Analytical Standards Market Report Scope & Overview:

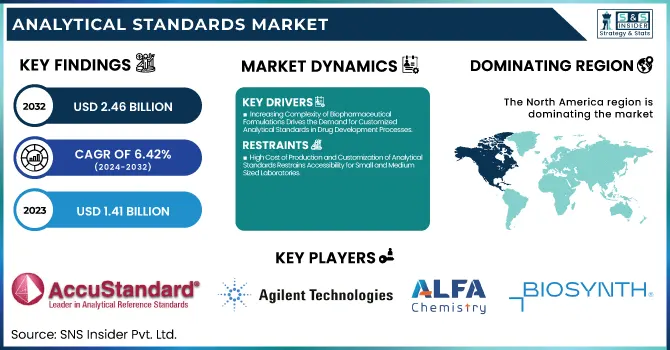

The Analytical Standards Market Size was valued at USD 1.41 Billion in 2023 and is expected to reach USD 2.46 Billion by 2032, growing at a CAGR of 6.42% over the forecast period of 2024-2032.

Get More Information on Analytical Standards Market - Request Sample Report

The analytical standards market is undergoing significant evolution, shaped by strict regulatory frameworks that demand high accuracy and traceability in testing. Our report explores how these regulations influence the development and production of analytical standards across industries. With rising environmental concerns, their role in pollution monitoring and ecological assessments has become vital, especially in environmental testing sectors. Economic shifts, such as changes in raw material and distribution costs, are also impacting pricing, a factor analyzed in detail. Furthermore, the report compares various types of analytical standards certified reference materials, primary, and secondary highlighting their specific applications. As globalization drives the need for standardized testing worldwide, the report captures how international expansion is creating both opportunities and challenges in the analytical standards market.

The US Analytical Standards Market Size was valued at USD 380.78 Million in 2023 with a market share of around 71% and growing at a significant CAGR over the forecast period of 2024-2032.

The US analytical standards market is experiencing steady growth, fueled by stringent regulatory oversight from organizations such as the Environmental Protection Agency (EPA), Food and Drug Administration (FDA), and United States Pharmacopeia (USP). These agencies mandate the use of high-precision standards in environmental testing, pharmaceutical quality control, and food safety. Increasing demand for PFAS detection, driven by EPA initiatives, and stricter drug validation processes regulated by the FDA are expanding market applications. U.S.-based companies like Agilent Technologies and Restek Corporation are innovating extensively in certified reference materials, further accelerating adoption across laboratories, biopharma, and forensic sectors. This robust regulatory and innovation-driven environment continues to support market expansion.

Market Dynamics

Drivers

-

Increasing Complexity of Biopharmaceutical Formulations Drives the Demand for Customized Analytical Standards in Drug Development Processes

The surge in biopharmaceutical innovation has introduced highly complex formulations that require precise analytical characterization. These drugs, including monoclonal antibodies, gene therapies, and cell-based treatments, often involve sensitive biological pathways and intricate molecular structures. As a result, analytical standards are crucial in ensuring the accuracy of quantitative and qualitative assessments during preclinical and clinical testing. In the United States, the Food and Drug Administration (FDA) has issued extensive guidance on bioanalytical method validation, reinforcing the necessity for pharmaceutical companies to utilize high-quality reference materials. The complexity of biologics and biosimilars demands tailored analytical standards to support immunogenicity testing, pharmacokinetic analysis, and potency assessments. Additionally, as more biopharmaceutical products seek global regulatory approval, companies must align with international standards such as those defined by the International Conference on Harmonisation (ICH), which further promotes the use of universally accepted analytical standards. Manufacturers are increasingly collaborating with contract research organizations (CROs) and custom reference material providers to design application-specific standards. This trend enhances reliability, reduces variability in results, and expedites the drug approval process, making it a key driver of growth in the analytical standards market.

