Laser Cladding Market Size & Trends:

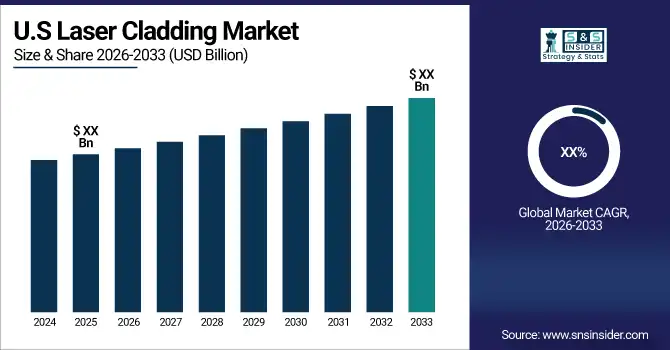

The Laser Cladding Market size is expected to be valued at USD 727.32 Million in 2025E, It is estimated to reach USD 1570.45 Million by 2033 with a growing CAGR of 10.1% over the forecast period 2026-2033. The rapid expansion of the Laser Cladding Market is driven by advancements in manufacturing technologies, especially in industries like aerospace, automotive, power generation, and oil & gas. Laser cladding is the process of using a strong laser to apply material onto a surface, leading to enhancements in properties like higher resistance to wear, protection from corrosion, and improved mechanical performance. The growing demand for high-performance surface treatment solutions in different industries is propelling the expansion of the Laser Cladding Market, driven by the increasing need for additive manufacturing (AM) technologies. In the pursuit of improved strength, performance, and durability of components, laser cladding, also known as Laser Metal Deposition (LMD) or Laser Cladding Deposition, has become a favored technique for obtaining exceptional surface qualities.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 727.32 Million

-

Market Size by 2033 USD 1570.45 Million

-

CAGR of 10.1% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get More Information on Laser Cladding Market - Request Sample Report

Laser Cladding Market Highlights:

-

Strong Market Growth – Rising demand for repairing and renovating industrial parts, combined with advancements in laser technology, is driving significant expansion in the laser cladding market.

-

Critical Role in Aerospace – Widely used for repairing turbine blades and other high-value components, laser cladding ensures durability and performance under harsh operating conditions.

-

Automotive Applications – Enhances engine parts, brake discs, and high-strength steel components to improve lifespan, fuel efficiency, and compliance with stricter emission standards like Euro 7.

-

Technological Advancements – Fiber lasers, Directed Energy Deposition (DED), and high-speed laser cladding boost precision, speed, and coating performance, enabling wider adoption in Industry 4.0 manufacturing.

-

Sustainability and Cost Efficiency – Laser cladding reduces material waste, restores parts instead of replacing them, and helps industries meet eco-friendly goals, especially in emission reduction.

-

Market Challenges – High setup costs and shortage of skilled technicians remain major barriers, though modular solutions, rentals, and workforce training are helping improve accessibility.

Laser Cladding Market Growth Drivers:

-

Enhancements in Additive Manufacturing (AM) and Their Influence on the Laser Cladding Industry

The ongoing progress in Additive Manufacturing (AM) is profoundly changing the Laser Cladding Market, as industries such as aerospace, automotive industry, oil & gas, and defense quickly embrace these technologies. Laser cladding has become an essential technology for industries advancing light weighting, complex geometries, and durability in addition to 3D printing. This collaboration improves the physical characteristics, durability, and ability to prevent rust of parts, ultimately prolonging their lifespan. Laser Metal Deposition (LMD) is an additive manufacturing method that employs a powerful laser to merge metal powder onto a base material, creating a strong metallurgical connection. This procedure produces coatings that improve the ability to withstand wear and last longer in crucial industrial components, particularly important in demanding industries like aerospace and automotive. LMD is especially useful for repair and refurbishment tasks, decreasing the requirement for brand new parts and reducing material waste. An example is laser cladding, which can restore turbine blades or automotive parts to their original strength, while also reducing time and expenses for companies.

