Coronary Stent Market Overview and Forecast:

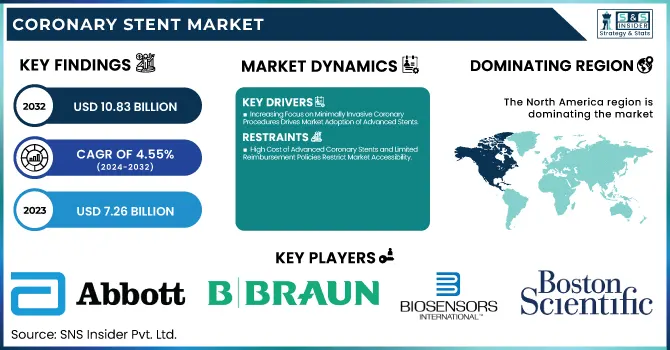

The Coronary Stent Market size was valued at USD 7.26 Billion in 2023 and is expected to reach USD 10.83 Billion by 2032, growing at a CAGR of 4.55% over the forecast period of 2024-2032.

Get more information on Coronary Stent Market - Request Sample Report

The Coronary Stent Market is evolving with advancements in technology, shifting insurance policies, and increasing cardiac cases worldwide. Our report presents a cost comparison between traditional and advanced stents, assessing affordability and long-term value. It explores insurance coverage trends, highlighting disparities in reimbursement and patient access. Insights into hospital and healthcare facility adoption reveal how top institutions are integrating innovative stent technologies. Analyzing patient demographics and epidemiology, the study uncovers age and gender trends shaping market demand. Additionally, an overview of clinical guidelines and best practices showcases evolving treatment protocols for improved patient outcomes. With these key elements, the report provides a strategic outlook on the industry's future, offering valuable insights for stakeholders navigating this dynamic market.

Coronary Stent Market Size & Growth Insights

The US Coronary Stent Market Size was valued at USD 4.42 Billion in 2023 and is expected to reach USD 7.07 Billion by 2032, growing at a CAGR of 5.35% over the forecast period of 2024-2032. The United States coronary stent market is experiencing growth due to several dynamic factors. Technological advancements, such as Boston Scientific's development of the SYNERGY Everolimus-Eluting Platinum Chromium Coronary Stent System, have improved patient outcomes. The U.S. Food and Drug Administration's (FDA) approval of innovative stent technologies, including the PROMUS Everolimus-Eluting Coronary Stent System, has expanded treatment options. Additionally, the American Heart Association (AHA) and the American College of Cardiology (ACC) have established clinical guidelines that support the use of drug-eluting stents, influencing physician practices. These factors collectively contribute to the market's expansion, offering patients more effective and safer coronary interventions.

Coronary Stent Market Dynamics

Drivers

-

Increasing Focus on Minimally Invasive Coronary Procedures Drives Market Adoption of Advanced Stents

The growing preference for minimally invasive procedures in cardiovascular treatments is accelerating the demand for advanced coronary stents. Patients and healthcare providers are increasingly opting for percutaneous coronary intervention (PCI) over traditional open-heart surgeries due to the benefits of reduced recovery time, lower surgical risks, and improved post-procedure comfort. Innovations in catheter-based delivery systems have significantly improved the precision and safety of stent implantation, allowing for better arterial expansion with minimal complications. Additionally, advancements in thin-strut stent designs and ultra-flexible stents have enhanced the success rates of PCI procedures, making them safer and more effective. The rise in outpatient cardiac catheterization procedures has further contributed to market growth, as hospitals and ambulatory surgical centers expand their interventional cardiology departments. Furthermore, insurance providers are increasingly recognizing the benefits of minimally invasive procedures, leading to improved reimbursement policies for stent-based interventions. As patient preference shifts toward less invasive treatment options, the adoption of advanced coronary stents is expected to continue growing, further strengthening the coronary stent market.

