Hemoglobinopathies Market Size Analysis:

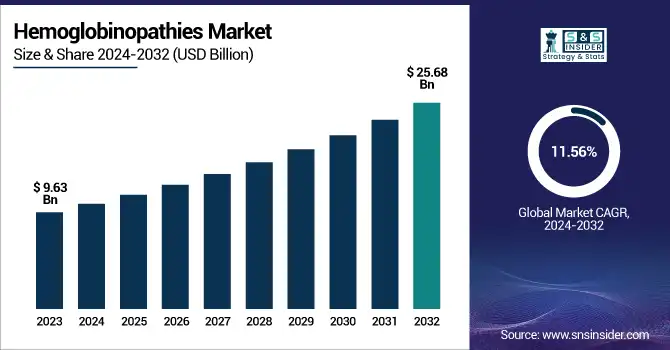

The Hemoglobinopathies Market was valued at USD 9.63 billion in 2023 and is expected to reach USD 25.68 billion by 2032, growing at a CAGR of 11.56% from 2024 to 2032.

To Get more information on Hemoglobinopathies Market - Request Free Sample Report

This report provides a unique analytical advantage by providing detailed statistical information about the Hemoglobinopathies Market, including incidence and prevalence figures with projections up to 2032. It uniquely charts therapeutic adoption trends in major regions, showing treatment accessibility and regional imbalances. It also analyzes disease management expenditures divided by region and payer type (government, private, commercial, and out-of-pocket), delivering key cost-of-care information. The report also identifies mortality and morbidity rates by condition and geography, combined with patient demographics and trends in disease onset, providing a detailed snapshot of patient burden and clinical timelines—factors typically underemphasized in typical market analyses.

The U.S. Hemoglobinopathies Market was valued at USD 2.58 billion in 2023 and is expected to reach USD 6.66 billion by 2032, growing at a CAGR of 11.18% from 2024 to 2032. The United States has a commanding market share of the North American hemoglobinopathies market because of its sophisticated diagnostic facilities, high level of awareness, and strong newborn screening programs. Furthermore, heavy investments in gene therapy research and early uptake of new treatments also support its leadership position in the region.

Hemoglobinopathies Market Dynamics

Drivers

-

The hemoglobinopathies market is witnessing strong momentum with the increased use of gene and cell-based treatments as a potential cure.

Conventional treatment for disorders such as sickle cell disease and thalassemia involves symptomatic therapy in the form of transfusions and iron chelation. Advances in gene editing and gene transfer technologies have revolutionized the direction toward long-term modification of disease and even curing. In April 2024, the U.S. FDA approved Pfizer's BEQVEZ (fidanacogene elaparvovec-dzkt), a single gene therapy for hemophilia B, marking regulatory readiness for novel modalities. Further, CRISPR-based treatments such as Vertex and CRISPR Therapeutics' Casgevy have raised hopes for analogous hemoglobinopathies. The growing pipeline of gene therapy candidates and rising clinical trial activity worldwide are driving their uptake, transforming treatment paradigms in North America and Europe.

-

The growing number of universal newborn screening programs is a major driving force enabling early diagnosis and management of hemoglobinopathies.

In the United States, all 50 states now have sickle cell disease (SCD) screening on their standard panels of newborn testing. Early identification by such programs allows for early initiation of prophylactic treatment, immunizations, and family counseling, significantly decreasing morbidity and mortality. Based on the CDC, newborn screening for SCD in the United States has resulted in a 90% decrease in childhood mortality over the past decades. Moreover, low- and middle-income nations are embracing pilot screening programs at a fast pace, aided by international health organizations. For example, Nigeria and India, the nations with the highest burden of hemoglobinopathies, have initiated regional newborn screening programs in partnership with international partners, indicating the global trend toward prevention and early intervention.

Restraint

-

High Cost and Limited Accessibility of Advanced Therapies are restraining the market from growing.

One of the key constraints in the hemoglobinopathies market is the expense and limited availability of sophisticated therapies like gene therapy and bone marrow transplantation. Although these therapies have curative potential, they are not affordable for patients in low- and middle-income countries, where hemoglobinopathies have the greatest burden. For example, gene treatments such as Zynteglo and Casgevy may cost $2 million per treatment or more, which leaves them out of reach without robust insurance coverage or government subsidies. In addition, these treatments have complex infrastructure demands, specialized teams of care professionals, and surveillance after treatment that are not evenly distributed outside wealthy countries. This gap restricts access to equitable treatment and further propels dependence on traditional symptomatic treatments such as transfusions and chelation, thus hindering the use of curative methods in resource-limited settings.

Opportunities

-

Growing Research Collaborations and Global Health Initiatives present a significant opportunity for the market.

