AUTOMATIC NUMBER PLATE RECOGNITION (ANPR) SYSTEM MARKET REPORT SCOPE & OVERVIEW

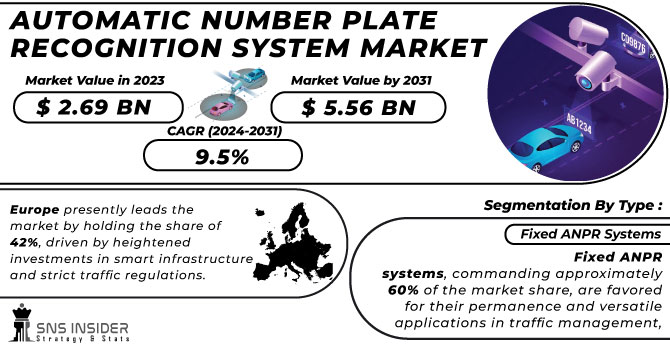

Automatic Number Plate Recognition (ANPR) System Market Size was valued at USD 3.17 Billion in 2023 and is expected to reach USD 6.96 Billion by 2032 and grow at a CAGR of 9.15% over the forecast period 2024-2032.

Get More Information on Automatic Number Plate Recognition System Market - Request Sample Report

The Automatic Number Plate Recognition (ANPR) System market is experiencing rapid growth because of increased global demand for intelligent traffic management and security systems. In 2023 and 2024, nations such as Japan, China, USA, France, Germany, and India have been at the forefront in implementing ANPR systems to improve road safety and strengthen law enforcement. For example, the Indian government is deploying ANPR systems in urban areas under its Smart Cities Mission for automatic traffic rule enforcement. As of late 2023, 6,271 projects worth ₹1.16 lakh crore have been completed under this mission. The USA and Germany are also adopting ANPR technology for border security and toll management systems.

Recent technological advancements like AI-powered image recognition and cloud-based ANPR solutions significantly improved accuracy and scalability. In 2023, Japan released a high-end ANPR system with both IoT and 5G capabilities, enabling real-time monitoring and paving the future of the product. The expansion of smart city initiatives and urban sustainability development in governments provides tremendous growth opportunities for ANPR system adoption. This has increased interest in decreasing vehicle theft and the implementation of more efficient parking management systems, thus growing the potential in this market. Industry players are now cooperating to ensure data privacy, among other challenges, in compliance with regional regulations.

MARKET DYNAMICS

KEY DRIVERS:

-

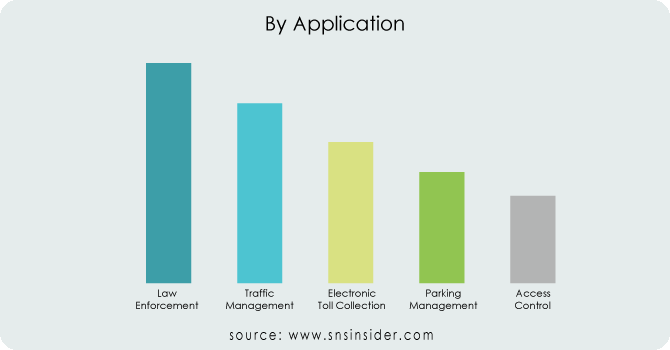

Governments around the world are implementing ANPR to manage traffic efficiently.

Smart traffic management is becoming the foundation of city infrastructure as cities strive to deal with rising vehicle numbers. Automatic Number Plate Recognition (ANPR) System are critical for reducing congestion and enforcing traffic laws because they can automatically identify any vehicles violating regulations. For instance, the French government has reported an increase of 27% in the issuance of penalties through automated Automatic Number Plate Recognition systems in 2023, which proves it to be effective. Besides, integrating Automatic Number Plate Recognition in toll collection systems has simplified the process and more than 40% of toll plazas in China use ANPR technology. The push toward smart cities and real-time traffic data collection further drives demand for Automatic Number Plate Recognition systems globally.

-

Automatic Number Plate Recognition helps the police keep track of and identify suspect cars.

The growing rate at which crimes are committed that involve vehicles has increased demand for Automatic Number Plate Recognition systems. Governments are adopting these systems to monitor public spaces and discover unauthorized or stolen vehicles. For example, Automatic Number Plate Recognition technology allowed the Japanese government to trace more than 1,200 stolen vehicles in 2023. The connectivity of this system with national databases will ensure alerts in real-time and thus add to security. With rising urbanization, public safety concerns are also compelling investment in Automatic Number Plate Recognition technologies in India and the USA, where security applications form more than 35% of deployment in those regions.

RESTRAIN:

-

High-end hardware and infrastructure restrict the use of ANPR systems in developing countries.

