Anime Merchandising Market Report Scope & Overview:

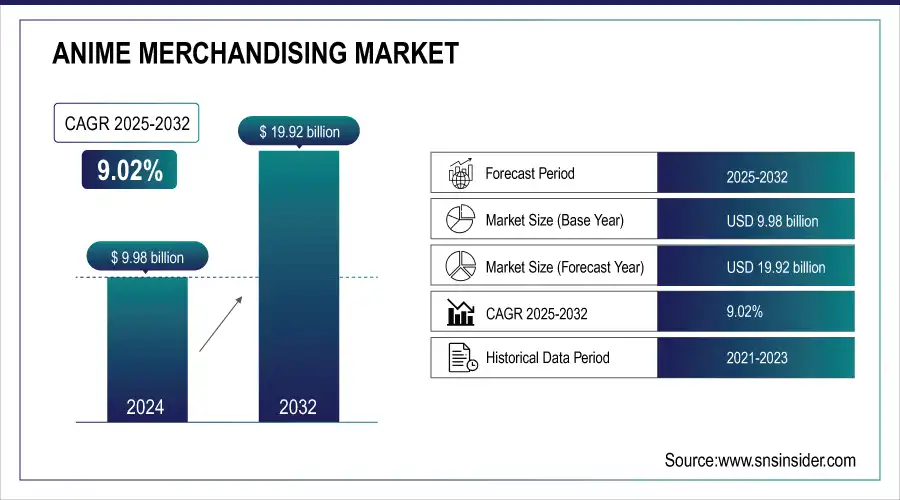

The Anime Merchandising Market Size was valued at USD 9.98 Billion in 2024 and is expected to reach USD 19.92 Billion by 2032 and grow at a CAGR of 9.02% over the forecast period 2025-2032.

To get more information on Anime Merchandising Market - Request Free Sample Report

The Market is growing rapidly, driven by the global popularity of anime series, films, and games. Streaming platforms like Crunchyroll, Netflix, and Funimation have expanded anime’s reach, increasing demand for figurines, apparel, posters, and toys. E-commerce plays a key role, with companies like Good Smile Company, Bandai Namco, and Aniplex dominating the market. Japan, North America, and Europe lead in revenue, with rising interest in Latin America and Southeast Asia. Future trends include AR/VR-based collectibles, blockchain authentication, and AI-driven customization, ensuring continued market expansion through digital accessibility, nostalgia, and fan engagement.

Market Size and Forecast:

-

Anime Merchandising Market Size in 2024: USD 9.98 Billion

-

Anime Merchandising Market Size by 2032: USD 19.92 Billion

-

CAGR: 9.02% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Anime Merchandising Market Trends

-

Rising global popularity of anime series and movies, driving demand for related merchandise.

-

Growth of licensed products including figurines, apparel, accessories, and collectibles.

-

Expansion of e-commerce and online fan communities, boosting direct-to-consumer sales.

-

Increasing collaborations between anime studios and fashion, lifestyle, or gaming brands.

-

Rising demand for limited-edition and premium collectibles among adult fans and collectors.

-

Adoption of AR/VR and digital collectibles (NFTs) to engage tech-savvy audiences.

-

Growth in conventions, pop-culture events, and fan expos driving on-site merchandise sales.

-

Expansion of regional licensing and international distribution in North America, Europe, and Asia-Pacific.

Anime Merchandising Market Growth Drivers

-

Rising Global Popularity of Anime and Streaming Platforms Driving Growth in the Anime Merchandising Market

The increasing worldwide popularity of anime, fueled by streaming platforms like Crunchyroll, Netflix, and Funimation, is a major driver of the anime merchandising market. With anime becoming more accessible to international audiences, the demand for figures, apparel, posters, and collectibles has surged. Major franchises such as Demon Slayer, One Piece, and Attack on Titan have gained immense global followings, further stimulating merchandise sales. Additionally, anime conventions and exclusive collaborations with renowned studios and brands contribute to market expansion. The digital era has made it easier for fans to purchase officially licensed merchandise online, while social media marketing and influencer collaborations have significantly boosted consumer engagement. The rise of limited-edition merchandise and premium collectibles has also increased market value, as dedicated collectors seek rare and high-quality anime-related products. This sustained global interest in anime, combined with digital accessibility, continues to propel the anime merchandising industry forward.

