Amphoteric Surfactants Market Report Scope & Overview

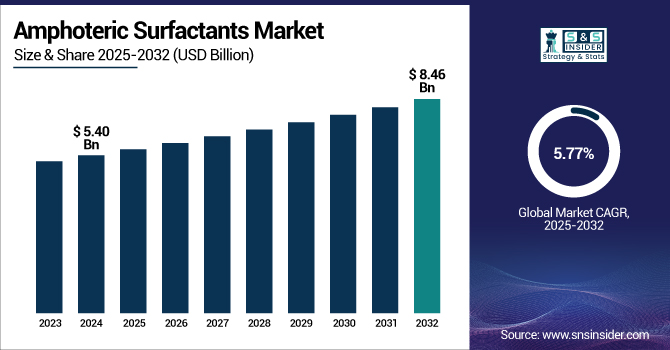

The Amphoteric Surfactants Market size was valued at USD 5.40 billion in 2024 and is expected to reach USD 8.46 billion by 2032 and grow at a CAGR of 5.77% over the forecast period of 2025-2032.

To Get more information on Amphoteric Surfactants Market - Request Free Sample Report

The key factor driving amphoteric surfactants market growth is the increasing use of home care and industrial cleaning applications. Its demand has been increasing in home use to cater to the need for milder but effective cleaning products such as dishwashing liquids, laundry detergents, and surface cleaners. This matches with consumer trends towards safer household products, as they can reduce skin irritation while maintaining cleaning efficacy.

For Instance, in February 2023, Croda acquired Solus Biotech, a company specializing in bio-engineered phospholipids. This acquisition is expected to enhance Croda's capabilities in developing biotech-based ingredients for home care and industrial cleaning applications. Moreover, this development helped the company as well as the market to increase its growth.

Market Dynamics

Drivers

-

Rising Demand for Personal Care Products Drives the Market Growth

The growing consumer awareness for gentle on the skin, non-sensitizing, and skin-friendly formulations in skincare, haircare, and other beauty products drives the market growth. This demand is met with amphoteric surfactants due to their mildness, versatility, and compatibility, properties which have made them a popular ingredient and are suitable for personal care applications (such as shampoos, body and facial cleansers, and baby care). The surge in demand for personal care products that are safe, milder, and eco-friendly is hence driving the amphoteric surfactants market growth across the globe.

According to the Personal Care Product Council in 2022, this vibrant sector drove USD 308.7 billion in GDP contribution (direct and indirect) to the U.S. economy, sustaining 4.6 million jobs, and generating USD 82.3 billion in federal, state, and local tax payments.

Moreover, in 2021, the U.S. sector invested USD 2.7 billion in research and development to support the safety and efficacy of hundreds of new products and their ingredients. This investment provides the new product to the market with different variants and increases its sales in the market.

Restrain

-

Regulatory Compliance and Safety Concerns May Hamper the Market Growth

The growth of the amphoteric surfactants market is likely to be hindered due to regulatory compliance and safety concerns. With the implementation of stringent environmental and safety standards by governments and regulatory bodies across the globe, manufacturers of amphoteric surfactants are required to comply with a growing number of regulations. This would encompass complying with toxicological safety, biodegradability, and environmental impact regulations. Failing to adhere to these regulations can result in expensive recalls, fines, and damage to brand reputation. Furthermore, the continuous need to monitor and test to ensure adherence to compliance activities translates into higher operational costs, which can shrink the profit margins of manufacturers. Thus, the increasing regulatory scrutiny, coupled with the need for product innovation to cater to these needs, slows market growth and creates financial pressure on firms operating in this industry.

Opportunity

-

Advancements in Research and Development Create the Opportunity for the Market

The amphoteric surfactant market is experiencing vast R&D owing to changing consumer preferences, with many industries requiring more effective and sustainable solutions. The development of bio-based amphoteric surfactants and multifunctional formulations to meet specific demands (such as improved foaming, wetting, or emulsifying function) is creating opportunities in personal care, home care, and industrial cleaning segments. Furthermore, Research and Development spearheaded for highly efficient and biodegradable surfactants also meet the growing consumer request for more sustainable products. This emphasis on innovation not only expands the possible applications of amphoteric surfactants but also establishes them as integral constituents of the green chemistry movement and thereby fuels the market over the years to come.

For instance, Sironix Renewables LLC, a plant-based surfactant company, received a USD 225,000 grant through the National Science Foundation's Small Business Innovation Research (SBIR) program. Through this funding, it develops bio-renewable detergent molecules that improve the performance and environmental sustainability of cleaning products.

Segmentation Analysis

By Type

Betaine held the largest amphoteric surfactants market share, around 32%, in 2024. It is owing to its versatile properties & numerous applications in industrial sectors. Betaine surfactants have outstanding foaming, emulsifying, and mildness characteristics and are widely used in personal care products, including shampoo, body wash, and facial wash. Due to their gentleness and skin-care properties, they are often used in formulations designed for sensitive skin. In addition, betaines are being used in more and more industrial applications, such as the formulation of detergents or cleaning agents, because they are compatible with other surfactants and are effective in both acidic and alkaline conditions.

Amine Oxide held a significant market share in the forecast period. It is known for its best foam stability and wetting and emulsifying properties for polishing and personal care products. Amine oxides have many applications in domestic and industrial cleaning products, as well as in personal care products such as shampoos and body washes, where they impart mild but effective cleansing. Furthermore, amine oxides are sought after due to their pH performance, which provides their performance over a wide pH range of different end-use formulations.

