Anti-jamming Market Size & Growth Drivers:

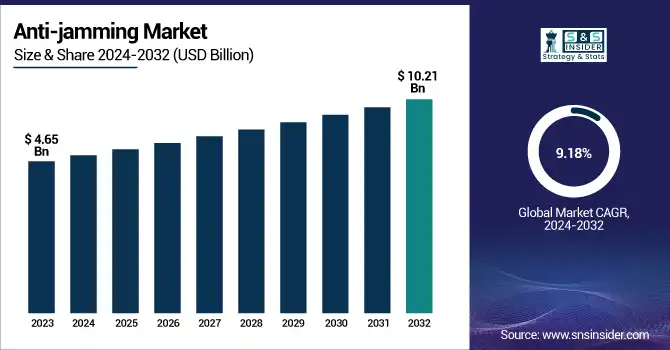

The Anti-jamming Market Size was valued at USD 4.65 Billion in 2023 and is expected to reach USD 10.21 Billion by 2032 and grow at a CAGR of 9.18% over the forecast period 2024-2032. The need for secure and uninterrupted navigation in military, commercial, and civilian sectors is one of the key factors in accelerating the adoption and deployment of the Anti-jamming Market. Critical performance/reliability metrics are signal quality, anti-jam performance, and system availability over jamming ensuring resilient performance under all interference scenarios.

Since anti-jamming measures must be operated at scale and ready for integration into many platforms, criteria such as operational metrics encompassing power consumption, integration time, and working environment must be included to evaluate the efficacy of anti-jamming measures. Sometimes referred to as Technical and engineering metrics, these factors, such as signal suppression efficiency, error rates, and adaptive filtering capabilities, are valued for their importance in not only evaluating the capabilities of a given technology but also for how well it can both defeat present forms of jamming and future threats fine-tuned to penetrate the best anti-jamming technologies available.

To Get more information on Anti-jamming Market - Request Free Sample Report

Anti-jamming Market Dynamics

Key Drivers:

-

Surge in Military and Commercial Operations Drives Growth of Anti-Jamming Technologies for Secure Navigation

Military and commercial operations are driving this explosive growth in both military and commercial operations anti-jamming market as concerns about security increases. Frequent interruptions of GPS signals, especially in defense systems, are propelling the need for strong anti-jamming solutions. With the wider usage of UAVs, unmanned ground vehicles (UGVs), and missile guidance systems, the increased competition has made the adverse effect of jamming a relevant factor, thereby energizing the development of anti-jamming technologies. Also boosting market growth is the increasing demand for satellite-based navigation systems for commercial and military customers. The development of wireless communication technologies, coupled with embedding anti-jamming mechanisms in autonomous vehicles and smart transportation systems, is growing as well, driving market growth.

Restrain:

-

Challenges in Overcoming Sophisticated Jamming Techniques and Integrating Anti-Jamming Solutions into Legacy Systems

The growing sophistication of jamming methods is one of the major hurdles to the expansion of the anti-jamming industry. This dynamic can oftentimes leave traditional anti-jamming solutions helpless, as those measures cannot always identify lie signals from real signals, and advanced jamming systems can replicate actual GPS signals. This presents a particular danger in defense and aerospace applications, where precision can mean life or death. Third, integrating anti-jamming solutions with existing systems can be a non-trivial technical challenge, often requiring re-engineering of hardware and software architectures. Factories relying on legacy systems may face compatibility issues, widening the adoption gap when compared to other sectors dependent on more advanced navigation technologies.

Opportunity:

-

Rising Investments and Growing Demand in Commercial Applications Drive Opportunities for Anti-Jamming Market Growth

The market opportunities are becoming apparent through the rising investments in defense modernization programs across nations. An increase in Anti-Jamming Demand for Different Commercial Applications Such as Marine Navigation, Agriculture, and Surveying Provides a Magnific Growth Opportunity In addition, miniaturized and low-cost anti-jamming devices provide an abundance of opportunities for market players to diversify their product offerings. Because of the increasing dependence on GPS-based services worldwide, the industry that aims to secure communication networks from cyberattacks, as well as signal interference, is anticipated to experience the most meaningful growth.

