Satellite Navigation System Market Report Scope & Overview:

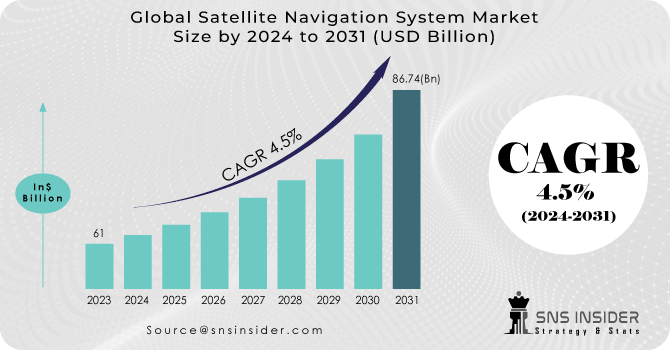

The Satellite Navigation System Market size amounted to USD 61 Billion in 2023 & is estimated to reach USD 86.74 Billion by 2031 with a growing compound annual growth rate (CAGR) of 4.5% between 2024 and 2031.

The explosive growth of the electronic sector, because of the widespread usage of smartphones and other digitalized applications, is expected to generate profitable chances for major PT apps. The shifting trend in sophisticated smartphones, according to Bankmycell, is contingent on the need for 5G-capable infrastructure. The introduction of 5G technology, smartphone firms, and technical improvement in other 5G applications focus on enhancing internet speed by raising performance and developing hardware capabilities by incorporating multi-frequency advantages. The primary use of satellite navigation was established and built for military applications in order to attain the best accuracy in critical missions. These significant breakthroughs are projected to boost demand for navigation satellites in the future years.

To get more information on Satellite Navigation System Market - Request Free Sample Report

Because of the growing demand for real-time information in a variety of applications ranging from automotive to autonomous robotics, navigation systems are becoming more frequently used across the world. With technical improvement, these systems have altered and provided a variety of services and navigation facilities, resulting in a significant service ecosystem centred on navigation technology. They have numerous diverse applications aside from identifying the position or direction of vehicles. They assist in receiving weather alerts, tracking goods and shipments, improving traffic flow, and so forth. Furthermore, these technologies are employed in a variety of sophisticated applications to enable smart environments.

GPS systems are used in a variety of industries, including mining, aviation, surveying, agriculture, marine, and military applications. In recent years, increased worldwide commerce and marine traffic have boosted the market's rise. Furthermore, governments throughout the world have made major investments in navigation systems across a variety of industrial verticals. The increasing expansion and defence expenditure in the aviation sector is predicted to drive navigation system market growth over the forecast period. However, high installation prices and strict safety standards are stifling business expansion. Nonetheless, overcoming such obstacles will centre on the introduction of new technical advancements.

The arrival of the twenty-first century brought with it digitalization, a massive technical progress source that aided in digital diversification and the growth of numerous Satellite Navigation System Market-enabled solutions and services. With strong demand for trustworthy Positioning, Navigation, and Time-sync (PT) services and growing consumer-induced cost-effectiveness, navigation satellite and receiver suppliers have prioritised delivering a better user experience for the future. To acquire traction for improved user experience, the importance of interoperability of multiple navigation satellite systems, system providers' acceptance of open compatible frequency band signals, and widespread usage of multi-constellation-based Satellite Navigation System Market receivers.

MARKET DYNAMICS

DRIVERS:

-

The transportation and logistics industry heavily relies on satellite navigation systems for fleet management.

-

Growing Demand for Location-Based Services (LBS) is the driver of the Satellite Navigation System Market.

The increasing use of smartphones and other mobile devices led to a higher demand for location-based services such as navigation, mapping, and geotagging. Satellite navigation systems, such as GPS (Global Positioning System), became integral to delivering accurate location information for these services.

RESTRAIN:

-

Satellite navigation systems depend on satellite constellations, ground stations, and supporting infrastructure.

-

Signal Interference and Jamming is the restraint of the Satellite Navigation System Market.

Satellite navigation systems like GPS are susceptible to signal interference, intentional jamming, and unintentional signal blockage caused by factors such as tall buildings, natural terrain, or electronic warfare tactics. These issues can degrade the accuracy and reliability of navigation systems.

OPPORTUNITY:

-

The Internet of Things (IoT) trend offers opportunities to integrate satellite navigation systems with various connected devices and sensors.

-

Emerging Applications are an opportunity for the Satellite Navigation System Market.

The expansion of satellite navigation technology beyond traditional uses, such as navigation and mapping, into new applications like augmented reality (AR), virtual reality (VR), geolocation-based gaming, and location-based advertising, presents significant growth potential.

CHALLENGES:

-

The operation of satellite navigation systems can be subject to regulations and legal challenges in different countries.

-

Signal Interference and Jamming is the challenges of the Satellite Navigation System Market.

Satellite navigation systems, such as GPS, are susceptible to signal interference, intentional jamming, and unintentional signal blockage caused by factors like tall buildings, natural terrain, or electronic warfare tactics. These issues can disrupt the accuracy and reliability of navigation systems.