Restraints

-

High Cost of Production and Customization of Analytical Standards Restrains Accessibility for Small and Medium-Sized Laboratories

The production of analytical standards, especially certified reference materials, involves a complex process that includes high-purity chemical synthesis, homogeneity testing, long-term stability studies, and rigorous quality certification. These processes require sophisticated laboratory infrastructure, advanced instrumentation, and highly skilled personnel, which contribute to high production costs. Custom standards tailored for unique analytical applications such as complex drug formulations or emerging environmental contaminants add further layers of cost due to the research and development involved. For many small and medium-sized laboratories, particularly in developing regions or academic settings, these expenses are often unaffordable, leading them to rely on lower-quality, uncertified standards or internal calibration methods. This can compromise test reliability and create inconsistencies in inter-laboratory comparisons. Moreover, limited bulk purchasing power restricts access to economies of scale. While large pharmaceutical and environmental laboratories may afford these costs, the price barrier significantly hinders market penetration among smaller stakeholders, thereby slowing the overall growth potential of the analytical standards market.

Opportunities

-

Expansion of Cannabis Testing Regulations Across U.S. States Creates New Revenue Streams for Analytical Standards Manufacturers

The expanding legalization of medical and recreational cannabis across various U.S. states has opened up significant opportunities for analytical standards manufacturers. Cannabis testing labs are now mandated to screen for a wide array of parameters, including cannabinoid potency, terpene profiles, pesticide residues, heavy metals, and microbial contamination. Each of these tests requires precise reference standards to ensure accurate and reproducible results. Regulatory frameworks vary by state, but all demand rigorous quality control, pushing laboratories to adopt certified analytical standards. The Association of Official Analytical Collaboration (AOAC) and other U.S.-based standard-setting organizations are developing official testing protocols, further standardizing practices across states. This increasing demand is driving specialized manufacturers to expand their product portfolios to include cannabis-specific standards, creating new revenue streams. The rapid evolution of cannabis regulations and the need for method validation also present recurring demand, providing a lucrative and sustained growth opportunity within the analytical standards market.

Challenge

-

Rapid Evolution of Analytical Techniques Demands Continuous Adaptation in Standard Formulation and Product Portfolio Updates

The analytical testing landscape is continuously evolving, with new instrumentation and methods emerging at a rapid pace. Technologies such as high-resolution mass spectrometry, hybrid chromatography techniques, and nanomaterial-based sensors are increasingly being adopted across industries. While these advancements improve testing sensitivity and accuracy, they also present a major challenge for analytical standards manufacturers, who must continually adapt their formulations and expand their product portfolios. Developing standards for novel matrices or emerging contaminants requires significant research and investment. Moreover, the lack of harmonization in global testing protocols means that a standard developed for one region may not be applicable elsewhere, adding further complexity. This constant need to update and validate new standards strains manufacturing capabilities and slows time-to-market, posing a significant challenge to staying competitive in a fast-moving industry.

Segmental Analysis

By Category

The organic segment dominated the analytical standards market in 2023 with a substantial market share of 63.8%, driven by its widespread application in pharmaceuticals, environmental monitoring, and food testing. Organic analytical standards are crucial for ensuring the quality and safety of products that contain complex organic molecules, especially in pharmaceutical formulations, pesticides, and food additives. The increasing demand for drug development and regulatory compliance has further intensified the reliance on high-purity organic standards. For instance, the United States Pharmacopeia (USP) and the European Medicines Agency (EMA) emphasize the use of certified organic reference materials to ensure accuracy and repeatability in drug testing and validation. In addition, rising contamination incidents in food and environmental sectors such as pesticide residues and organic pollutants have driven regulatory bodies like the U.S. Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) to enforce strict monitoring protocols, which in turn demand reliable organic analytical standards. Consequently, organic standards continue to dominate due to their essential role in safeguarding public health and maintaining compliance with international analytical norms.

By Methodology

The bioanalytical testing segment held the leading position in 2023, capturing 37.7% of the analytical standards market, owing to its pivotal role in pharmaceutical research, clinical trials, and biologics development. Bioanalytical testing supports quantification of drugs, metabolites, and biomarkers in biological matrices such as plasma and serum, making it indispensable for pharmacokinetics and toxicokinetics studies. The growth in biologics, biosimilars, and personalized medicine has significantly increased the demand for high-quality analytical standards in this segment. Organizations such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have placed heavy emphasis on bioanalytical method validation, requiring pharmaceutical companies to use accurate and standardized testing methods. For example, the FDA’s “Bioanalytical Method Validation Guidance for Industry” clearly outlines the need for precise standards in determining drug concentrations during clinical development. Moreover, the boom in biopharmaceutical research, coupled with the growing number of clinical trials globally, particularly in the United States and Europe, underscores the dominance of bioanalytical testing in driving the analytical standards market.