Challenges:

-

Cybersecurity Challenges and Need for Technological Advancements in Anti-Jamming Solutions to Secure Communication Networks

Cyber Security is another big challenge these days as cyberattacks aimed at satellite communication systems are growing. The proliferation of GNSS-dependent systems across industries also means they are increasingly susceptible to spoofing and jamming attacks. A need for constant technological advancement for the detection and mitigation of these threats in real-time. In addition, employing and maintaining high-end anti-jamming systems is not an easy task that requires experienced specialized personnel, as well. Implementation of these solutions on a wider scale would also require the standardization of anti-jamming protocols across regions–a task that current solutions would act to hinder rather than promote. Solving these obstacles in terms of signal processing algorithms, filtering techniques, and system integration is still necessary and is related to secure communication networks.

Anti-jamming Market Segments Analysis

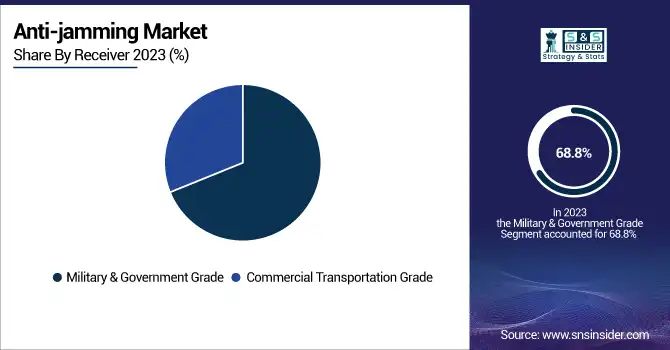

By Receiver

The Military & Government Grade segment held the largest share in 2023, with a share of 68.8% of the anti-jamming market. The segment will continue to dominate owing to the high adoption of anti-jamming solutions in military aircraft, missile guidance systems, and defense communication networks. The demand for advanced anti-jamming technologies in the military sector is also due to the increasing geopolitical tensions and growing investments in defense modernization programs.

The Commercial Transportation Grade segment is expected to grow the fastest CAGR from 2024 to 2032. The growth of this segment can be attributed to the increasing adoption of GPS-based navigation systems over the globe in autonomous cars, marine transport, and commercial flight. With growing adoption of satellite-based position, navigation, and timing for streamlined transportation route planning and fleet management, the need for anti-jamming equipment to maintain signal integrity and prevent signal interference is anticipated to increase.

By Technique

The anti-jamming market is mainly characterized in the form of the nulling technique, in 2023 nulling technique accounted for around 42.6% of the total market. The reason for this dominance is its better ability to detect and suppress interference signals effectively. Nulling is incredibly popular amongst military and defense applications, requiring secure and line-of-sight communication to ensure mission success. In high-threat environments, its ability to adaptively change signal waveforms to counter jamming sources makes it a popular solution.

The civilian Technique segment is expected to grow at the fastest CAGR between 2024 and 2032. The rise in the market is due to the growing demand for anti-jamming solutions in the commercial arena which includes agriculture, surveying, and autonomous vehicles. The growing dependency of industries on GPS-based services is prioritizing the security of navigation systems from potential interference, which is ultimately driving the growth of this segment.

By Application

The Position, Navigation, and Timing segment of the anti-jamming market accounted for 28.6% of the total anti-jamming market share in 2023. PNT systems play an essential role in location service provision, time synchronization, and secure data transfer, which is the key growth reason for this segment. With rising installations of GPS-based systems for mission-critical operations and emergency response, this segment witnessed a consistent market penetration.

The Flight Control is estimated to achieve the fastest growth rate from 2024 to 2032. The increasing investments in advanced-generation aircraft systems with features that ensure secure flight navigation and control are supporting this growth. With this technological expansion of the UAV and other next-gen aviation solutions, the requirement for innovative anti-jam solutions for safe and accurate flight operations is expected to enter an exponential growth curve.