Restraints

-

High Cost of Advanced Coronary Stents and Limited Reimbursement Policies Restrict Market Accessibility

One of the primary restraining factor hindering the widespread adoption of advanced coronary stents is their high cost, which limits accessibility for many patients. Next-generation drug-eluting stents and bioresorbable stents come at a significantly higher price compared to older models, making them less affordable, particularly in cost-sensitive healthcare systems. In many developing regions, healthcare coverage is limited, forcing patients to pay high out-of-pocket expenses, which reduces the overall adoption of newer stent technologies. Even in developed markets like the United States, reimbursement policies vary, and some insurance providers are hesitant to cover advanced stent options due to their high costs. Hospitals and healthcare facilities often face budget constraints, leading them to prioritize cost-effective alternatives over cutting-edge stent technologies. The financial burden on patients and healthcare providers is a major factor slowing market penetration, despite the clinical benefits offered by innovative stent solutions. Unless there are improvements in healthcare reimbursement policies and cost-effective manufacturing approaches, the adoption of advanced coronary stents will remain restricted in certain regions.

Opportunities

-

Growing Adoption of 3D Printing and Custom-Made Coronary Stents for Personalized Patient Treatment

The emergence of 3D printing technology in coronary stent manufacturing is opening up new possibilities for personalized cardiovascular care. Unlike conventional stents, 3D-printed stents can be tailored to fit a patient’s specific arterial anatomy, improving precision and reducing the risk of complications such as restenosis. Research institutions and medical device manufacturers are actively exploring the use of biocompatible materials in 3D-printed stents to enhance their long-term safety and efficacy. This advancement is particularly beneficial for patients with unique arterial structures or complex lesions that require a customized solution. Additionally, 3D printing technology allows for rapid prototyping and cost-effective production of patient-specific stents, reducing lead times and making personalized treatments more accessible. As 3D printing technology advances and regulatory approvals streamline, the market for custom-made coronary stents is expected to grow significantly, providing a major opportunity for innovation in interventional cardiology.

Challenge

-

Rising Concerns Over Long-Term Biocompatibility and Potential Late Stent Thrombosis Risks

Despite significant advancements in coronary stent technology, concerns about long-term biocompatibility and the risk of late stent thrombosis continue to pose challenges. Some drug-eluting stents have been associated with delayed healing, chronic inflammation, and hypersensitivity reactions, leading to potential complications years after implantation. Late stent thrombosis, in particular, remains a serious concern, as it can result in life-threatening events such as heart attacks. Researchers are continuously investigating new materials and drug-elution techniques to mitigate these risks, but ensuring long-term safety remains a complex issue. Effective post-market surveillance and rigorous clinical trials are crucial to addressing these challenges and maintaining patient confidence in coronary stent therapies.

Coronary Stent Market Segmentation Analysis

By Product

Drug Eluting Stents dominated the coronary stent market in 2023 with a market share of 66.7%. The widespread adoption of drug-eluting stents (DES) is driven by their superior efficacy in reducing restenosis rates compared to bare metal stents (BMS) and bioresorbable vascular scaffolds (BVS). DES releases antiproliferative drugs that prevent excessive tissue growth, significantly reducing the likelihood of artery re-narrowing. Organizations like the American College of Cardiology (ACC) and the European Society of Cardiology (ESC) consistently recommend DES as the standard of care for percutaneous coronary interventions (PCI). Moreover, the U.S. Food and Drug Administration (FDA) has approved next-generation DES with enhanced biocompatibility and thinner struts, further improving patient outcomes. Companies like Abbott, Medtronic, and Boston Scientific have launched innovative DES, such as Abbott’s Xience Sierra and Medtronic’s Resolute Onyx, which offer enhanced deliverability and reduced thrombosis risk. The continuous advancements in DES technology, supported by regulatory approvals and clinical endorsements, have cemented their dominance in the coronary stent market.