By Technique

Spectroscopy emerged as the dominant technique in 2023, commanding 39.06% of the analytical standards market, owing to its broad applicability, rapid analysis capability, and high sensitivity. Spectroscopic methods such as UV-Vis, atomic absorption, infrared, and mass spectroscopy are extensively used in pharmaceutical, environmental, and food safety laboratories for qualitative and quantitative analysis. These techniques offer rapid detection and accurate characterization of molecular structures and elements, making them ideal for compliance with regulatory testing. For instance, the U.S. Environmental Protection Agency (EPA) extensively employs spectroscopy for monitoring water and air quality, enforcing strict limits on pollutants using certified reference standards. In pharmaceuticals, organizations like the International Conference on Harmonisation (ICH) recommend spectroscopy-based identity and purity tests as part of GMP protocols. Furthermore, spectroscopy equipment has become increasingly automated and integrated with software analytics, enhancing throughput and efficiency. This technological advancement, paired with stringent global testing mandates, has secured spectroscopy’s position as the most utilized analytical technique across various sectors.

By Application

In 2023, the pharmaceutical and life science analysis segment dominated the analytical standards market with a 41.2% share, driven by surging drug development activity, regulatory stringency, and technological advances in analytical instrumentation. Analytical standards in this segment are vital for ensuring drug efficacy, purity, and safety from the early stages of research to post-marketing surveillance. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO) have set rigorous validation requirements for analytical procedures that use certified reference materials. The proliferation of novel therapeutics including biologics, vaccines, and gene therapies further necessitates precise standards to ensure method reproducibility and compliance. For instance, the FDA’s continual updates on Good Laboratory Practices (GLP) and Quality by Design (QbD) frameworks have emphasized the role of validated standards in bioequivalence and stability testing. Additionally, the global COVID-19 vaccine rollout spotlighted the critical need for robust analytical validation using high-purity standards, reinforcing the segment’s dominance across both developed and emerging markets.

Regional Analysis

North America dominated the analytical standards market in 2023, accounting for 38.4% of the global share, owing to its advanced pharmaceutical and biotechnology industries, stringent regulatory frameworks, and expansive research infrastructure. The United States leads within the region, supported by prominent regulatory bodies like the U.S. Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and the U.S. Pharmacopeial Convention, all of which mandate the use of certified analytical standards in routine testing and compliance. The presence of major pharmaceutical companies such as Pfizer, Merck, and Johnson & Johnson further drives the regional demand for high-purity analytical standards, particularly in drug development, stability testing, and clinical validation processes. Additionally, a strong academic and research ecosystem—fueled by institutes like the National Institutes of Health (NIH) continues to push analytical innovation and collaboration with private sector labs. Canada also contributes significantly, particularly in environmental testing and food safety, supported by Health Canada and the Canadian Food Inspection Agency (CFIA). In 2023, several policy initiatives such as the FDA’s tightened oversight on pharmaceutical impurities and the EPA’s water quality monitoring directives directly expanded the use of certified reference standards. These factors, coupled with substantial R&D investments and a mature healthcare infrastructure, cemented North America’s leadership position in the global analytical standards market.

Moreover, Asia Pacific emerged as the fastest growth in the analytical standards market during the forecast period, with a significant growth rate, driven by rapid industrialization, expanding pharmaceutical production, and growing regulatory awareness. Countries such as China, India, South Korea, and Japan are at the forefront of this growth due to increased investment in healthcare infrastructure, environmental monitoring, and academic research. India and China, in particular, are emerging as global pharmaceutical manufacturing hubs, with companies like Sun Pharma and WuXi AppTec contributing to the growing demand for precise analytical validation and quality control. The Indian Pharmacopoeia Commission and China’s National Medical Products Administration (NMPA) are increasingly aligning their regulations with international standards, thereby driving adoption of certified analytical reference materials. In addition, growing concerns over environmental pollution and food safety have led agencies like China’s Ministry of Ecology and Environment and India’s Food Safety and Standards Authority of India (FSSAI) to enforce stricter analytical testing protocols. Japan, with its robust medical device and diagnostics sectors, further fuels demand for high-grade analytical standards. The rise of contract research organizations (CROs) and international collaborations also enhance market penetration across the region. Collectively, these dynamics are fostering a rapidly evolving analytical landscape in Asia Pacific, positioning it as the fastest growing region globally.