Anime Merchandising Market Restraints

-

High Costs of Licensed Merchandise and Counterfeiting Issues Restrain the Anime Merchandising Market Growth

The anime merchandising market is the high cost of officially licensed products and the widespread issue of counterfeit merchandise. Premium-quality collectibles, figures, and apparel from renowned brands such as Good Smile Company, Bandai Namco, and Aniplex often come at steep prices, making them less accessible to budget-conscious consumers. At the same time, the proliferation of fake and unauthorized merchandise on online marketplaces significantly impacts legitimate sales. Counterfeit products not only result in financial losses for official manufacturers but also diminish brand reputation and customer trust due to inferior quality. Consumers looking for affordable options may unknowingly purchase knockoffs, further affecting market revenue. Addressing this issue requires strict intellectual property enforcement, blockchain authentication, and enhanced consumer awareness. Until a reliable solution is implemented, counterfeiting and pricing concerns will continue to pose challenges for the anime merchandising industry.

Anime Merchandising Market Opportunities

-

Integration of AR/VR and Blockchain Authentication Presents Growth Opportunities for the Anime Merchandising Market

The adoption of AR/VR technology and blockchain authentication presents a major growth opportunity in the anime merchandising market. Augmented and virtual reality can enhance fan engagement by allowing customers to interact with digital versions of their favorite anime figures before purchase. AR applications could enable fans to visualize how figures and collectibles fit into their spaces, boosting buying confidence. Additionally, blockchain authentication ensures the authenticity of limited-edition and high-value merchandise, protecting consumers from counterfeit products. This technology can store detailed ownership records and provenance, making collectibles more valuable for resale and investment. By incorporating these innovations, companies can attract tech-savvy and serious collectors, thereby increasing revenue and customer loyalty. As digital integration becomes a key factor in merchandising, brands leveraging immersive technology and secure authentication methods will gain a competitive edge, leading to long-term market growth and sustainability.

Anime Merchandising Market Challenges:

-

Fluctuating Consumer Trends and Short Product Life Cycles Pose Challenges in the Anime Merchandising Market

The anime merchandising market is constantly changing consumer preferences and the short product life cycle of anime-related merchandise. The popularity of anime series and franchises varies over time, with some gaining global recognition while others fade quickly. As a result, merchandise linked to trending anime titles has a limited sales window before consumer interest shifts to newer releases. Companies must continuously predict trends and produce merchandise rapidly to stay relevant. This rapid turnover also creates inventory management challenges, as unsold products from declining franchises may lead to financial losses. Additionally, seasonal demand spikes, such as during anime conventions or major series premieres, require brands to strategically plan production and marketing efforts. Addressing these challenges demands data-driven market analysis, adaptable production strategies, and flexible inventory management systems to ensure that anime merchandising companies can sustain profitability amid shifting consumer interests.

Anime Merchandising Market Segments Analysis

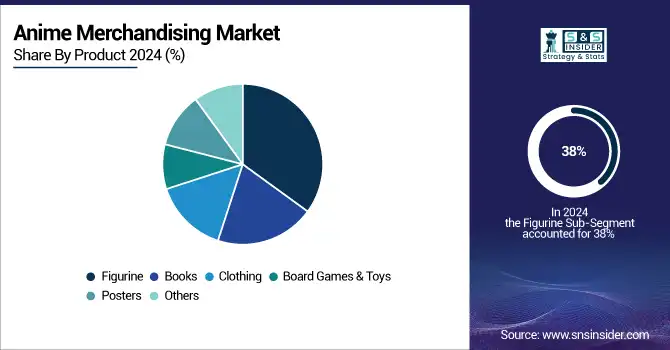

By Product

The Figurine segment held the largest revenue share of 38% in 2024, driven by strong consumer demand for high-quality collectible figures based on popular anime franchises. Companies like Good Smile Company, Bandai Namco, and Kotobukiya continue to expand their figurine offerings, introducing detailed scale figures, Nendoroids, and Figma action figures to cater to different collectors.

In 2023, Good Smile Company launched new Nendoroid figures from Chainsaw Man, Jujutsu Kaisen, and Spy x Family, further fueling market demand. Bandai Namco's Tamashii Nations line also expanded with new S.H. Figuarts figures from Dragon Ball Z and One Piece, targeting premium collectors. Limited-edition and exclusive event-based figures continue to drive sales, as anime conventions and online pre-orders create high anticipation among fans.

The Books segment is experiencing the fastest growth, with a CAGR of 10.6% in the forecast period, driven by the increasing global demand for manga, art books, and light novels. Companies like VIZ Media, Kodansha, and Yen Press have aggressively expanded their translated manga offerings, making anime-related literature more accessible to international audiences.

The success of anime adaptations also fuels book sales, as viewers seek original source material after watching an anime series. This synergy between anime streaming and book merchandising strengthens the overall anime merchandising market, ensuring continued growth through multi-platform engagement and expanding global accessibility.

