Anime Market Report Scope & Overview:

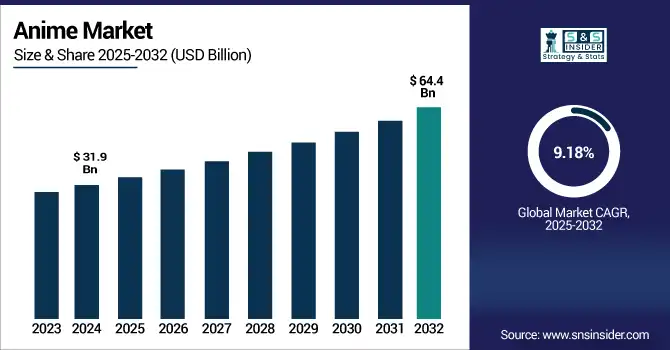

The Anime Market size was valued at USD 31.9 billion in 2024 and is expected to reach USD 64.4 billion by 2032, growing at a CAGR of 9.18% during 2025-2032.

The anime market growth is driven by international fandoms, cross-platform content strategies, and digital embrace. With the evolution of streaming technology, anime use has proliferated, encompassing real-time simultaneous releases in multiple languages through such portals as Crunchyroll and Netflix. Current anime market trends highlight that AI is getting incorporated into anime by means of animation and scriptwriting to design new characters at a cheaper cost, at a separate level, creativity increases. Virtual reality is influencing how we experience immersive anime, allowing us to wander around story worlds in three-dimensional space as long as we have the right equipment. According to leading anime market analysis, these innovations set new storytelling formats and audience engagement. Perhaps more importantly, as both AI and VR mature, the anime industry will need to deliver on the promise of personalised, interactive, cinematic content at scale, turning technology into a central pillar of anime production, distribution, and fan engagement in global markets of the future.

To Get more information on Anime market - Request Free Sample Report

Factors such as subscription-based streaming growth, increasing anime fandom, and more Japanese content appealing to localization are driving the rapid growth of the U.S. anime market. Market Size USD 10.3 billion in 2024, Market Size USD 20.5 billion by 2032, at a CAGR of 8.97%. The consumer interest is anticipated to grow even more with exclusive content deals and immersive experiences.

Anime Market Dynamics:

Drivers:

-

Global Expansion of Streaming Platforms Increases Accessibility and International Demand for Anime Content

Netflix, Crunchyroll, Hulu, Amazon Prime Video, just a few of the worldwide web giants responsible for changes to the anime market since before the global coronavirus pandemic. With immense libraries, original productions, and the ability to offer multi-lingual access, these platforms have started to position anime as much more readily available to the global public, including themselves. This simulcasting, airing of anime episodes immediately around the world has increased fan participation and an international presence. In addition, content recommendations driven by algorithms are bringing new audiences that were previously not aware of anime. With these platforms jostling for competitive advantage versus exclusive deal rights, anime production investment has increased, leading to higher quality, diverse, and innovative content. This trend not only enhances earnings but also puts anime as a dominant genre in the global digital entertainment market.

For Instance, Netflix reported a 35% year-over-year increase in global anime viewership in 2024, with anime titles watched by over 140 million households across 100+ countries.

Restraints:

-

High Production Costs and Time-Intensive Processes Limit Output Capacity and Delay Content Releases

Anime creation employs painstaking artistry, talented animators, and lengthy post-production, driving costs and scalability into the sky. While the beauty of traditional hand-drawn animation is held in space and time, it is physically demanding and costly. Many studios, particularly smaller or independent ones, often feel the financial strain, restricting what they can do, particularly if they wish to scale or play around with new formats. Indie development at its heart is about a group of creative people and their passion project, but the industry’s over-reliance on tight schedules and limited staff leads to burnout and quality issues in the long run. Costs of running a typical animation studio also include skilled animators‘ wages, which are driven higher up, as well as the costs of digital tools. These kinds of challenges will affect output volume and release time, subjecting the anime market form a drive for growing global demand.

The average cost to produce a 12-episode anime series exceeded USD 2.5 million in 2024, a 15% increase from 2022, primarily due to rising labor and digital production expenses.

