Autonomous Cars Market Size & Overview:

Get More Information on Autonomous Cars Market - Request Sample Report

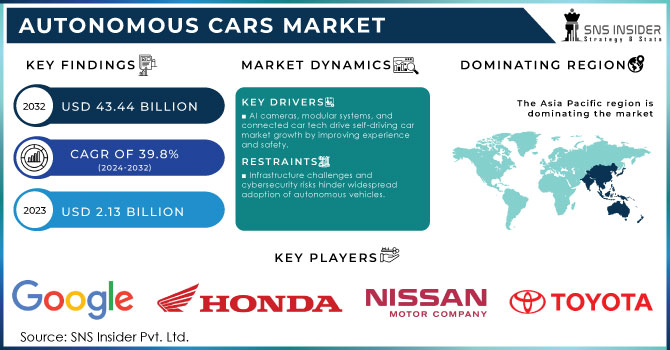

The Autonomous Cars Market Size was valued at USD 2.13 billion in 2023 and is expected to reach USD 43.44 billion by 2032 and grow at a CAGR of 39.8% over the forecast period 2024-2032.

Autonomous vehicles, also known as self-driving cars, utilize a combination of sensors and artificial intelligence to navigate and operate without human input. These cars utilize LiDAR, RADAR, and cameras to make a 3D outline of their environment and utilize this data to perform tasks like situational analysis, motion planning, and trajectory control. It has found that over 90% of street accidents include human error. Autonomous vehicles eliminate this risk by depending on advanced sensors and computers to make choices. Not at all like human drivers, they do not get diverted, intoxicated, or exhausted. This continuous and objective perception of the environment permits them to respond much quicker and avoid situations that might lead to accidents. As autonomous vehicle technology develops, it has the potential to drastically reduces crashes, driving to more secure roads for everyone. This potential for expanded security is a major driving force behind the advancement and adoption of autonomous vehicles. In expansion to security benefits, autonomous vehicles also offer advantages like reduced traffic blockage and emissions due to more efficient operation. These variables, combined with the safety improvements, are driving major automakers and tech companies to invest heavily in autonomous vehicle development.

MARKET DYNAMICS:

KEY DRIVERS:

-

AI cameras, modular systems, and connected car tech drive self-driving car market growth by improving experience and safety.

The Advanced technology is fueling the growth of self-driving cars. AI-powered camera systems provide a smoother ride and ensure passenger safety. Modular self-driving systems, where carmakers can choose the tech they integrate, are crucial for wider adoption. These advancements entice consumers. Additionally, the development of dynamic mobility apps and connected car technologies are key drivers, making self-driving cars an increasingly attractive option.

-

Self-driving cars promise cheaper rides, fewer accidents, and lower emissions.

RESTRAINTS:

-

Infrastructure challenges and cybersecurity risks hinder widespread adoption of autonomous vehicles.

The problems are still there, despite Autonomous Vehicle promises to improve road safety through AI powered decision making. Poor infrastructure in both developed and developing nations can confuse a self-driving car's sensors. Additionally, the heavy reliance on data collection for vehicle improvement creates a vulnerability. Cyberattacks exploiting security weaknesses could potentially disrupt vehicle operations and endanger passenger safety.

OPPORTUNITIES:

-

Development of self-driving trucks can revolutionize logistics by optimizing delivery routes and reducing transportation costs.

-

Advancements in mapping technology can unlock the potential for autonomous vehicles in complex urban environments, expanding their reach.

CHALLENGES:

-

Limited sensor effectiveness in poor weather or complex road environments can hinder a self-driving car's ability to navigate safely.

-

High costs for development, manufacturing, and integrating advanced sensor and AI technologies remain a barrier to mass adoption.

KEY MARKET SEGMENTS:

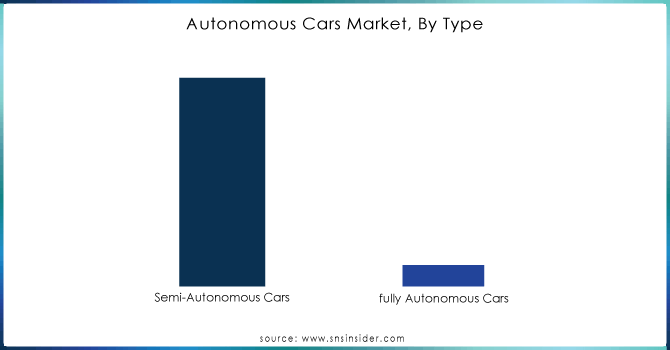

By Type:

Semi-Autonomous Cars is the dominating sub-segment in the autonomous cars market by type holding around 95% of market share due to their lower development costs. Sophisticated sensors and AI systems aren't required to the same extent as fully autonomous cars, making them more readily available at a consumer-friendly price point. The regulatory landscape for fully autonomous vehicles is still under construction, whereas semi-autonomous features already have established guidelines.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Autonomy Level:

Level 2 Autonomy is the dominating sub-segment in the autonomous cars market by autonomy level holding around 70% of market share. Level 2 features are well-developed and readily available in many mass-produced vehicles. Furthermore, they strike a sweet spot between affordability and offering advanced driver assistance features. Consumers are increasingly familiar and comfortable navigating with Level 2 systems, further solidifying its dominance.

By Vehicle Type:

Passenger cars is the dominating sub-segment in the autonomous cars market by vehicle type holding around 74% of market share due to the sheer size of the existing passenger car market compared to commercial vehicles. Major players in the automotive and tech industries are also prioritizing development efforts in passenger car technology.

KEY PLAYERS:

The major key players are Audi AG, Google LLC, Honda Motor Co., Ltd.; Nissan Motor Company; Tesla; Toyota Motor Corporation; Uber Technologies, BMW AG, Daimler AG, Ford Motor Company, General Motors, Nissan Motors Co., Ltd., Tesla, Inc., Robert Bosch GMBH, Aptiv, Continental AG, Denso Corporation, Honda Motor Co., Ltd., Toyota Motor Corporation, and Volkswagen AG.

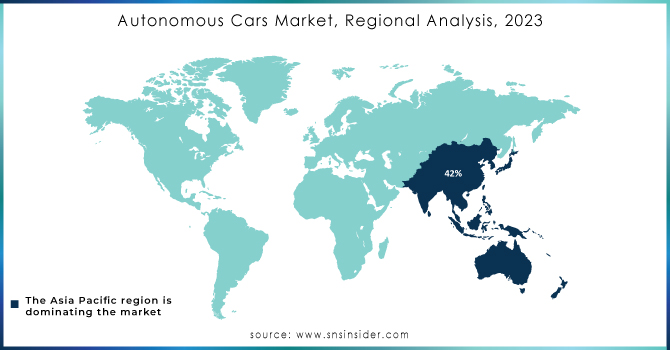

REGIONAL ANALYSES

The Asia Pacific region is dominating the autonomous cars market holding around 42% of market share due to government support, massive populations with growing middle classes, and strong tech infrastructure. North America is the second highest region in this market with 35% of market share due to established automakers, advancements in key components, and a consumer base open to new technology. Europe is experiencing the fastest growth holding a share of 18% with projected CAGR of 28.4% due to its focus on stringent safety regulations, strong existing infrastructure, and increasing investments in research and development.

RECENT DEVELOPMENTS:

-

In Dec. 2023: Mercedes-Benz announced that they got the approval from California and Nevada to use special turquoise lights on their self-driving cars. These lights will help other drivers easily identify vehicles operating in autonomous mode, promoting better awareness and potentially safer roads.

-

In April 2023: DiDi announced that it is developing self-driving taxis for launch in 2025. They've also unveiled two key hardware components: the DiDi Beiyao Beta LiDAR, co-developed with Benewake, a Chinese tech firm. This move positions DiDi as a major player in the autonomous vehicle race.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.13 Billion |

|

Market Size by 2032 |

US$ 43.44 Billion |

| CAGR | CAGR of 39.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Semi-Autonomous cars, Fully-Autonomous cars), • by Autonomy Level (Level 1, Level 2, Level 3, Level 4) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Audi AG, Google LLC, Honda Motor Co., Ltd.; Nissan Motor Company; Tesla; Toyota Motor Corporation; Uber Technologies, BMW AG, Daimler AG, Ford Motor Company, General Motors, Nissan Motors Co., Ltd., Tesla, Inc., Robert Bosch GMBH, Aptiv, Continental AG, Denso Corporation, Honda Motor Co., Ltd., Toyota Motor Corporation, and Volkswagen AG |

| Key Drivers | •Increasing research and development activity for self-driving vehicles. •Auto-tech investment is increasing. |

| RESTRAINTS | •The large first investment may limit expansion. •The considerable risk of hackers gaining unauthorized access to system data and vehicle functions could stifle market expansion. |