Laser Cladding Market Restraints:

-

High deployment costs and lack of technical expertise are challenges faced in the Laser Cladding market.

The laser cladding market is limited by expensive implementation costs and a lack of skilled personnel. Laser systems, which vary in power from a few hundred to several thousand watts, are necessary for a range of tasks including welding, cutting, and altering surfaces. High-power lasers are essential for various industries such as medical, military, and materials processing, but they demand significant upfront costs for installation. These expenses include both the laser devices and the necessary infrastructure, such as specialized software, long-lasting components, and continuous service plans. For example, a standard industrial laser cutting system may require an investment of over USD 100,000, with additional costs from extensive service agreements.

Laser Cladding Market Segment Analysis

By Type

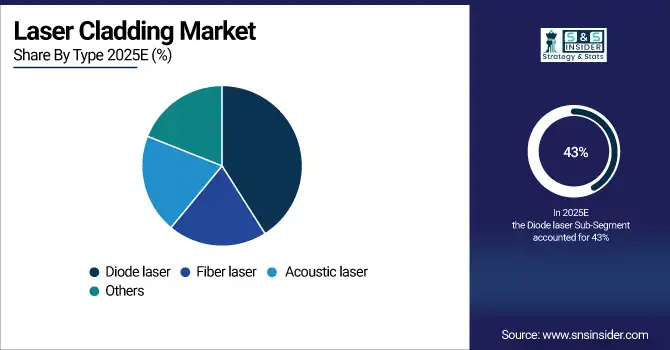

In 2025E, diode lasers had a strong hold on the laser cladding market, accounting for 43% of total revenue due to their precision and energy control benefits. Diode lasers use semiconductor diodes to produce laser light, providing great versatility in shaping and modulating beams, which plays a key role in obtaining ideal coating characteristics for different uses. Their accuracy makes them especially suitable for sectors like automotive, electronics, and medical devices, where top-notch performance and affordability are crucial. Recent advancements have increased their attractiveness in the market; such as firms like Coherent, Inc. and Trumpf releasing advanced diode laser systems with improved cooling methods and energy efficiency, making them optimal for high-volume production.

By Material,

In the laser cladding market of 2025E, cobalt-based alloys dominated with a 35% revenue share, attributed to their exceptional characteristics like corrosion resistance, wear resistance, and high-temperature strength. These alloys are highly prized in industries with challenging conditions such as oil and gas, aerospace, and power generation, where components experience extreme operating conditions. Laser cladding's accuracy and effectiveness allow for the successful application of cobalt-based alloys onto different surfaces, resulting in the improved performance and longevity of important parts.

Laser Cladding Market Regional Outlook:

Asia-Pacific Laser Cladding Market Trends:

Asia-Pacific leads the global laser cladding market with 38% share in 2025, driven by rapid industrialization and manufacturing growth. China dominates, using laser cladding in aerospace for turbine and engine repair. India shows rising demand in automotive, aerospace, and medical sectors, with companies like Linde India and GKN Aerospace boosting adoption

.

.

Need any customization research on Laser Cladding Market - Enquiry Now

North America Laser Cladding Market Trends:

North America is the fastest-growing region for laser cladding, supported by aerospace, automotive, and oil & gas industries. GE Aviation, Honeywell, Ford, Tesla, and Schlumberger are advancing adoption for repair, durability, and efficiency. IPG Photonics leads with high-speed laser systems. Strong industrial focus positions the region as a global innovation hub.

Europe Laser Cladding Market Trends:

Europe’s laser cladding market is anchored by Germany, France, and the UK, with TRUMPF and Oerlikon leading developments. Automotive and aerospace industries drive adoption for repair and durability, while renewable energy leverages laser cladding for turbines and generators. Sustainability goals and innovation ensure steady growth in precision-driven industrial applications across the region.