By Mode of Delivery

Balloon-expandable stents dominated the coronary stent market in 2023 with a market share of 74.2%. These stents are preferred due to their precise placement and controlled expansion, making them the most widely used option in percutaneous coronary interventions. Balloon-expandable stents provide excellent radial strength and optimal arterial scaffolding, reducing the risk of restenosis. The American Heart Association (AHA) and the Society for Cardiovascular Angiography & Interventions (SCAI) endorse balloon-expandable stents as the primary choice for coronary artery disease treatment. Leading manufacturers, including Boston Scientific, Medtronic, and Terumo, have developed advanced balloon-expandable stents such as Synergy and Promus PREMIER, which offer thin-strut designs and improved drug-elution properties. Additionally, government initiatives promoting interventional cardiology procedures, such as the Centers for Medicare & Medicaid Services (CMS) expanding coverage for PCI, have further driven the adoption of balloon-expandable stents. Their clinical reliability, ease of deployment, and strong regulatory backing make them the dominant segment in the coronary stent market.

By Material

Metallic stents dominated the coronary stent market in 2023 with a market share of 33.8%. The dominance of metallic stents is primarily attributed to their strength, durability, and proven track record in treating coronary artery disease. Cobalt-chromium and platinum-chromium alloys are widely used due to their excellent biocompatibility, flexibility, and corrosion resistance. Organizations such as the National Institutes of Health (NIH) and the World Health Organization (WHO) emphasize the continued reliance on metallic stents, particularly for high-risk patients requiring long-term arterial support. In recent years, Boston Scientific’s Synergy XD and Medtronic’s Resolute Onyx have gained significant traction, offering improved drug-elution properties and reduced thrombosis risks. Additionally, regulatory approvals from bodies like the FDA and EMA have reinforced the adoption of metallic stents in interventional cardiology. Their ability to provide effective vascular support while ensuring long-term safety has solidified their position as the leading material choice in the coronary stent market.

By End User

Hospitals dominated the coronary stent market in 2023 with a market share of 55.4%. Hospitals remain the primary end users of coronary stents due to their advanced infrastructure, availability of skilled cardiologists, and access to high-quality imaging technologies for precise stent placement. Government initiatives, such as the U.S. Department of Health and Human Services (HHS) increasing funding for cardiovascular research, have further strengthened hospital-based interventional cardiology programs. Additionally, hospitals offer comprehensive post-procedural care, making them the preferred choice for complex coronary interventions. Leading hospital networks, including Mayo Clinic, Cleveland Clinic, and Mount Sinai Hospital, have reported high volumes of percutaneous coronary interventions (PCI), reinforcing their dominance in the market. The increasing number of catheterization labs in hospitals worldwide, coupled with favorable reimbursement policies for PCI procedures, continues to drive the adoption of coronary stents in hospital settings.

Coronary Stent Market Regional Insights

North America dominated the optical coating market in 2023 with an estimated market share of 38.5%. The region's dominance is driven by the widespread adoption of optical coatings in industries such as consumer electronics, aerospace, automotive, and healthcare. The presence of key market players like Materion Corporation, PPG Industries, and DuPont has facilitated continuous technological advancements in anti-reflective, high-reflective, and filter coatings. Additionally, government initiatives such as the National Science Foundation (NSF) funding for photonics research and the U.S. Department of Defense investments in advanced optics for military applications have significantly contributed to market expansion. The United States is the leading country within North America, accounting for over 75% of the regional market share, owing to high demand from semiconductor and display panel industries. The U.S. military’s increasing investment in laser-based defense systems and NASA’s extensive use of optical coatings in satellite technology further fuel market growth. Canada follows as a key contributor, with companies like Gooch & Housego investing in high-precision coatings for scientific research. Meanwhile, Mexico is emerging as a manufacturing hub, attracting investments from global optics firms due to its cost-effective production capabilities.

