Iron Ore Market Size:

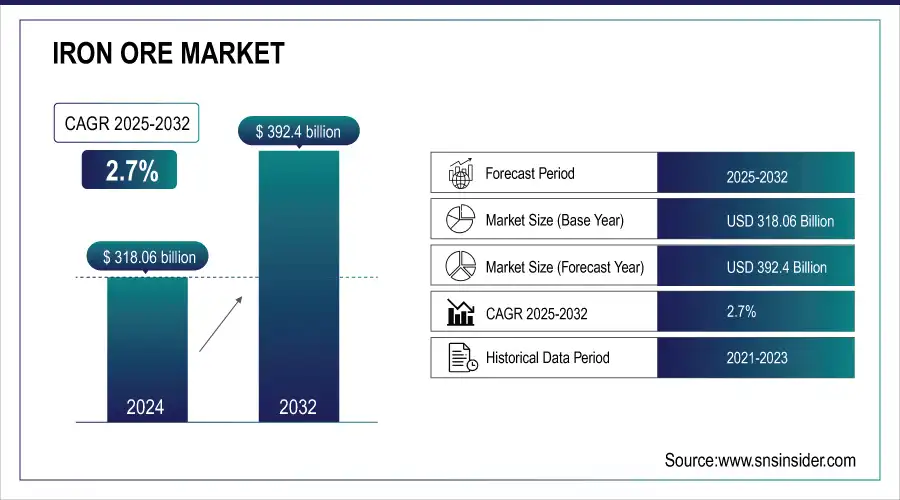

The Iron Ore Market size was valued at USD 326.65 billion in 2025 and is expected to reach USD 426.37 billion by 2035, growing at a CAGR of 2.7% over the forecast period 2025-2035.

The Iron Ore market is shaped by a complex set of dynamics that influence both supply and demand on a global scale. One of the key drivers in recent months has been fluctuations in iron ore prices, largely influenced by supply-side disruptions and currency exchange rates. For example, in January 2025, iron ore prices saw a four-week high due to reduced shipments and a weaker U.S. dollar. Lower shipments, which stemmed from supply chain issues in major mining regions, limited the availability of iron ore on the global market, further contributing to price increases. A weakening U.S. dollar over the same time also lent support to iron ore prices as they became more affordable for buyers that are not based in America. Government policy and industrial regulations also influence market dynamics significantly, she adds. A significant policy reversal in October 2025 mandated that steel producers in India use iron ore fines, a byproduct of production, to manufacture steel. This new regulation was put through into practice to abate broke down the efficiency of steel production and waste, hence there emerges the new demand for iron ore fines. The new announcement from the Indian government addresses a change in industry attitude towards sustainable resource use and cost-effective steel production.

To Get more information on Iron Ore Market - Request Free Sample Report

Development And Production Updates By Key Players In The Market has shown that few players are improving operations or ramping up production capacity. BHP reported a significant increase in production levels and a greater emphasis on efficiency in January 2025. These also consisted of technology-focused initiatives designed to improve the efficiency of its processes, which, in turn, increased production while cutting its operational expenses. Doing so is becoming increasingly important to profitability in our commodity-price volatile and globally-demand driven world. Ukrainian seaports also processed 18.5 million tons of iron ore in the same month, demonstrating a stable movement of raw materials through key transport routes. This is indicative of an important feature of the market, in which port and logistical capacities that effectively limit the amounts/tonnage of iron ore available to the rest of the world (including price). For instance, in January 2025, iron ore prices were impacted by developments on the supply side of the market as disruptions to operations in major iron ore mining regions led to modifications in several iron ore player operations to adapt to the disrupted environment. Both these developments and the manoeuvring of key players like BHP changing their mining operations will continue to define the future of the industry.

Market Size and Forecast:

-

Market Size in 2025 USD 326.65 Billion

-

Market Size by 2035 USD 426.37 Billion

-

CAGR of 2.7% From 2025 to 2035

-

Base Year 2025

-

Forecast Period 2025-2035

-

Historical Data 2022-2024

Iron Ore Market Trends:

-

Preference for premium-grade iron ore, such as lump ore and pellets, is rising due to higher efficiency, better yield, and reduced operational costs in steelmaking.