By End Use

The Military segment led the anti-jamming market in 2023 with a market share of 67.8%. Such high presence has been attributed to the large-scale implementation of anti-jamming solutions in defense applications such as military aircraft, missile guidance, and secure communication systems. The rising menace of electronic warfare, alongside the need for foolproof, tamper-proof GPS signals in critical operations, has pushed up the deployment of advanced anti-jamming technologies in this segment.

Civilians are expected to grow at the fastest rate between 2024 and 2032 The growth is driven by the growing adoption of GPS-based systems for commercial applications including autonomous vehicles, precision agriculture, and marine navigation. The growing civilian demand for secure navigation and communication systems coupled with the need for cost-effective anti-jamming solutions and efficient anti-jam performance will drive this market during this period.

Anti-jamming Market Regional Outlook

North America held the largest shares of the Anti-jamming market, at 33.6% of the total market in 2023. The preeminence is due to high investments in defense modernization programs, especially in the U.S. For secure military communication, missile guidance systems, and UAV operations, the U.S. Department of Defense (DoD) extensively uses advanced anti-jamming solutions. As an example, the new U.S. Air Force. GPS II satellites come with sophisticated anti-jamming systems to increase navigation security. Further, the presence of leading companies, such as Raytheon Technologies, Lockheed Martin, and BAE Systems, continually developing breakthrough anti-jamming technologies will continue to supplement the regional market growth over the projected period.

In Asia Pacific, it is estimated to exhibit the fastest CAGR during 2024 – 2032 owing to increasing defense and commercial infrastructure investments. Moreover, nations such as China, India, and Japan are investing more in state-of-the-art navigation systems to enhance military operations and smart transportation networks. China's BeiDou Navigation Satellite System (BDS) offers a prominent example, incorporating anti-jamming capabilities to enhance both the accuracy and safety of its signals. The growth of the region is also being driven by aviation safety improvements from India such as the GPS-Aided Geo Augmented Navigation (GAGAN) system.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Anti-jamming Market are:

-

Raytheon Technologies (GPS Anti-Jam System)

-

Lockheed Martin Corporation (GPS Spatial Temporal Anti-Jam Receiver)

-

BAE Systems (NavStorm-G)

-

L3Harris Technologies (Harris Rockwell Collins GPSDome)

-

Northrop Grumman Corporation (M-Code GPS Receivers)

-

Thales Group (TopShield Anti-Jamming Solutions)

-

Cobham Limited (Anti-Jam GPS Antenna)

-

Israel Aerospace Industries (IAI) (ADA GPS Anti-Jamming System)

-

NovAtel Inc. (GAJT-710ML)

-

u-blox AG (u-blox F9 Platform)

-

Chemring Group PLC (Resolve Electronic Countermeasure System)

-

Forsberg Services Ltd (StarLink Anti-Jam Solutions)

-

Mayflower Communications (NavGuard 710)

-

Trimble Inc. (RES720 GNSS Anti-Jamming System)

-

Tualcom (TUALAJ Anti-Jamming System)

Recent Trends

-

In December 2024, Lockheed Martin successfully launched its seventh GPS III satellite, enhancing the U.S. Space Force’s constellation with improved accuracy, anti-jamming capabilities, and rapid deployment features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.65 Billion |

| Market Size by 2032 | USD 10.21 Billion |

| CAGR | CAGR of 9.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Receiver (Military & Government Grade, Commercial Transportation Grade) • By Technique (Nulling Technique, Beam Steering Technique, Civilian Technique) • By Application (Flight Control, Surveillance and Reconnaissance, Position, Navigation, and Timing, Targeting, Casualty Evacuation, Other Applications) • By End Use (Military, Civilian) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Raytheon Technologies, Lockheed Martin Corporation, BAE Systems, L3Harris Technologies, Northrop Grumman Corporation, Thales Group, Cobham Limited, Israel Aerospace Industries (IAI), NovAtel Inc., u-blox AG, Chemring Group PLC, Forsberg Services Ltd, Mayflower Communications, Trimble Inc., Tualcom. |