Moreover, Asia Pacific emerged as the fastest-growing region in the optical coating market with at a significant CAGR during the forecast period of 2024 to 2032. This growth is fueled by increasing demand from the consumer electronics, automotive, and renewable energy sectors. Countries such as China, Japan, South Korea, and India are at the forefront due to rising investments in display technologies, semiconductors, and advanced optics. China dominates the regional market, driven by the presence of leading display manufacturers like BOE Technology and TCL and the government's push for self-reliance in semiconductor manufacturing. Japan follows closely with innovations in optical lens coatings from companies like Nikon and Canon, particularly in the medical imaging and camera lens segments. South Korea is another key player, with Samsung and LG Display heavily investing in anti-reflective and high-durability coatings for OLED and flexible displays. Meanwhile, India’s optical coatings sector is gaining traction due to increasing demand for high-performance coatings in the automotive and telecommunications industries.

Need any customization research on Coronary Stent Market - Enquiry Now

Leading Companies in The Coronary Stent Market

-

Abbott Laboratories (Xience, Absorb, Xpedition)

-

B. Braun Melsungen AG (Coroflex ISAR, Coroflex Blue Ultra, Coroflex DEBlue)

-

Biosensors International Group, Ltd. (BioMatrix Alpha, BioFreedom, BioMatrix NeoFlex)

-

BIOTRONIK SE & Co. KG (Orsiro, Magmaris, PK Papyrus)

-

Boston Scientific Corporation (Promus Elite, Synergy XD, REBEL)

-

Hexacath (Titan 2, Teneo, TITAN OPTIMAX)

-

Lepu Medical Technology (Beijing) Co., Ltd. (*Nano+, Taurus Elite, Taurus II)

-

Medtronic PLC (Resolute Onyx, Resolute Integrity, Endeavor)

-

Meril Life Sciences Pvt. Ltd. (BioMime Morph, BioMime Branch, MeRes100)

-

MicroPort Scientific Corporation (Firehawk, Firebird 2, Foxtrot NC)

-

Sahajanand Medical Technologies Limited (Supraflex Cruz, Supraflex Star, Supraflex Trio)

-

Shanghai MicroPort Endovascular MedTech Co., Ltd. (Minos, Castor, Aegis)

-

STENTYS SA (Xposition S, Xposition R)

-

Sino Medical Sciences Technology Inc. (Tetrilimus, BuMA Supreme, BuMA)

-

Translumina GmbH (Yukon Choice PC, Yukon Chrome, VIVO ISAR)

-

Terumo Corporation (Ultimaster, Ultimaster Tansei, Nobori)

-

Vascular Concepts (GenX CrCo, Flexy Rapamycin, Pronova)

-

Alvimedica (Cre8 EVO, NiTiDES)

-

Balton Medical (Coracto, Alex Plus)

-

Essen Technology (BuMA Supreme, BuMA)

Recent Developments in the Coronary Stent Market

May 2024: Abbott launched the XIENCE Sierra coronary stent system in India, aiming to enhance treatment options for heart patients. Tushar Sharma, General Manager for Abbott’s vascular business in India & South Asia, stated that the innovative design and improved deliverability of XIENCE Sierra would enable physicians to access and unblock difficult-to-treat lesions with greater flexibility and precision.

September 2024: The Indian government considered creating a separate category for advanced coronary stents and raising the price ceiling to attract manufacturers. This initiative aimed to encourage the introduction of next-generation stents in India, addressing concerns from manufacturers about existing price control measures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.26 Billion |

| Market Size by 2032 | USD 10.83 Billion |

| CAGR | CAGR of 4.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Bare Metal Stents, Drug Eluting Stents, Bioresorbable Vascular Scaffolds (BVS)/Bioresorbable Coronary Stents, Others) •By Mode of Delivery (Balloon-expandable Stents, Self-expanding Stents) •By Material (Metallic Stents, Cobalt Chromium, Platinum Chromium, Nickel Titanium, Stainless Steel, Others) •By End User (Hospitals, Cardiac Centers, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Boston Scientific Corporation, Medtronic PLC, Terumo Corporation, B. Braun Melsungen AG, BIOTRONIK SE & Co. KG, MicroPort Scientific Corporation, Biosensors International Group, Ltd., Cook Medical (Cook Group), Stentys SA and other key players |