Need any customization research on Analytical Standards Market - Enquiry Now

Key Players

-

AccuStandard (PAH Mix 13, PCB Congener Mix Aroclor 1260, VOC Mix 1)

-

Agilent Technologies, Inc. (EPA 524.3 VOC Calibration Standard, LC/MS Pesticide Standard Mix, PFAS Standard Mix)

-

Alfa Chemistry (Benzene Standard Solution, Chlorpyrifos Standard, Bisphenol A Standard)

-

Biosynth (Histamine Dihydrochloride Standard, Serotonin Hydrochloride Standard, Dopamine Hydrochloride Standard)

-

Cambridge Isotope Laboratories, Inc. (D-Glucose-13C6, L-Glutamic Acid-13C5, Urea-15N2)

-

Cayman Chemical (Delta-9-THC Standard, Aflatoxin B1 Standard, Cortisol Standard)

-

Chiron AS (Part of Antylia Scientific) (Petroleum Hydrocarbon Standard Mix, Alkylphenol Standard Mix, PFAS Native Standard Mix)

-

GFS Chemicals Inc. (Potassium Dichromate Primary Standard, Sodium Carbonate Volumetric Standard, Benzoic Acid Standard)

-

Inorganic Ventures (ICP-MS Multi-Element Standard Solution, Trace Metals in Water Standard, Anion Calibration Standard)

-

LGC Group / LGC Limited (Mycotoxin Standard Mix, Pesticide Residue Standard, Heavy Metals in Food Standard)

-

Merck KGaA (TOC Standard Solution, Acetone Standard for GC, Methanol Calibration Standard)

-

PerkinElmer Inc. (Organic Chlorine Pesticide Mix, USP Residual Solvent Standard, ICP-MS Calibration Standard)

-

Reagecon Diagnostics Ltd. (Conductivity Standard 1413 µS/cm, pH Buffer Solution 7.00, Turbidity Standard 400 NTU)

-

Restek Corporation (8260B Calibration Mix, Pesticide Residue Mix A, Gaseous Hydrocarbon Standard)

-

Ricca Chemical Company (pH Buffer Solution 4.00, Sulfuric Acid Volumetric Solution, Sodium Thiosulfate Standard Solution)

-

Shimadzu Corporation (Organic Acids Standard Mix, Amino Acid Standard Mix, LC/MS/MS Pesticide Standard)

-

Spex Certiprep (Antylia Scientific) (US EPA 200.7 Calibration Standard, CLP Volatile Mix, Inorganic Element Mix for ICP)

-

Thermo Fisher Scientific Inc. (Environmental VOC Standard Mix, Pesticide Screening Standard, Trace Metals Calibration Standard)

-

Tokyo Chemical Industry Co., Ltd. (TCI) (Phthalic Acid Standard, 1-Naphthol Standard, 2,4-Dichlorophenol Standard)

-

Wellington Laboratories Inc. (PFOS Standard, PCB Congener Standard Mix, Dioxin/Furan Calibration Standard)

Analytical Standards Market Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.41 Billion |

| Market Size by 2032 | USD 2.46 Billion |

| CAGR | CAGR of 6.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Category (Inorganic, Organic) •By Methodology (Stability Testing, Bioanalytical Testing, Dissolution Testing, Raw Material Testing, Others) •By Technique (Chromatography, Spectroscopy, Titrimetric, Physical Properties Tests, Others) •By Application (Food and Beverage Analysis, Pharmaceutical and Life Science Analysis, Petrochemical Analysis, Forensic Standards, Veterinary Drug Analysis, Environmental Analysis, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Waters Corporation, PerkinElmer Inc., LGC Group / LGC Limited, Restek Corporation, Spex Certiprep (Antylia Scientific), AccuStandard, Cayman Chemical and other key players |