-

Large steel producers in China, India, and Japan are driving demand for high-quality ore to meet industrialization and infrastructure growth needs.

-

Advanced steelmaking technologies, particularly electric arc furnaces, are increasing the requirement for more refined raw materials.

-

The automotive industry is boosting iron ore demand through its need for high-strength, lightweight steel in fuel-efficient vehicles.

-

Rapid growth in the global construction sector continues to generate strong demand for steel, thereby supporting iron ore market expansion.

Iron Ore Market Growth Drivers:

The increasing demand for high-quality iron ore is a significant driver of market growth. Steel manufacturers prefer high-quality iron ore, specifically lump ore and pellets, due to its higher efficiency in the production process. High-grade ore results in better yield, higher quality steel, and lower operational costs during steel production. This trend for premium iron ore is most significant for large steel producers like within China, India and Japan where the demand for premium steel remains strong as industrialisation and infrastructure continues. For steelmakers, a higher grade iron ore allows them to create steel with fewer impurities, improving the final product with a stronger, more durable product needed to meet the high standards of today construction and automotive needs. Steelmakers are looking to make their processes more efficient and profitable in a competitive market so demand is growing steadily for such ore. As a result, this bodes well for iron ore miners that are able to provide superior ore. Additionally, the rise in use of advanced steelmaking technology like electric arc furnaces only increases the need for quality, since these types of technology can use lower grade raw materials in general. The rising demand for a better grade of iron ore continues and will continue to participate in the growth of the iron ore market.

Iron Ore Market Restraints:

Another challenge in the iron ore market is environmental regulations and sustainability issues. The new global regulations are aimed at minimizing the environmental effects of mining. The regulations include pollution control, carbon emissions, and sustainable use of resources. The new regulations require companies to adhere to high environmental standards, including reclamation and restoration of land, which increases costs of doing business. Some governments have restricted mining licenses due to sustainability issues, such as depletion of resources. Although sustainability is important for development, it increases costs and lowers profits. market growth.

Iron Ore Market Opportunities:

The increasing demand for steel in the automotive and construction sectors is another major opportunity area for the iron ore market. Steel is an essential material in the production of automobiles, infrastructure, and buildings, and these sectors are steadily expanding across the globe. Among them, the automotive industry is receiving a boost with the demand for high-strength, low-weight steel to be utilized in manufacturing cars since consumers are looking for efficient as well as durable cars drove by the continuous rise in crude oil price. However, another thriving area around the world is the global construction industry, with continual steel demand throughout commercial, residential, and industrial buildings. Higher steel demand consequently increases the demand for iron ore which is the primary feedstock used in the steelmaking process. With rising demands for iron ore as automotive and construction industries are booming, the market has a large growth opportunity. In particular, countries such as India and China, which are experiencing a rapid expansion in the automotive and construction industries, will be at the forefront of the growing demand for iron ore in the future.

| Iron Ore Grade | Description | Typical Fe Content (%) | Common Applications | Processing Requirement |

|---|---|---|---|---|

| High-Grade Ore (Hematite) | Dense and rich in iron, low in impurities | 60-70% | Steel production, blast furnaces | Minimal processing, direct use |

| Medium-Grade Ore (Magnetite) | Requires processing to separate iron from impurities | 50-60% | Steel production, pelletizing | Requires beneficiation |

| Low-Grade Ore | Contains higher levels of impurities | 45-50% | Iron-making, sometimes blended | Requires extensive beneficiation |

| Pelletized Ore | Iron ore processed into pellets for ease of use | 62-65% | Direct reduction in steel mills | Requires pelletizing process |

| Lump Ore | Naturally mined ore, larger pieces | 58-62% | Direct reduction in steel mills | Limited processing required |