Opportunities:

-

Integration of AI and VR Technologies Enables Innovative Immersive Experiences and Efficient Production

Anime production and interaction would receive endless innovation opportunities if AI, VR, and similar technologies matured and gained significant traction. Animation is undergoing an evolution, thanks to AI automating the mundane, assisting with character design, amalgamating voices and accelerating production and cost. On the other hand, VR brings the immersive storytelling experience wherein fans can actually interact with a character or move around in one anime world in 360 degrees. This technology also meets the demands of a younger, more tech-savvy audience (especially Gen Z) that expect interactive and personalized content. Combining anime with AI/VR can create new formats such as virtual concerts, immersive storytelling in the metaverse, and interactive episodes, increasing monetization avenues and reinventing how anime is experienced.

For instance, over 40% of Japanese animation studios adopted AI-based tools for in-betweening, coloring, or script assistance by late 2024, up from just 12% in 2022, significantly reducing manual workloads.

Challenges:

-

Piracy and Complex Licensing Issues Reduce Revenue and Restrict Global Availability of Anime Titles

Piracy is a major issue in the anime industry, as it affects revenue and intellectual property rights due to people streaming or downloading anime without paying for it. However, many viewers still go for illegal sites due to high prices or low accessibility in some regions, even if they have legal platforms available! Such reduction affects the profitability, but also slows down the steps of the content creator as well as the investors. Furthermore, a patchwork of licensing involving numerous regional and distributor agreements often hampers release and availability and annoys global fans. However, when it comes to rights fragmentation, that can become very uneven when it comes to localization and dubbing. Unless more severely enforced or better coordinated globally through licensing, piracy and access restrictions will remain as key impediments to growth in the market.

Anime Market Segmentation Analysis:

By Type:

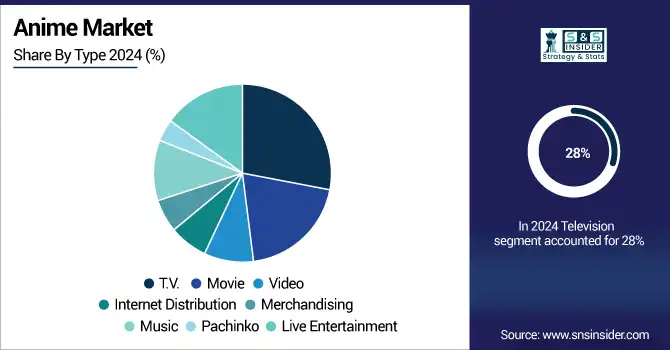

Television anime dominated the market in 2024 and accounted for 28% of the anime market share. With its legacy following, television anime has a consistent presence in broadcasting and high viewer loyalty to traditional and digital platforms. Its reach is still expanding, thanks to season programming, episodic storytelling, and global syndication. While networks and streamers will continue to broaden multilingual availability, TV anime will remain at the center of the picture, producing stable licensing revenue, allowing TV anime to connect with global audiences through 2032.

In October 2023, Nippon TV introduced a new late-night anime block, Friday Anime Night, premiering shows like Frieren: Beyond Journey’s End in prime slots, aiming to recapture broad viewership.

Internet distribution is the fastest-growing segment during the forecast period, propelled mostly by on-demand platforms, mobile streaming, and exclusive first-run releases direct to internet channels such as Netflix, Crunchyroll, and Disney+. With binge-watching & simulcasting fused into global audiences, the rise of digital-first anime and algorithm-based content discovery will redefine viewing habits. This segment will open new revenue channels through 2032 while changing the perception of how anime is consumed globally while opening up into emerging markets.

By Genre

Action & Adventure dominated the anime market in 2024 and accounted for a significant revenue share, due to its universal popularity, fast-paced storytelling, and well-known franchises such as Naruto and Demon Slayer. With studios playing the long game via extended sagas and new IPs, and streaming services encouraging dubbed fare, the genre will continue to ride high on the films and games, and merchandise side, cementing its status as the most commercially sustainable anime sub-sector through 2032.