IMPACT OF RUSSIA-UKRAINE WAR

There is no satellite fleet in Ukraine. However, it has profited immensely not just from an unparalleled number of weapons and military equipment given by the US, but also from an unprecedented amount of information, including real-time data on Russian army movements. Up to 90% of the electronics used in the next generation GLONASS K-1 satellites are imported, as they must be resistant to space radiation, which may swiftly damage delicate equipment. Russia attempted to develop and manufacture replacement parts at home, but the result was a satellite that was twice as hefty as earlier models and has yet to be deployed into orbit. Half of the GLONASS satellites might fail at any time. Around 18 units are required for typical coverage of Russia's area.

IMPACT OF ONGOING RECESSION

The UK space sector is a success story in the UK, rising in real terms by roughly 9% per year since 2021/22, which is more than three times faster than the whole economy. And it has the potential to grow even faster over the next decade as new technologies. Technological gains made possible by R&D expenditure in the space industry can be passed to enterprises in other industries via spillover effects. Spillover effects are significant, with R&D investment in the aerospace sector producing a social return of over 74%. Every $120 million invested in R&D leads to a $80 million rise in GDP over time. On this premise, estimate that the space sector contributes $950 million in GDP per year owing to the spillover effects of its R&D, in addition to the $5.6 billion in direct and multiplier benefits. In the ongoing recession, the satellite navigation system market is grain profit up to 4-5%.

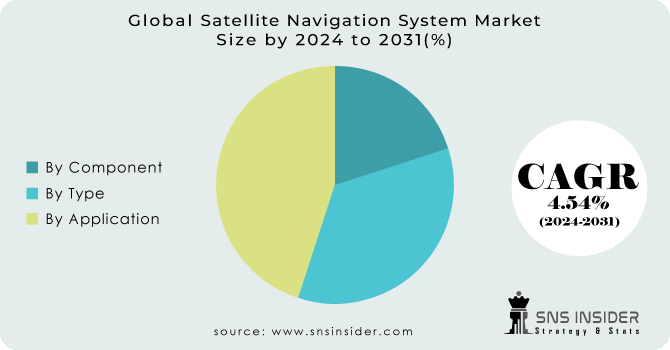

KEY MARKET SEGMENTATION

By Component

-

Services

-

Devices

By Type

-

Regional Constellations

-

Satellite-based Augmentation Systems

-

Global Constellations

By Application

-

Road and Automotive

-

Consumer and Health Solutions

-

Others

Need any customization research on Satellite Navigation System Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: During the predicted period, North America is expected to increase at a substantial CAR. The United States superiority is due to the multi-sensor data capture technology for track mapping, which is widely employed in the country. Driver Advisory System (DAS) is widely used in rail applications in Mexico and Canada to optimise traffic flow, use less energy, and save costs, which is expected to increase the market in North America.

Asia Pacific: The Asia Pacific worldwide navigation satellite systems market is expected to develop at the quickest CAGR during the forecast period. Primary revenue growth is supported by India, Japan, China, and Australia. The vast number of customers in China has been linked to the considerable rise in positioning devices, cell phones, electronic gadgets, and other critical applications. India has made significant progress in navigation satellites such as NAVIC. It was created for essential applications such as marine, aviation, and automotive.

KEY PLAYERS

The major Players are Texas Instrument Inc., Qualcomm Inc., Trimble Inc., Broadcom Inc., Rockwell Collins, Furuno Electric Co. Ltd., Hexagon AB, Cobham Plc., Laird Plc., L3Harris Corporation and other players.

Texas Instrument Inc-Company Financial Analysis

RECENT DEVELOPMENT

In 2023: Inertial Labs announced the release of an updated version of the "INS-U" GPS-assisted Inertial Navigation System. This upgraded INS-U version can deliver fused (GNSS + IMU) NMEA data to the Pixhawk autopilot, allowing the Pixhawk autopilot to guide the UAV for extended periods of time (more than an hour) under GNSS-denied circumstances.

In 2022: Airbus revealed that ILS (Instrument Landing System) has been installed into its aircraft. The newly certified cockpit avionics function, a satellite-based/augmented landing system (SLS), will be available as a line-fit and retrofit option for A320 and A330 operators.

In 2021: NigComSat, Geoflex, ASECNA, and Thales Alenia Space are working together to accelerate the development of A-SBAS for the delivery of precise point positioning (NES/Geoflux and PPP) & risk warnings for a variety of African applications.

| Report Attributes | Details |

| Market Size in 2023 | US$ 61 Bn |

| Market Size by 2031 | US$ 86.74 Bn |

| CAGR | CAGR of 4.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Devices) • By Type (Regional Constellations, Satellite-based Augmentation Systems, Global Constellations,) • By Application (Road and Automotive, Consumer and Health Solutions, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Texas Instrument Inc., Qualcomm Inc., Trimble Inc., Broadcom Inc., Rockwell Collins, Furuno Electric Co. Ltd., Hexagon AB, Cobham Plc., Laird Plc., L3Harris Corporation |

| Key Drivers | • The transportation and logistics industry heavily relies on satellite navigation systems for fleet management. • Growing Demand for Location-Based Services (LBS) is the driver of the Satellite Navigation System Market. |

| Market Restraints | • Satellite navigation systems depend on satellite constellations, ground stations, and supporting infrastructure. • Signal Interference and Jamming is the restraint of the Satellite Navigation System Market. |