The iron ore market is mainly segmented on the basis of the quality and grade of the iron ore, which determines its use in different industrial processes. High-grade iron ore, including hematite, generally contains a high percentage of iron (60-70%) and needs little processing, making it suitable for steel production in blast furnaces. Medium-grade iron ore, including magnetite, contains 60% iron and needs beneficiation to remove impurities before use. Low-grade iron ore, containing 50% iron, requires extensive processing because of its high impurity content. Pelletized iron ore, containing 62-65% iron, is preferred for direct reduction in steel production, while lump iron ore (58-62% Fe) provides a direct steel production process with only limited processing. The quality and grade of iron ore have a direct effect on its price, processing, and demand in the steel industry.

Iron Ore Market Segment Analysis:

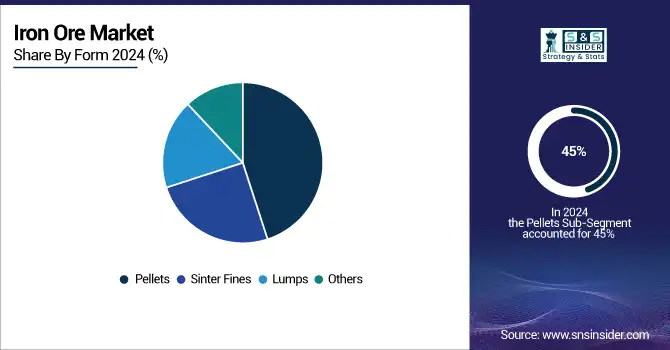

By Form

In 2025, Pellets form dominated the iron ore market with a market share of 45%. Pellets are made by agglomerating iron ore fines and are known for their size uniformity and high iron content, which is approximately 62-65% Fe. The preference for pellets is based on their suitability for direct reduction iron (DRI) processes, especially in electric arc furnaces, which have gained popularity because of their efficiency and reduced environmental impact. The shift in the global steel industry towards more environmentally friendly production processes has fueled the demand for high-quality pellets, making them a necessity for steel producers who want to optimize their productivity and minimize emissions. Large iron ore producers, such as Vale and Rio Tinto, have made substantial investments in pelletizing plants to cater to the rising demand. Moreover, the capacity of pellets to minimize the generation of slag in steel production furnaces makes them attractive to steel producers. With the continuous development of the steel industry, the dominance of pellets as the preferred iron ore form is expected to continue.

By Type

In 2025, Hematite leads the iron ore market with a market share of 60%. Hematite is a high-grade iron ore that is known for its dense structure and high iron concentration, ranging from 60% to 70%. Hematite's leading market position is mainly because of its application in the steel industry, especially in blast furnaces. Steel producers favor hematite over other iron ores because of its easy processing, which makes steel production less expensive and more efficient. China and India are major consumers of hematite, and their demand for hematite is fueled by their increasing steel production to support the growing infrastructure and manufacturing sectors. Additionally, hematite's widespread availability and well-developed supply chain networks are also factors that establish its leading market position. Key market players such as Vale and Rio Tinto are concentrating on hematite mining to meet the high-quality demands of the steel industry. The increasing growth of the construction and manufacturing industries worldwide ensures that hematite continues to be an important market participant in the iron ore market, solidifying its position as the most prominent iron ore in 2025.

By Grade

In 2025, the High-grade iron ore segment led the iron ore market with a market share of 55%. High-grade iron ore, also known as hematite, is defined by its high iron content, which is usually between 60% and 70%. High-grade iron ore is preferred by steel manufacturers because of its efficiency in steel production processes. High-grade iron ore helps steel producers consume less energy and produce more in blast furnaces. Crude iron ore that is a higher grade is economically more efficient than lower grades of iron ores. The expanding world-wide steel enterprise, especially in developing countries, combined with the solid demand on top of the range iron ore, keep this phase in the iron ore market. It is also cheaper to process iron ore of high-grade so producers of steel favour it. Countries like China, the largest consumer of iron ore, depend on high-quality iron ore directly to satisfy domestic steel production requirements. Because of the major iron ore producers focus on high-grade iron ore, high-grade iron ore will be the most preferable iron ore in 2025 as to be the best segment in the iron ore market.