Growth of the hemoglobinopathies market is fueled by intensified partnerships between pharmaceutical firms, research organizations, and international health bodies. Such partnerships are also speeding up the process of discovery of new therapies, like gene editing drugs and disease-modifying drugs, and enhancing access to treatment in underdeveloped areas. For example, the Global Alliance for Gene Therapy and the Bill & Melinda Gates Foundation have initiated programs to create cost-effective gene treatments for sickle cell disease and beta-thalassemia specific to low-income groups. Moreover, academia-industry collaborations are broadening the horizon of clinical trials, which facilitates quicker regulatory approval and wider recruitment of patients. These partnerships not only encourage innovation but also allow for knowledge sharing, capacity building, and infrastructure development, particularly in high-prevalence areas like Sub-Saharan Africa and South Asia, laying the groundwork for equitable and sustainable market expansion.

Challenges

-

One of the main challenges for the hemoglobinopathies market is the genetic and clinical heterogeneity of these diseases, which makes diagnosis and treatment more complex.

Heterogeneity in disease severity within individuals with the same genotype makes it hard to develop uniform treatment regimens. Additionally, co-inheritance of other hemoglobin variants and modifiers may further determine disease expression and cause diagnostic uncertainty. This sophistication calls for personalized medicine strategies and sophisticated diagnostic instruments, which may not always be available or affordable in resource-poor environments. Furthermore, treatment of comorbidities like stroke, organ injury, and chronic pain needs to be provided through multidisciplinary care, raising logistical and financial challenges. Consequently, patient stratification, therapy optimization, and long-term care are problematic, potentially holding back the early application of new therapies and hampering uniform patient outcomes in varying healthcare settings.

Hemoglobinopathies Market Segmentation Analysis

By Type

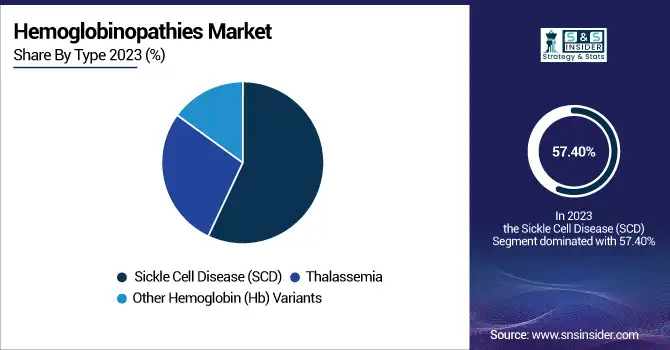

The Sickle Cell Disease (SCD) dominated the hemoglobinopathies market by type in 2023 with a 57.40% market share because of its much higher incidence, intense clinical interest, and fast development in treatment. More than 300,000 babies are born worldwide each year with SCD, most of them in Sub-Saharan Africa, India, and the Middle East. Yet, in areas such as North America and Europe, where healthcare infrastructure is more established, SCD has emerged as a prime target for therapeutic innovation and research. In 2023, this resulted in an upsurge in the use of disease-modifying agents such as hydroxyurea, monoclonal antibodies (e.g., crizanlizumab), and curative strategies including gene therapies such as Casgevy (approved in late 2023).

In addition, public health initiatives and newborn screening for SCD, which are compulsory in the U.S. and Europe, have made early diagnosis and intervention possible, leading to enhanced patient outcomes. The ongoing introduction of clinical trials and regulatory favor for the development of orphan drugs also helped establish market leadership. Increased investment in curative therapy and supportive care for sickle cell disease has put this segment at the lead in the hemoglobinopathies market in 2023.

By Diagnosis

The Sickle Cell Disease (SCD) segment dominated the hemoglobinopathies market with a 51.08% market share by diagnosis in 2023 because of widespread adoption of targeted screening programs, increased clinical awareness, and better diagnostic technologies. SCD ranks among the most frequently screened hemoglobin disorders worldwide, particularly among newborns, because of its serious health consequences and early manifestation. In the United States and the United Kingdom, universal newborn screening programs have had SCD included for many years, making early and correct diagnosis possible. Screening programs have also been assisted by the World Health Organization and other NGOs in highly prevalent areas such as Sub-Saharan Africa and South Asia, increasing global diagnostic coverage. Technological advancements in diagnostic equipment, such as high-performance liquid chromatography (HPLC), electrophoresis, and point-of-care rapid tests, have further simplified and increased SCD detection. The high degree of disease awareness among the medical community and the general population has also resulted in earlier diagnosis and identification, particularly in high-risk groups. Consequently, the number of SCD diagnoses exceeded that of other hemoglobinopathies such as thalassemia and unusual Hb variants in 2023 and propelled the segment's leadership in diagnostics.

