Automatic Number Plate Recognition (ANPR) System Market Size:

Get more information on Automatic Number Plate Recognition (ANPR) System Market - Request Sample Report

The ANPR System Market Size was valued at USD 3.20 Billion in 2023 and is expected to reach USD 7.00 Billion by 2032, growing at a CAGR of 9.10% over the forecast period 2024-2032.

The automatic number plate recognition (ANPR) system market is witnessing significant growth, primarily driven by the increasing demand for automated surveillance, vehicle tracking systems, and traffic management solutions. The rising need for public safety, crime prevention, and more efficient traffic flow management has led to the widespread adoption of ANPR technology in government and commercial applications. Currently, approximately 80% of police departments worldwide use ANPR technology in either patrol vehicles or fixed locations to identify and track vehicles of interest, showcasing its vital role in law enforcement and security. ANPR is increasingly integrated into urban infrastructure to monitor traffic flow, prevent traffic violations, and aid in criminal activity prevention. With its ability to identify vehicles in real time, ANPR has become essential for toll collection systems, where vehicles are automatically recognized by their plates for seamless toll payments. This process significantly reduces traffic congestion and enhances the efficiency of road networks, making it an invaluable tool for governments and cities aiming to streamline urban transportation systems.

The market is further boosted by the rise of smart city initiatives, which focus on improving public services and urban infrastructure. Currently, 55% of the world’s population resides in urban areas, with projections indicating that this will increase to 68% by 2050. This urban growth drives a higher demand for smart infrastructure to optimize city management, reduce environmental impact, and enhance quality of life. In this context, ANPR plays a pivotal role by providing real-time data that aids in traffic monitoring and management, aligning with the efficiency, safety, and sustainability goals of smart cities.

Automatic Number Plate Recognition System Market Dynamics

Drivers

-

The primary driver of the automatic number plate recognition (ANPR) market is the increasing global demand for security and surveillance solutions.

As security concerns escalate across the globe, both government and private organizations are seeking advanced technologies that can help monitor public spaces and enhance safety. ANPR systems provide real-time data that can be used to track vehicles, identify criminals, and monitor suspicious activities. The technology enables authorities to instantly match vehicle number plates against databases to identify stolen cars, track criminal suspects, or even monitor traffic violations. This demand for enhanced security has led to the growing adoption of the ANPR systems market, particularly in urban areas, as cities strive to improve their surveillance capabilities. Governments are increasingly deploying ANPR systems in public spaces such as highways, parking lots, and border crossings. Law enforcement agencies use ANPR to enhance their crime prevention capabilities, as it can automatically capture and process vehicle license plate numbers, which are then cross-referenced with criminal databases. Additionally, ANPR systems help authorities track the movement of vehicles across regions, thus aiding in the identification of potential threats.

-

Government policies and regulations aimed at enhancing public safety and automating processes are another driver of the ANPR system market.

Governments worldwide are introducing regulations that mandate the use of ANPR for various applications. For example, many countries now require ANPR-based systems for toll collection, traffic monitoring, and enforcement of traffic violations such as speeding and red-light running. In addition to regulatory mandates, government initiatives aimed at improving infrastructure in smart cities have spurred the demand for ANPR systems. Smart cities rely heavily on data-driven technologies to optimize traffic flow, reduce congestion, and ensure public safety. ANPR systems, as part of the broader smart city initiative, provide an efficient way to monitor vehicles and enforce regulations. As governments invest in smart city infrastructure, the adoption of ANPR systems is expected to increase, creating new opportunities for market players. The European Union, for instance, has supported the deployment of intelligent transport systems (ITS) that use ANPR for congestion management, reducing traffic violations, and improving overall transportation efficiency. The implementation of such government-backed projects plays a crucial role in propelling the growth of the ANPR systems market.

Restraints

-

Privacy and data security concerns are a significant restraint for the ANPR systems market.

ANPR systems capture sensitive data, including vehicle number plates, timestamps, and location information, which could be vulnerable to misuse if not properly protected. In many regions, the collection and processing of such data are subject to strict privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe. The implementation of ANPR systems raises concerns about surveillance, especially in public spaces, as they can potentially track individuals' movements without their consent. The risk of unauthorized access to sensitive data or misuse of collected information could lead to privacy violations, creating legal and ethical challenges for organizations deploying ANPR technology. To address these concerns, governments and companies must invest in robust data protection measures and ensure compliance with privacy laws. However, the need for high levels of security adds to the complexity and cost of deploying ANPR systems, which could deter potential users from adopting the technology.

ANPR System Market Segmentation Analysis

by Type

The fixed segment dominated the market in 2023 with a 55% market share. Their stability and higher accuracy in reading number plates in controlled environments make them a preferred choice for applications like surveillance, law enforcement, and traffic management. They can capture plates over long distances with enhanced optical resolution and are often integrated into existing infrastructure. Companies like Vigilant Solutions (a part of Neology) offer fixed ANPR solutions used by law enforcement to track vehicles in real-time.

The portable segment is expected to have the fastest CAGR during 2024-2032. They are typically used in police patrol vehicles or for temporary surveillance at events or traffic stops. Due to their mobility, these systems offer the flexibility to scan number plates in diverse environments. Portable ANPR systems are gaining popularity due to the increasing need for adaptable surveillance solutions in different regions. For example, Genetec offers portable ANPR solutions used by law enforcement agencies for enforcement in mobile units.

by Component

The hardware segment dominated in 2023 with a 50% market share. Cameras with high-resolution sensors are vital for capturing clear images of vehicle plates, while processors handle the image processing and recognition tasks. The demand for efficient, high-quality hardware is driven by the need for reliable, accurate, and fast license plate recognition in applications such as traffic monitoring, security, and toll collection. For example, companies like Vigilo, a provider of traffic enforcement solutions, integrate high-performance hardware components for reliable ANPR functionality in urban traffic management and law enforcement.