Sci-Fi & Fantasy is the fastest-growing anime genre during the forecast period, bolstered by demand for sci-fi, magical, isekai & fantasy stories among Gen Z and gamers. This sub-genre will also boast expansive world-building, a significant effort to incorporate AI and VR technology, and additional investment into original IPs, everything needed to keep the anime innovation and trans-industry collaboration between gaming, streaming.

Anime Market Regional Outlook:

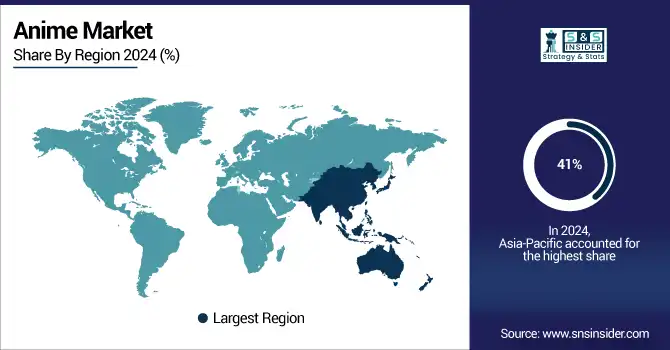

Asia-Pacific dominated the anime market in 2024 and accounted for 41% of revenue share, owing to a strong cultural connection to anime. Japan serves as the dominant production center worldwide, unlike any other country in the world. Japan represents such a huge chunk of anime content creation across top-notch studios and long-standing franchises, not to mention support through government-backed cultural exports. At the same time, mobile-first audiences and powerhouse streaming services in countries such as China, South Korea, and India, as well as rapidly expanding youth populations, are leading to a swift expansion of anime consumption. Meanwhile, regional platforms such as Bilibili, IQIYI, and Muse Asia are also stoking local demands with dubbed and subbed materials. Japanese studios have been doing more co-productions with emerging market studios in Southeast Asia. Supported by better infrastructure, increasing digital literacy, and regional support, Asia-Pacific is set to remain a centre of global anime growth through 2032.

For Instance, Anime Festival Asia drew 145,000 attendees in 2024, up from 130,000 in 2023, highlighting thriving regional fandom

North America is the fastest-growing in anime during the forecast period, driven by the growing streaming access, Gen Z viewership, an increasing number of conventions, and successful localization efforts. Netflix and Crunchyroll are starting to put money into dubbing and co-productions. As cosplay culture grows, more merchandising opportunities emerge, and fans demand immersive experiences, North America will drive global anime growth and innovation

Europe's anime market is growing due to rising streaming penetration, multilingual dubbing, and increased acceptance of Japanese pop culture among Gen Z. Expanding anime festivals and stronger distribution deals with local broadcasters will fuel steady demand across major countries through 2032, especially in digital-first regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major anime market companies are Studio Ghibli, Inc., Toei Animation Co., Ltd., MADHOUSE, Inc., Crunchyroll (Sony Pictures Entertainment Inc.), Kyoto Animation Co., Ltd., Bones Inc., Sunrise, Inc. (Bandai Namco Filmworks), Bioworld Merchandising, Inc., Production I.G, Inc., Discotek Media and others

Recent Developments:

In March 2025, Studio Ghibli released a 4K IMAX restoration of Princess Mononoke, emphasizing its focus on premium theatrical re-releases and cinematic preservation.

In April 2025, Sunrise premiered the original TV anime Maebashi Witches on Tokyo MX, and partnered with Crunchyroll for international licensing and distribution.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 31.9 Billion |

| Market Size by 2032 | US$ 64.4 Billion |

| CAGR | CAGR of 9.18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment) • By Genre (Action & Adventure, Sci-Fi & Fantasy, Romance & Drama, Sports, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Studio Ghibli, Inc., Toei Animation Co., Ltd., MADHOUSE, Inc., Crunchyroll (Sony Pictures Entertainment Inc.), Kyoto Animation Co., Ltd., Bones Inc., Sunrise, Inc. (Bandai Namco Filmworks), Bioworld Merchandising, Inc., Production I.G, Inc., Discotek Media and others in the report |