By Therapy

The Other Hemoglobin (Hb) Variants segment dominated the hemoglobinopathies market by therapy in 2023, with a 63.25% share because of growing awareness, diagnosis, and supportive treatment strategies for a large number of rare but clinically important hemoglobin variants. In contrast to thalassemia and sickle cell disease, whose therapeutic pathways are more defined, other Hb variants—Hemoglobin C, D, E, and unstable hemoglobins—need varied, symptom-oriented management plans based on their clinical presentations. In 2023, better diagnostic technologies such as genetic sequencing and high-resolution hemoglobin electrophoresis caused an increase in the detection of these variants, particularly in multi-ethnic populations and genetically diverse regions. The segment also gained increased clinical interest due to the multiple complications involved with these variants, ranging from mild to moderate hemolytic anemia, splenomegaly, and a higher risk for other hematologic disorders. Consequently, supportive therapies such as folic acid supplementation, transfusion protocols, and symptom management targeted at specific needs were used more extensively. Furthermore, since these variants tend to co-exist with other hemoglobin disorders, combination therapies became more common, increasing the value of the therapeutic segment. The wide and diverse nature of these variants generated a consistent demand for personalized and flexible care, thus becoming the most dominant therapy segment in 2023.

Hemoglobinopathies Market Regional Insights

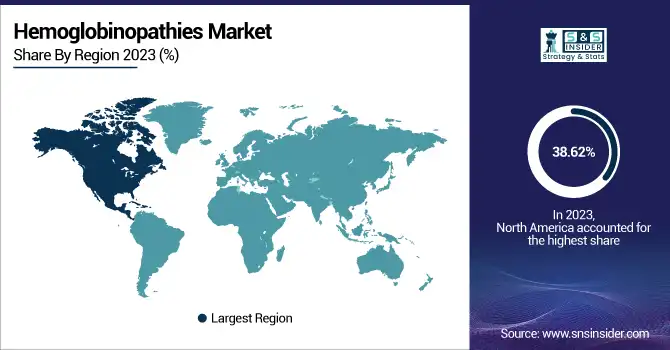

North America dominated the hemoglobinopathies market with a 38.62% market share in 2023, mainly because of its established healthcare infrastructure, universal newborn screening programs, and early embrace of cutting-edge therapeutic technologies. The United States, specifically, has made universal screening for sickle cell disease mandatory in all states, allowing early detection and effective management of the disease. Moreover, the region enjoys substantial research funding, a robust presence of leading biopharmaceutical firms, and speedy regulatory approvals for new therapies. High patient consciousness, presence of extensive care facilities, and good reimbursement policies also augment access to curative and disease-modifying treatments like hydroxyurea, gene therapy, and bone marrow transplantation, consolidating North America's leadership in the market.

The Asia Pacific market is experiencing the fastest growth with 12.31% CAGR throughout the forecast period, with the region's high disease burden, enhanced healthcare infrastructure, and increased government-sponsored screening programs. India and China, for example, have some of the world's highest rates of thalassemia and sickle cell disease, fueling critical demand for diagnostic and treatment solutions. National governments, with the backing of global health organizations, are making investments in public education campaigns, carrier screening, and prenatal diagnosis. There are also increasing alliances with multinational biotech companies, enhancing the availability of sophisticated diagnostic equipment and new treatments. While spending on healthcare grows and regulatory options enhance, the Asia Pacific will be undergoing robust market growth during the years ahead.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hemoglobinopathies Market Key Players

Sangamo Therapeutics, Inc., Global Blood Therapeutics, Inc., bluebird bio, Inc., Emmaus Life Sciences Inc., Pfizer, Inc., Novartis AG, Prolong Pharmaceuticals, LLC, Bioverativ Inc., Gamida Cell, Celgene Corporation, and other players.

Recent Development in the Hemoglobinopathies Market

-

April 2024 – The U.S. Food and Drug Administration approved Pfizer's BEQVEZ (fidanacogene elaparvovec-dzkt), a one-time gene therapy indicated for the treatment of adult patients with Hemophilia B.

-

February 2025 – Novo Nordisk reported encouraging interim results from its Phase 3 FRONTIER3 clinical trial, showing that its investigational treatment Mim8, given once weekly, is effective and well tolerated in children between 1 and 11 years of age with hemophilia A, both with and without inhibitors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.63 Billion |

| Market Size by 2032 | US$ 25.68 Billion |

| CAGR | CAGR of 11.56 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thalassemia, Sickle Cell Disease, Other Hemoglobin (Hb) Variants) • By Diagnosis (Thalassemia, Sickle Cell Disease, Other Hemoglobin (Hb) Variants) • By Therapy (Thalassemia, Sickle Cell Disease, Other Hemoglobin (Hb) Variants) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bio-Rad Laboratories, Inc., PerkinElmer Inc., Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers, Roche Diagnostics, Trivitron Healthcare, Danaher Corporation, BioMedomics Inc., Nexcelom Bioscience LLC, Agilent Technologies, Inc., ARUP Laboratories, Quest Diagnostics Incorporated, HemoCue AB, Sysmex Corporation, Helena Laboratories Corporation, Streck, Inc., GCC Diagnostics, Spinreact S.A.U., Zentech S.A., and other players. |