Middle East & Africa Laser Cladding Market Trends:

MEA’s laser cladding market is fueled by oil and gas industries in Saudi Arabia and UAE, adopting technology for corrosion and wear resistance. Aerospace and defense sectors are gradually integrating laser cladding. With infrastructure investments and diversification, the region offers growth opportunities, positioning MEA as an emerging hub for advanced repair solutions.

Latin America Laser Cladding Market Trends:

Latin America’s laser cladding market is expanding in Brazil and Mexico, driven by automotive, mining, and energy sectors. Petrobras uses the technology for equipment durability, while Embraer explores aerospace applications. Growing industrial modernization, coupled with demand for cost-effective and sustainable repair solutions, is positioning the region for significant long-term growth.

Laser Cladding Companies are:

-

TRUMPF (TruLaser Series)

-

OC Oerlikon Management AG (Metco Laser Cladding Solutions)

-

Höganäs AB (Höganäs Laser Cladding Powders)

-

Coherent Corp (Lasers for Additive Manufacturing)

-

Jenoptik (Laser Systems for Cladding)

-

IPG Photonics Corporation (High-Power Fiber Lasers)

-

Hayden Corp (Laser Cladding Systems)

-

Titanova, Inc (Laser Cladding Equipment)

-

Swanson Industries (Custom Laser Cladding Solutions)

-

American Cladding Technologies (Cladding Services and Solutions)

-

Alabama Laser (Laser Cladding and Coating Services)

-

Kondex Corporation U.S.A. (Laser Cladding for Agricultural Components)

-

HORNET LASER CLADDING (Laser Cladding Equipment)

-

TopClad (Advanced Cladding Systems)

-

Laserline GmbH (Laser Systems for Material Processing)

Laser Cladding Market Competitive Landscape:

TRUMPF is a leading German high-tech company specializing in machine tools, laser technology, and industrial electronics. Founded in 1923, it empowers manufacturing industries with advanced solutions in sheet metal processing, additive manufacturing, and smart factory automation. TRUMPF drives innovation, efficiency, and digital transformation across global industrial and production sectors.

-

In January 2024, TRUMPF opened a new production facility in Pune, India, to serve the growing Indian market and expand its global supply chain

Coherent Corp. is a global leader in materials, networking, and laser technology, serving industries such as communications, electronics, and industrial manufacturing. Headquartered in Pennsylvania, the company delivers innovative solutions in photonics, compound semiconductors, and precision optics, enabling advancements in 5G, electric vehicles, AI, and next-generation healthcare applications worldwide.

-

In September 2023: Coherent Corp., a frontrunner in pump laser technology designed for Erbium-Doped Fiber Amplifiers (EDFAs) utilized in optical networks, introduced the inaugural pump laser module in the industry featuring an output power of 1,200 mW within a 10-pin butterfly package. This 1,200 mW pump laser module addresses the increased power demands essential for amplifying a greater number of channels supported by the next-generation ultra-broadband optical transmission systems. Simultaneously, it meets the exacting reliability standards crucial for these advanced networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 727.32 Million |

| Market Size by 2033 | USD 1570.45 Million |

| CAGR | CAGR of 10.1% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diode Laser, CO2 Laser, Fiber Laser, Acoustic Laser, Others) |

| • By Revenue (Laser, System) | |

| • By Materials (Nickel-Based Alloys, Carbides & Carbide Blends, Cobalt-Based Alloys, Iron-Based Alloys) | |

| • By End Use Industry (Oil & Gas, Aerospace & Defense, Power Generation, Mining, Automotive, Others) | |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | TRUMPF, OC Oerlikon Management AG, Höganäs AB, Coherent Corp, Jenoptik, IPG Photonics Corporation, Hayden Corp, Titanova, Inc, Swanson Industries, American Cladding Technologies, Alabama Laser, Kondex Corporation U.S.A., HORNET LASER CLADDING, TopClad, Laserline GmbH, and Others |