systems across multiple devices, including smart homes and entertainment setups, are further fueling market expansion, enabling seamless integration and heightened user experiences.

By Type

In 2023, the surface-mounted lights segment dominates the ambient lighting market, holding approximately 30% of the market share. These lights are favored for their versatility, ease of installation, and ability to provide efficient, dynamic lighting solutions in various environments. Their widespread adoption in both residential and commercial applications, including homes, offices, and vehicles, contributes significantly to their market share. Surface-mounted lights' growing demand is driven by technological advancements in LED lighting and the increasing preference for energy-efficient, customizable lighting systems.

The recessed lights segment is projected to experience the fastest growth in the ambient lighting market between 2024 and 2032. Their sleek, unobtrusive design makes them ideal for both residential and commercial spaces, and they are increasingly used in automotive applications as well. As demand for minimalist and energy-efficient lighting solutions rises, recessed lights, which integrate well with smart lighting systems, are becoming a popular choice. Their versatility, energy efficiency, and ability to create ambient lighting are key factors driving their rapid adoption in various industries.

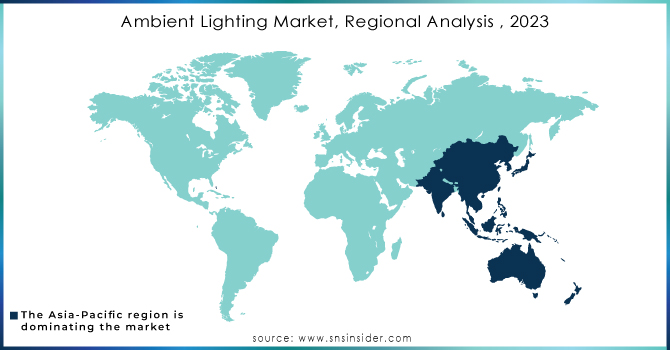

Regional Analysis

Asia-Pacific holds the largest share of the ambient lighting market, accounting for 39% in 2023. The region's dominance is driven by rapid urbanization, a surge in smart home installations, and advanced lighting technologies. Countries like China, Japan, and South Korea are at the forefront, with China being a key contributor due to its large manufacturing base and technological advancements. Additionally, the growing demand for innovative lighting solutions in both residential and commercial sectors fuels the region’s market growth. The presence of key market players and expanding infrastructure projects further support Asia-Pacific is leading position in the global market.

North America is the fastest-growing region in the ambient lighting market over the forecast period from 2024 to 2032. This growth is driven by increasing demand for smart homes, advanced lighting solutions in automotive applications, and higher consumer preference for energy-efficient and customizable lighting systems. The U.S. and Canada are leading the way, with significant investments in infrastructure and technological innovations. Additionally, the integration of ambient lighting with entertainment systems and the rise of connected, IoT-based lighting solutions in residential and commercial spaces are key factors contributing to the region's rapid growth.

Need any customization research on Ambient Lighting Market - Enquiry Now

Key Players

Some of the major key players in Ambient Lighting Market along with some of their notable products:

-

Signify Holding (Philips Hue, Wiz Connected, Interact Pro, Philips Ambiance)

-

OSRAM GmbH (Lightify, SMART+ Series, OLED, LED-based ambient lighting solutions)

-

GE Lighting (SAVANT TECHNOLOGIES LLC) (Cync, GE Reveal, Smart LED bulbs)

-

Koninklijke Philips NV (Philips Hue, Philips Scene Switch, Philips Ambiance)

-

Samsung Electronics Co. Ltd (Samsung SmartThings, LED lighting solutions, Luminous LED Panel)

-

Eaton Corporation Inc. (Cooper Lighting Solutions, Halo, Metalux, Shaper LED)

-

SCHOTT Group (LED ambient lighting, Schott LED modules, Special glass-based lighting)

-

Acuity Brands, Inc. (Juno, Lithonia Lighting, Synergy LED, Sensor Switch)

-

Dialight plc (Dialight LED, Smart lighting systems, LED street and industrial lighting)

-

Häfele (LOOX LED Lighting, Hafele LED lighting systems)

-

Helvar (Helvar DALI, Dynamic Lighting, Smart lighting control systems)

-

Honeywell International Inc. (Lyric smart lighting, Lutron, LED solutions for commercial and residential use)

-

Hubbell Incorporated (Hubbell Lighting, Tech lighting, Kim Lighting)

-

Ideal Industries (Ideal LED Lighting, Lighting Control Systems)

-

Lutron Electronics (Caseta Wireless, RadioRA 2, Lutron LED drivers)

-

RAB Lighting Inc. (RAB LED light fixtures, Smart outdoor ambient lighting)

-

SPI Lighting Holdings, LLC (SPI LED solutions, Architectural LED fixtures)

-

Zumtobel Group (Zumtobel LED lights, Tridonic, Ambient lighting systems)

List of suppliers that provide raw materials and components for the Ambient Lighting Market:

-

Osram Opto Semiconductors GmbH

-

Cree, Inc.

-

Nichia Corporation

-

Lumileds (a subsidiary of Signify)

-

Samsung LED

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

Seoul Semiconductor

-

LG Innotek

-

Epistar Corporation

Recent Development

-

September 5, 2024, Signify launches the Philips Hue Play HDMI sync box 8K for immersive gaming and movie experiences, along with new ceiling lights like the Hue Datura and Hue Tento. The Philips Hue Secure now integrates with Alexa and Google Home for enhanced automation and personalization.

-

July 25, 2024, ams OSRAM introduces the Superflex Utility Lamp (LEDIL416), a flexible LED strip light designed for versatile use in automotive, construction, and handicraft sectors. The lamp features four light settings, lasting up to 20 hours on low, and can be twisted and bent to fit various applications.

-

January 17, 2025, Samsung Electronics announces that its Neo QLED and Lifestyle TVs have received EyeCare Circadian certification from VDE, ensuring visual comfort and circadian rhythm alignment. The certification highlights the TVs' EyeComfort Mode, which adjusts luminance and color temperature to reduce strain and promote well-being.

-

November 5, 2024, Zumtobel introduces the EXDURA explosion-proof high-bay luminaire for Zone 2/21, designed for industrial environments with explosive risks. The luminaire ensures high safety and uniform light distribution, ideal for high-ceilinged halls, enhancing visibility for safe navigation.

| Report Attributes | Details |

| Market Size in 2023 | USD 70.26 Billion |

| Market Size by 2032 | USD 155.11 Billion |

| CAGR | CAGR of 9.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware [Lamps and luminaires, Lighting controls] ,Software & Services) • By Type(Recessed Lights, Surface-Mounted Lights, Suspended Lights, Track Lights, Strip Lights) • By End User(Residential, Hospitality & Retail, Healthcare, Office Buildings, Industrial, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Signify Holding, OSRAM GmbH, GE Lighting (SAVANT TECHNOLOGIES LLC), Koninklijke Philips NV, Samsung Electronics Co. Ltd, Eaton Corporation Inc., SCHOTT Group, Acuity Brands, Inc., Dialight plc, Häfele, Helvar, Honeywell International Inc., Hubbell Incorporated, Ideal Industries, Lutron Electronics, RAB Lighting Inc., SPI Lighting Holdings, LLC, Zumtobel Group. |

| Key Drivers | • Integration of Ambient Lighting in Entertainment and Energy Efficiency |

| Restraints | • Challenges in Integrating Advanced Ambient Lighting Systems with Entertainment and Smart Devices |