The Automatic Number Plate Recognition system requires significant investment in high-resolution cameras, robust software, and supporting infrastructure. This makes it very expensive to deploy Automatic Number Plate Recognition systems at a large scale, especially in developing countries. For instance, a standard Automatic Number Plate Recognition camera costs around USD 10,000, not considering installation and maintenance costs. Governments in developing countries like India face budgetary constraints, which slows down large-scale deployment. In addition, these systems require periodic updates and integration with other databases, which increases costs. Despite initial reductions in operational costs, the front-end investment is still the largest barrier to market entry. To break through this, industry players are researching cheaper, scalable models for developing markets.

KEY MARKET SEGMENTS

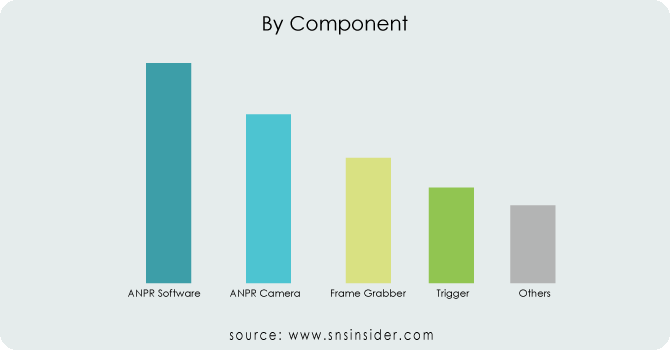

BY COMPONENT

In 2023, the Hardware segment dominated the market with a share of 73.64%. This is because high-resolution cameras and sensors are necessary for capturing clear images of vehicles. Advances in hardware, such as night vision and weather-resistant designs, increase demand.

The Software segment is expected to grow with the fastest CAGR of 9.51% during the forecast period from 2024 to 2032. Enhanced algorithms, cloud computing, and artificial intelligence boost the adoption of software for real-time data processing and analytics. The governments are increasingly investing in AI-driven software for improving recognition accuracy and efficiency in systems. Both hardware and software developments together bring forth a robust and scalable Automatic Number Plate Recognition system for varied application needs, such as traffic management to surveillance.

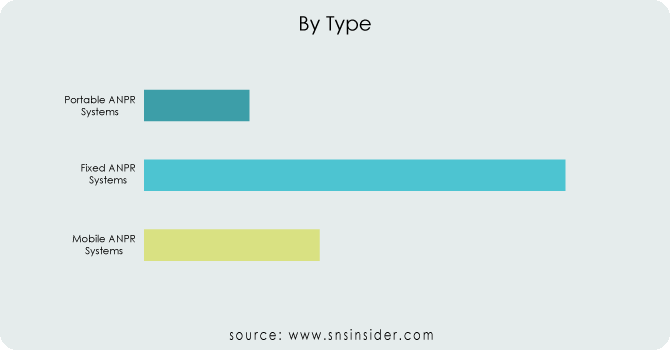

BY TYPE

In 2023, Mobile ANPR systems segment held the largest share, with 52.33% market share, owing to its flexibility and integration into law enforcement vehicles. These systems are highly effective for patrolling and real-time monitoring, gaining traction in regions like the USA and Europe.

Portable ANPR systems segment, on the other hand, are projected to grow with the fastest CAGR of 9.60% during the forecast period 2024–2032. Their ease of deployment and cost-effectiveness make them ideal for temporary installations, such as event security or construction zones. Fixed systems are still an integral part of toll management and smart city infrastructure and are continuously monitored. Technological advancements will continue to advance Automatic Number Plate Recognition systems in terms of efficiency and adaptability in various environments.

Get Customized Report as per your Business Requirement - Request For Customized Report

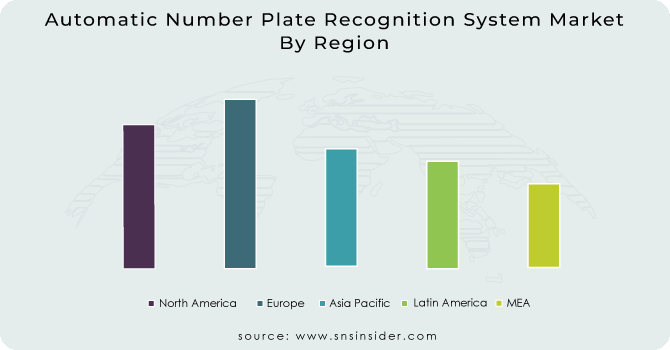

REGIONAL ANALYSIS

Asia Pacific region was the most dominant in 2023, accounting for 32.48% of the market share, due to strong infrastructure projects and government-led smart city initiatives in countries such as China and India. These regions are experiencing rapid urbanization, thus requiring advanced traffic management solutions.