By Application

In 2025, the Steel Manufacturing segment leads the iron ore market, accounting for a market share of 70%. Iron ore is the key raw material used in steel manufacturing, which is a significant requirement for different sectors such as construction, automotive, and infrastructure development. The demand for steel has been steadily increasing, especially in emerging countries where urbanization and infrastructure development are gaining momentum. With the growth of economies, the demand for strong and durable materials such as steel has become the need of the day, further fueling the demand for iron ore. Steel manufacturers require high-quality iron ore to enhance their steel manufacturing operations, cut down costs, and improve the mechanical properties of the finished steel products. The increasing focus on infrastructure development activities worldwide, such as residential and commercial buildings, transportation systems, and power plants, substantially fuels the demand for steel and, in turn, iron ore. This increasing focus on steel manufacturing establishes its position as the most prominent application of iron ore, ensuring a steady demand in the market as industries progress.

By End-Use Industry

In 2025, the Construction industry accounted for the largest market share of 40% in the iron ore market. The construction industry is one of the biggest steel consumers, which is mainly extracted from iron ore. The current global phenomenon of urbanization and development has resulted in a substantial increase in the demand for steel products, from beams to rebar, to structural components for buildings and bridges. As nations are investing heavily in the development of infrastructure to support the growth of their populations and economies, the demand for quality iron ore to produce steel has accelerated. Additionally, the current trend of sustainable construction has further fueled the demand for reliable and quality materials, thereby propelling the demand for steel produced from quality iron ore. Massive infrastructure development projects, such as transportation infrastructure, residential infrastructure, and commercial infrastructure, require massive steel, which directly translates into substantial demand for iron ore. The current expansion in the construction industry underscores its critical importance in the iron ore market, thereby ensuring its status as the foremost industry in 2023.

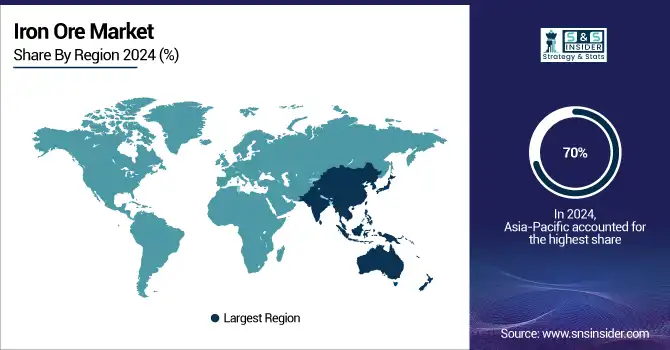

Iron Ore Market Regional Analysis:

Asia Pacific Iron Ore Market Insights

In 2025, the Asia Pacific region leads the world iron ore market with a market share of 70%. The main reason for the dominance of the Asia Pacific region is China, which is the world's largest iron ore importer and consumer. China currently imports around 60% of the world's iron ore, which is used in the country's massive steel production industry to support the country's large infrastructure. The demand for iron ore in China is expected to continue rising as the country focuses on developing its urbanization programs and infrastructure. India, another major player in the Asia Pacific region, is also contributing to the dominance of the region, with rising iron ore production due to the growth of the country's steel production and construction industries. Other countries such as Japan and South Korea are also major iron ore consumers, mainly due to the growth of their automotive industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Iron Ore Market Insights

The North America iron ore market has the advantage of well-established steel production facilities and sophisticated mining operations, especially in the U.S. and Canada. The demand is fueled by infrastructure development, the automotive industry, and the renewable energy sector, promoting a positive growth trajectory while focusing on sustainable mining and the provision of high-quality iron ore.