By Deployment

The Online segment held the largest revenue share in 2024, driven by the convenience of e-commerce platforms, global accessibility, and exclusive digital sales. Major companies like Crunchyroll, Good Smile Company, and Aniplex have strengthened their direct-to-consumer (DTC) online stores, offering exclusive pre-orders, limited-edition releases, and regional shipping.

In 2024, Crunchyroll Store expanded its online catalog with exclusive figures, apparel, and Blu-rays from Demon Slayer, One Piece, and Jujutsu Kaisen. Good Smile Company introduced an international pre-order system, allowing global collectors to access Nendoroids, Figma, and Pop-Up Parade figures directly from their official site.

The Offline segment is experiencing the fastest growth in the forecast period, fueled by the increasing popularity of anime conventions, specialty stores, and theme-based retail experiences. Companies like Animate, Kotobukiya, and Mandarake have expanded their physical store networks, offering exclusive in-store merchandise, limited-run collectibles, and immersive anime-themed shopping experiences.

In 2024, Animate opened new flagship stores in Tokyo and Osaka, introducing dedicated sections for Spy x Family and Blue Lock merchandise. Kotobukiya expanded its Akihabara retail space, allowing visitors to experience prototype figure displays before launch.

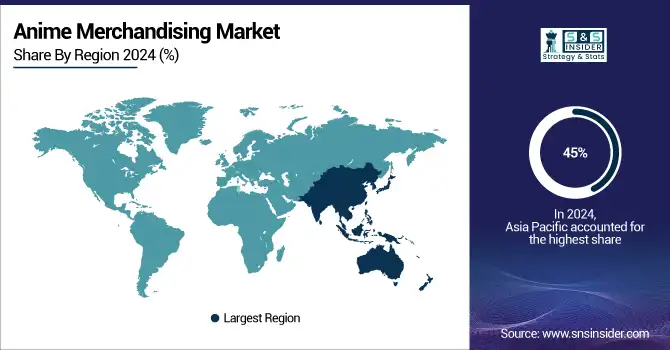

Anime Merchandising Market Regional Analysis

Asia Pacific Anime Merchandising Market Insights

The Asia Pacific region dominated the anime merchandising market in 2024, holding an estimated market share of 45%, driven by Japan’s deep-rooted anime culture, strong consumer demand, and established industry players. Japan remains the global hub for anime production and merchandising, with companies like Bandai Namco, Good Smile Company, and Aniplex leading the market. The region also benefits from high consumer spending on otaku culture, particularly in Japan, South Korea, and China. In 2023, Bandai Namco expanded its Premium Bandai store offerings, while animate opened additional flagship stores in Japan, further boosting regional sales. The rise of anime-themed cafes, pop-up shops, and conventions in cities like Tokyo, Seoul, and Shanghai has reinforced Asia Pacific's dominance in the anime merchandising market.

Get Customized Report as per Your Business Requirement - Enquiry Now

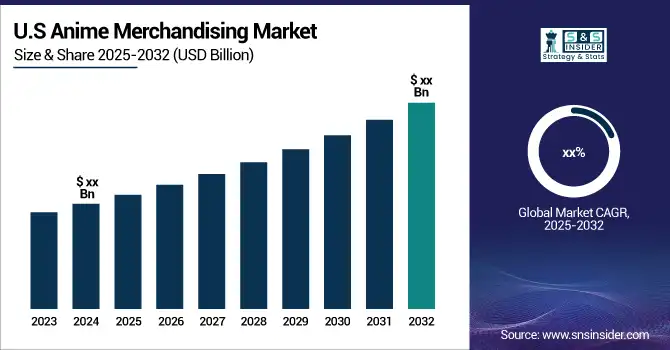

North America Anime Merchandising Market Insights

The North America region is the fastest-growing in the anime merchandising market, with an estimated CAGR of 12.4% in 2024. This growth is fueled by the increasing popularity of anime streaming platforms, rising convention culture, and growing acceptance of anime in mainstream entertainment. Streaming giants like Crunchyroll and Netflix have expanded their anime libraries, driving merchandise demand. Anime conventions like Anime Expo in Los Angeles and New York Comic Con have become major merchandising hubs, with companies such as Funimation (Sony Pictures Entertainment) and Good Smile Company launching exclusive regional products. The expansion of retail partnerships with Walmart, Target, and Hot Topic has also contributed to sales growth. With increasing consumer engagement and rising disposable income, North America is expected to remain the fastest-growing region in the anime merchandising industry.

Europe Anime Merchandising Market Insights

The Europe Anime Merchandising Market is witnessing steady growth in 2024, driven by increasing popularity of Japanese anime, strong fan communities, and expansion of licensed merchandise. Key markets such as the U.K., Germany, and France are experiencing rising demand for collectibles, apparel, and accessories. E-commerce platforms and pop-culture conventions are enhancing accessibility to anime merchandise. Moreover, collaborations between European brands and Japanese studios, along with the growing interest in limited-edition and premium products, are further propelling market growth across the region.