Europe region is likely to see the fastest growth at a compound annual growth rate of 9.47% during 2024–2032 due to stringent vehicle emission norms and increasing investments in surveillance systems. The USA is another prominent country adopting Automatic Number Plate Recognition for border security and crime control. The growth of the market can be seen as an initiative of collaborations between the industries and governments in these geographies.

KEY PLAYERS

Some of the major players in the Automatic Number Plate Recognition (ANPR) System Market are

-

Kapsch TrafficCom (ANPR Cameras, Toll Collection Systems)

-

Genetec (Security Center AutoVu, Cloud-based ANPR Software)

-

Siemens Mobility (ANPR Hardware Solutions, Smart Traffic Systems)

-

Conduent (Parking Management Systems, Tolling Services)

-

Hikvision (Intelligent ANPR Cameras, Video Surveillance Solutions)

-

Bosch Security Systems (License Plate Cameras, AI-based ANPR Software)

-

Jenoptik (Traffic Law Enforcement Systems, Traffic Cameras)

-

Neology (RFID Solutions, Automated Toll Systems)

-

Tattile (Smart ANPR Cameras, Traffic Monitoring Systems)

-

PIPS Technology (Mobile ANPR Systems, Integrated Data Management Tools)

-

Elsag North America (Fixed ANPR Cameras, Mobile Plate Hunter Systems)

-

Axis Communications (Network Cameras, Edge-based ANPR Software)

-

TagMaster (RFID Solutions, ANPR Sensors)

-

Digital Recognition Systems (Vehicle Recognition Software, ANPR Cameras)

-

Leonardo (Traffic Surveillance Systems, Border Control Solutions)

-

Adaptive Recognition (Automatic Plate Readers, Intelligent Analytics Tools)

-

Vigilant Solutions (LEARN Cloud Platform, Mobile ANPR Systems)

-

Q-Free (Tolling Solutions, Traffic Management Systems)

-

Parkopedia (Parking Data Solutions, ANPR-based Access Control Systems)

-

ARH Inc. (High-Resolution ANPR Cameras, Intelligent Vehicle Identification Systems)

MAJOR SUPPLIERS (Components, Technologies)

-

Sony Corporation (Image Sensors, Camera Components)

-

NVIDIA (AI Processors, GPUs)

-

Intel (Processors, IoT Platforms)

-

Ambarella (Video Processing Chips, AI-based SoCs)

-

ON Semiconductor (Image Sensors, Power Management ICs)

-

Analog Devices (Signal Processing Components, Power ICs)

-

Texas Instruments (Microcontrollers, Power Management ICs)

-

Broadcom (Networking Components, Connectivity Solutions)

-

Samsung Electronics (Memory Chips, Processing Units)

-

LG Innotek (Optical Modules, Camera Modules)

MAJOR CLIENTS

-

National Highway Authorities (e.g., USA, India)

-

Municipal Traffic Departments

-

Airport Authorities

-

Smart City Administrations

-

Toll Road Operators

-

Police Departments

-

Commercial Parking Operators

-

Logistics Companies

-

Retail Chains

-

Public Transport Authorities

Siemens (Germany)-Company Financial Analysis

RECENT TRENDS

April 2023: Kapsch TrafficCom has recently published a major update to its ANPR software. With the new version, top performance is possible in the automatic recognition of number plates, depending on the application. This latest release includes a totally reworked architecture that contains numerous deep learning elements, hence significantly improving performance. Hundreds of thousands of images were used in the training of an artificial intelligence software that was later employed in the identification of number plates with new ANPR software in a GDPR-compliant manner.

October 2023: Hikvision India released its Latest Multilane ANPR Cameras and ANPR Cameras with in-built Radar at TrafficInfraTech. The keynote features of the exhibition are latest Transportation Security Systems, intelligent traffic management solutions with a multilane 3D Radar with detection range up to 150 meters. Hikvision India took part in the 11th edition of TrafficInfraTech Expo 2023 with the latest technologies, products, and solutions meant for India's fastgrowing transportation sector.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 3.17 Billion |

|

Market Size by 2032 |

US$ 6.96 Billion |

|

CAGR |

CAGR of 9.15% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Fixed ANPR Systems, Portable ANPR Systems, Mobile ANPR Systems), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Kapsch TrafficCom, Genetec, Siemens Mobility, Conduent, Hikvision, Bosch Security Systems, Jenoptik, Neology, Tattile, PIPS Technology, Elsag North America, Axis Communications, TagMaster, Digital Recognition Systems, Leonardo, Adaptive Recognition, Vigilant Solutions, Q-Free, Parkopedia, ARH Inc. |

|

Key Drivers |

• Governments around the world are implementing ANPR to manage traffic efficiently. |

|

Restraints |

• High-end hardware and infrastructure restrict the use of ANPR systems in developing countries. |