The software segment in the ANPR system market is projected to be the fastest-growing from 2024 to 2032. Software solutions are key to image processing, license plate recognition, and database integration. Advanced algorithms and machine learning techniques enhance accuracy, speed, and adaptability, even in complex environments with varying lighting conditions. Companies like Genetec, known for its security and surveillance solutions, utilize sophisticated software to improve the performance of ANPR systems in urban security applications, such as access control for restricted areas and parking enforcement.

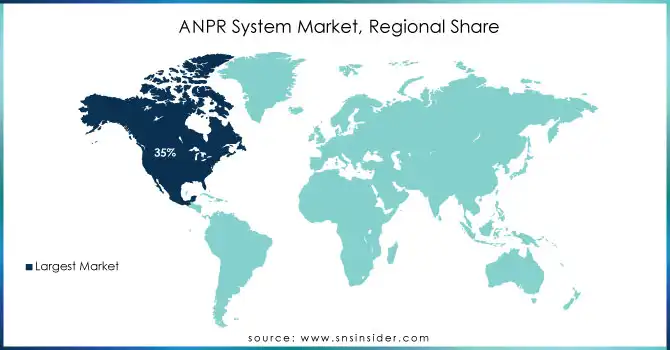

Automatic Number Plate Recognition Market Regional Outlook

North America dominated the market with a 35% market share in 2023. The region has a strong presence of advanced technological infrastructure, along with high demand for traffic management, law enforcement, and security applications. The United States, in particular, leads the market due to its widespread use of ANPR in smart city initiatives, toll collection systems, and surveillance of high-security areas. Companies such as Vigilant Solutions (a major player in the U.S.) are leveraging ANPR systems for law enforcement and public safety. Additionally, Kapsch TrafficCom provides intelligent transportation systems, including ANPR technology, for tolling and traffic monitoring across North America.

APAC is projected to be the fastest-growing region in the ANPR market during the forecast period 2024-2032, fueled by rapid urbanization, increasing adoption of smart city technologies, and growing demand for enhanced security solutions in countries like China, India, and Japan. The region has witnessed a surge in the installation of ANPR systems for traffic monitoring, automated tolling, and vehicle access control. Tattile, an Italian company, has expanded its presence in APAC, offering advanced ANPR solutions to address traffic management and law enforcement needs. In China, Hangzhou Hikvision Digital Technology Co. has made strides in incorporating ANPR into its surveillance cameras for enhanced security and traffic control.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players in the Automatic Number Plate Recognition (ANPR) System Market are:

-

Vigie 360 (Vigie ANPR, Vigie Access Control)

-

Kapsch TrafficCom (ANPR System, ANPR LPR Camera)

-

Genetec (AutoVu, AutoVu SharpV)

-

Neology (ANPR System, SecureFleet)

-

Bosch Security Systems (Bosch ANPR Camera, Security Camera Systems)

-

ARH Inc. (Carmen, Mobile ANPR)

-

Zebra Medical Vision (ANPR Software, Z-Med Imaging Platform)

-

LILIN (ANPR Camera, Video Surveillance System)

-

Siemens Mobility (Traffic Monitoring System, ANPR LPR Camera)

-

Tattile (Tattile ANPR Camera, Tattile Sensity)

-

SAMSUNG Techwin (Wisenet ANPR Camera, Wisenet Video Analytics)

-

Flir Systems (Flir TrafiCam, Flir Systems ANPR)

-

Fujitsu (Fujitsu ANPR Solution, Traffic Management System)

-

Vivotek (IP Camera with ANPR, Vivotek LPR Solution)

-

Q-Free (Q-Free LPR, Urban Traffic Management)

-

3M (3M ANPR System, 3M Traffic Camera System)

-

Vaysham (Vaysham ANPR Camera, Vaysham Vehicle Detection)

-

Camera Matics (Camera Matics ANPR, Fleet Tracking System)

-

PlateSmart (PlateSmart ARES, ARES Analytics)

-

Ubiq Mobile (Ubiq ANPR, Vehicle Recognition)

Recent Developments

-

April 2023: Kapsch TrafficCom launched a significant update for its Automatic Number Plate Recognition (ANPR) software. The update enables optimal performance in automatically identifying number plates, based on the specific usage.

-

March 2023: AutoVuTM SharpOS 14.1.0 launched by Genetec, provides operators with additional vehicle data from their ALPR systems, helping them enhance efficiency in their daily duties.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.20 Billion |

| Market Size by 2032 | USD 7.00 Billion |

| CAGR | CAGR of 9.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed, Portable) • By Component (Hardware, Software, Service) • By Application (Security & Surveillance, Toll Management, Parking Management, Traffic Management, Others) • By End User (Government, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vigie 360, Kapsch TrafficCom, Genetec, Neology, Bosch Security Systems, ARH Inc., Zebra Medical Vision, LILIN, Siemens Mobility, Tattile, SAMSUNG Techwin, Flir Systems, Fujitsu, Vivotek, Q-Free, 3M, Vaysham, Camera Matics, PlateSmart, Ubiq Mobile |

| Key Drivers | • The primary driver of the automatic number plate recognition (ANPR) market is the increasing global demand for security and surveillance solutions. • Government policies and regulations aimed at enhancing public safety and automating processes are another driver of the ANPR system market. |

| RESTRAINTS | • Privacy and data security concerns are a significant restraint for the ANPR systems market. |