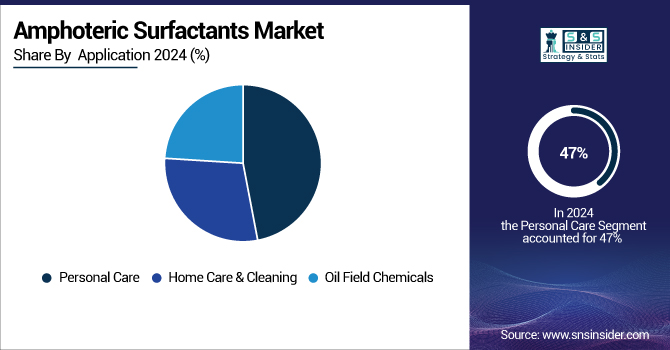

By Application

Personal Care held the largest market share, around 47%, in 2024. This is due to the growing demand for mild, skin-friendly, and effective personal care products and cleaning agents. Amphoteric surfactants, especially in shampoo and body wash, facial cleansers, and other cosmetic applications, are well known for their excellent compatibility with skin and mildness to sensitive skin and are highly preferred in the personal care industry.

The home care & cleaning segment held a significant market share. This is owing to the demand for effective and green cleaning products. Amphoteric surfactants are preferred in this segment due to their gentle nature, rich foam, and high cleaning power, which makes them suitable for household cleaners, dishwashing liquids, laundry detergents, and other cleaning agents.

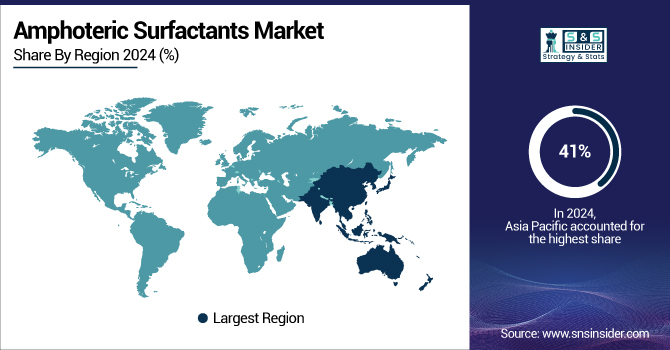

Regional Analysis

Asia Pacific held the largest market share, around 41%. It is due to factors such as rapid industrialization, rising demand for personal care and the home care industry, and the proliferation and diversification of the middle class in the region. As urbanization increases, the high disposable income levels in this region will drive demand for more core personal care products, including shampoos, body wash, or facial cleansers, where amphoteric surfactants are often used due to their mildness as well as cleaning ability. Moreover, amphoteric surfactants are used in the home care and cleaning product industries that have a strong manufacturing sector in Asia Pacific owing to their properties, such as being skin-friendly as well as eco-friendly.

In February 2023, Croda announced the acquisition of Solus Biotech, the leading provider of premium, biotechnology-derived beauty actives globally. Through this acquisition, Croda is gaining access to Solus' unique ceramide and phospholipid technologies based on biotech, further expanding Croda's offering in natural retinol and other cosmetic ingredients.

Europe held a significant market share and is expected to be the fastest-growing segment during the forecast period. Consumer demand for personal care products, home care solutions, and sustainable formulations has increased in this region due to a rising preference for natural and eco-friendly ingredients. Likewise, the strict regulations of the European Union on product safety and environmental sustainability push for safer and more sustainable surfactants, too. In addition, regional giants are now emphasizing knockout and new-generation goods, which is also expected to boost growth in market trends. Europe is expected to remain the leading growing region in the amphoteric surfactants market, owing to the large research and development in the personal care and home care industry.

North America held a significant market share during the forecast period. Growing demand for personal care, home care, and industrial cleaning products is expected to bolster the North America amphoteric surfactants market trends during the forecast period. This region has a significant market share owing to increasing consumer inclination towards greener and milder formulations in personal care products and increasing industrial applications requiring specialty surfactants.

In 2024, Croda International, based on sustainable and nature-derived raw material sourcing, expanded its portfolio of personal care options with amphoteric surfactants available from Croda International.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Amphoteric Surfactants Companies

Evonik Industries AG, BASF SE, Akzo Nobel N.V., Clariant AG, Croda International Plc, Solvay S.A., Stepan Company, Lonza Group, KAO Corporation, Oxiteno S.A.

These key players help to understand Amphoteric Surfactants market analysis, Amphoteric Surfactants Market Trends, and Amphoteric Surfactants industry trends.

Recent Development:

-

In August 2024, Galaxy Surfactants announced new product innovations that align with the increasing demand for effective, safe, and sustainable solutions in home and personal care.

-

In April 2024, Nouryon launched Structure M3, a biodegradable co-surfactant for use in personal care applications such as shampoos, conditioners, and face and body cleansers.

-

In October 2024, LanzaTech is teaming up with Dow to make sustainable amphoteric surfactants by using carbon capture and utilization technologies, which can convert waste carbon into valuable products.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.40 Billion |

| Market Size by 2032 | USD 8.46 Billion |

| CAGR | CAGR of 5.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Betaine, Amine Oxide, Amphoacetates, Amphopropionates, Sultaines, Substituted Imidazoline) • By Application (Personal Care, Home Care & Cleaning, Oil Field Chemicals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Evonik Industries AG, BASF SE, Akzo Nobel N.V., Clariant AG, Croda International Plc, Solvay S.A., Stepan Company, Lonza Group, KAO Corporation, Oxiteno S.A. |