Asia Pacific Iron Ore Market Insights

The Asia Pacific iron ore market is dominated by China, India, and Japan, which have a strong demand for iron ore due to their growing industrialization, construction, and automotive industries. The region has a strong steel production capacity, with the government undertaking infrastructure development activities, making it the largest consumer and driving force in the iron ore market.

Europe Iron Ore Market Insights

The Europe iron ore market is driven by the region’s strong automotive and construction sectors, as well as the emerging trend of low-carbon steel production. The demand for high-quality iron ore is increasing due to the region’s investment in green technologies, the circular economy, and sustainable mining initiatives to decrease dependence on imported iron ore.

Latin America (LATAM) and Middle East & Africa (MEA) Iron Ore Market Insights

The LATAM iron ore market is a major iron ore-producing region with large reserves and export-oriented production, mainly to Asia. The MEA iron ore market is experiencing increasing demand due to infrastructure development and industrialization. Both regions are experiencing increased foreign investments, which are fueling the expansion of mining capacities and integration into the global steel value chain.

Iron Ore Market Key Players:

-

Ansteel Group Corporation Limited (Iron ore pellets, Iron ore concentrate)

-

Anglo American (Iron ore fines, Iron ore lumps)

-

ArcelorMittal (Iron ore pellets, Iron ore concentrate)

-

BHP (Iron ore fines, Iron ore lump)

-

Cleveland-Cliffs Inc. (Iron ore pellets, Iron ore concentrate)

-

EVRAZ PLC (Iron ore concentrate, Iron ore pellets)

-

Fortescue Metals Group Ltd (Iron ore fines, Iron ore pellets)

-

HBIS Group (Iron ore concentrate, Iron ore pellets)

-

LKAB (Iron ore pellets, Iron ore fines)

-

METALLOINVEST (Iron ore concentrate, Iron ore pellets)

-

Metalloinvest MC LLC (Iron ore concentrate, Iron ore pellets)

-

Niron Metals (Iron ore pellets, Iron ore fines)

-

Palabora Mining Company (Iron ore concentrate, Iron ore pellets)

-

Rio Tinto (Iron ore fines, Iron ore lumps)

-

Shaanxi Coal and Chemical Industry Group (Iron ore concentrate, Iron ore fines)

-

South32 (Iron ore fines, Iron ore lumps)

-

Tata Steel (Iron ore pellets, Iron ore fines)

-

Thyssenkrupp AG (Iron ore pellets, Iron ore concentrate)

-

Vale (Iron ore fines, Iron ore pellets)

-

Waratah Coal (Iron ore fines, Iron ore concentrate)

Competitive Landscape for Iron Ore Market:

BHP is one of the world’s largest iron ore producers, with major operations in Western Australia’s Pilbara region. The company supplies high-quality iron ore fines and lumps to global steelmakers, particularly in Asia. Its focus on efficiency, sustainability, and large-scale production strengthens its leadership in the global iron ore market.

-

January 2025: BHP reported increased iron ore and copper production in the December quarter, driven by efficiency improvements at major sites like South Flank. Despite global copper production challenges, BHP plans significant investments, particularly in Chile's Escondida mine, anticipating a copper supply deficit by the 2030s.

-

February 2025: Indian authorities are considering an export tax on low-grade iron ore due to rising domestic demand, despite opposition from the Federation of Indian Mineral Industries. Smaller steel manufacturers support the potential tax, as steel exports from China are increasing India's steel demand.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 326.65 Billion |

| Market Size by 2035 | USD 426.37 Billion |

| CAGR | CAGR of 2.7% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hematite, Magnetite, Limonite, Siderite, Others) • By Form (Sinter Fines, Lumps, Pellets, Others) • By Grade (High-grade, Medium-grade, Low-grade) • By Application (Steel Manufacturing, Iron Production, Others) • By End-Use Industry (Construction, Automotive, Shipbuilding, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Vale, Rio Tinto, BHP, Fortescue Metals Group Ltd, Ansteel Group Corporation Limited, ArcelorMittal, METALLOINVEST, Cleveland-Cliffs Inc., HBIS Group, Anglo Americanand other key players |