Latin America (LATAM) Anime Merchandising Market Insights

The LATAM Anime Merchandising Market is expanding gradually in 2024, fueled by the increasing influence of anime streaming platforms and growing fan communities in countries like Brazil, Mexico, and Argentina. Local retailers and online stores are seeing rising demand for anime-themed apparel, figures, and school supplies. Fan conventions and events are stimulating merchandise sales, while collaborations between local artists and Japanese studios are diversifying product offerings. The growing digital infrastructure and social media engagement are further driving market penetration in the region.

Middle East & Africa (MEA) Anime Merchandising Market Insights

The MEA Anime Merchandising Market is gaining momentum in 2024, supported by rising youth population, increased internet penetration, and growing interest in Japanese pop culture. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing higher adoption of anime collectibles, apparel, and accessories through both online and offline channels. Regional fan conventions and social media-driven communities are boosting merchandise visibility and sales. Furthermore, partnerships with international anime distributors are helping expand the availability and variety of licensed merchandise across the region.

Anime Merchandising Market Competitive Landscape

Studio Ghibli

Studio Ghibli is a renowned Japanese animation studio known for its critically acclaimed films and iconic characters.

-

In December 2024, Studio Ghibli issued a trilingual statement on its official website addressing the proliferation of unauthorized merchandise infringing on its intellectual property rights. The studio specifically highlighted the sale of high-priced framed images and paintings derived from its films and publications without proper authorization.

Crunchyroll

Crunchyroll is a leading global streaming platform specializing in anime, manga, and related content, catering to international audiences.

-

In August 2024, Crunchyroll revealed plans to collaborate with Japanese creators to develop anime series rooted in Indian characters, themes, and stories. This initiative aims to diversify anime narratives and cater to a broader audience by incorporating non-Japanese cultural elements.

Anime Merchandising Market Key Players

Some of the major players in the Anime Merchandising Market are:

-

Studio Ghibli, Inc. (Studio Ghibli Collectible Figures, Studio Ghibli Art Books)

-

Bandai Namco Filmworks Inc. (Gunpla Model Kits, Tamashii Nations Figures)

-

Crunchyroll (Sony Pictures Entertainment Inc.) (Crunchyroll Exclusive Figures, Crunchyroll Anime Apparel)

-

Good Smile Company, Inc. (Nendoroid Figures, Figma Action Figures)

-

Sentai Holdings, LLC (AMC Networks) (Sentai Filmworks Blu-rays, Sentai Filmworks Limited Edition Box Sets)

-

Ufotable Co., Ltd. (Ufotable Café Exclusive Merchandise, Demon Slayer Collectibles)

-

Atomic Flare (Anime-Themed Apparel, Anime Art Prints)

-

MegaHouse (Bandai Namco Filmworks Inc.) (G.E.M. Series Figures, Variable Action Heroes Figures)

-

MAX FACTORY, INC. (Max Factory Figma, PLAMAX Plastic Model Kits)

-

Alter Co., Ltd. (Alter Scale Figures, Alter Prize Figures)

-

BANDAI SPIRITS CO., LTD. (Ichiban Kuji Prize Figures, S.H. Figuarts Figures)

-

Bioworld Merchandising, Inc. (Anime-Themed Apparel, Anime Accessories)

-

Stronger Co., Ltd. (Stronger Scale Figures, Stronger Limited-Edition Statues)

-

Aniplex Inc. (Sony Pictures Entertainment Inc.) (Aniplex Exclusive Figures, Aniplex Limited Edition Blu-rays)

-

Medicom Toy Co., Ltd. (BE@RBRICK Figures, Real Action Heroes Figures)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 9.98 Billion |

| Market Size by 2032 | US$ 19.92 Billion |

| CAGR | CAGR of 9.0 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Figurine, Clothing, Books, Board Games & Toys, Posters, Others) • By Deployment (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Studio Ghibli, Inc., Bandai Namco Filmworks Inc., Crunchyroll (Sony Pictures Entertainment Inc.), Good Smile Company, Inc., Sentai Holdings, LLC (AMC Networks), Ufotable Co., Ltd., Atomic Flare, MegaHouse (Bandai Namco Filmworks Inc.), MAX FACTORY, INC., Alter Co., Ltd., BANDAI SPIRITS CO., LTD., Bioworld Merchandising, Inc., Stronger Co., Ltd., Aniplex Inc. (Sony Pictures Entertainment Inc.), Medicom Toy Co., Ltd. |